Содержание

- 2. 8- In this chapter, you will learn about… Pricing Considerations Price as an Indicator of Value

- 3. 8- Price is a direct determinant of profits (or losses) Price indirectly affects costs (through quantity

- 4. 8- Profit = Total Revenue – Total Cost Relationship between Price and Profits Total Revenue =

- 5. 8- Pricing Considerations Examples of Pricing Objectives: Maximization of profits Enhancing product or brand image Providing

- 6. 8- Pricing Considerations Demand sets the price ceiling Direct (variable) costs set the price floor Campbell

- 7. Pricing Considerations Conceptual Orientation to Pricing Source: Kent B. Monroe, Pricing: Making Profitable Decisions, 3rd ed.

- 8. 8- Pricing Considerations Factors narrowing pricing discretion Government regulations Price of competitive offerings Organizational objectives and

- 9. 8- Life-cycle stage of product or service Effect of pricing decisions on profit margins of marketing

- 10. 8- Value = perceived benefits price Value can be defined as the ratio of perceived benefits

- 11. 8- Price affects perception of quality Price affects consumer perceptions of prestige Example: Swiss watchmaker TAG

- 12. 8- Pricing Considerations Price as an Indicator of Value Consumer value assessments are often comparative –

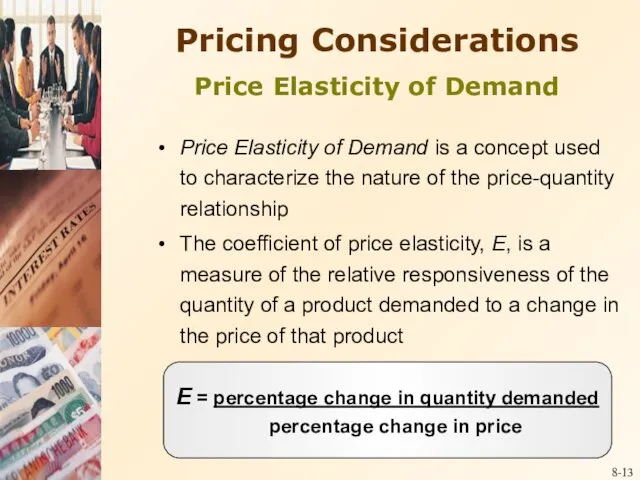

- 13. 8- E = percentage change in quantity demanded percentage change in price Pricing Considerations Price Elasticity

- 14. 8- If the percentage change in quantity demanded is greater than the percentage change in price,

- 15. 8- The more substitutes the product or service has, the greater the elasticity The more uses

- 16. 8- Pricing Considerations Product-Line Pricing Cross-Elasticity of Demand relates the price elasticity simultaneously to more than

- 17. 8- the lowest-priced product and price plays the role of traffic builder the highest-priced product and

- 18. 8- Cost data Price data Volume data for individual products and services Impact of price changes

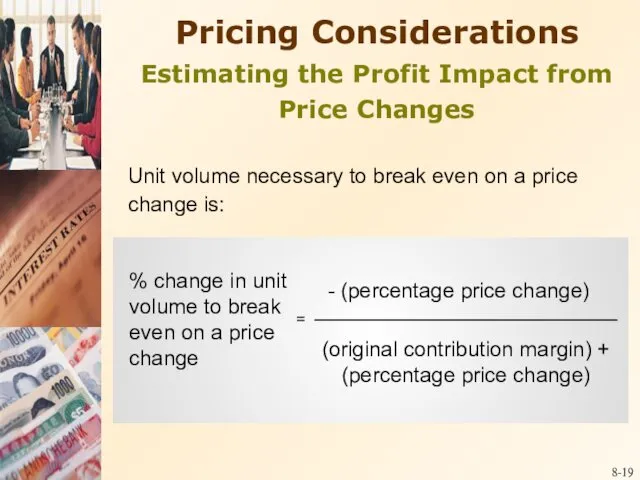

- 19. 8- Pricing Considerations Estimating the Profit Impact from Price Changes Unit volume necessary to break even

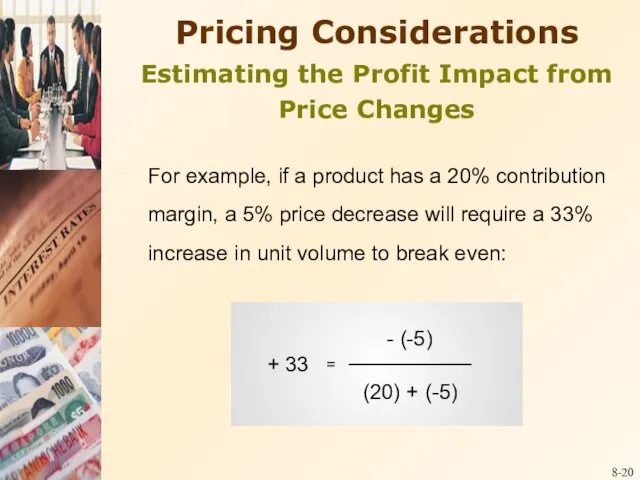

- 20. 8- Pricing Considerations Estimating the Profit Impact from Price Changes For example, if a product has

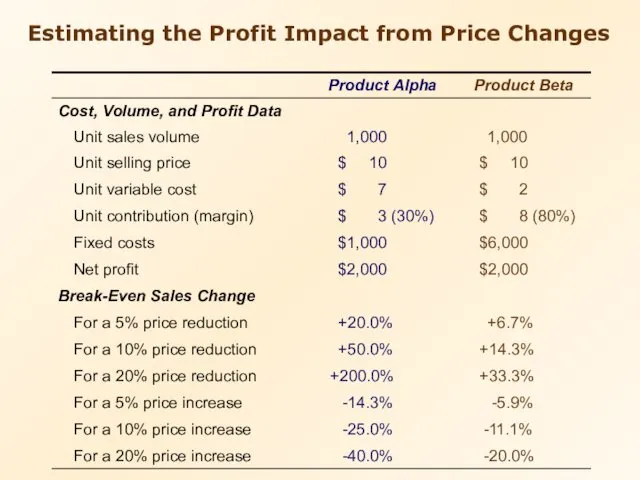

- 21. Estimating the Profit Impact from Price Changes

- 22. 8- Pricing Strategies Full-cost Price Strategies Considers both (direct) variable and (indirect) fixed costs Variable-cost Price

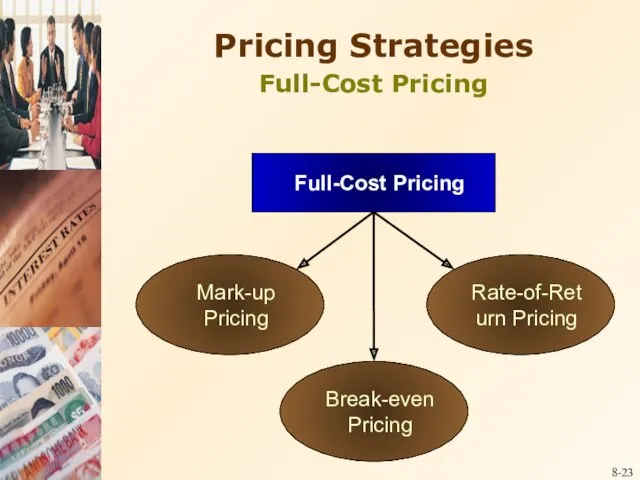

- 23. 8- Pricing Strategies Full-Cost Pricing Full-Cost Pricing Mark-up Pricing Rate-of-Return Pricing Break-even Pricing

- 24. 8- Selling price is determined by adding a fixed amount, usually a percentage, to the (total)

- 25. 8- Equals the per-unit fixed costs plus the per-unit variable costs Useful tool for determining the

- 26. 8- Price is set so as to obtain a pre-specified rate of return on investment (capital)

- 27. 8- Pricing Strategies Rate-of-Return Pricing where P = Unit Selling Price; C = Unit Cost; Q

- 28. 8- Pricing Strategies Rate-of-Return Pricing Example An organization desires an ROI of 15% on an investment

- 29. 8- Stimulate demand (lower fares for seniors) Can increase revenues, and hence, lead to economies of

- 30. 8- Pricing Strategies New-Offering Pricing Strategies Skimming Pricing Strategy (Gillette Mach3) price initially set very high

- 31. 8- Demand is likely to be price inelastic There are different price-market segments The offering is

- 32. 8- Demand is likely to be price elastic The offering is not unique or protected by

- 33. 8- Competitive Interaction refers to the sequential action and reaction of rival companies in setting and

- 34. 8- Managers are advised to focus less on short-term outcomes and attend more to longer-term consequences

- 35. 8- What are competitors’ goals and objectives? How are they different from our goals and objectives?

- 36. 8- Pricing Strategies Pricing and Competitive Interaction A Price War involves successive price cutting by competitors

- 37. 8- The company has a cost or technological advantage over its competitors Primary demand for a

- 39. Скачать презентацию

Решение финансового кейса, разработанное командой Акулы бизнеса

Решение финансового кейса, разработанное командой Акулы бизнеса Себестоимость и цена

Себестоимость и цена Оценка акций. Риск и доходность портфеля ценных бумаг

Оценка акций. Риск и доходность портфеля ценных бумаг Ценовая политика и ценообразование

Ценовая политика и ценообразование Лабуан оффшорлық аймақ

Лабуан оффшорлық аймақ Сутність страхування

Сутність страхування Кредит наличными

Кредит наличными Преимущества карт линейки GOLD

Преимущества карт линейки GOLD Арбитраж на пабликах. Раскрутка и монетизация сообществ ВКонтакте

Арбитраж на пабликах. Раскрутка и монетизация сообществ ВКонтакте Финансовое планирование

Финансовое планирование Мультиплікатор. Зв’язок мультиплікатора з інвестиціями. Гранична схильність до заощадження та її зв’язок з інвестуванням

Мультиплікатор. Зв’язок мультиплікатора з інвестиціями. Гранична схильність до заощадження та її зв’язок з інвестуванням Перспективы развития лизинговых операций в России

Перспективы развития лизинговых операций в России Краудфандинг

Краудфандинг Объекты государственного финансового контроля

Объекты государственного финансового контроля Центральный Банк (Банк России)

Центральный Банк (Банк России) Особенности недвжимости как товара. Роль и место недвижимости в рыночной системе

Особенности недвжимости как товара. Роль и место недвижимости в рыночной системе Учет затрат на производство и калькулирование себестоимости продукции. (Тема 6)

Учет затрат на производство и калькулирование себестоимости продукции. (Тема 6) Баға индексі, сипаттамасы

Баға индексі, сипаттамасы Патентная система налогообложения

Патентная система налогообложения Банковские информационные системы

Банковские информационные системы Предмет и метод бухгалтерского учета. Бухгалтерский баланс

Предмет и метод бухгалтерского учета. Бухгалтерский баланс Инвестиции. Инвестиционные проекты

Инвестиции. Инвестиционные проекты Формирование банковской системы США

Формирование банковской системы США Система права социального обеспечения

Система права социального обеспечения Учет затрат по объектам калькулирования и калькулирование себестоимости отдельных видов продукции

Учет затрат по объектам калькулирования и калькулирование себестоимости отдельных видов продукции Инвестиции и бизнес-планирование

Инвестиции и бизнес-планирование Залог как способ обеспечения кредита и инструмент предупреждения банковских рисков

Залог как способ обеспечения кредита и инструмент предупреждения банковских рисков Инкотермс в международной практике

Инкотермс в международной практике