Содержание

- 2. 10.1 Individual Securities 10.2 Expected Return, Variance, and Covariance 10.3 The Return and Risk for Portfolios

- 3. 10.1 Individual Securities The characteristics of individual securities that are of interest are the: Expected Return

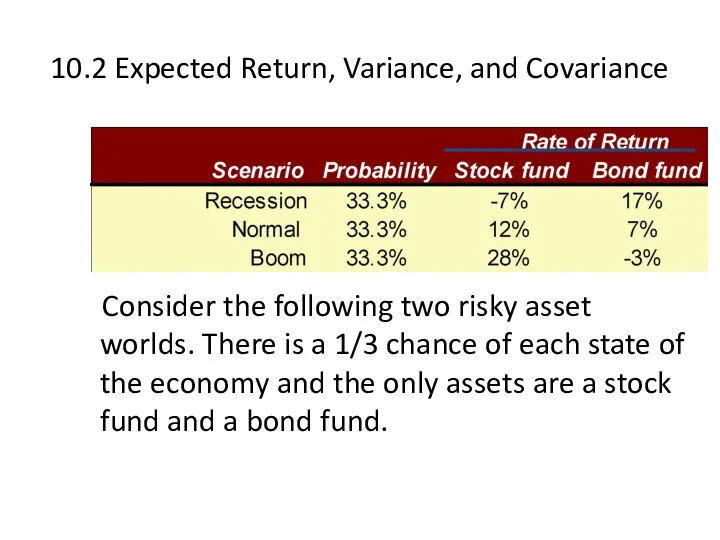

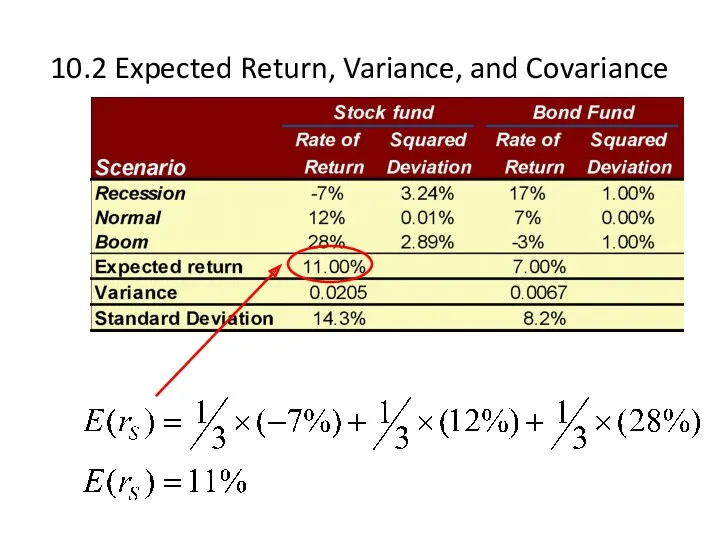

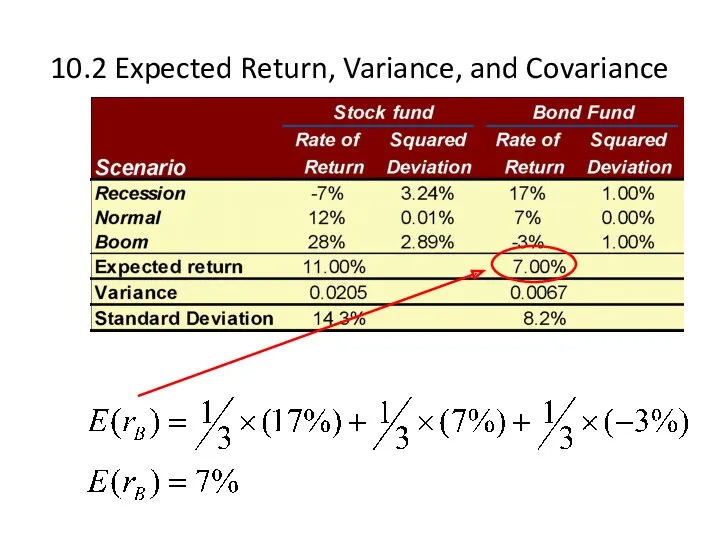

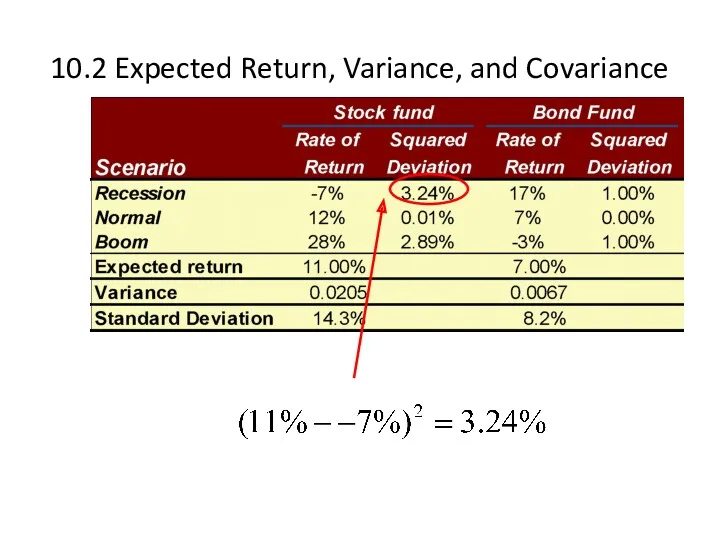

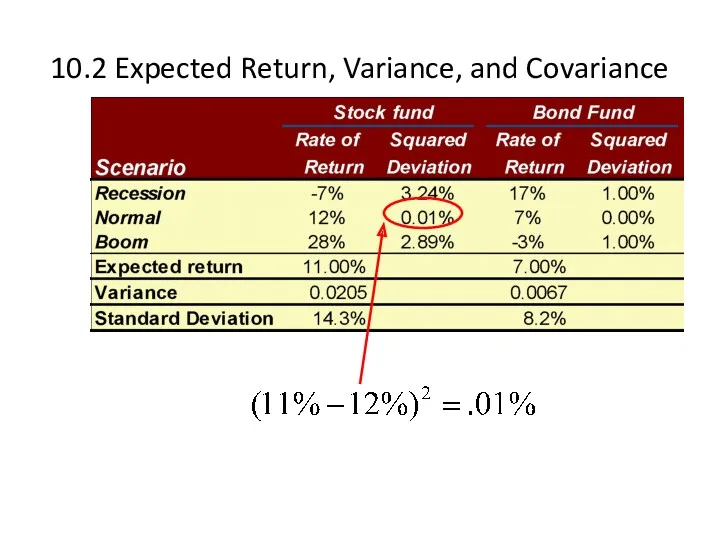

- 4. 10.2 Expected Return, Variance, and Covariance Consider the following two risky asset worlds. There is a

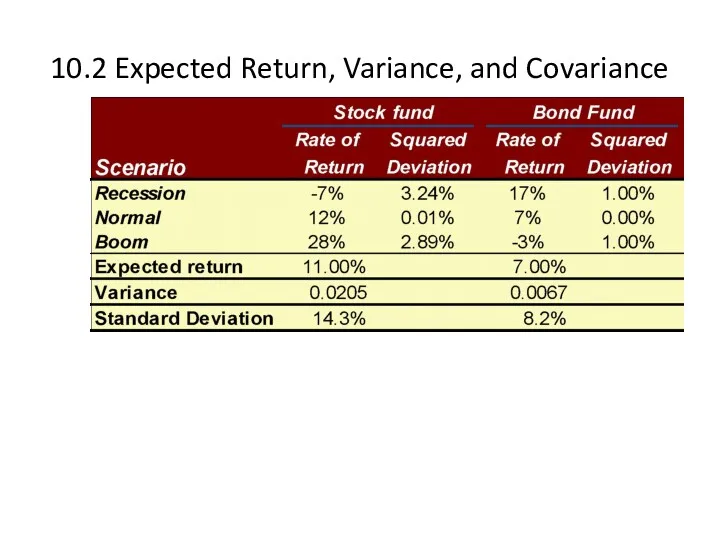

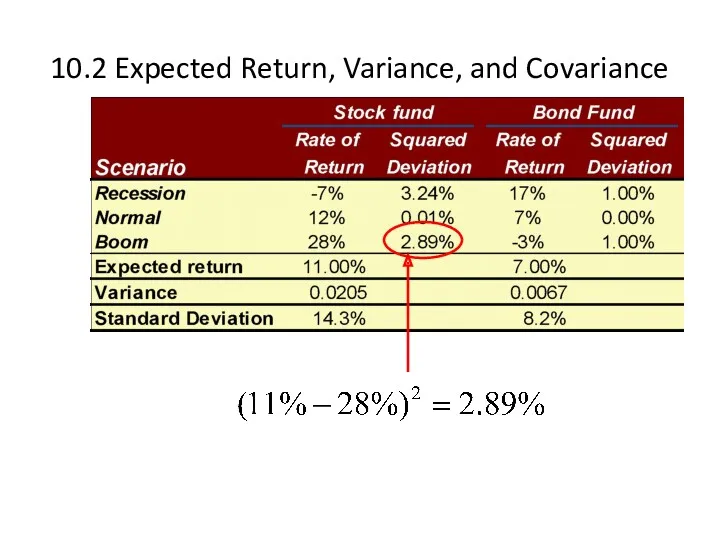

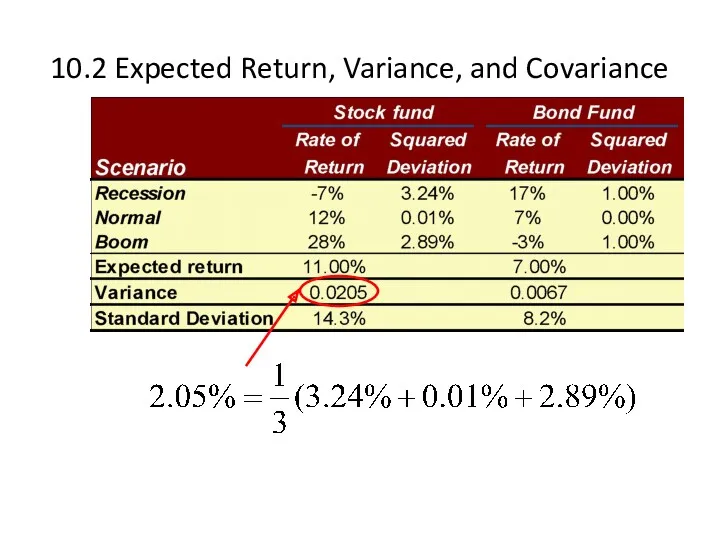

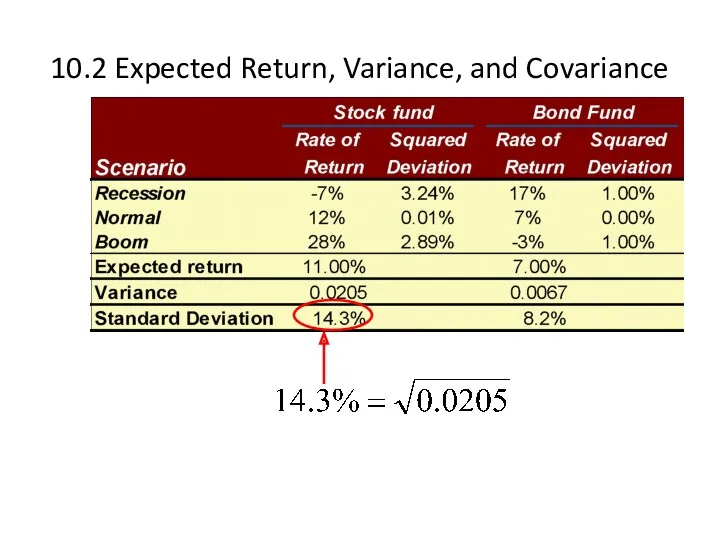

- 5. 10.2 Expected Return, Variance, and Covariance

- 6. 10.2 Expected Return, Variance, and Covariance

- 7. 10.2 Expected Return, Variance, and Covariance

- 8. 10.2 Expected Return, Variance, and Covariance

- 9. 10.2 Expected Return, Variance, and Covariance

- 10. 10.2 Expected Return, Variance, and Covariance

- 11. 10.2 Expected Return, Variance, and Covariance

- 12. 10.2 Expected Return, Variance, and Covariance

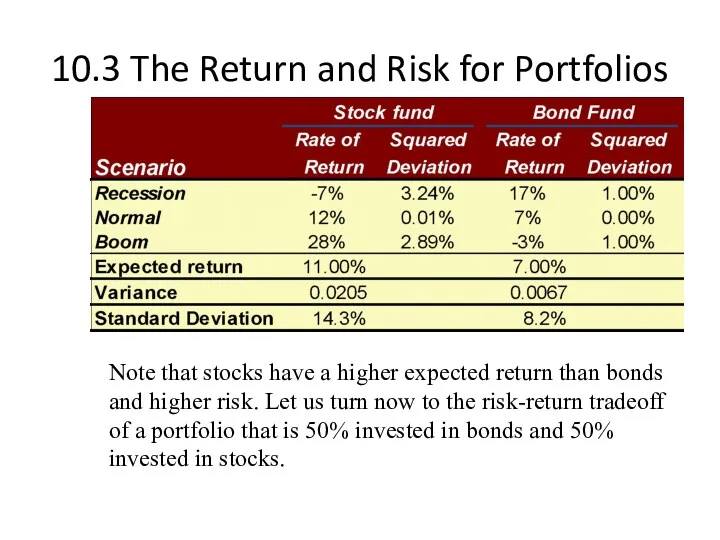

- 13. 10.3 The Return and Risk for Portfolios Note that stocks have a higher expected return than

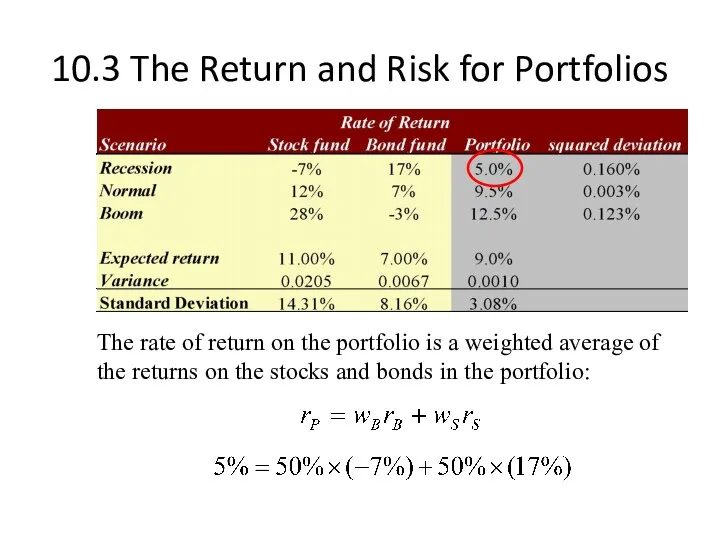

- 14. 10.3 The Return and Risk for Portfolios The rate of return on the portfolio is a

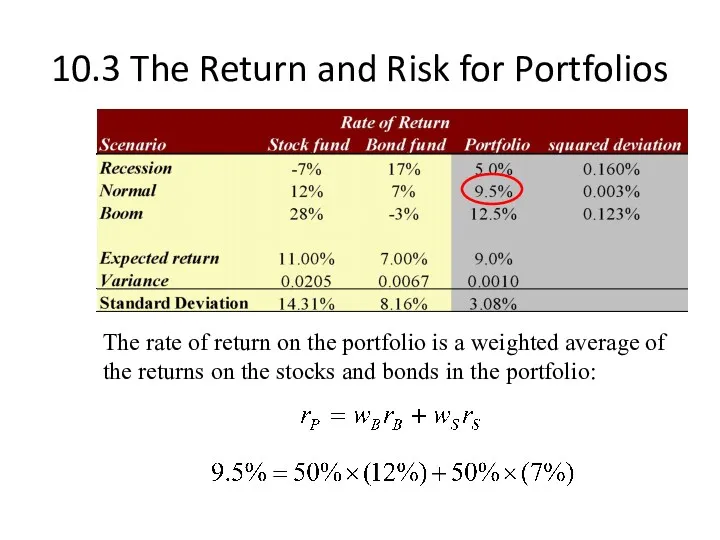

- 15. 10.3 The Return and Risk for Portfolios The rate of return on the portfolio is a

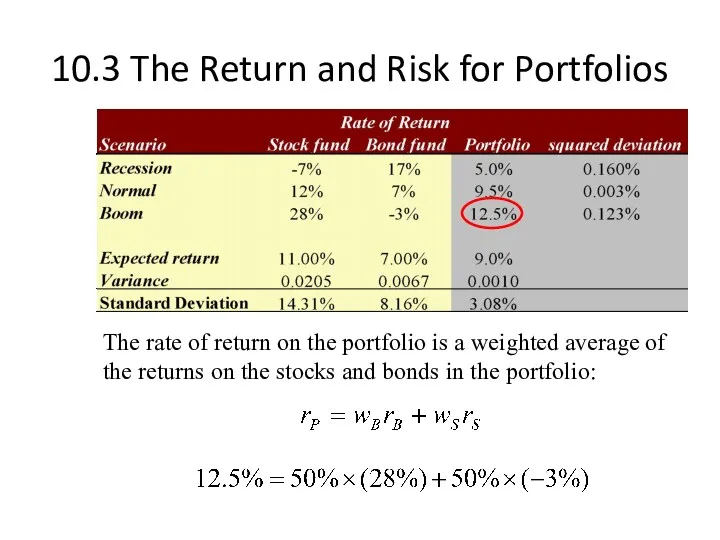

- 16. 10.3 The Return and Risk for Portfolios The rate of return on the portfolio is a

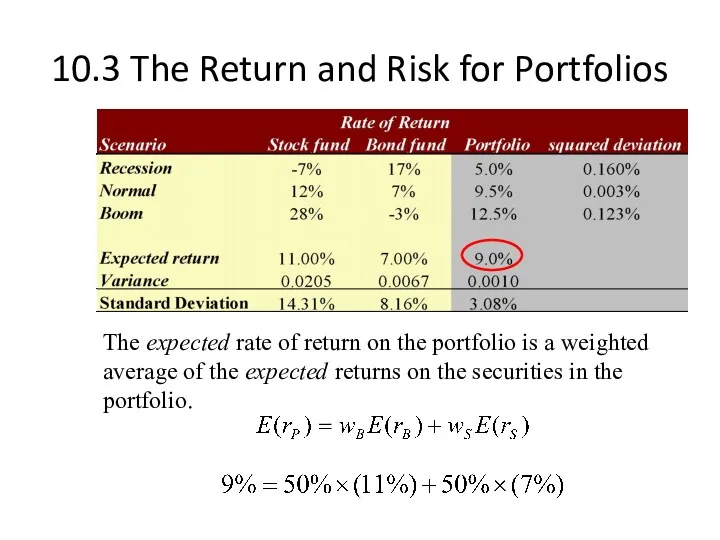

- 17. 10.3 The Return and Risk for Portfolios The expected rate of return on the portfolio is

- 18. 10.3 The Return and Risk for Portfolios The variance of the rate of return on the

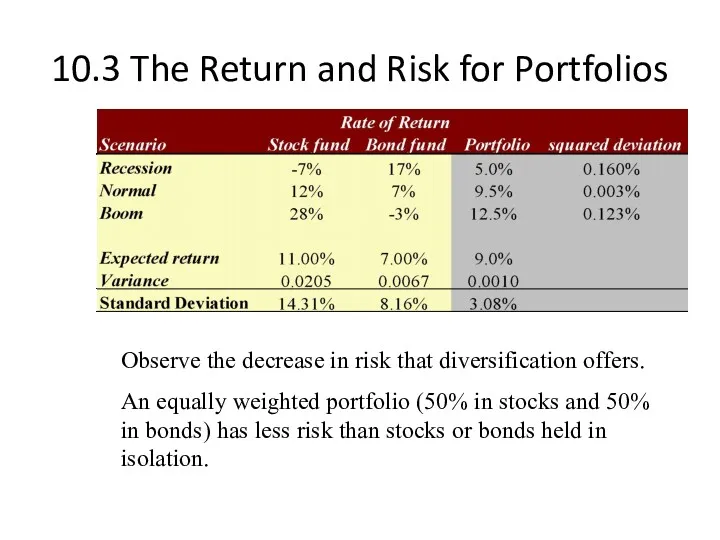

- 19. 10.3 The Return and Risk for Portfolios Observe the decrease in risk that diversification offers. An

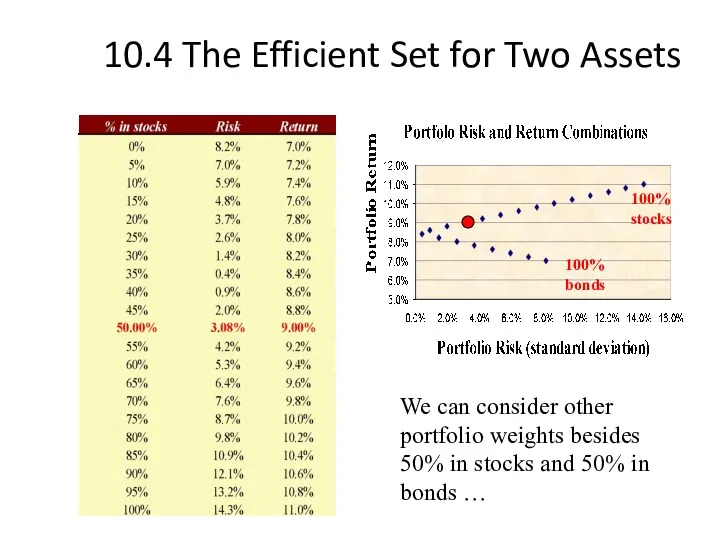

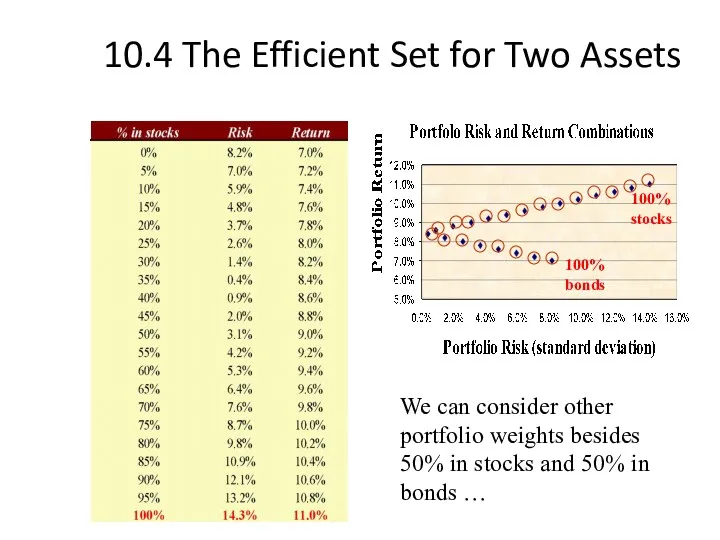

- 20. 10.4 The Efficient Set for Two Assets We can consider other portfolio weights besides 50% in

- 21. 10.4 The Efficient Set for Two Assets We can consider other portfolio weights besides 50% in

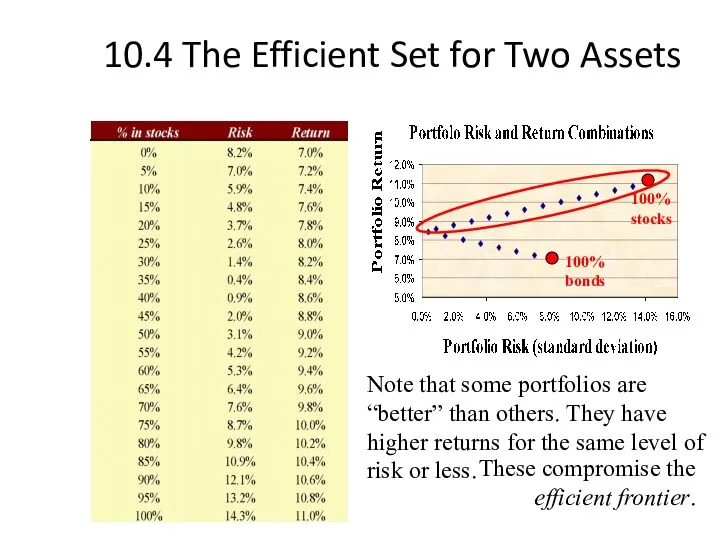

- 22. 10.4 The Efficient Set for Two Assets 100% stocks 100% bonds Note that some portfolios are

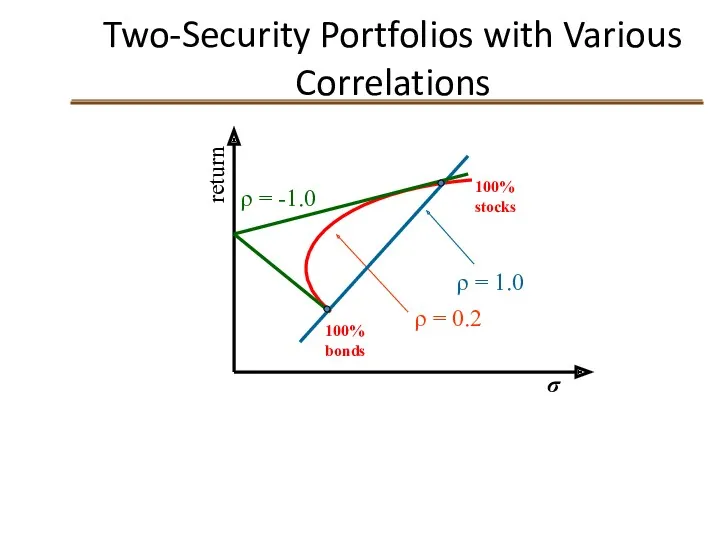

- 23. Two-Security Portfolios with Various Correlations 100% bonds return σ 100% stocks ρ = 0.2 ρ =

- 24. Portfolio Risk/Return Two Securities: Correlation Effects Relationship depends on correlation coefficient -1.0 The smaller the correlation,

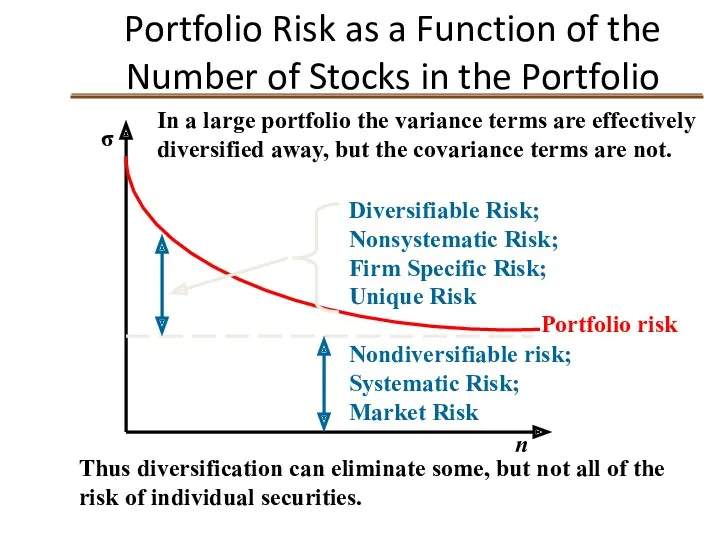

- 25. Portfolio Risk as a Function of the Number of Stocks in the Portfolio Nondiversifiable risk; Systematic

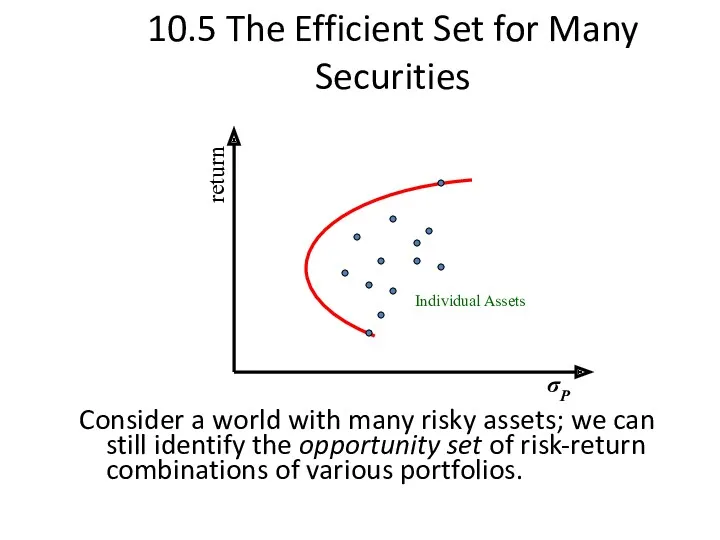

- 26. 10.5 The Efficient Set for Many Securities Consider a world with many risky assets; we can

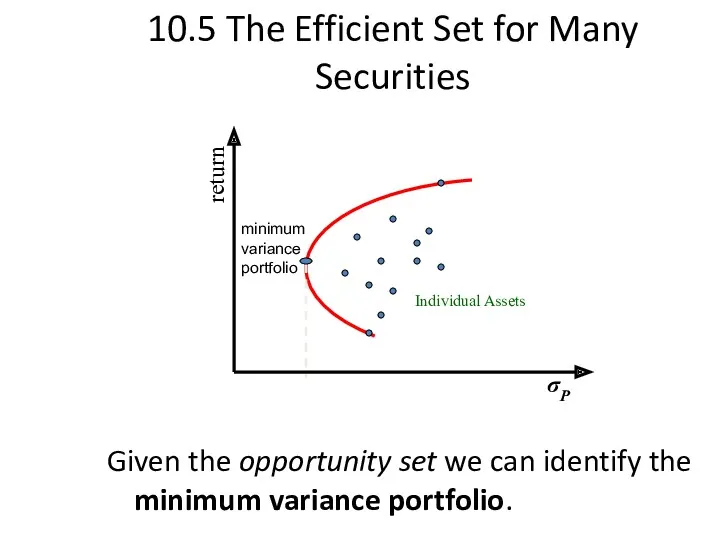

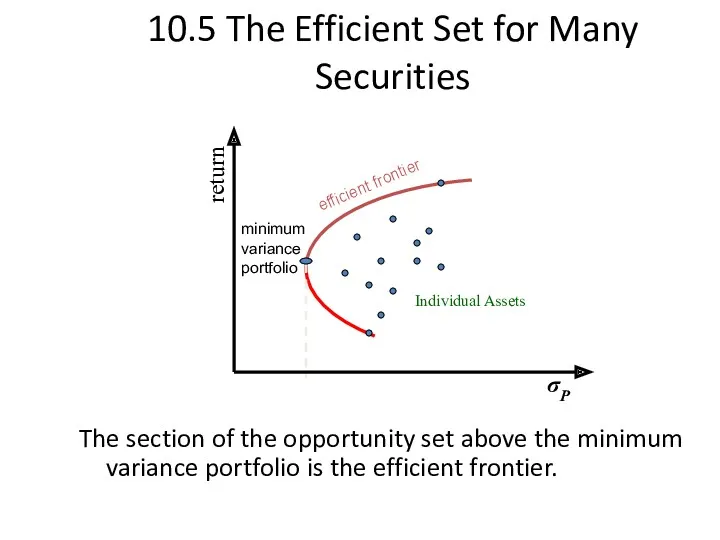

- 27. 10.5 The Efficient Set for Many Securities Given the opportunity set we can identify the minimum

- 28. 10.5 The Efficient Set for Many Securities The section of the opportunity set above the minimum

- 29. Optimal Risky Portfolio with a Risk-Free Asset In addition to stocks and bonds, consider a world

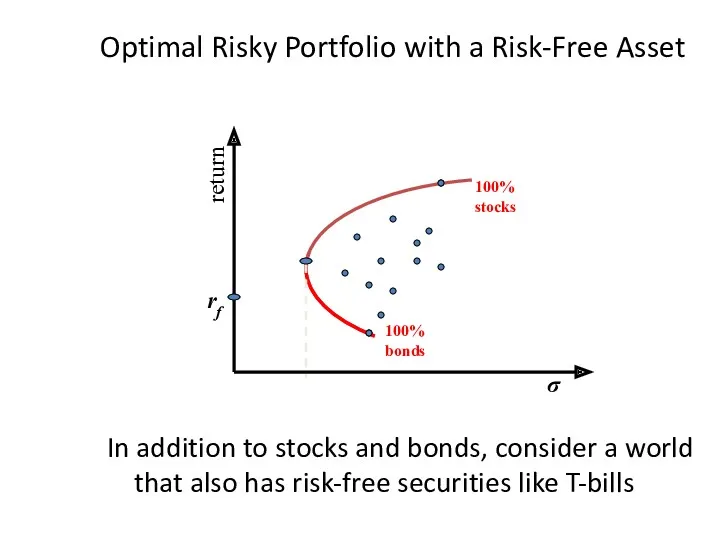

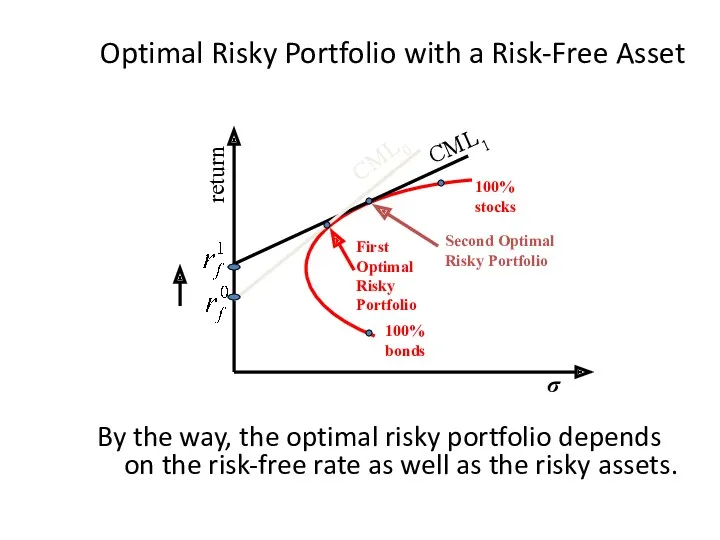

- 30. 10.7 Riskless Borrowing and Lending Now investors can allocate their money across the T-bills and a

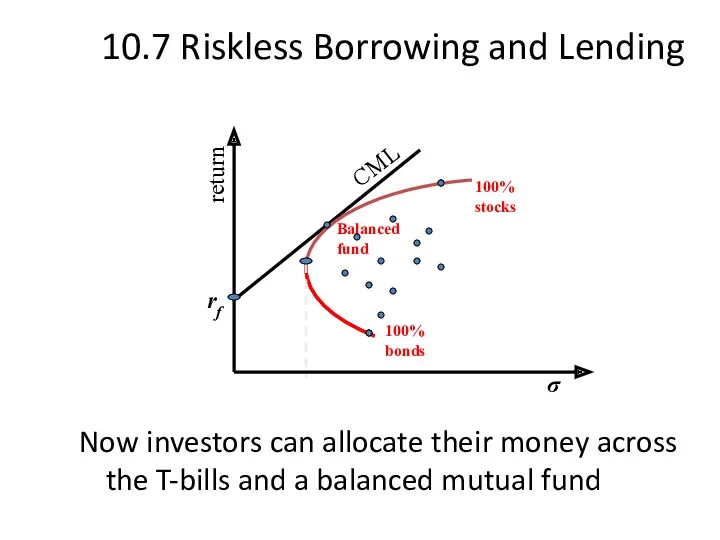

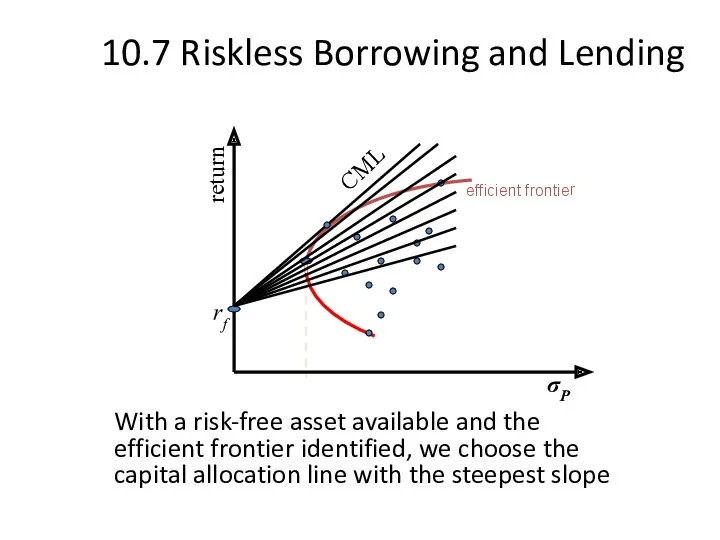

- 31. 10.7 Riskless Borrowing and Lending With a risk-free asset available and the efficient frontier identified, we

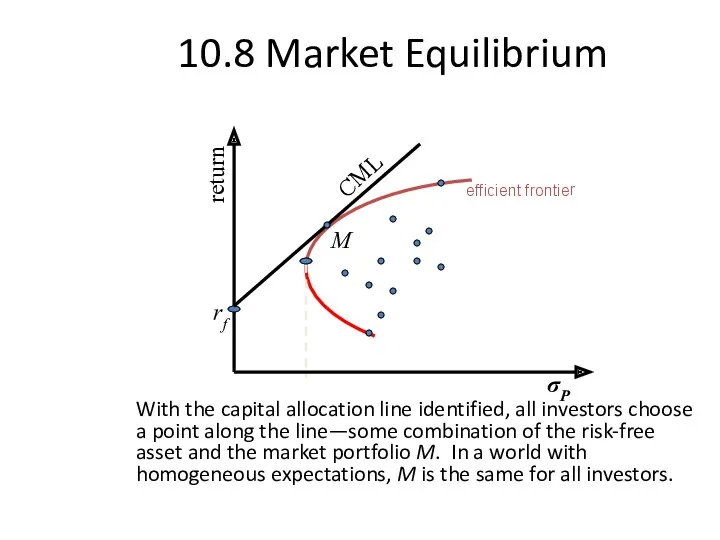

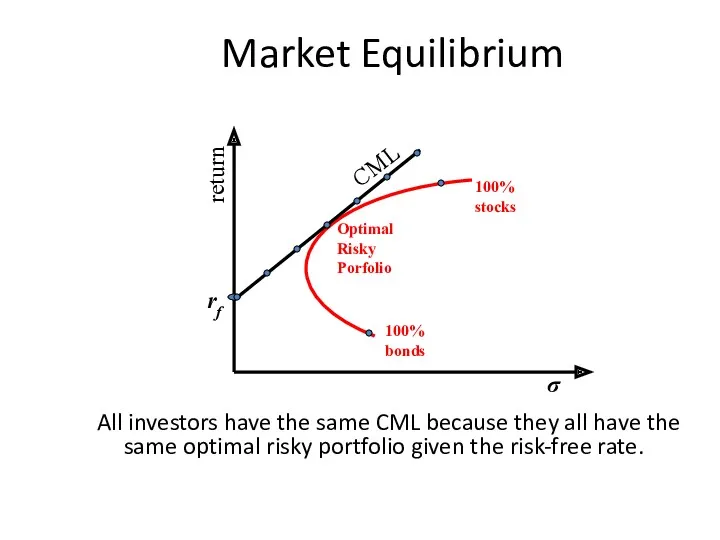

- 32. 10.8 Market Equilibrium With the capital allocation line identified, all investors choose a point along the

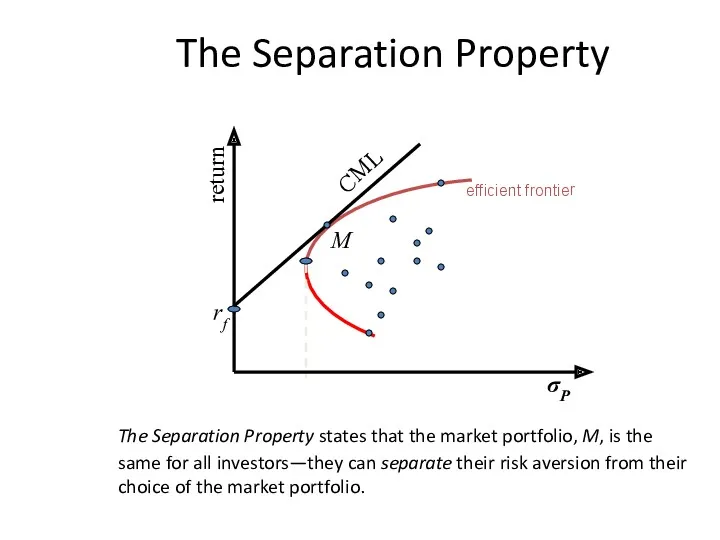

- 33. The Separation Property The Separation Property states that the market portfolio, M, is the same for

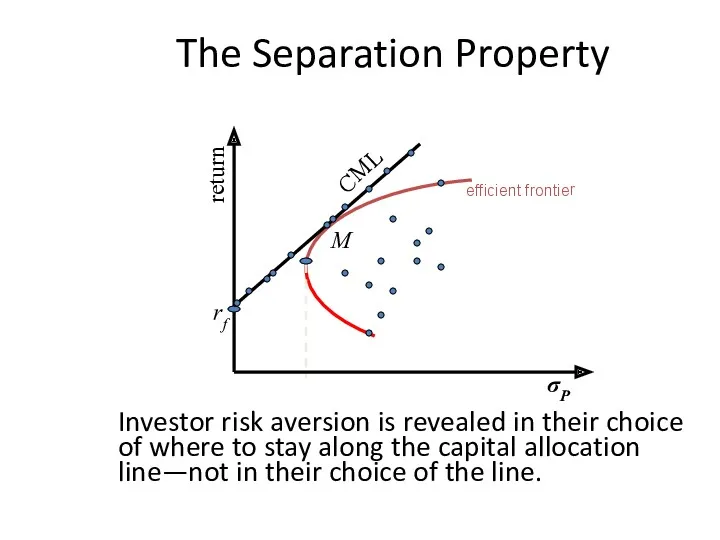

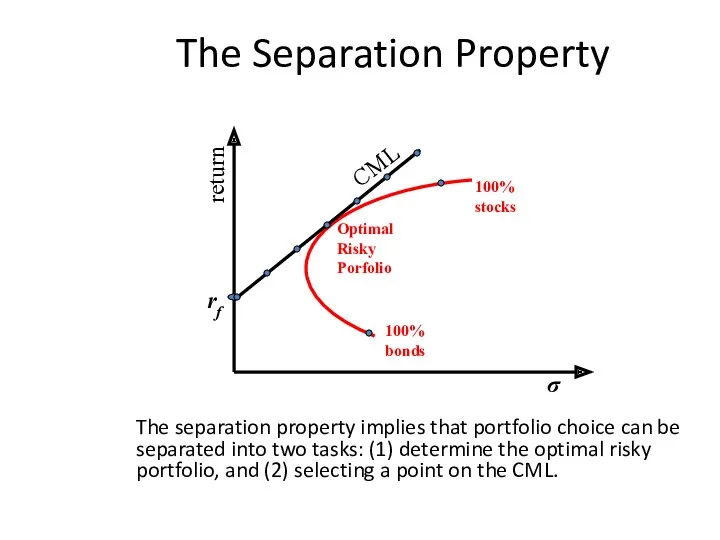

- 34. The Separation Property Investor risk aversion is revealed in their choice of where to stay along

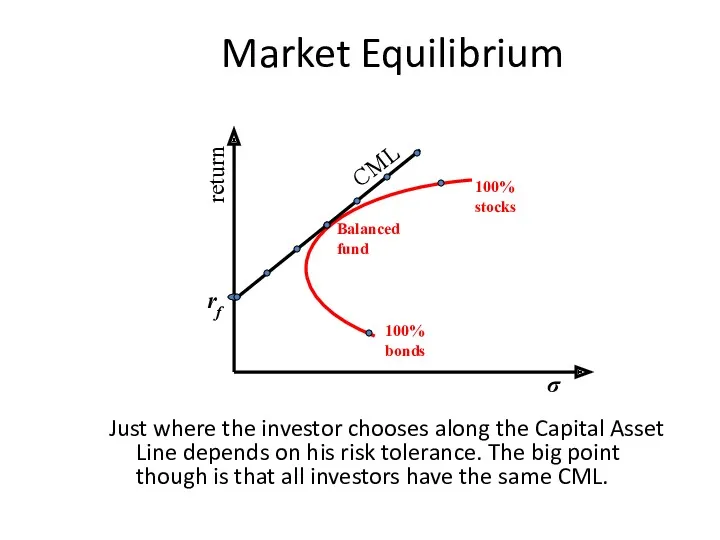

- 35. Market Equilibrium Just where the investor chooses along the Capital Asset Line depends on his risk

- 36. Market Equilibrium All investors have the same CML because they all have the same optimal risky

- 37. The Separation Property The separation property implies that portfolio choice can be separated into two tasks:

- 38. Optimal Risky Portfolio with a Risk-Free Asset By the way, the optimal risky portfolio depends on

- 39. Definition of Risk When Investors Hold the Market Portfolio Researchers have shown that the best measure

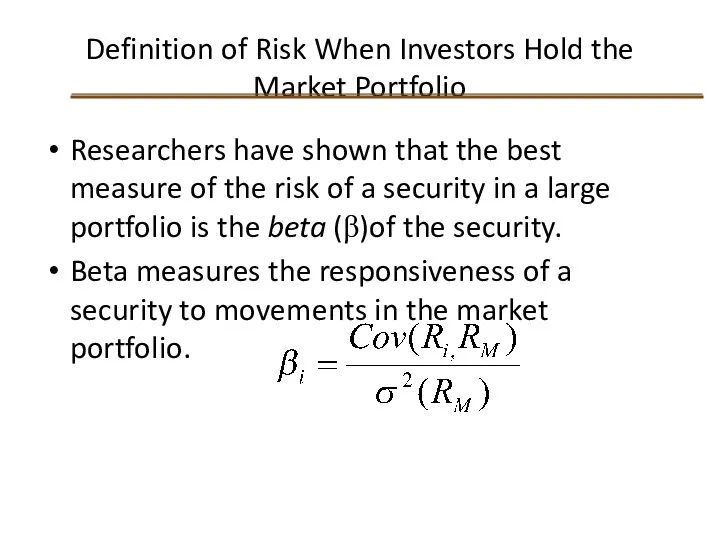

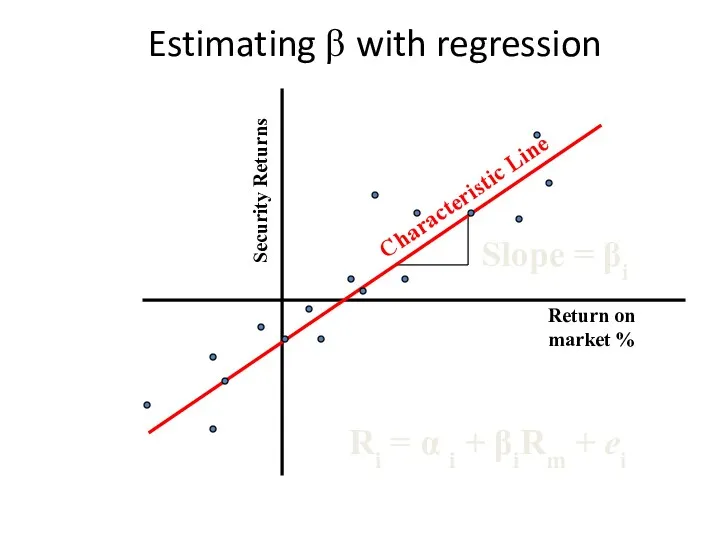

- 40. Estimating β with regression Security Returns Return on market % Ri = α i + βiRm

- 41. Estimates of β for Selected Stocks

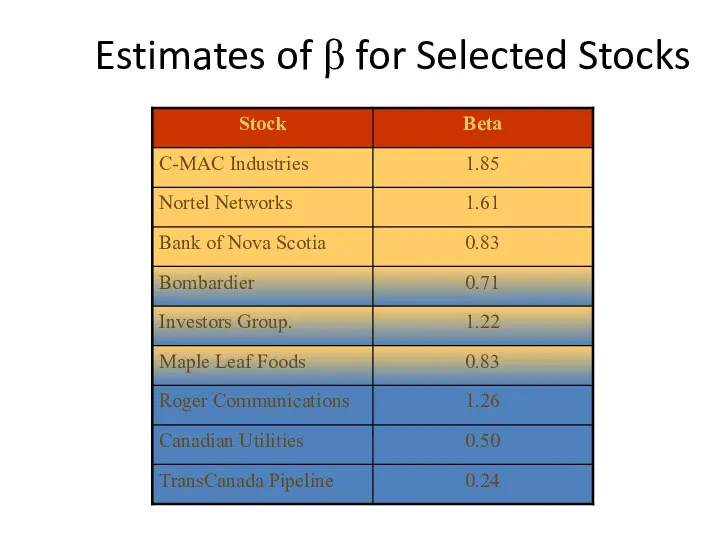

- 42. The Formula for Beta Clearly, your estimate of beta will depend upon your choice of a

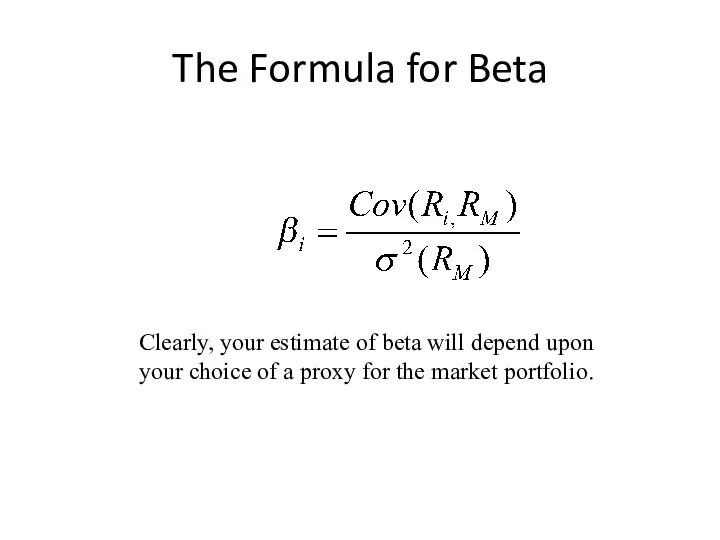

- 43. 10.9 Relationship between Risk and Expected Return (CAPM) Expected Return on the Market: Expected return on

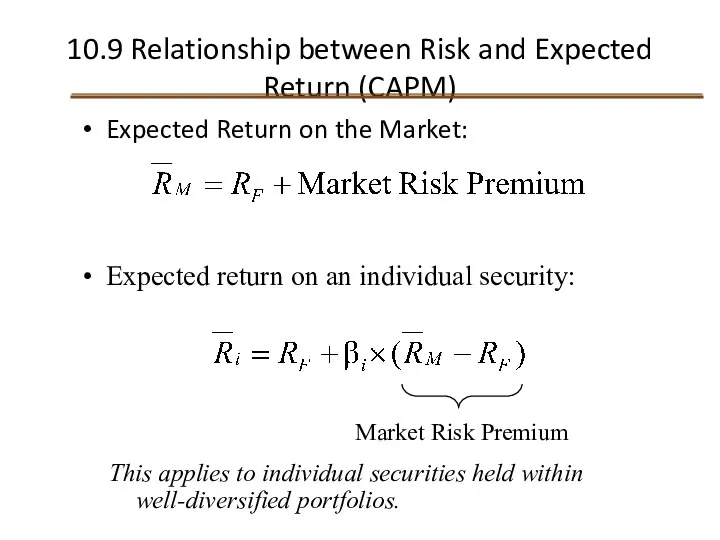

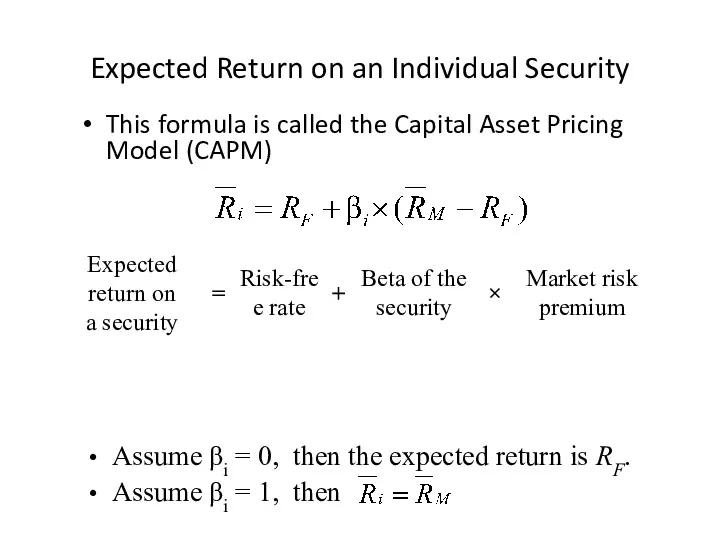

- 44. Expected Return on an Individual Security This formula is called the Capital Asset Pricing Model (CAPM)

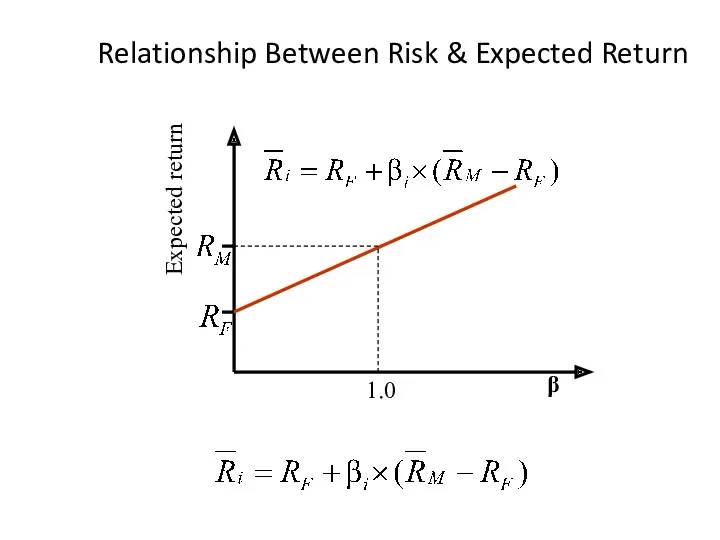

- 45. Relationship Between Risk & Expected Return Expected return β 1.0

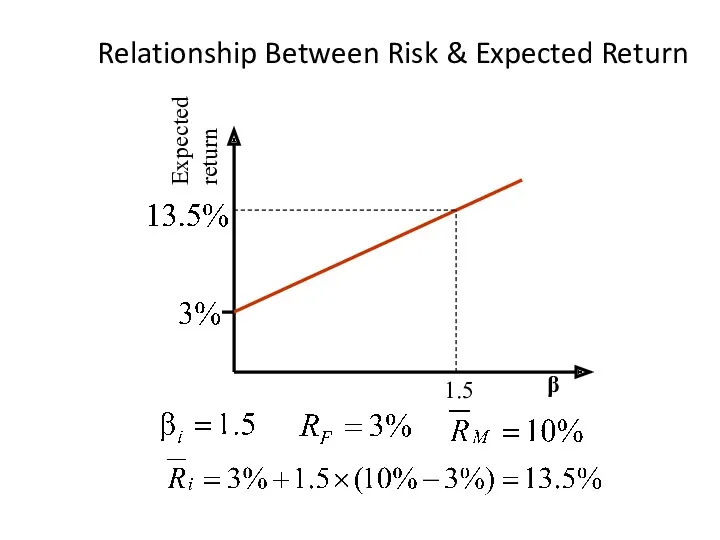

- 46. Relationship Between Risk & Expected Return Expected return β 1.5

- 47. 10.10 Summary and Conclusions This chapter sets forth the principles of modern portfolio theory. The expected

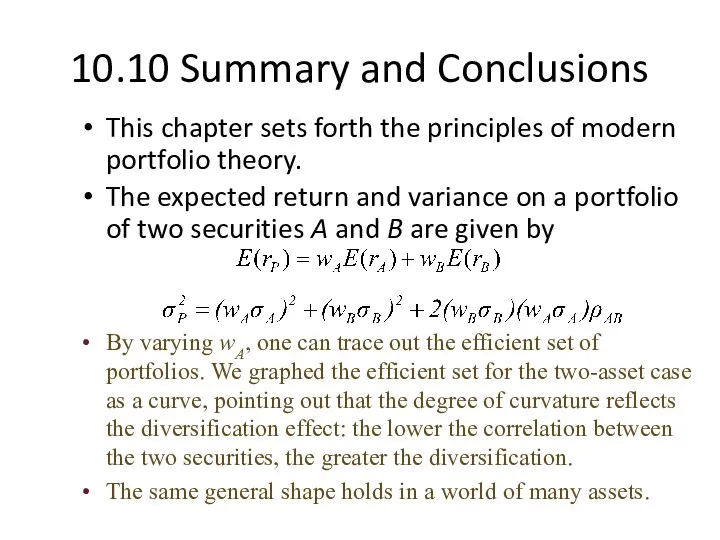

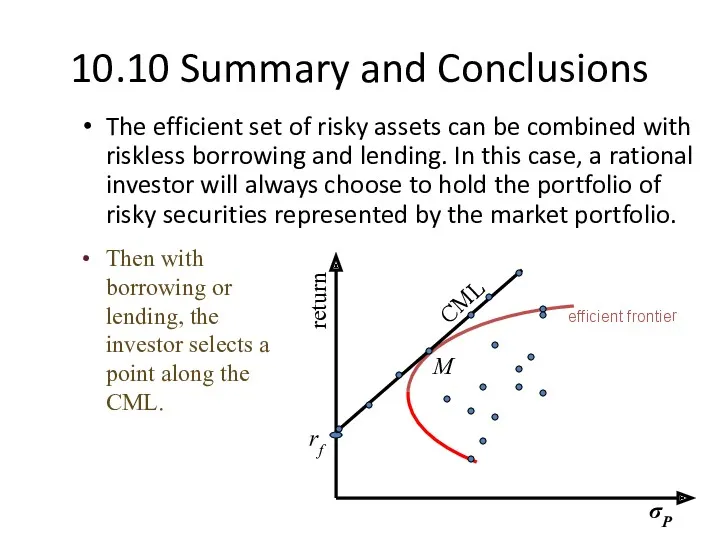

- 48. 10.10 Summary and Conclusions The efficient set of risky assets can be combined with riskless borrowing

- 50. Скачать презентацию

Методология таможенной статистики

Методология таможенной статистики Международная академия бизнеса. Международные стандарты финансовой отчётности

Международная академия бизнеса. Международные стандарты финансовой отчётности Страхование экспортных кредитов в Чехии

Страхование экспортных кредитов в Чехии Итоги работы управления Федерального казначейства по Курской области

Итоги работы управления Федерального казначейства по Курской области Виды стипендий. Оcобенности назначения государственной социальной стипендии,

Виды стипендий. Оcобенности назначения государственной социальной стипендии, Loan Repayment Options: What You Need to Know

Loan Repayment Options: What You Need to Know Анализ капитальных вложений

Анализ капитальных вложений Инвестиция. Инвестициялар төмендегі мақсаттарды шешуге көмектеседі

Инвестиция. Инвестициялар төмендегі мақсаттарды шешуге көмектеседі Налог на доходы физических лиц

Налог на доходы физических лиц Персонал предприятия. Понятие и классификация персонала. Показатели эффективности использования трудовых ресурсов

Персонал предприятия. Понятие и классификация персонала. Показатели эффективности использования трудовых ресурсов Организационные основы проведения финансового контроля. (Лекция 3)

Организационные основы проведения финансового контроля. (Лекция 3) Как заработать больше, а тратить меньше

Как заработать больше, а тратить меньше Проект поддержки местных инициатив (ППМИ)

Проект поддержки местных инициатив (ППМИ) Денежные фонды и резервы организации

Денежные фонды и резервы организации Оценка финансово-хозяйственной деятельности предприятия в системе экономической безопасности предприятия

Оценка финансово-хозяйственной деятельности предприятия в системе экономической безопасности предприятия Зарплатный проект Газпромбанк

Зарплатный проект Газпромбанк О публичных обязательствах в 2018 году

О публичных обязательствах в 2018 году Price. Pricing Considerations

Price. Pricing Considerations Сутність страхування

Сутність страхування Фінансова стратегія підприємства

Фінансова стратегія підприємства Money show film - history of money

Money show film - history of money The official currency japanese, yen

The official currency japanese, yen Нормативная база ценообразования в строительстве. Сметно-нормативная база

Нормативная база ценообразования в строительстве. Сметно-нормативная база Государственный кредит

Государственный кредит Финансовый сектор экономики и основы его функционирования

Финансовый сектор экономики и основы его функционирования Бизнес-ангелы и их роль в современной экономике

Бизнес-ангелы и их роль в современной экономике Ценовая политика

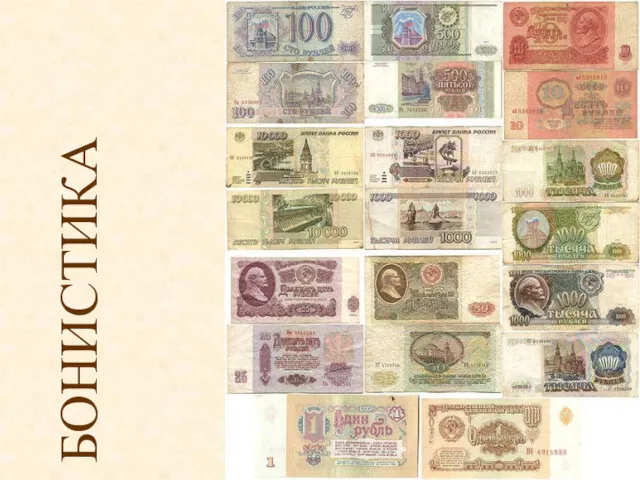

Ценовая политика Бонистика. Виды бумажных денежных знаков и ценных бумаг

Бонистика. Виды бумажных денежных знаков и ценных бумаг