Содержание

- 2. Get out your handout and be prepared to jot down the 3 uses of money

- 3. Money is anything that serves as a medium of exchange, a unit of account, and a

- 4. The Three Uses of Money – write in graphic organizer .. 1st bubble - Money as

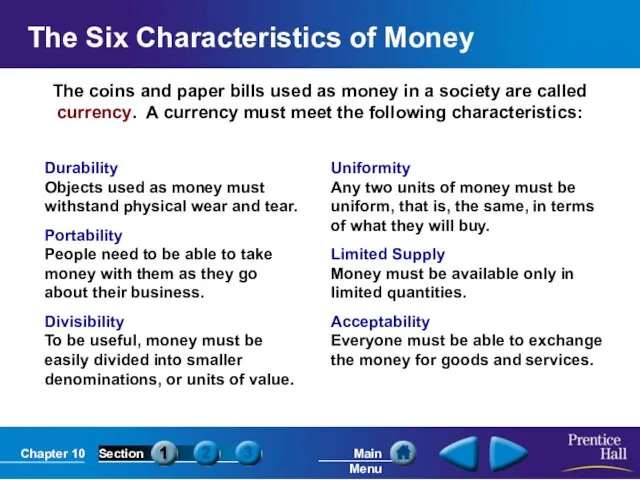

- 5. Get out your handout and be prepared to jot down the 6 characteristics of money

- 6. The coins and paper bills used as money in a society are called currency. A currency

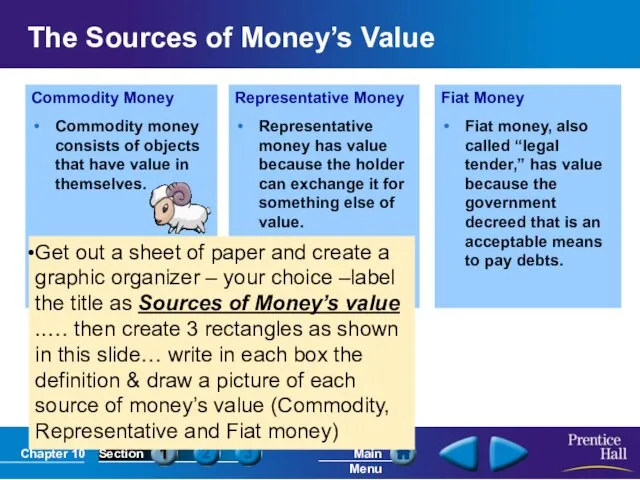

- 7. Commodity Money Commodity money consists of objects that have value in themselves. Representative Money Representative money

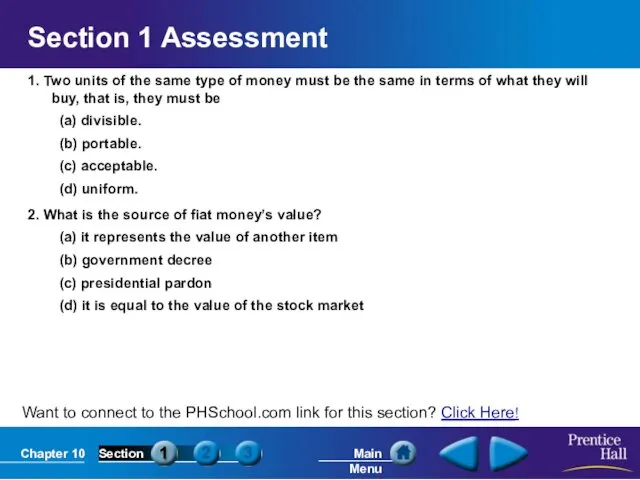

- 8. Want to connect to the PHSchool.com link for this section? Click Here! Section 1 Assessment 1.

- 9. Want to connect to the PHSchool.com link for this section? Click Here! Section 1 Assessment 1.

- 10. The History of American Banking How did American banking change in the 1700s and 1800s? How

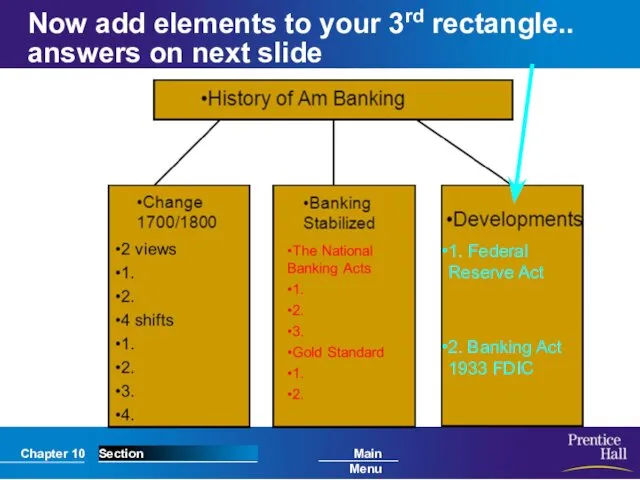

- 11. Add elements to first rectangle… then go to next slide & get answers … 2 views

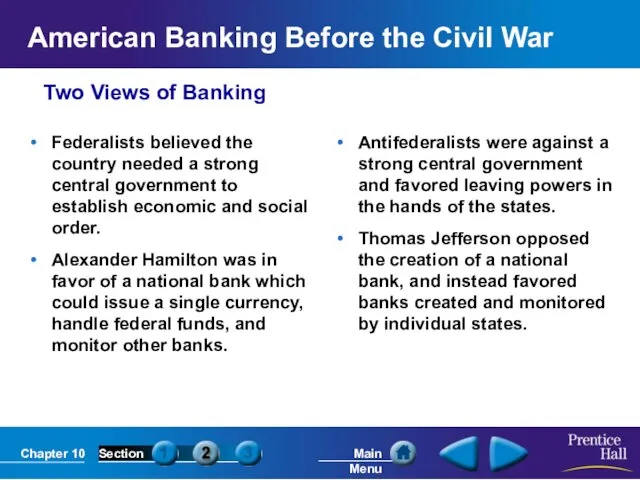

- 12. Two Views of Banking American Banking Before the Civil War Federalists believed the country needed a

- 13. Shifts in the Banking System The First Bank of the United States The first Bank of

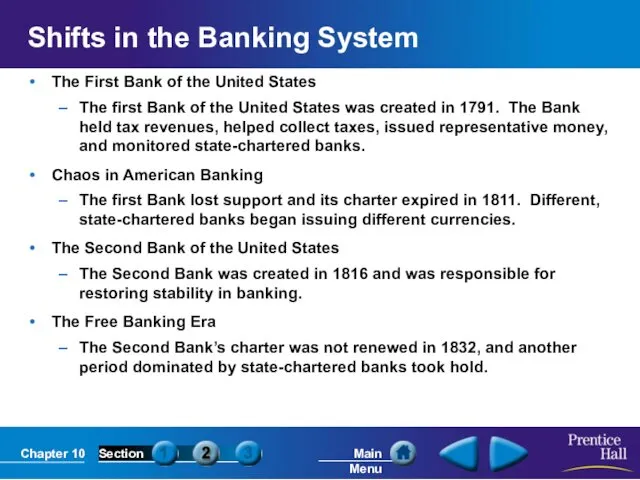

- 14. Now add elements for 2nd column… answers next slide

- 15. Banking Stabilization in the Late 1800s The National Banking Acts of 1863 and 1864 gave the

- 16. Now add elements to your 3rd rectangle.. answers on next slide 1. Federal Reserve Act 2.

- 17. Banking in the Twentieth Century The Federal Reserve Act of 1913 created the Federal Reserve System.

- 18. Watch bank run clip

- 19. Want to connect to the PHSchool.com link for this section? Click Here! Section 2 Assessment 1.

- 20. Want to connect to the PHSchool.com link for this section? Click Here! Section 2 Assessment 1.

- 21. Banking Today – Take out sheet of paper and take notes! How do economists measure the

- 22. Measuring the Money Supply M1 M1 consists of assets that have liquidity, or the ability to

- 23. Banking Services Banks perform many functions and offer a wide range of services to consumers. Storing

- 24. How Banks Make a Profit The largest source of income for banks is the interest they

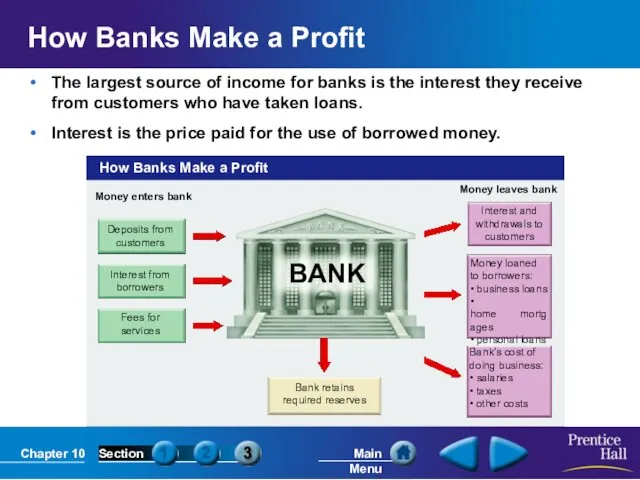

- 25. Types of Financial Institutions Commercial Banks Commercial banks offer checking services, accept deposits, and make loans.

- 26. The role of computers in banking has increased dramatically. Automated Teller Machines (ATMs) Customers can use

- 27. Want to connect to the PHSchool.com link for this section? Click Here! Section 3 Assessment 1.

- 29. Скачать презентацию

Кредиттік оқыту технологиясы

Кредиттік оқыту технологиясы Using Credit Cards: The Role of Open Credit

Using Credit Cards: The Role of Open Credit Реструктуризація і санація підприємств

Реструктуризація і санація підприємств История возникновения Международных Стандартов, Финансовой Отчетности (МСФО), суть, цели и задачи

История возникновения Международных Стандартов, Финансовой Отчетности (МСФО), суть, цели и задачи Отчетность в апреле 2023 г. Заполнение уведомления. Ошибки в уведомлениях. УФНС по РС(Я)

Отчетность в апреле 2023 г. Заполнение уведомления. Ошибки в уведомлениях. УФНС по РС(Я) Financial markets: Equity market in details. Lecture 7

Financial markets: Equity market in details. Lecture 7 Цели, функции, основные направления и процедуры внутреннего аудита цикла доходов

Цели, функции, основные направления и процедуры внутреннего аудита цикла доходов 1С-Рейтинг: Элеватор для 1С:Предприятие 8. Учет зерна и производимой продукции на зерноперерабатывающих предприятиях

1С-Рейтинг: Элеватор для 1С:Предприятие 8. Учет зерна и производимой продукции на зерноперерабатывающих предприятиях Цели, функции, задачи финансового менеджмента

Цели, функции, задачи финансового менеджмента Налог на добычу полезных ископаемых. Глава 26 НК РФ

Налог на добычу полезных ископаемых. Глава 26 НК РФ Налоговая система Республики Беларусь

Налоговая система Республики Беларусь Финансовые ресурсы предприятия и их источники, направления и использование

Финансовые ресурсы предприятия и их источники, направления и использование Анализ прибыли и рентабельности предприятия

Анализ прибыли и рентабельности предприятия Информационное обеспечение банковской деятельности

Информационное обеспечение банковской деятельности Совершенствование системы мотивации и стимулирования персонала ИП Хомякова Е.Е

Совершенствование системы мотивации и стимулирования персонала ИП Хомякова Е.Е Государственная пенсия по инвалидности

Государственная пенсия по инвалидности Финансовые ресурсы и собственный капитал организации. Тема 2

Финансовые ресурсы и собственный капитал организации. Тема 2 Семинар. Порядок проведения закупок товаров (работ, услуг) за счет собственных средств ГО Минское городское жилищное хозяйство

Семинар. Порядок проведения закупок товаров (работ, услуг) за счет собственных средств ГО Минское городское жилищное хозяйство Зарплатные карты национальной платежной системы Мир Саровбизнесбанка

Зарплатные карты национальной платежной системы Мир Саровбизнесбанка Предмет и метод бухгалтерского учета

Предмет и метод бухгалтерского учета Инвестиционная политика государства. (Тема 14)

Инвестиционная политика государства. (Тема 14) Вартість та оптимізація структури капіталу на ДП Чернігівська мехколона

Вартість та оптимізація структури капіталу на ДП Чернігівська мехколона Банки и банковская система

Банки и банковская система Финансовый менеджмент

Финансовый менеджмент Ночной аудитор отеля

Ночной аудитор отеля Практика применения механизмов инициативного бюджетирования на муниципальном уровне

Практика применения механизмов инициативного бюджетирования на муниципальном уровне Гранты в образовании

Гранты в образовании Международные Стандарты Финансовой Отчетности

Международные Стандарты Финансовой Отчетности