Содержание

- 2. Learning Objectives Know how credit cards work. Understand the costs of credit. Describe the different types

- 3. A First Look at Credit Cards and Open Credit Credit involves receiving cash, goods, or services

- 4. Interest Rates The main determinant of the cost of a line of credit is the annual

- 5. Interest Rates Variable Rate Cards Are tied to another interest rate, usually the prime rate. Charge

- 6. Calculating the Balance Owed The method of determining the balance (balance calculation method) varies from one

- 7. Calculating the Balance Owed 3 ways to determine interest charges on unpaid balances: Average daily balance

- 8. Calculating the Balance Owed Average Daily Balance Method The most common method - used by 95%

- 9. Calculating the Balance Owed Previous Balance Method Interest payments are charged against what was owed at

- 10. Calculating the Balance Owed Adjusted Balance Method Interest is charged against the previous month’s balance only

- 11. Buying Money: The Cash Advance Cash advances at ATMs are just like taking out a loan.

- 12. Grace Period Grace period of 20-25 days is common, interest is then charged on outstanding balance.

- 13. Annual Fee Some issuers impose an annual fee for using the credit card. Typical charge of

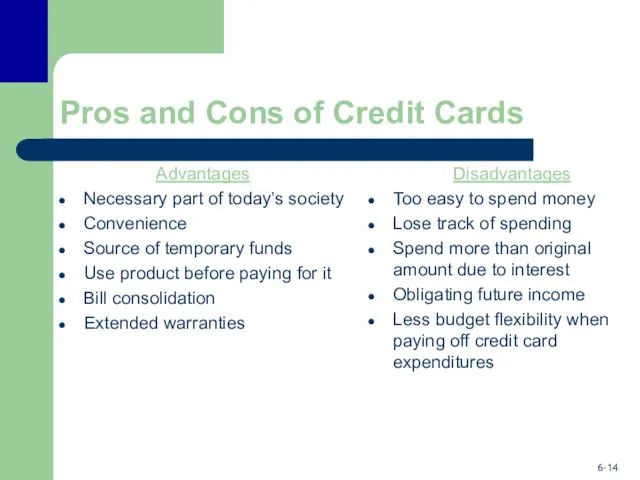

- 14. Pros and Cons of Credit Cards Advantages Necessary part of today’s society Convenience Source of temporary

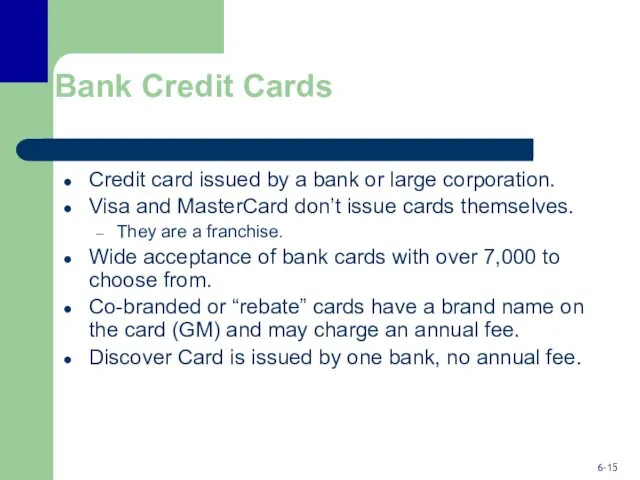

- 15. Bank Credit Cards Credit card issued by a bank or large corporation. Visa and MasterCard don’t

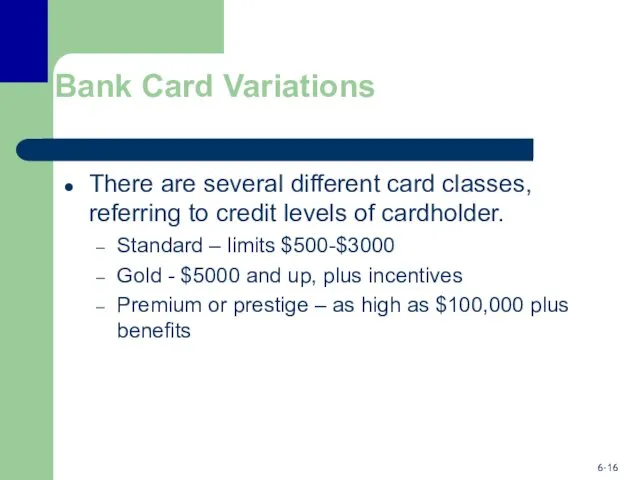

- 16. Bank Card Variations There are several different card classes, referring to credit levels of cardholder. Standard

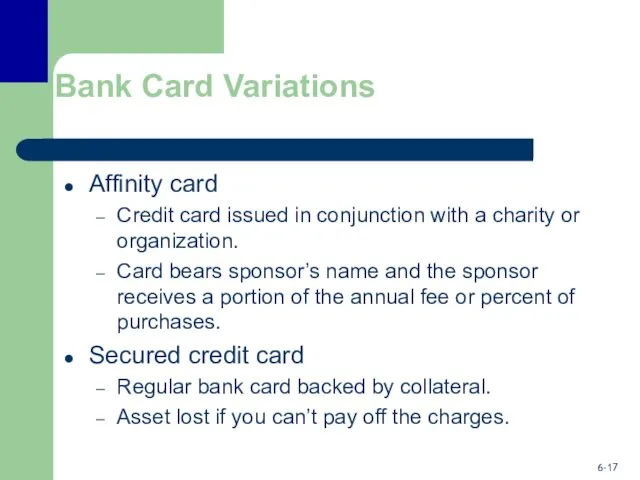

- 17. Bank Card Variations Affinity card Credit card issued in conjunction with a charity or organization. Card

- 18. Travel and Entertainment Cards Travel and entertainment cards (T&E) Initially aimed at business customers, providing a

- 19. Single-Purpose Cards A single-purpose card can be used only at a specific company. Companies issue these

- 20. Traditional Charge Account A traditional charge account is offered by a business. Utility companies and doctors

- 21. Getting a Credit Card Should a student get a credit card? Yes! It can be used

- 22. Credit Evaluation: The Five C’s of Credit Creditworthiness is determined by 5 C’s: Character Sense of

- 23. Your Credit Score A credit bureau is a private organization that maintains credit information on individuals,

- 24. Determining Creditworthiness Your credit information translates into a three digit number – your credit score –

- 25. How Your Credit Score is Computed A credit score is referred to as a FICO score.

- 26. How Your Credit Score is Computed What is a good score? The national average is 678.

- 27. What’s in Your Credit Report? Identifying Information: Name, address, date of birth, SS number, and employment

- 28. What’s in Your Credit Report? Inquiries: Lists everyone who has accessed your report in the last

- 29. Factors That Determine Your Score Your Payment History (35%) Amount You Owe and Your Available Credit

- 30. Factors That Determine Your Score Your Payment History Lenders want to know how you have handled

- 31. Factors That Determine Your Score Length of Credit History The longer the credit accounts have been

- 32. Factors That Determine Your Score New Credit New applications for credit will lower your score. Those

- 33. Monitoring Your Credit Score Monitor your score to ensure there are no errors. The Fair and

- 34. The Credit Bureau and Your Rights Congress passed the FACT Act in 2003. Allowing individuals a

- 35. The Credit Bureau and Your Rights You have the right to have a statement in your

- 37. Скачать презентацию

Заработная плата

Заработная плата Денежная система

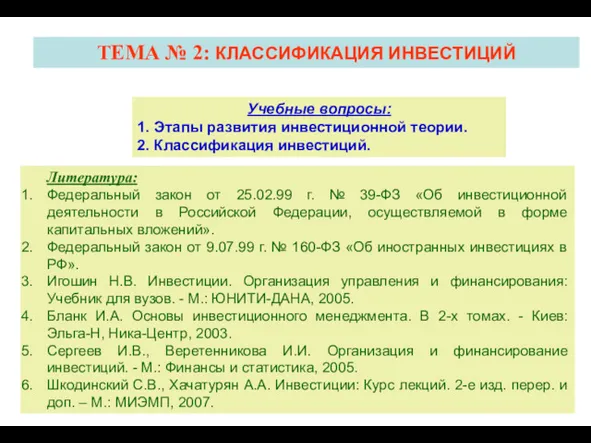

Денежная система Лекция 2. Классификация инвестиций

Лекция 2. Классификация инвестиций Зарплатная карта МТС банк

Зарплатная карта МТС банк Методические подходы к оценке стоимости жизненного цикла. Классификация затрат при определении стоимости жизненного цикла

Методические подходы к оценке стоимости жизненного цикла. Классификация затрат при определении стоимости жизненного цикла Налог на прибыль организации

Налог на прибыль организации Бухгалтерский финансовый учет. Основы организации бухгалтерского финансового учета

Бухгалтерский финансовый учет. Основы организации бухгалтерского финансового учета Финансовая система Китайской народной республики

Финансовая система Китайской народной республики Обязательное социальное медицинское страхование (ОСМС)

Обязательное социальное медицинское страхование (ОСМС) Бухгалтерский учет как информационная система

Бухгалтерский учет как информационная система Зміст та структура звіту про власний капітал

Зміст та структура звіту про власний капітал Финансовое планирование и методы прогнозирования

Финансовое планирование и методы прогнозирования Теория налогов и налогообложения

Теория налогов и налогообложения Сравнительный анализ информационных систем инвестиционной деятельности

Сравнительный анализ информационных систем инвестиционной деятельности Российский университет дружбы народов. Стипендии в РУДН

Российский университет дружбы народов. Стипендии в РУДН Основные фонды сельскохозяйственного предприятия

Основные фонды сельскохозяйственного предприятия Семейный бюджет

Семейный бюджет Разработка бизнес - плана

Разработка бизнес - плана Страхование финансовых рисков

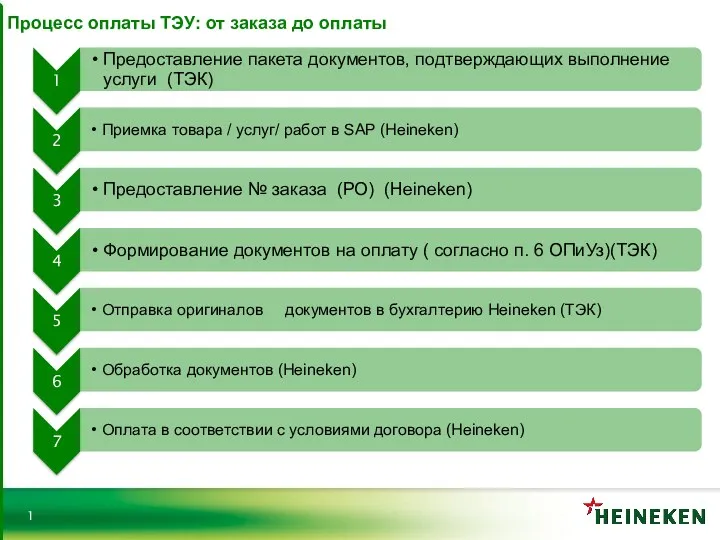

Страхование финансовых рисков Процесс оплаты ТЭУ: от заказа до оплаты

Процесс оплаты ТЭУ: от заказа до оплаты Итоги исполнения местных бюджетов Калининградской области за 9 месяцев 2018 года

Итоги исполнения местных бюджетов Калининградской области за 9 месяцев 2018 года Review of the grain market. Prices for wheat

Review of the grain market. Prices for wheat Анализ финансового состояния предприятия и оценка финансовой устойчивости. Анализ ликвидности и платежеспособности

Анализ финансового состояния предприятия и оценка финансовой устойчивости. Анализ ликвидности и платежеспособности Разработка и внедрение электронных документов развитие

Разработка и внедрение электронных документов развитие Облік витрат та калькулювання собівартості продукції рослинництва та тваринництва

Облік витрат та калькулювання собівартості продукції рослинництва та тваринництва 1С-Отчетность за 9 месяцев 2019 г. – на что обратить внимание

1С-Отчетность за 9 месяцев 2019 г. – на что обратить внимание Қазақстан Халық Банкі

Қазақстан Халық Банкі Инвестиционная политика ПФР и НПФ

Инвестиционная политика ПФР и НПФ