©Ella Khromova

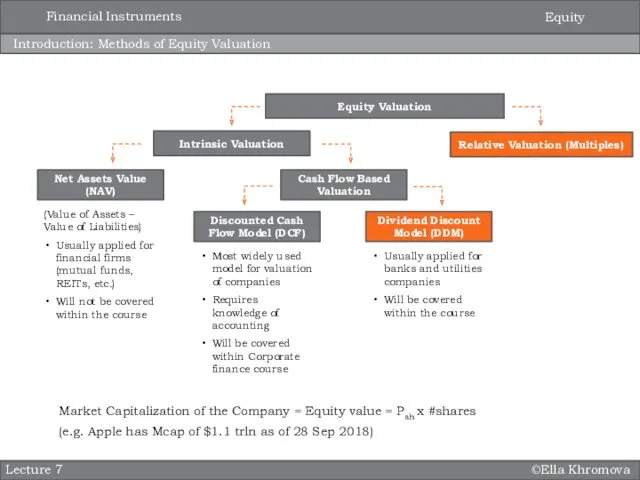

Introduction: Methods of Equity Valuation

Lecture 7

Intrinsic Valuation

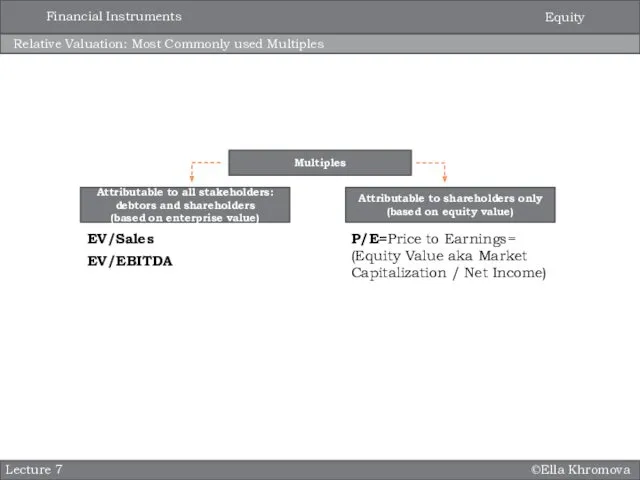

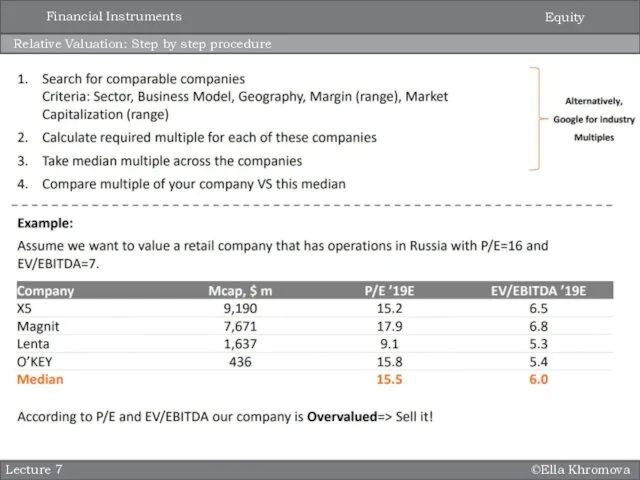

Relative Valuation (Multiples)

Net Assets

Value (NAV)

(Value of Assets – Value of Liabilities)

Usually applied for financial firms (mutual funds, REITs, etc.)

Will not be covered within the course

Cash Flow Based Valuation

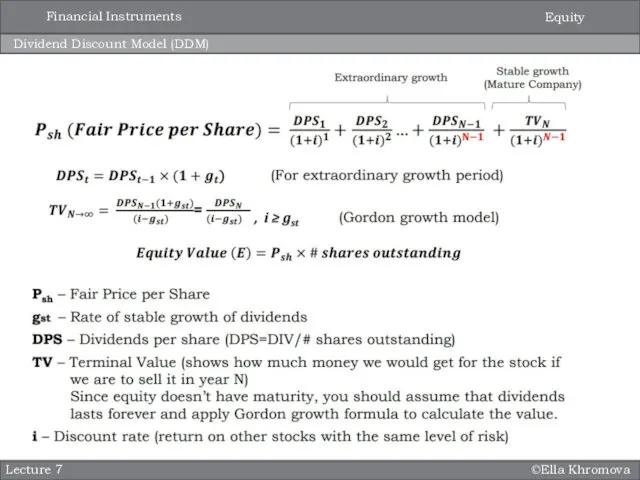

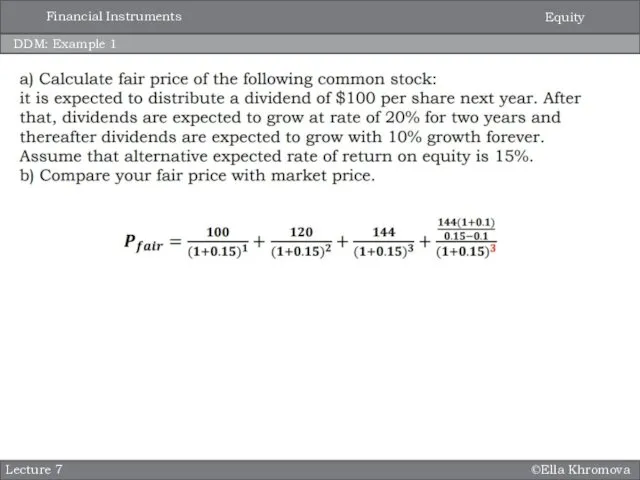

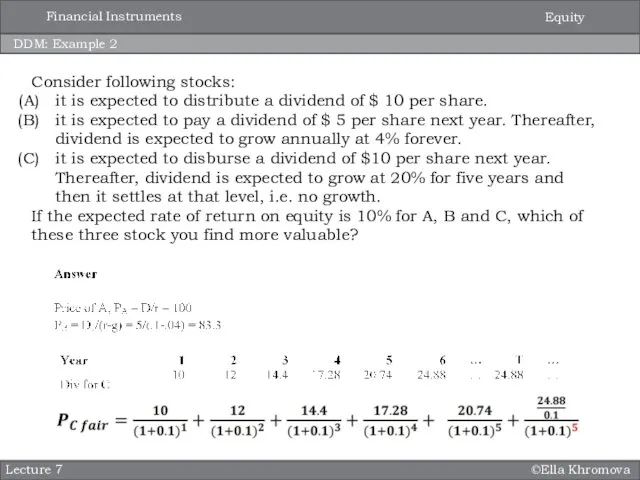

Dividend Discount Model (DDM)

Discounted Cash Flow Model (DCF)

Usually applied for banks and utilities companies

Will be covered within the course

Most widely used model for valuation of companies

Requires knowledge of accounting

Will be covered within Corporate finance course

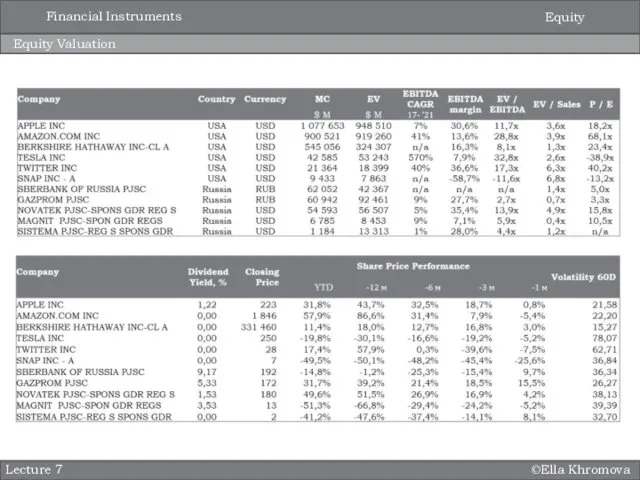

Equity

Financial Instruments

Market Capitalization of the Company = Equity value = Psh x #shares

(e.g. Apple has Mcap of $1.1 trln as of 28 Sep 2018)

Страхование от несчастных случаев и профзаболеваний

Страхование от несчастных случаев и профзаболеваний Моніторинг та оцінка бюджетних програм

Моніторинг та оцінка бюджетних програм Дебетовая карта Visa Телефонная карта

Дебетовая карта Visa Телефонная карта Договор банковского счёта

Договор банковского счёта Анализ собственного и заемного капитала

Анализ собственного и заемного капитала Управление основными элементами оборотных активов

Управление основными элементами оборотных активов Валютные операции уполномоченных банков. Операции кредитных организаций на рынке ценных бумаг

Валютные операции уполномоченных банков. Операции кредитных организаций на рынке ценных бумаг Халықаралық банк ісінің негіздері және валюта-қаржылық қатынастар

Халықаралық банк ісінің негіздері және валюта-қаржылық қатынастар Налоги. Налоги прямые, косвенные

Налоги. Налоги прямые, косвенные Модели налогового учета

Модели налогового учета Дипломная работа. Разработка и реализация инвестиционного проекта по строительству жилищного комплекса

Дипломная работа. Разработка и реализация инвестиционного проекта по строительству жилищного комплекса Страховая терминология

Страховая терминология Инициативное бюджетирование в Республике Башкортостан

Инициативное бюджетирование в Республике Башкортостан Робота банку з готівкою, розрахунково-касові операції

Робота банку з готівкою, розрахунково-касові операції Money making

Money making Налоги. Структура налога

Налоги. Структура налога Особенности бюджетного процесса в Великобритании

Особенности бюджетного процесса в Великобритании Характеристика финансовых институтов, как объекта оценки. (Лекция 1)

Характеристика финансовых институтов, как объекта оценки. (Лекция 1) Цены и ценообразование

Цены и ценообразование Финансы

Финансы Концепция достойного труда в России

Концепция достойного труда в России Представление в Пенсионный фонд РФ сведений о страховых взносах и страховом стаже

Представление в Пенсионный фонд РФ сведений о страховых взносах и страховом стаже Компенсация родителям (законным представителям) детей расходов на отдых и оздоровление детей в Свердловской области

Компенсация родителям (законным представителям) детей расходов на отдых и оздоровление детей в Свердловской области Бухгалтерская (финансовая) отчетность

Бухгалтерская (финансовая) отчетность Introduction to Financial Statement Analysis. Chapter 2

Introduction to Financial Statement Analysis. Chapter 2 Почему мы нужны друг другу. Финансовые решения банка Открытие. Зарплатный проект

Почему мы нужны друг другу. Финансовые решения банка Открытие. Зарплатный проект Виды банковских счетов

Виды банковских счетов Практикум по начислению и взиманию республиканских налогов и сборов

Практикум по начислению и взиманию республиканских налогов и сборов