Содержание

- 2. Objectives Solve for simple interest. Calculate maturity value. Use a table to find the number of

- 3. Objectives Find exact and ordinary interest. Define the basic terms used with notes. Find the due

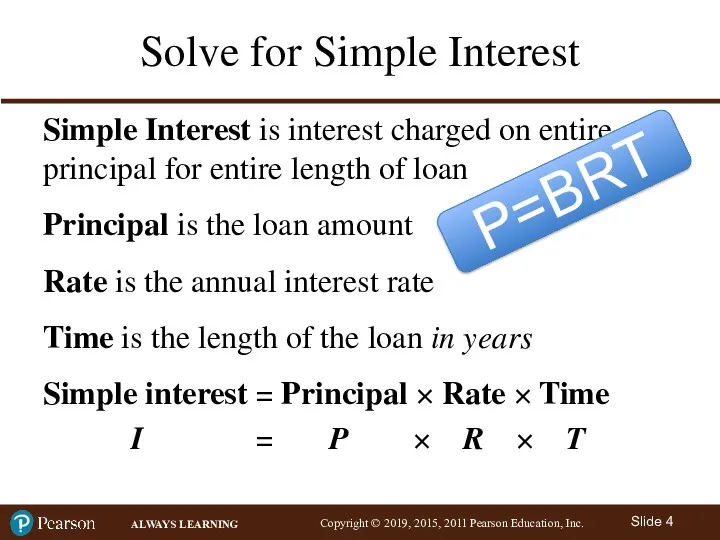

- 4. Solve for Simple Interest Simple Interest is interest charged on entire principal for entire length of

- 5. When Using the Formula I = PRT Rate (R) must first be changed to a decimal

- 6. Example 1 (1 of 4) Jessica Hernandez needs to borrow $85,000 for 9 months. Her bank

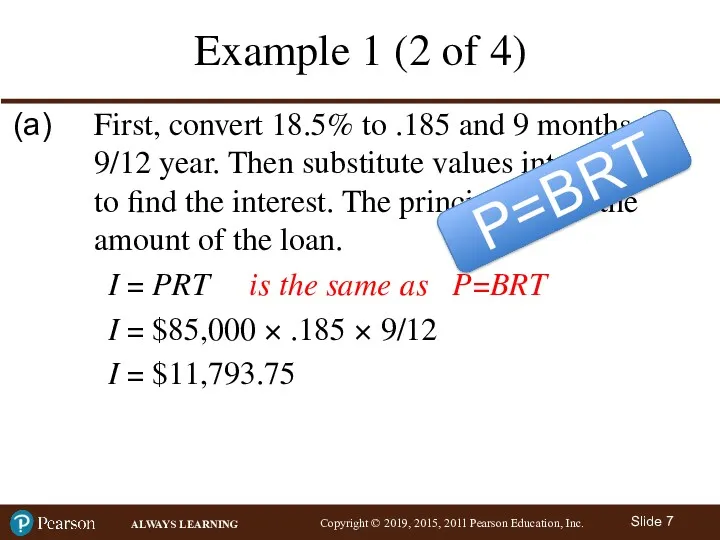

- 7. Example 1 (2 of 4) First, convert 18.5% to .185 and 9 months to 9/12 year.

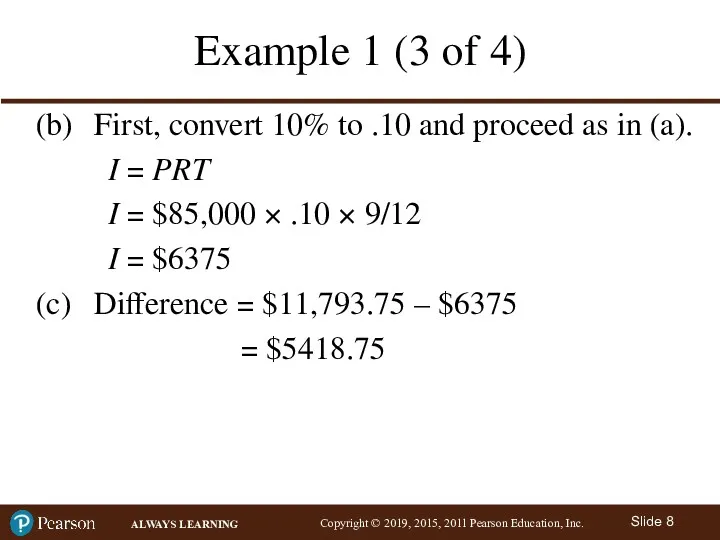

- 8. Example 1 (3 of 4) (b) First, convert 10% to .10 and proceed as in (a).

- 9. Example 1 (4 of 4) Hernandez quickly learned an important lesson: Interest costs can be very

- 10. Calculate Maturity Value Maturity Value is the amount that must be repaid when the loan is

- 11. Example 2 (1 of 2) Tom Swift needs to borrow $28,300 to remodel his bookstore so

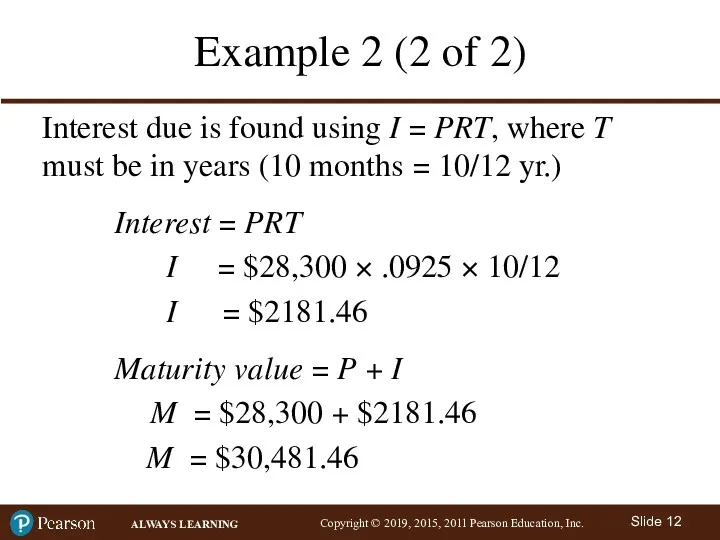

- 12. Example 2 (2 of 2) Interest due is found using I = PRT, where T must

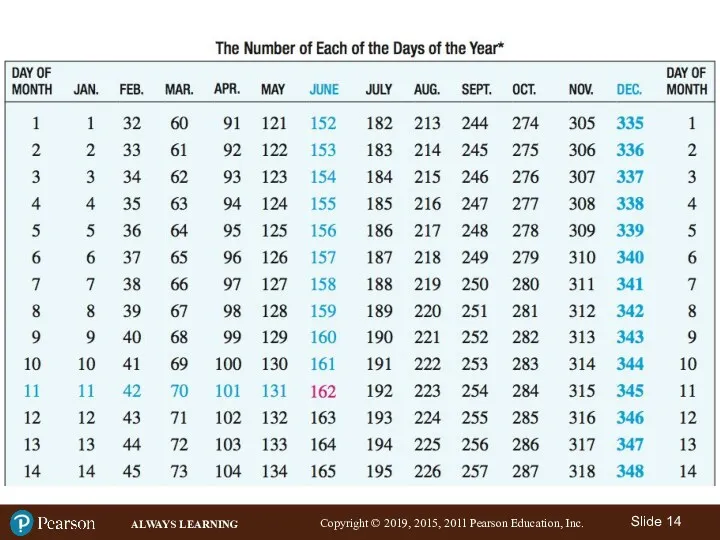

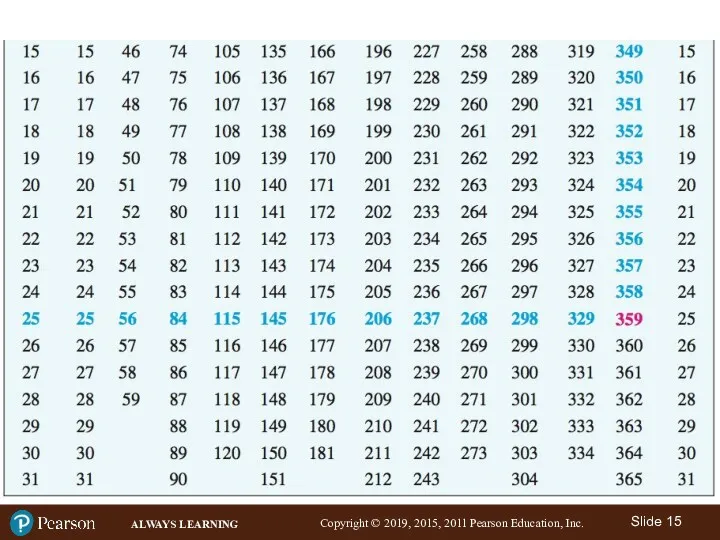

- 13. Use a Table to Find the Number of Days from One Date to Another Loan may

- 16. Example 3 (1 of 4) Use the table to find the number of days from (a)

- 17. Example 3 (2 of 4) (a) July 22 is day 203 March 24 is day –

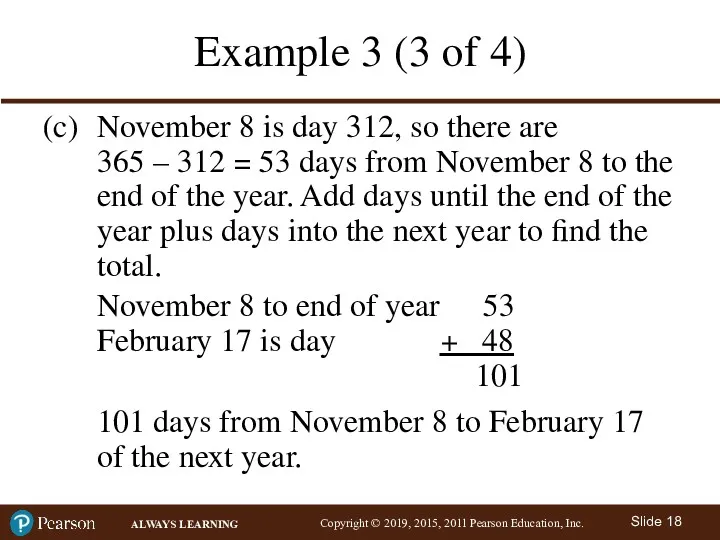

- 18. Example 3 (3 of 4) (c) November 8 is day 312, so there are 365 –

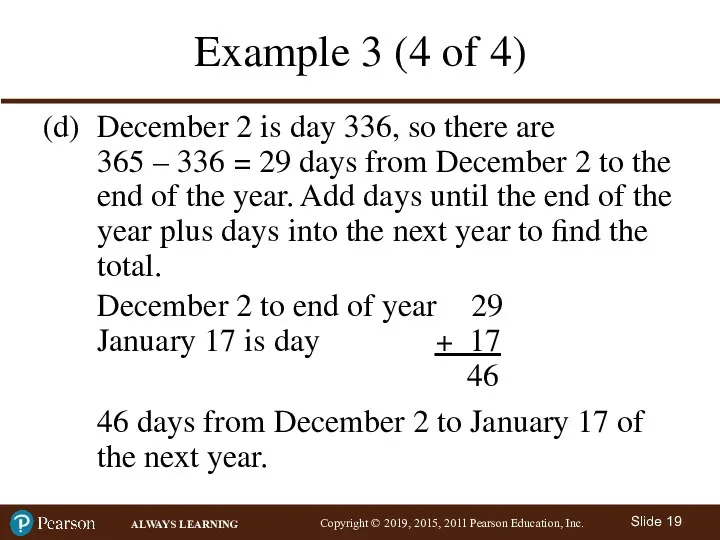

- 19. Example 3 (4 of 4) (d) December 2 is day 336, so there are 365 –

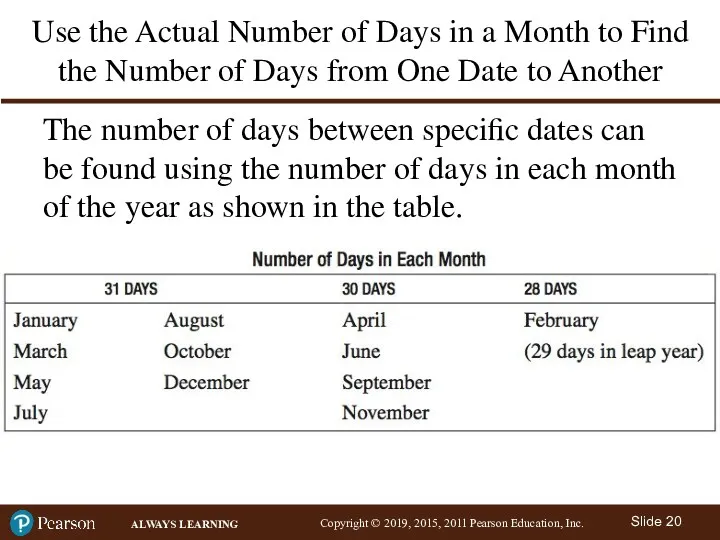

- 20. Use the Actual Number of Days in a Month to Find the Number of Days from

- 21. Rhyme Method Rhyme Method: 30 days hath September, April, June, and November. All the rest have

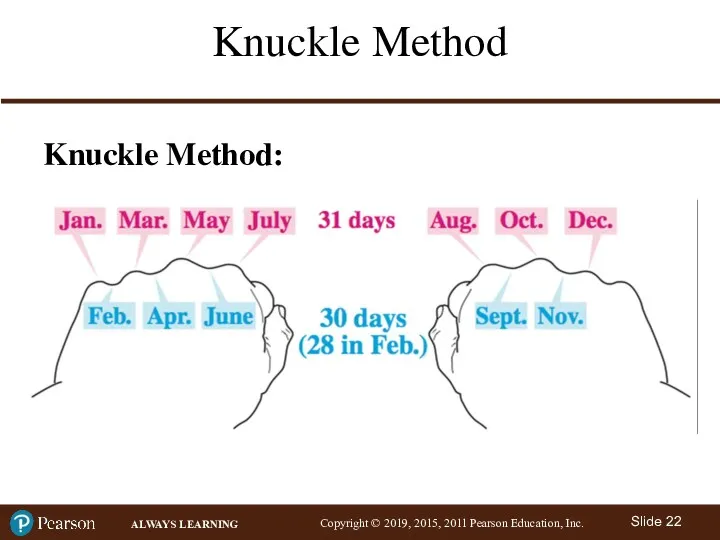

- 22. Knuckle Method Knuckle Method:

- 23. Example 4 (1 of 3) Find the number of days from (a) June 3 to August

- 24. Example 4 (2 of 3) (a) June has 30 days, so there are 30 – 3

- 25. Example 4 (3 of 3) (b) November has 30 days, so there are 30 – 4

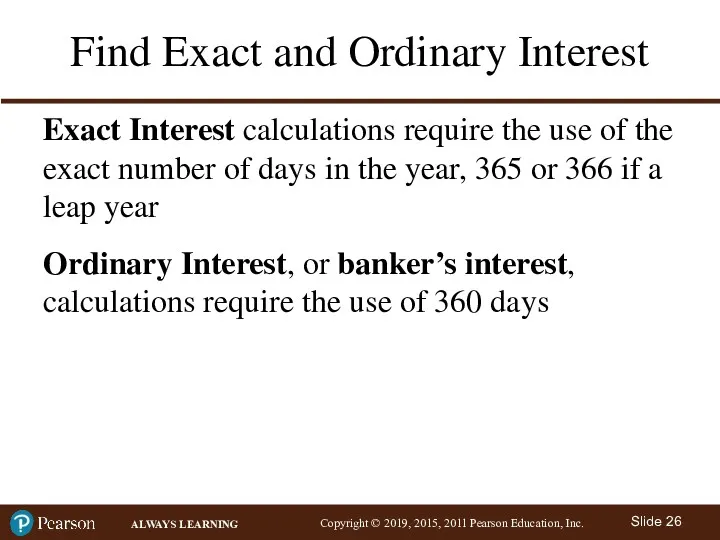

- 26. Find Exact and Ordinary Interest Exact Interest calculations require the use of the exact number of

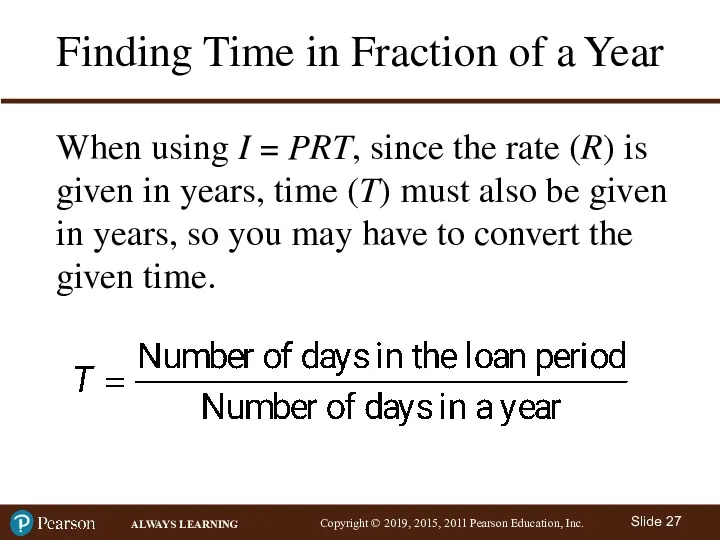

- 27. Finding Time in Fraction of a Year When using I = PRT, since the rate (R)

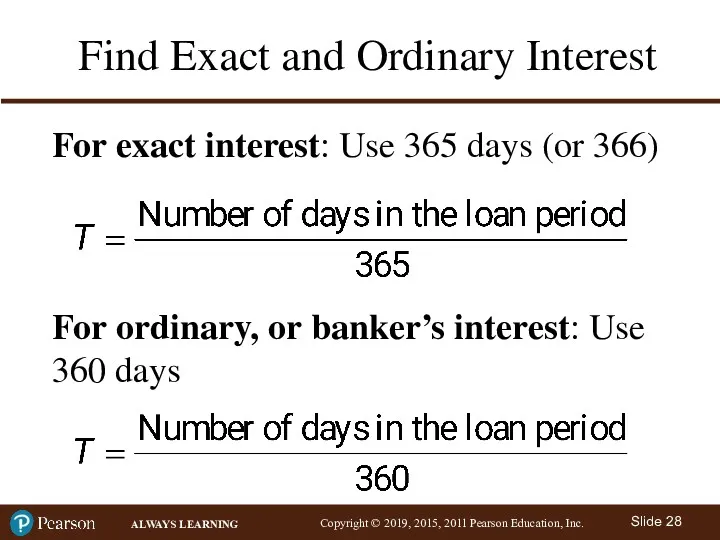

- 28. Find Exact and Ordinary Interest For exact interest: Use 365 days (or 366) For ordinary, or

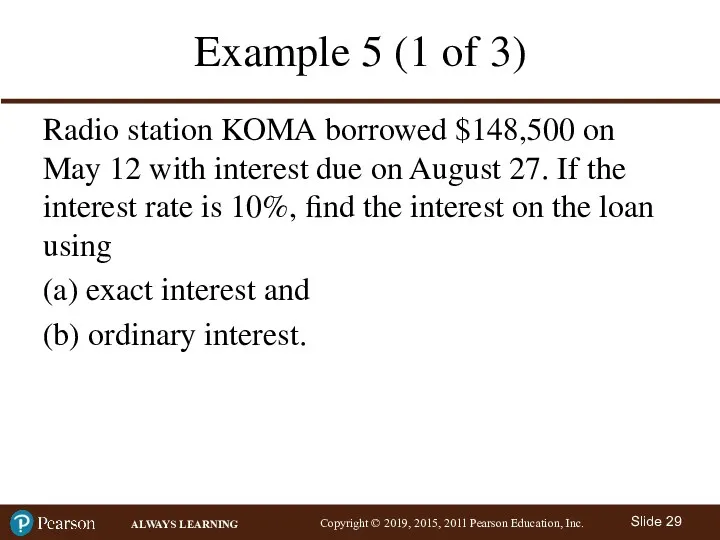

- 29. Example 5 (1 of 3) Radio station KOMA borrowed $148,500 on May 12 with interest due

- 30. Example 5 (2 of 3) Either the table method or the method of the number of

- 31. Example 5 (3 of 3) (b) Find ordinary interest with the same formula and values, except

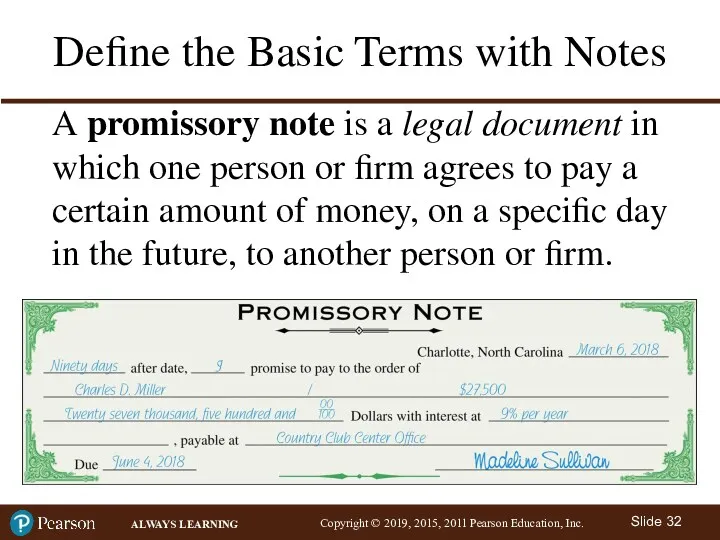

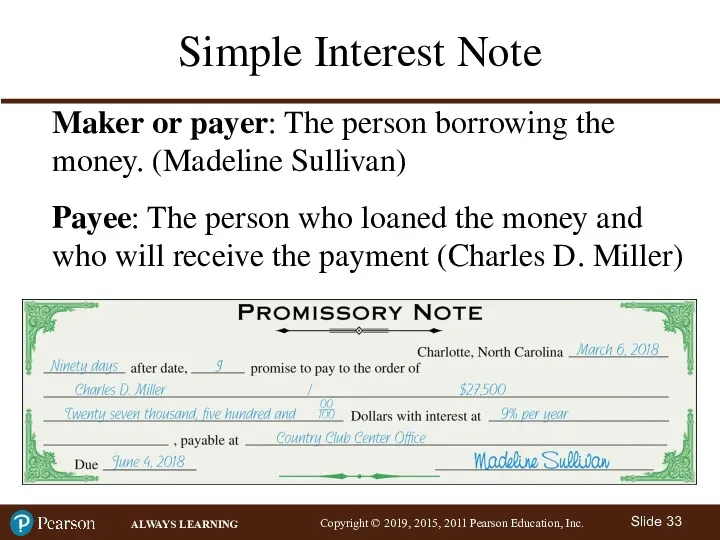

- 32. Define the Basic Terms with Notes A promissory note is a legal document in which one

- 33. Simple Interest Note Maker or payer: The person borrowing the money. (Madeline Sullivan) Payee: The person

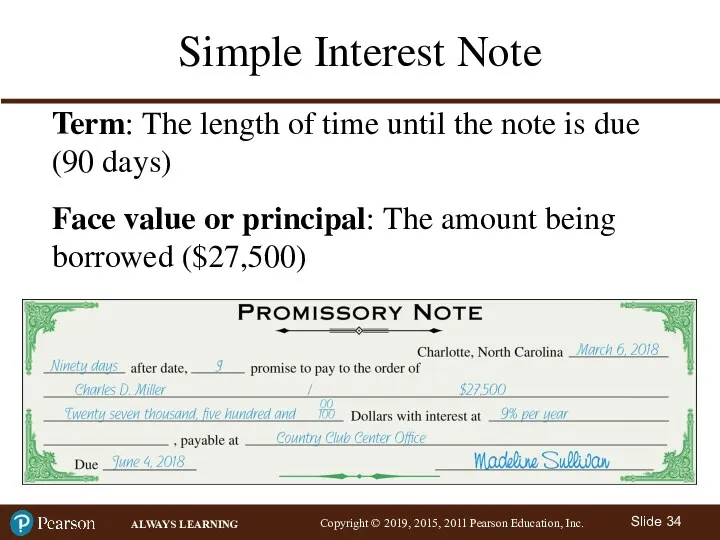

- 34. Simple Interest Note Term: The length of time until the note is due (90 days) Face

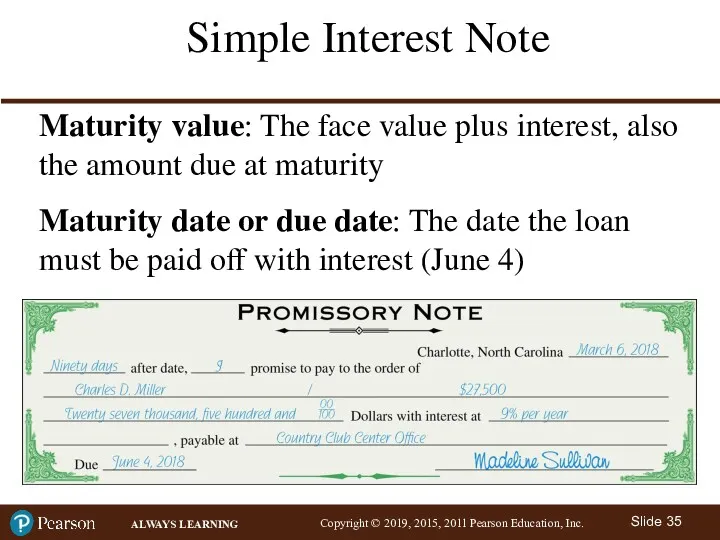

- 35. Simple Interest Note Maturity value: The face value plus interest, also the amount due at maturity

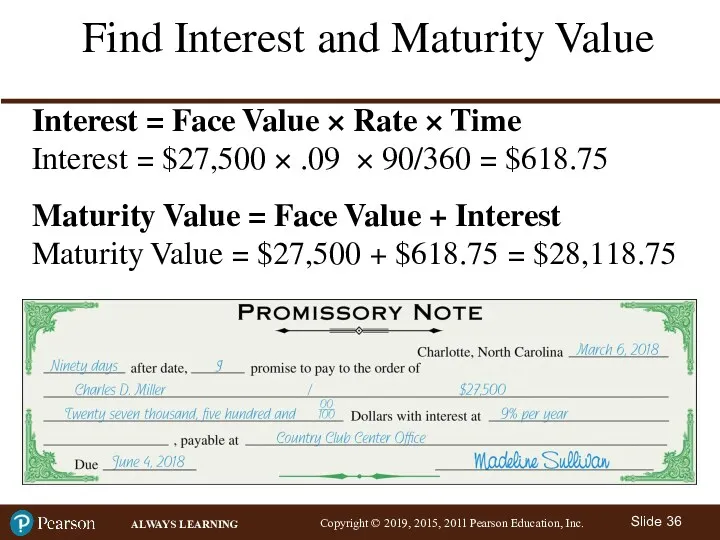

- 36. Find Interest and Maturity Value Interest = Face Value × Rate × Time Interest = $27,500

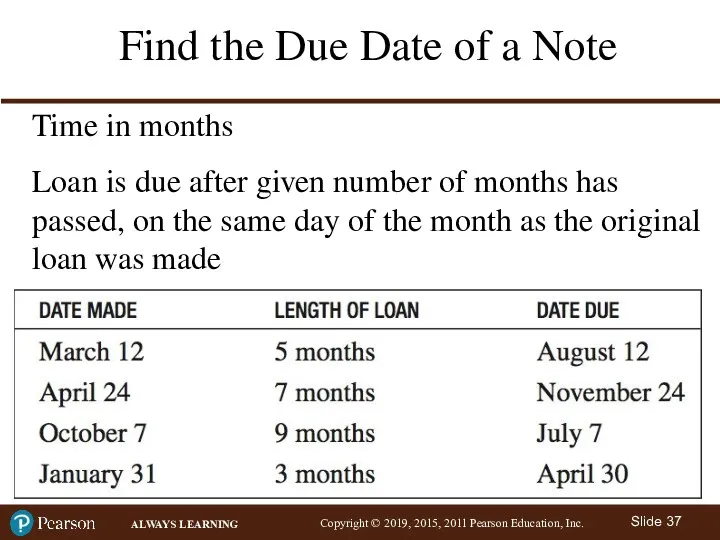

- 37. Find the Due Date of a Note Time in months Loan is due after given number

- 38. Example 6 (1 of 2) Find the due date, interest, and maturity value for a $600,000

- 40. Скачать презентацию

Финансы и кредит

Финансы и кредит Инвестиционный анализ и инвестиционное проектирование на предприятии

Инвестиционный анализ и инвестиционное проектирование на предприятии Становление и развитие социального страхования

Становление и развитие социального страхования Финансовый менеджмент международной фирмы

Финансовый менеджмент международной фирмы Participation banks in the financial system of Turkey

Participation banks in the financial system of Turkey Источники дохода. Стратегии финансового развития

Источники дохода. Стратегии финансового развития Временная стоимость денег. Тема 3

Временная стоимость денег. Тема 3 SCP-анализ

SCP-анализ Теория организации

Теория организации Финансовый анализ компании

Финансовый анализ компании Capital adequacy: BASEL 2 and BASEL 3

Capital adequacy: BASEL 2 and BASEL 3 Материнский капитал как социальная защита населения

Материнский капитал как социальная защита населения Финансирование инновационной деятельности

Финансирование инновационной деятельности Как работать с единым налоговым платежом

Как работать с единым налоговым платежом Теории, методы и инструменты управления банковской ликвидностью

Теории, методы и инструменты управления банковской ликвидностью Структура и объекты социальной защиты населения

Структура и объекты социальной защиты населения Основные задачи и функции Федеральной налоговой службы

Основные задачи и функции Федеральной налоговой службы Жилой Комплекс Окский берег. Государственная программа “Жилье для российской семьи” Нижний Новгород

Жилой Комплекс Окский берег. Государственная программа “Жилье для российской семьи” Нижний Новгород Образовательные мероприятия. Система Госфинансы. Обучающая презентация для сотрудников

Образовательные мероприятия. Система Госфинансы. Обучающая презентация для сотрудников Учет расчетов с покупателями и заказчиками. Анализ дебиторской и кредиторской задолженности на примере ООО ЧОП Далекс

Учет расчетов с покупателями и заказчиками. Анализ дебиторской и кредиторской задолженности на примере ООО ЧОП Далекс Электронный аукцион

Электронный аукцион Ипотечное кредитование для физических лиц

Ипотечное кредитование для физических лиц Механизм управления финансовым состоянием и пути его совершенствования

Механизм управления финансовым состоянием и пути его совершенствования Ценовая политика государства

Ценовая политика государства Анализ учета труда и заработной платы

Анализ учета труда и заработной платы Дистанционное хищение денежных средств граждан

Дистанционное хищение денежных средств граждан Управление проектами. Расчетная часть бизнес-проекта

Управление проектами. Расчетная часть бизнес-проекта Вопросник по внутреннему контролю финансового бизнес-цикла

Вопросник по внутреннему контролю финансового бизнес-цикла