Слайд 2

Lesson objectives

Introduce the concept of currency forwards and FX swaps and

currency swaps

Review the mechanics of those contracts.

Create synthetic instruments for currency forwards.

Evaluate cash flows.

Слайд 3

Introduction

Financial instruments can be denominated in different currencies.

Financial markets offer

wide variety of liquid financial instruments denominated in USD .

However, the range of liquid financial instruments denominated in such currencies as Swiss francs or Swedish crones is relatively small.

Foreign exchange forward and swap contracts make USD denominated financial instruments available to market participants trading in other currencies.

Слайд 4

Currency forwards definition

Foreign currency forwards are used as a foreign currency

hedge when an investor has obligation to pay or receive foreign currency at some point in the future.

The currency forward represents a binding contract in foreign exchange market which fixes the exchange rate for sale or purchase of currency on a future date.

Currency forwards also known as outright forwards are over-the-counter financial instruments.

Слайд 5

Currency forward contracts

Слайд 6

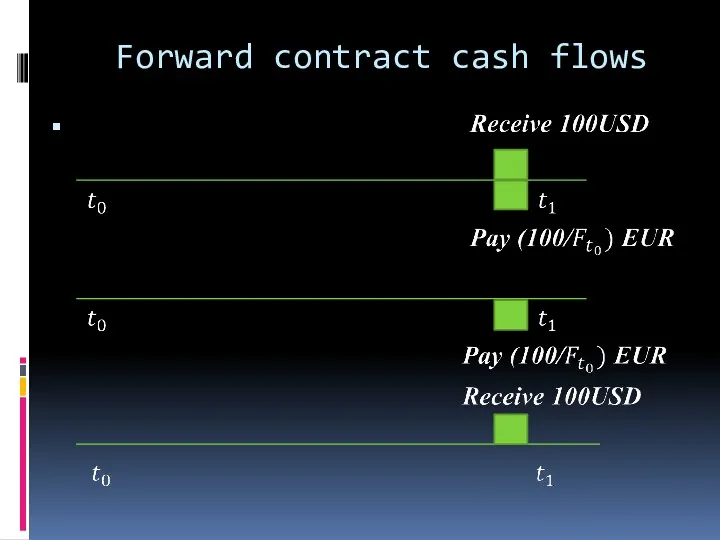

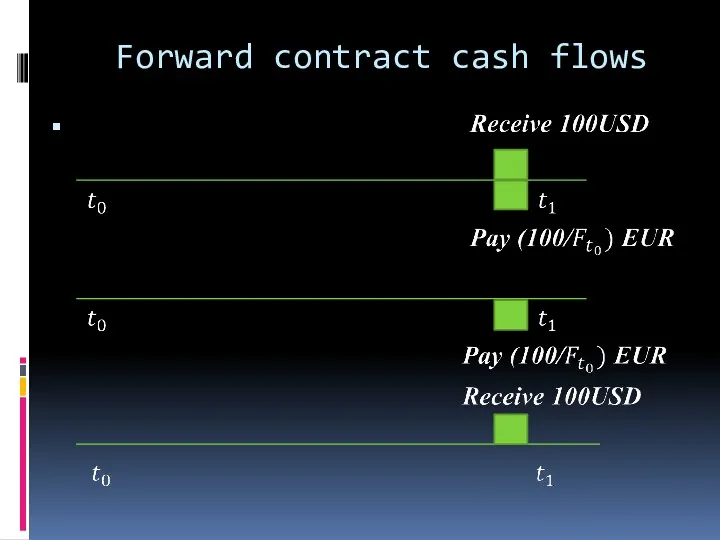

Forward contract cash flows

Слайд 7

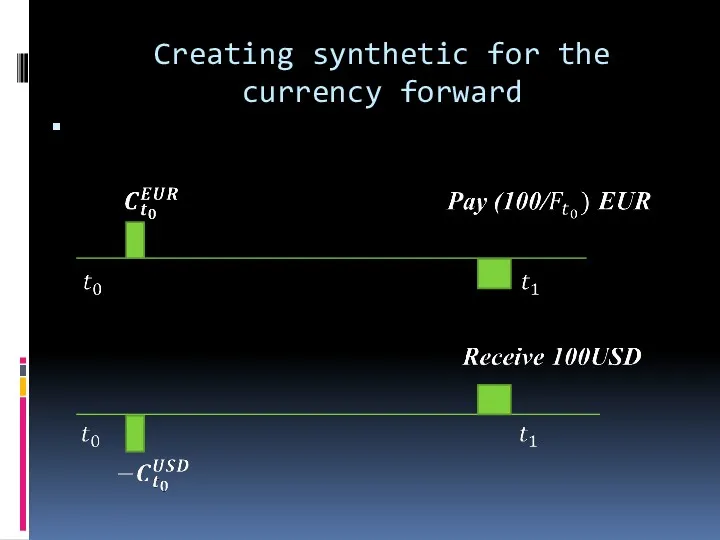

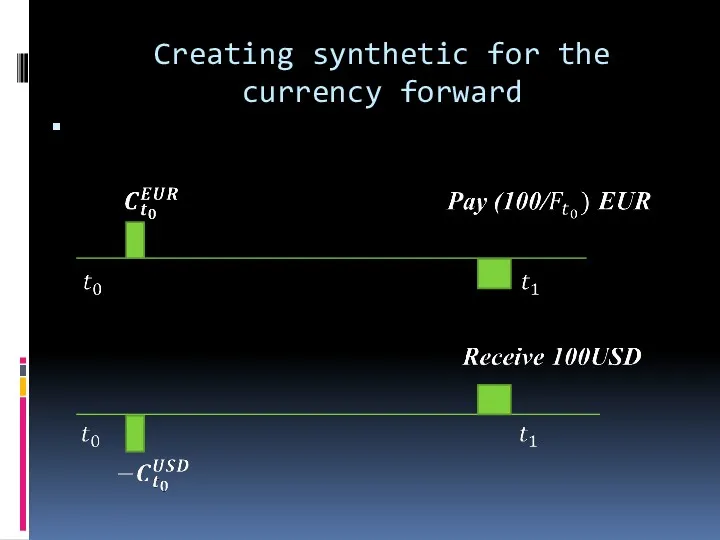

Creating synthetic for the currency forward

Слайд 8

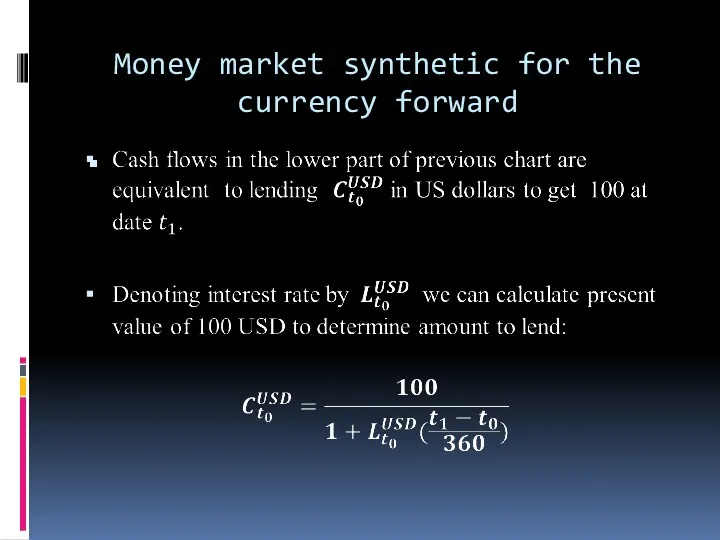

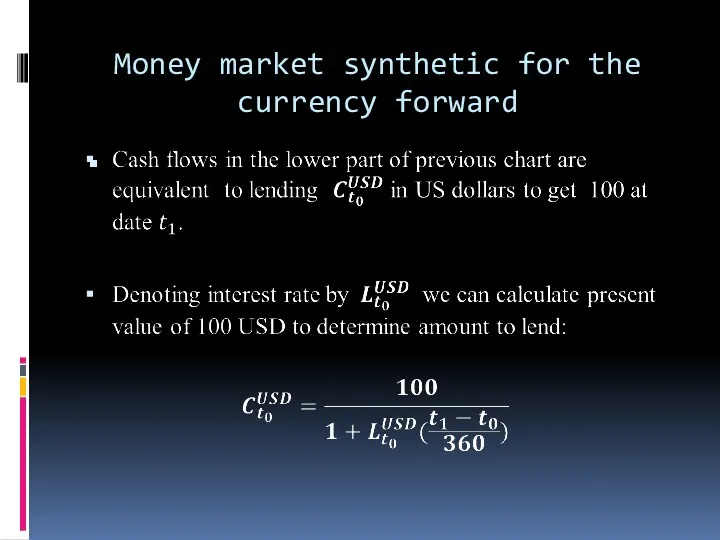

Money market synthetic for the currency forward

Слайд 9

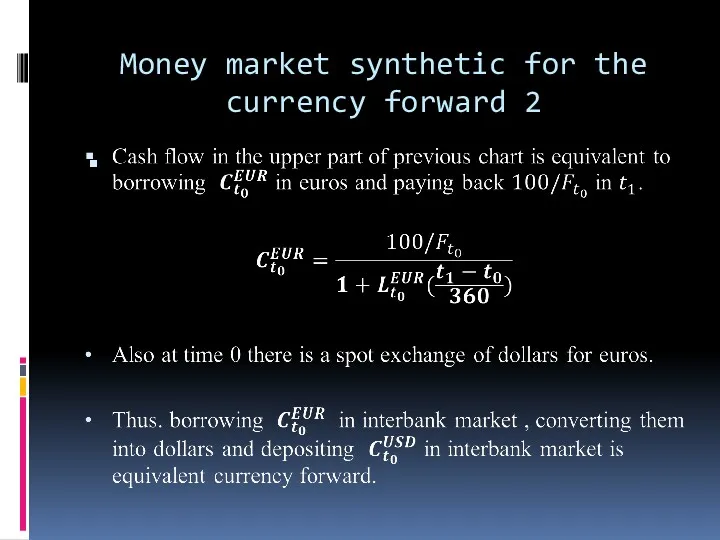

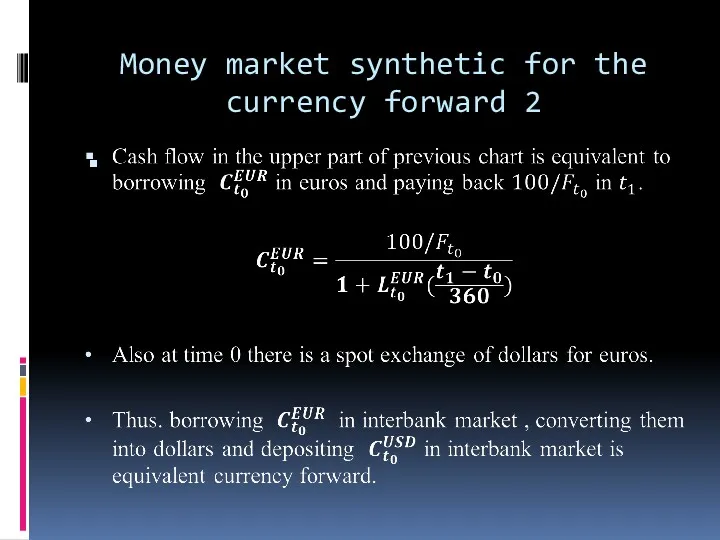

Money market synthetic for the currency forward 2

Слайд 10

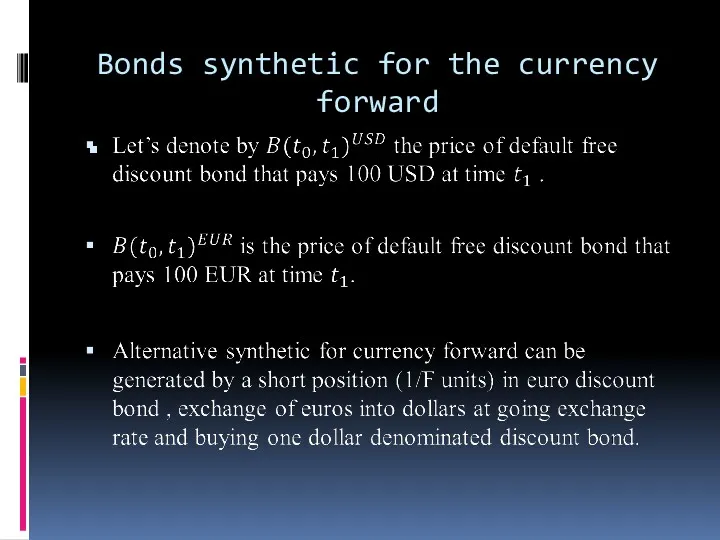

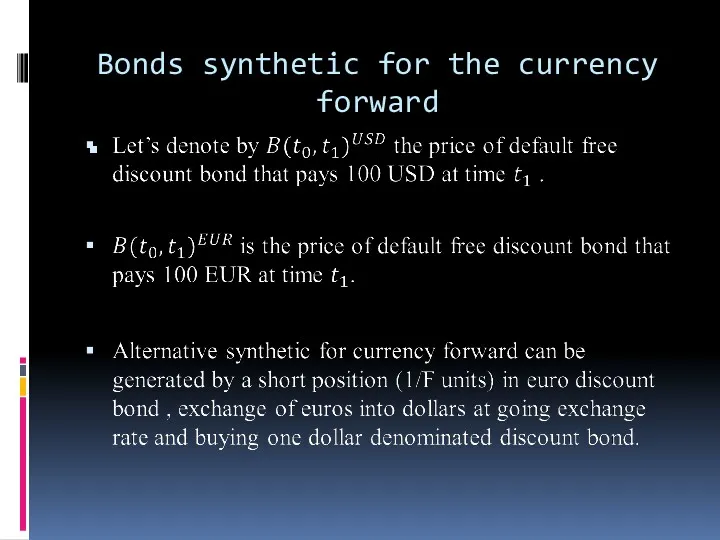

Bonds synthetic for the currency forward

Слайд 11

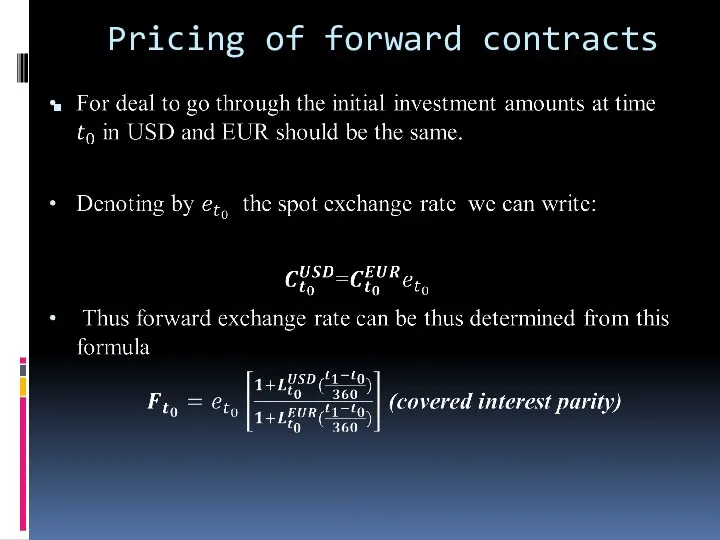

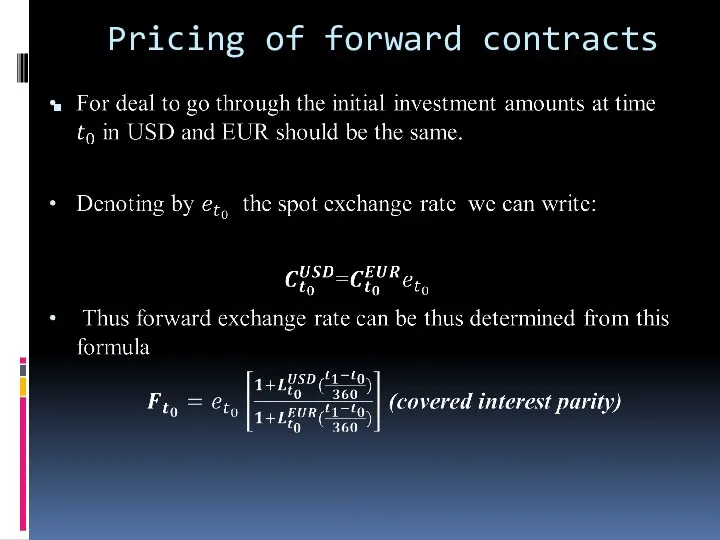

Pricing of forward contracts

Слайд 12

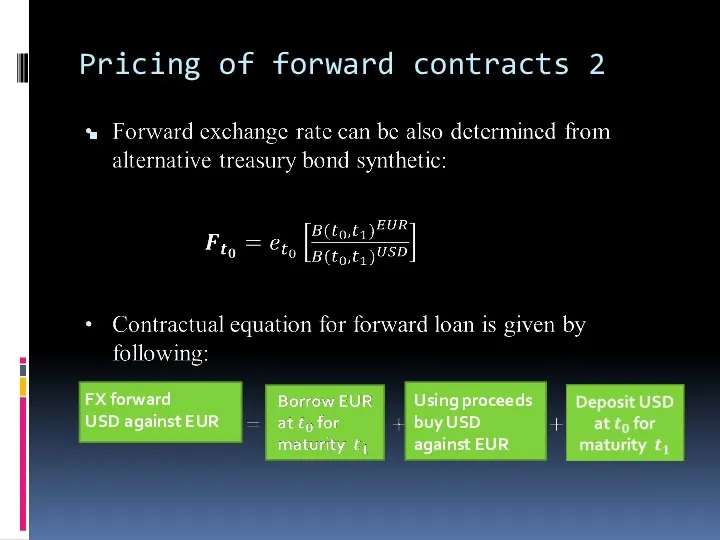

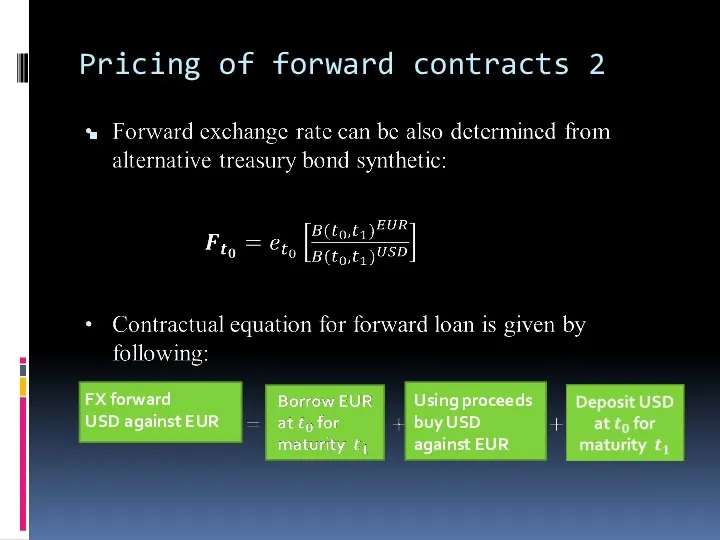

Pricing of forward contracts 2

FX forward

USD against EUR

Using proceeds

Слайд 13

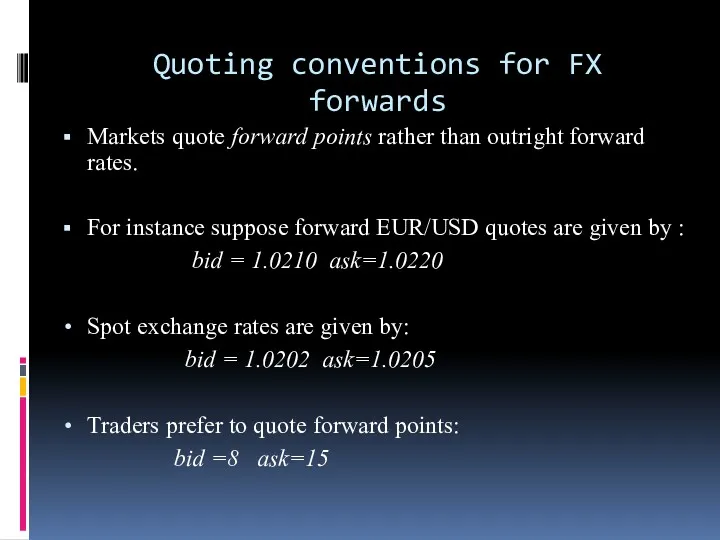

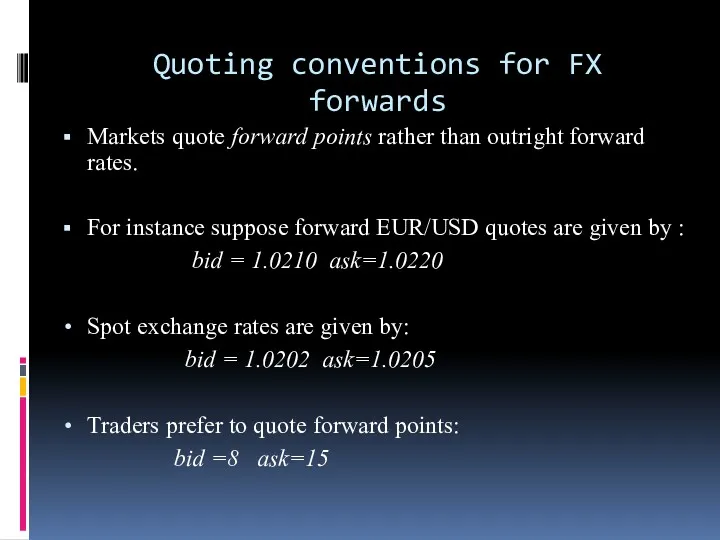

Quoting conventions for FX forwards

Markets quote forward points rather than outright

forward rates.

For instance suppose forward EUR/USD quotes are given by :

bid = 1.0210 ask=1.0220

Spot exchange rates are given by:

bid = 1.0202 ask=1.0205

Traders prefer to quote forward points:

bid =8 ask=15

Слайд 14

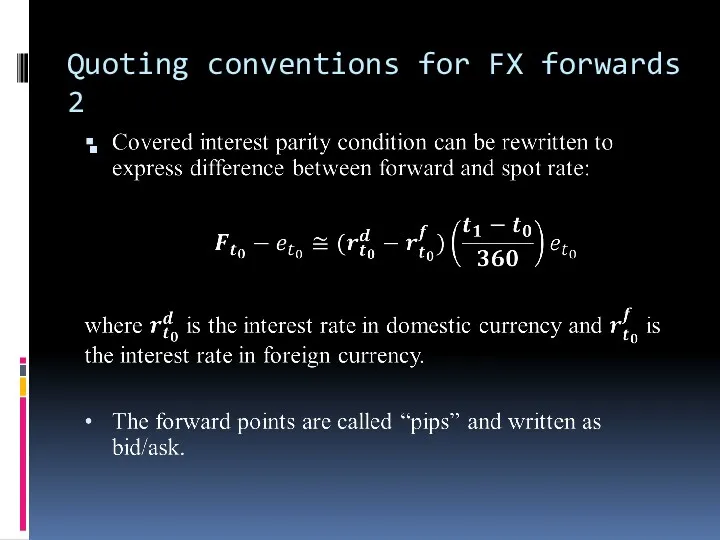

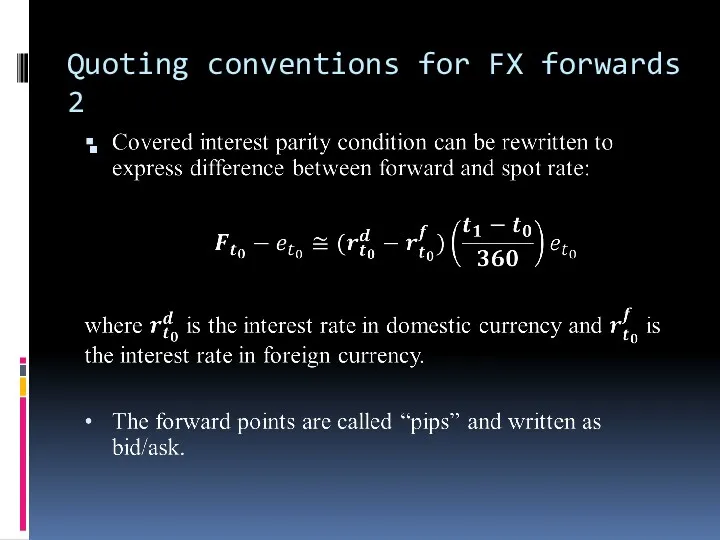

Quoting conventions for FX forwards 2

Слайд 15

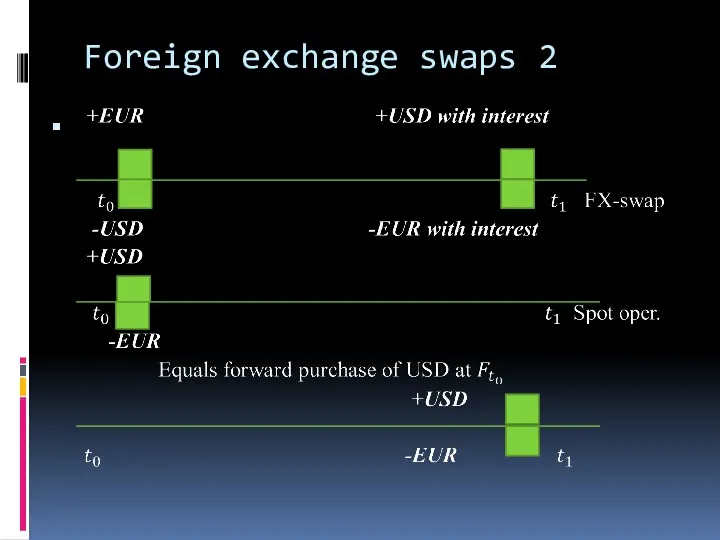

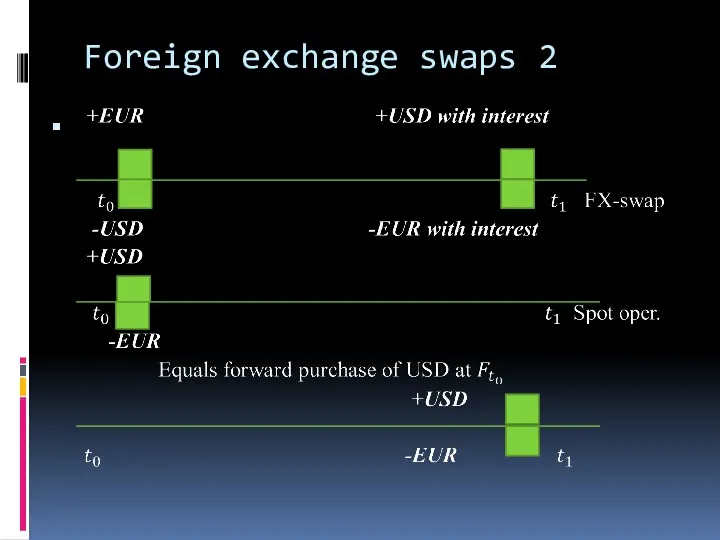

Foreign exchange swaps

Foreign exchange swap is a contract in which

one party borrows one currency from and at the same time lends another currency to second party.

The repayment obligation is used as collateral and the amount of repayment is fixed by the FX forward rate. The FX swap can be considered as riskless collateralized borrowing/lending.

We can also think of foreign exchange swap as if the two counterparties spot purchase and forward sell two currencies against each other.

Слайд 16

Слайд 17

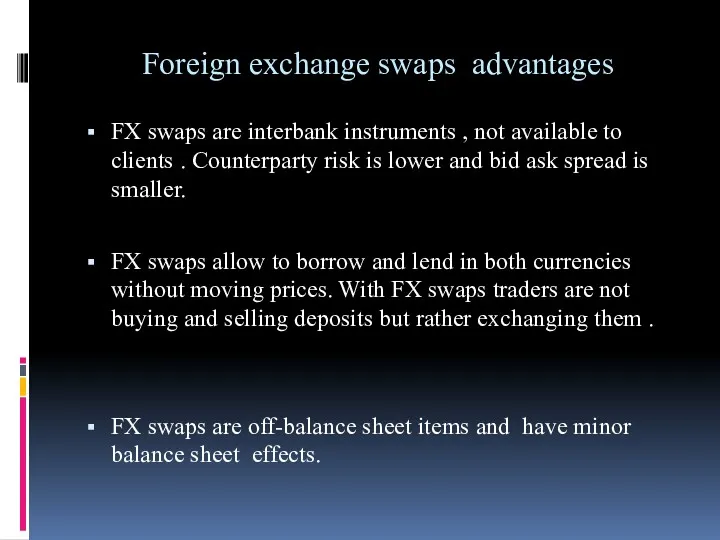

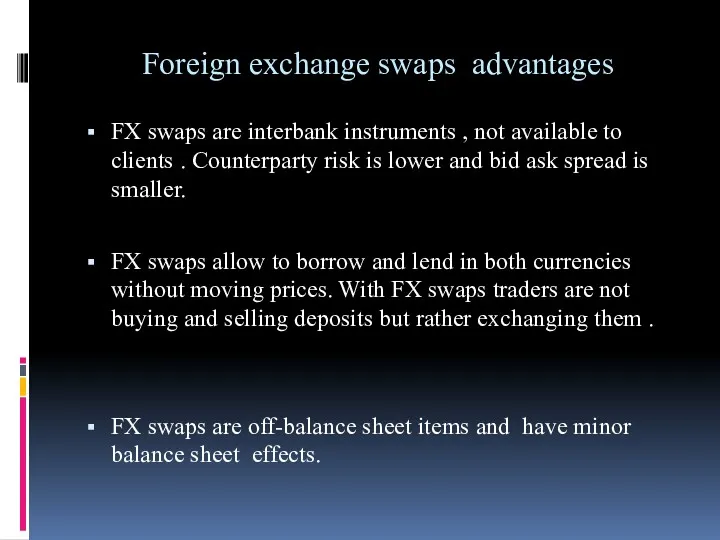

Foreign exchange swaps advantages

FX swaps are interbank instruments , not available

to clients . Counterparty risk is lower and bid ask spread is smaller.

FX swaps allow to borrow and lend in both currencies without moving prices. With FX swaps traders are not buying and selling deposits but rather exchanging them .

FX swaps are off-balance sheet items and have minor balance sheet effects.

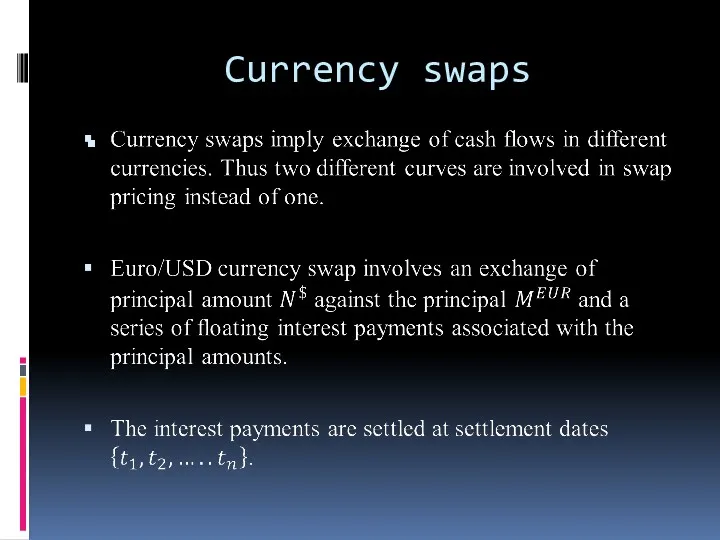

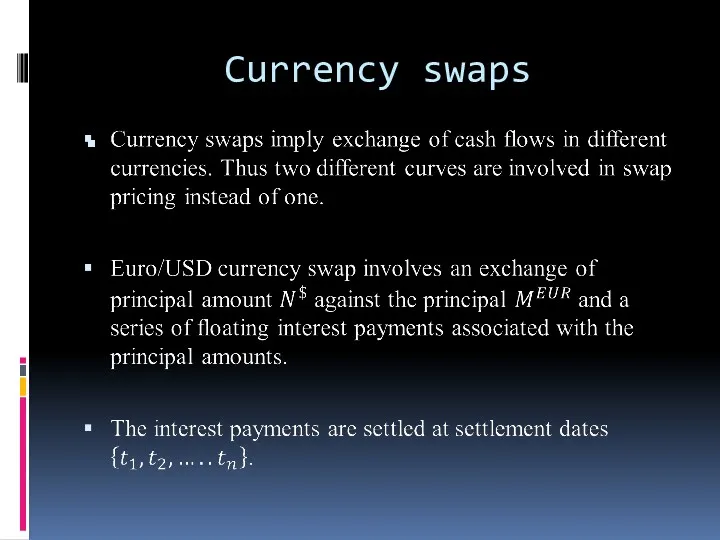

Слайд 18

Слайд 19

Финансовые инструменты АО Банк Развития Казахстана

Финансовые инструменты АО Банк Развития Казахстана Дебетовая карта

Дебетовая карта Отчетность страхователей для ведения индивидуального (персонифицированного) учета

Отчетность страхователей для ведения индивидуального (персонифицированного) учета Как работать с единым налоговым платежом

Как работать с единым налоговым платежом Основи побудови фінансово обліку

Основи побудови фінансово обліку Государственное регулирование кризисных ситуаций. Тема № 2

Государственное регулирование кризисных ситуаций. Тема № 2 Корректировка плана МТО ООО Таргин

Корректировка плана МТО ООО Таргин Бухгалтерлік есеп және аудит

Бухгалтерлік есеп және аудит Как проявить должную осмотрительность. Мнение ФНС

Как проявить должную осмотрительность. Мнение ФНС Сущность и функции денег. Денежное обращение

Сущность и функции денег. Денежное обращение Виды кредитов

Виды кредитов Навчальна дисципліна Фінанси для спеціальності Правознавство

Навчальна дисципліна Фінанси для спеціальності Правознавство Основы кредитно-денежной политики

Основы кредитно-денежной политики Положение по ведению бухгалтерского учета и бухгалтерской отчетности в РФ

Положение по ведению бухгалтерского учета и бухгалтерской отчетности в РФ Коммерческое предложение. Проект POS-credit

Коммерческое предложение. Проект POS-credit Недержавне пенсійне страхування: стан та перспективи розвитку

Недержавне пенсійне страхування: стан та перспективи розвитку Корпорация EG

Корпорация EG Налог на прибыль организаций

Налог на прибыль организаций Инвестиции и источники финансирования инвестиционной деятельности

Инвестиции и источники финансирования инвестиционной деятельности Анализ финансово-хозяйственной деятельности предприятия на примере ООО Фурла Рус

Анализ финансово-хозяйственной деятельности предприятия на примере ООО Фурла Рус Счета-фактуры по корректировкам отгрузок и возвратам, сводные справки. 1С:ERP Управление предприятием 2

Счета-фактуры по корректировкам отгрузок и возвратам, сводные справки. 1С:ERP Управление предприятием 2 Перевод работников АО Красная звезда на новые условия оплаты труда

Перевод работников АО Красная звезда на новые условия оплаты труда Управление пассивами банка

Управление пассивами банка Налог на доходы физических лиц

Налог на доходы физических лиц Рабочий отчет департамента аналитики компании IPO

Рабочий отчет департамента аналитики компании IPO Валютные системы. Валютные риски. Валютные кризисы

Валютные системы. Валютные риски. Валютные кризисы Банковские услуги. Виды банковских услуг для физических лиц

Банковские услуги. Виды банковских услуг для физических лиц Бюджет процесі

Бюджет процесі