Содержание

- 2. Universal exchange Tokenized assets, cryptocurrency, real estate, FX market, precious metals market, commodities Stock market -

- 3. Organization and practice General meeting of shareholders. - Board of Directors. - Chairman of the board

- 4. Tokenized assets Local and foreign securities Government securities STO is a faster and cheaper counterpart to

- 5. Local and foreign securities Securities sectors: • Stock • Blue chips companies • Mining sector Startup

- 6. Tokenizing foreign shares Tokenized shares are digital share tokens that are traded on traditional stock exchanges.

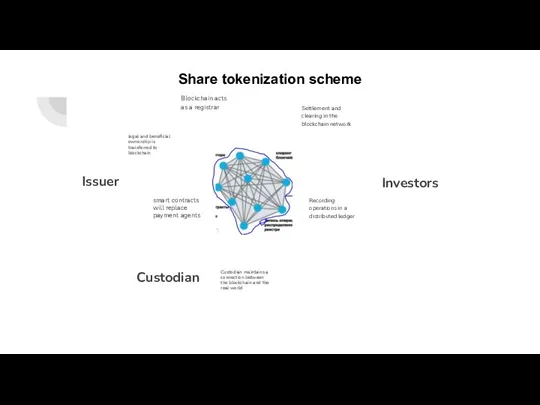

- 7. Issuer Custodian Investors Blockchain acts as a registrar legal and beneficial ownership is transferred to blockchain

- 8. Stages of stock digitization Take, for example, the gold mining company OJSC "Mining" To issue tokenized

- 9. Benefits of stock digitization 1. High liquidity; 2. Reducing the costs of trading operations; 3. Simplification

- 10. Сrypto sector

- 11. Tools Trading Spot market: Cryptocurrencies Tokens Derivatives market (futures: open-ended and deliverable) Initial offering Standard Stocks

- 12. Asset management Many financial companies offer asset management, trading stocks, resources, etc. with investor funds. For

- 13. Ecosystem Own decentralized cryptocurrency wallet, OTC Marketplace and NFT Marketplace and much more. Envoys Vision provides

- 14. DeFI Decentralized finance (DeFi) refers to an ecosystem of financial applications that are built on top

- 15. NFT A non-fungible token (NFT), also a unique token, is a title ownership of any digital

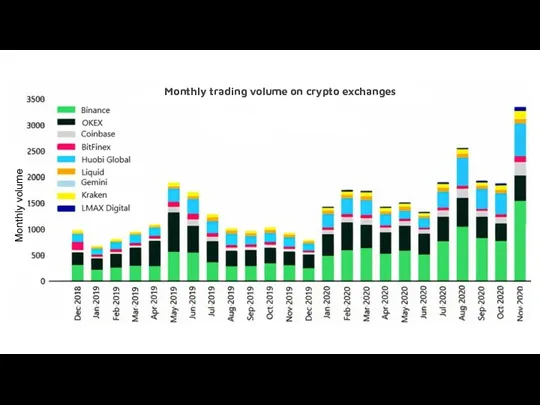

- 16. Monthly trading volume on crypto exchanges Monthly volume

- 17. Volumes on the cryptocurrency market 2009 - creation of the "Bitcoin" cryptocurrency 500 million confirmed transactions

- 18. Examples of two major crypto-exchanges: Binance and Bybit Binance Exchange $15 billion - historical maximum spot

- 19. Examples of two major crypto-exchanges: Binance and Bybit Bybit Exchange More than 1,200,000 users 5 cryptocurrencies

- 20. Examples of capitalization of new exchanges

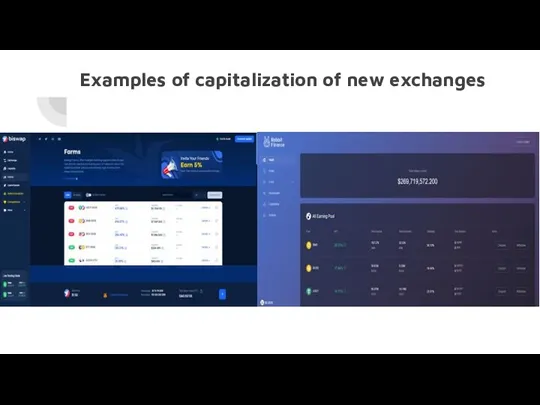

- 21. Precious metals sector

- 22. Non-ferrous metals and diamond market Non-ferrous metals market Precious metals credit market Diamond and Gem Market

- 23. Exchange participants Arbitrage Buyer Jewelry companies Brokers Gold mining companies Private Entrepreneurs

- 24. Requirements for participants entity or individual The founders must meet special conditions, which are specified in

- 25. Non-standard precious metals Non-standard precious metals with the following characteristics can be traded in the Precious

- 26. Standard precious metals Standard precious metals with the following characteristics can be traded in the precious

- 27. Currency market Foreign exchange deals Spot deals Currency - American dollars Cross rates Outright forwards Derivatives

- 28. Participants Exchanges - transparency and real volume! Legal entities - benefits and hedging Bank International single

- 29. Foreign exchange market participants Commercial banks Currency Exchanges Central banks Financial Organizations Brokers Individuals International monetary

- 30. Benefits for corporations in the foreign exchange market More favorable pricing terms for foreign exchange rates

- 31. Commodity sector Procurements and tenders (including State) for blockchain technology! Vendor selection by rating Transparent auction

- 32. Advantages Security The site gives you access to trusted suppliers for your wholesale food shopping around

- 33. Benefits to the government Transparency of commercial transactions in bidding and procurement on blockchain technology Expanding

- 34. Real Estate Sector The minimum amount of the Guarantee Amount is set at 50,000 (fifty thousand)

- 35. Stages of the Auction Posting of the Lot. Opening of the Auction. Registration of the Buyers

- 37. Скачать презентацию

Техника продажи страховых услуг

Техника продажи страховых услуг Слагаемые мастерства. Чем определяется размер зарплаты

Слагаемые мастерства. Чем определяется размер зарплаты Деньги в нашей жизни

Деньги в нашей жизни Облік у зарубіжних кранах

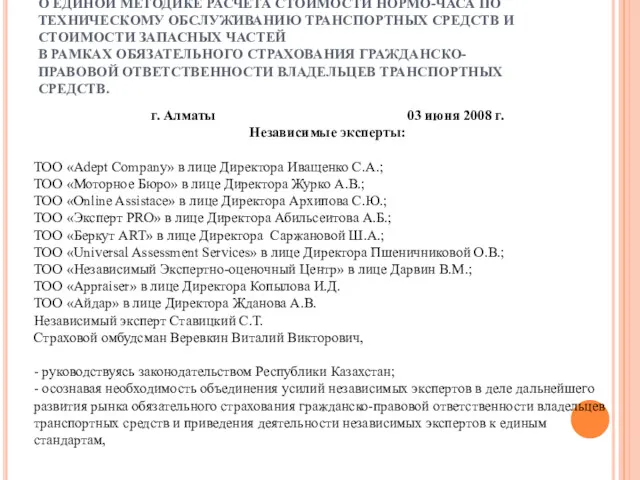

Облік у зарубіжних кранах Меморандум о единой методике расчета стоимости нормо-часа по техническому обслуживанию транспортных средств

Меморандум о единой методике расчета стоимости нормо-часа по техническому обслуживанию транспортных средств Виды реализации. Учет реализации товаров. Учет реализованных торговых наложений. лекция №16

Виды реализации. Учет реализации товаров. Учет реализованных торговых наложений. лекция №16 Выдача ЕТК льготной тарификации в МФЦ

Выдача ЕТК льготной тарификации в МФЦ Європейська модель регіональної інтеграції

Європейська модель регіональної інтеграції Точки контроля финансовой и юридической службы строительной компании

Точки контроля финансовой и юридической службы строительной компании Плановое изменение тарифов на коммунальные услуги с 1 июля 2019 года Республике Башкортостан

Плановое изменение тарифов на коммунальные услуги с 1 июля 2019 года Республике Башкортостан Фінансові посередники

Фінансові посередники Залучення іноземного капіталу

Залучення іноземного капіталу Финансы предприятия

Финансы предприятия Повышение инвестиционной привлекательности российских нефтяных компаний

Повышение инвестиционной привлекательности российских нефтяных компаний Облік виробничих запасів підприємства

Облік виробничих запасів підприємства Міжнародні інвестиційні операції з цінними паперами

Міжнародні інвестиційні операції з цінними паперами Учет труда и его оплаты

Учет труда и его оплаты Урок финансовой грамотности Кредиты

Урок финансовой грамотности Кредиты Эффективность функционирования организации

Эффективность функционирования организации Как создаются криптовалюты

Как создаются криптовалюты Реформа міжбюджетних відносин в Україні

Реформа міжбюджетних відносин в Україні Управление рисками и маржинальная торговля на российском рынке

Управление рисками и маржинальная торговля на российском рынке Международные расчеты

Международные расчеты Учет вложений во внеоборотные активы. (Тема 5)

Учет вложений во внеоборотные активы. (Тема 5) Учет товаров на складе

Учет товаров на складе ВКР: Разработка и обоснование мероприятий по увеличению прибыли ООО БС-Шиппинг

ВКР: Разработка и обоснование мероприятий по увеличению прибыли ООО БС-Шиппинг Введение в сметное дело и ценообразование в строительстве

Введение в сметное дело и ценообразование в строительстве Дивидендная политика фирмы

Дивидендная политика фирмы