Содержание

- 2. © 2006 Pearson Education Canada Inc. Chapter 1 Introduction

- 3. © 2006 Pearson Education Canada Inc. Some Historical Perspective Paciolo, 1494 English Corporations Acts Compulsory audit

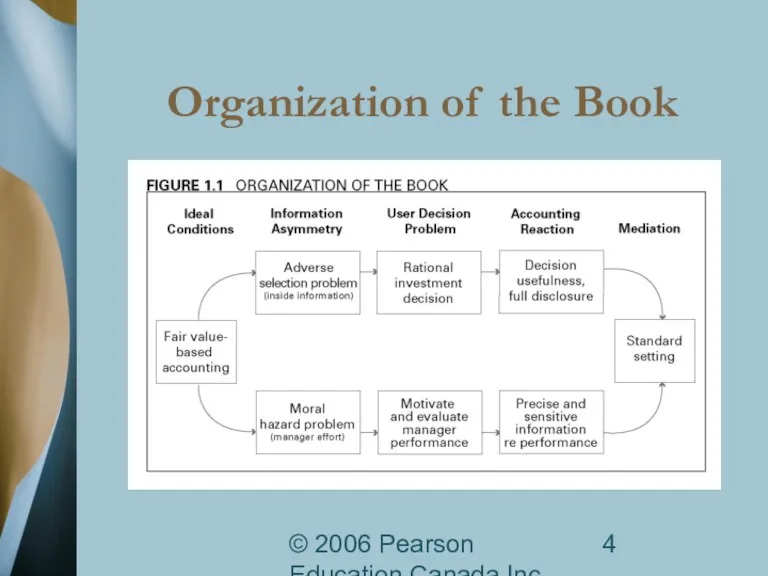

- 4. © 2006 Pearson Education Canada Inc. Organization of the Book

- 5. © 2006 Pearson Education Canada Inc. Information Asymmetry Two Main Types Adverse selection Persons with an

- 6. © 2006 Pearson Education Canada Inc. User Decision Problem In Presence of Adverse Selection Rational investment

- 7. © 2006 Pearson Education Canada Inc. Role of Financial Reporting To Control Adverse Selection Decision usefulness

- 8. © 2006 Pearson Education Canada Inc. The Fundamental Problem Of Financial Accounting Theory The best measure

- 9. © 2006 Pearson Education Canada Inc. ENRON CORP. Implications for Accountants

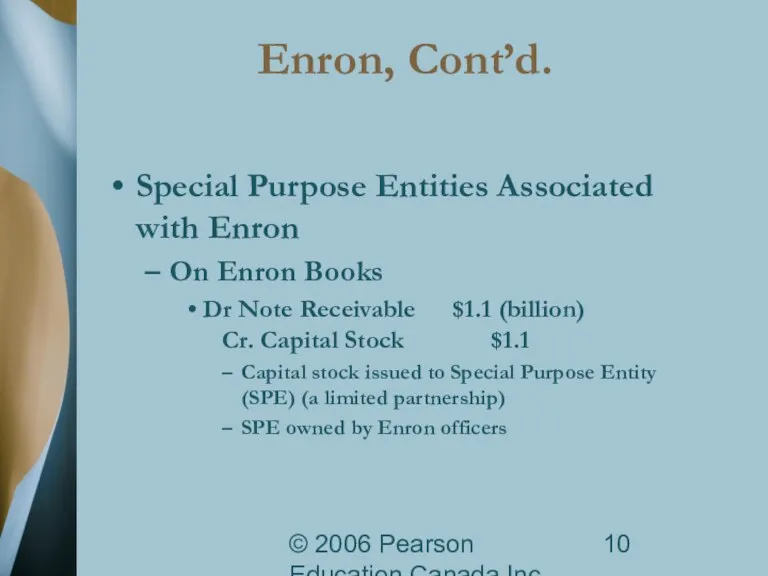

- 10. © 2006 Pearson Education Canada Inc. Enron, Cont’d. Special Purpose Entities Associated with Enron On Enron

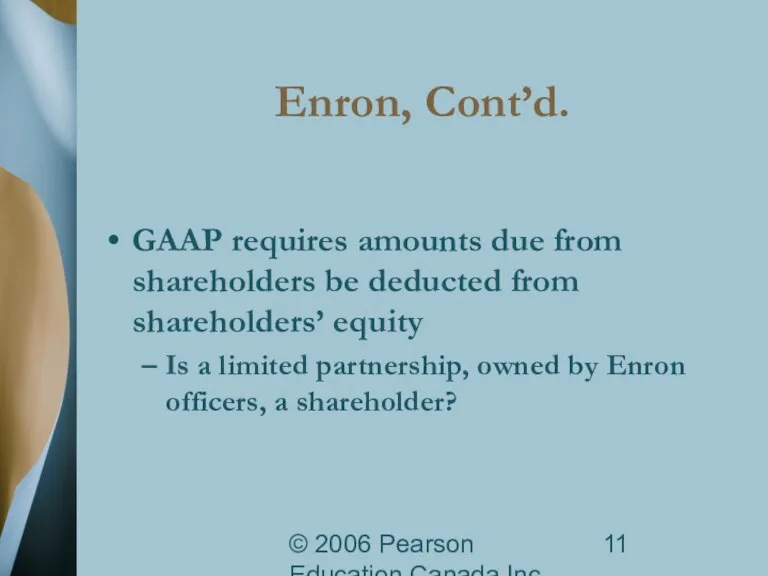

- 11. © 2006 Pearson Education Canada Inc. Enron, Cont’d. GAAP requires amounts due from shareholders be deducted

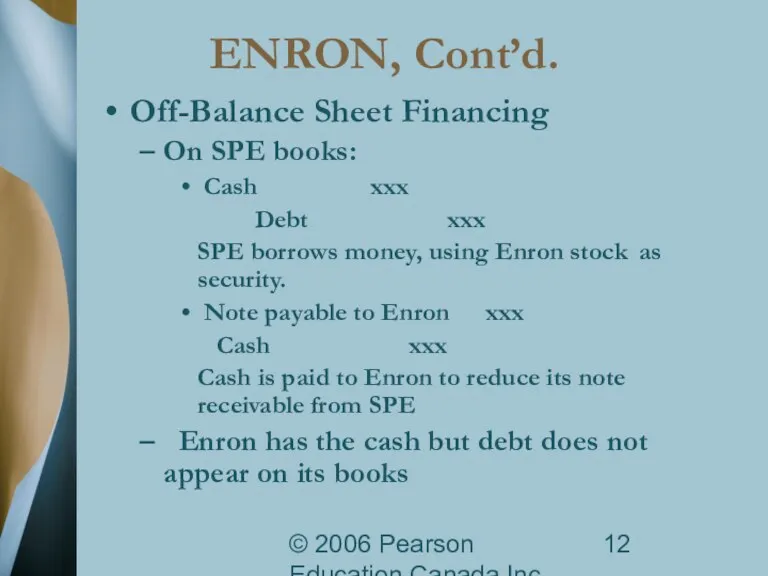

- 12. © 2006 Pearson Education Canada Inc. ENRON, Cont’d. Off-Balance Sheet Financing On SPE books: Cash xxx

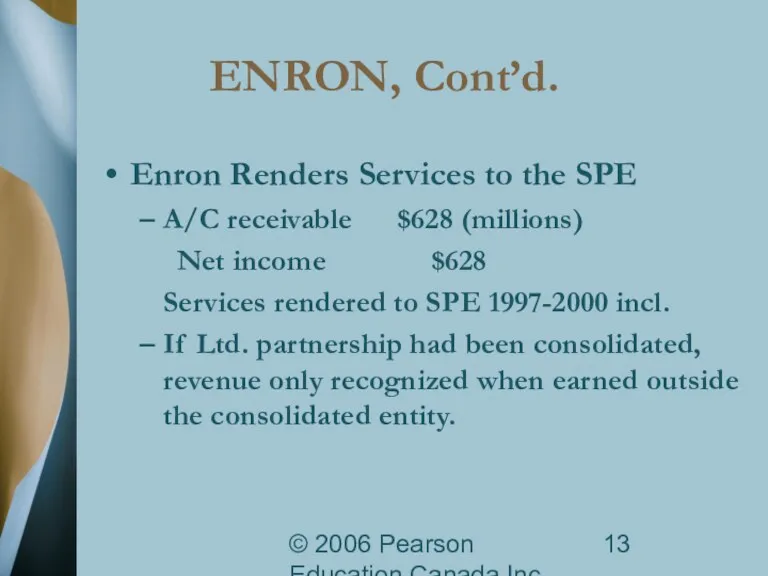

- 13. © 2006 Pearson Education Canada Inc. ENRON, Cont’d. Enron Renders Services to the SPE A/C receivable

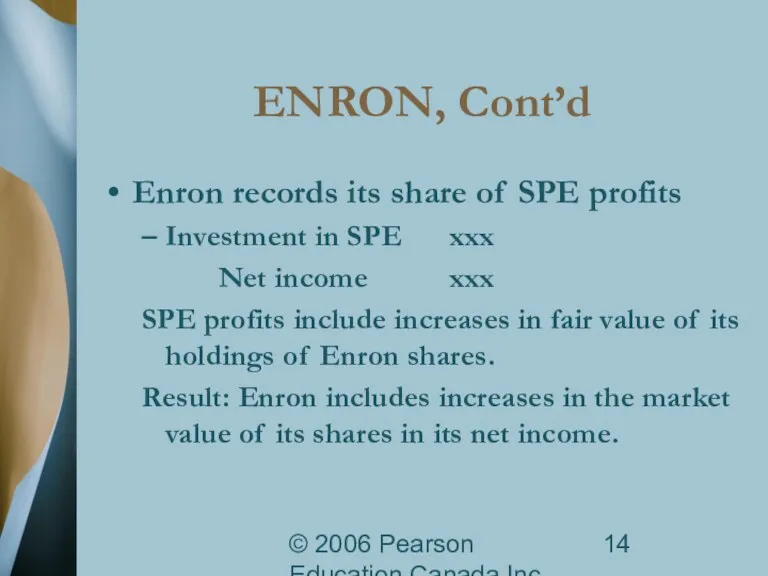

- 14. © 2006 Pearson Education Canada Inc. ENRON, Cont’d Enron records its share of SPE profits Investment

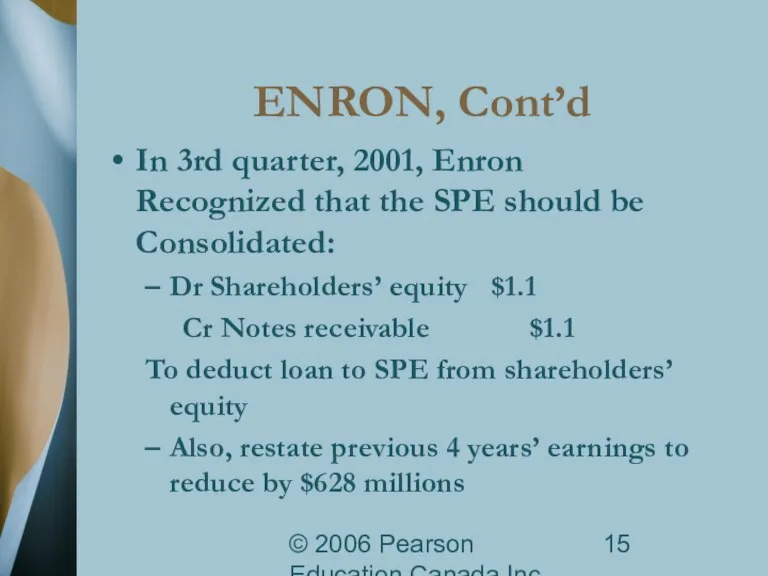

- 15. © 2006 Pearson Education Canada Inc. ENRON, Cont’d In 3rd quarter, 2001, Enron Recognized that the

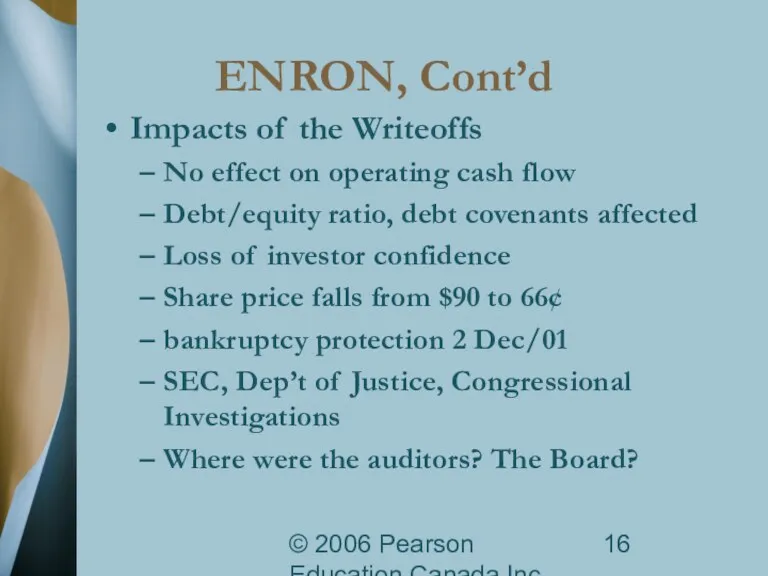

- 16. © 2006 Pearson Education Canada Inc. ENRON, Cont’d Impacts of the Writeoffs No effect on operating

- 18. Скачать презентацию

Концептуальні основи комп'ютерних інформаційних систем в аудиті

Концептуальні основи комп'ютерних інформаційних систем в аудиті Облигации. История возникновения облигации

Облигации. История возникновения облигации Валютный контроль

Валютный контроль Қазіргі коммерциялық банктер

Қазіргі коммерциялық банктер Основы экономики. Задачи государства. Государственный бюджет

Основы экономики. Задачи государства. Государственный бюджет Банкротство предприятия: основные определения и порядок оценки вероятности. (тема 15)

Банкротство предприятия: основные определения и порядок оценки вероятности. (тема 15) Финансовая безопасность. (Тема 3)

Финансовая безопасность. (Тема 3) Финансовые ресурсы компании, их состав и содержание

Финансовые ресурсы компании, их состав и содержание Методы оценки коммерческой эффективности инвестиционных проектов

Методы оценки коммерческой эффективности инвестиционных проектов Страховий ринок США

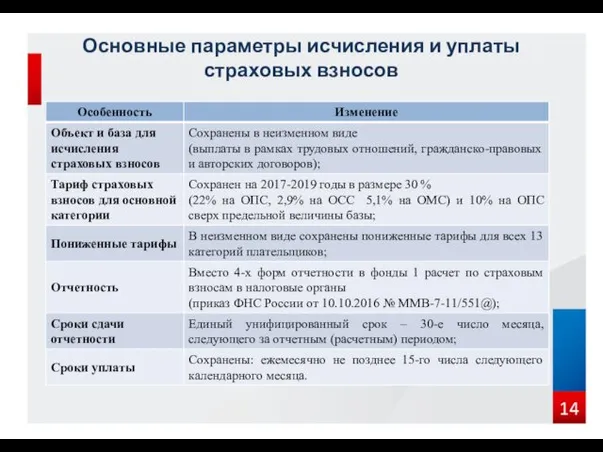

Страховий ринок США Страховые взносы

Страховые взносы Исламдық бағалы қағаздар нарығы

Исламдық бағалы қағаздар нарығы Государственные финансы. Государственные внебюджетные фонды

Государственные финансы. Государственные внебюджетные фонды История бухгалтерского учета

История бухгалтерского учета Финансирование инновационного предпринимательства

Финансирование инновационного предпринимательства State Support Shipbuilding in Ukraine

State Support Shipbuilding in Ukraine Структура и содержание внешнеторгового контракта

Структура и содержание внешнеторгового контракта Споживче кредитування

Споживче кредитування Карта вместо денег

Карта вместо денег Бухгалтерская (финансовая) отчетность

Бухгалтерская (финансовая) отчетность Общая характеристика хозяйственного учета

Общая характеристика хозяйственного учета Зарубіжний досвід забезпечення безпеки банківської діяльності

Зарубіжний досвід забезпечення безпеки банківської діяльності Личное финансовое планирование

Личное финансовое планирование Состав и характеристика источников финансирования

Состав и характеристика источников финансирования Суды о необоснованной налоговой выгоде

Суды о необоснованной налоговой выгоде Таблицы по продуктам МСП Банка

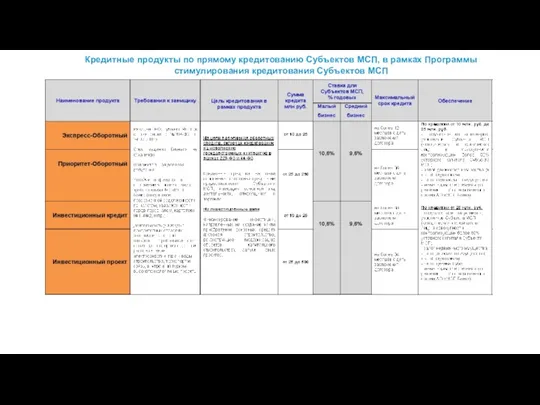

Таблицы по продуктам МСП Банка Анализ безубыточности

Анализ безубыточности Прогноз бюджета муниципального района Стерлитамакский район Республики Башкортостан на 2017 год и на период 2018 и 2019 годов

Прогноз бюджета муниципального района Стерлитамакский район Республики Башкортостан на 2017 год и на период 2018 и 2019 годов