Содержание

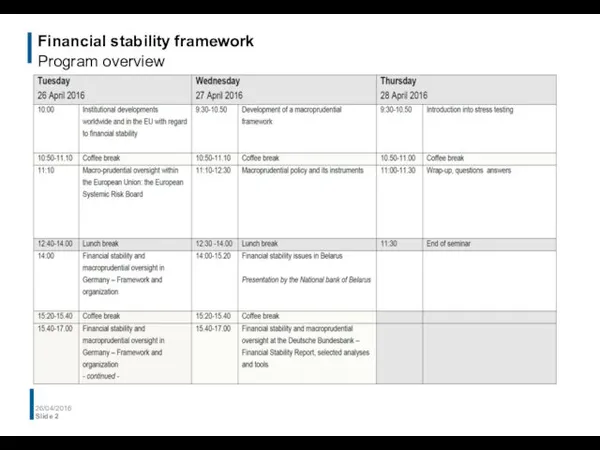

- 2. Financial stability framework Program overview 26/04/2016 Slide

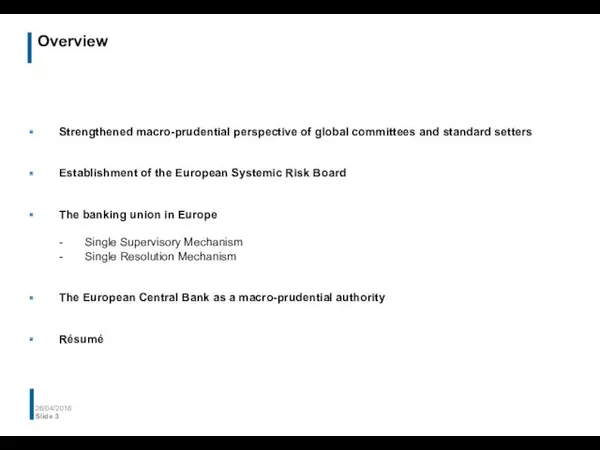

- 3. Overview 26/04/2016 Slide Strengthened macro-prudential perspective of global committees and standard setters Establishment of the European

- 4. Global committees and standard setters Strengthened macro-prudential perspective 26/04/2016 Slide

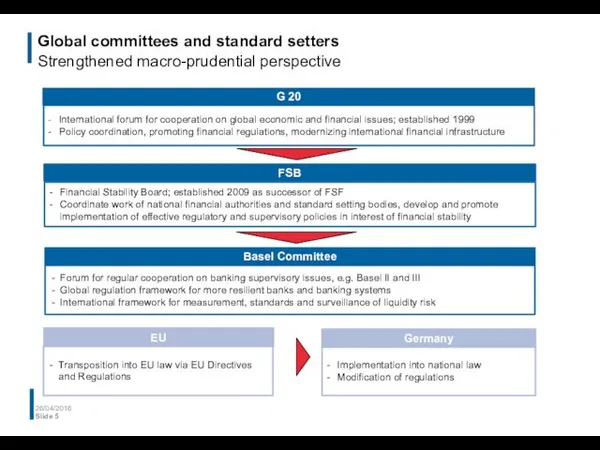

- 5. Global committees and standard setters Strengthened macro-prudential perspective 26/04/2016 Slide G 20 - International forum for

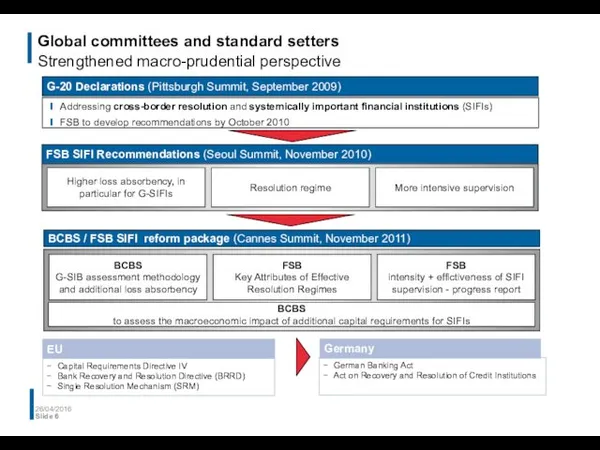

- 6. Global committees and standard setters Strengthened macro-prudential perspective 26/04/2016 Slide

- 7. Overview 26/04/2016 Slide Strengthened macro-prudential perspective of global committees and standard setters Establishment of the European

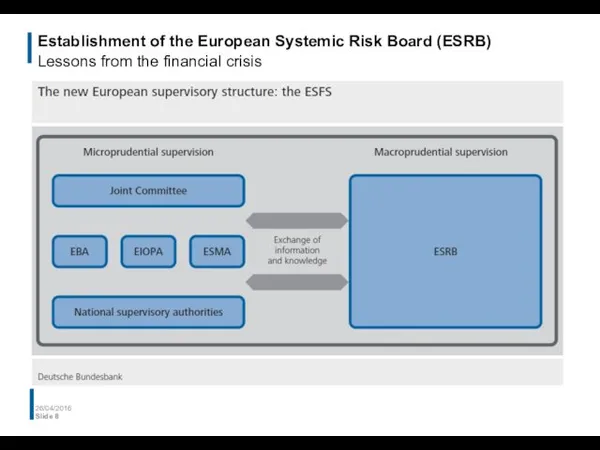

- 8. Establishment of the European Systemic Risk Board (ESRB) Lessons from the financial crisis 26/04/2016 Slide

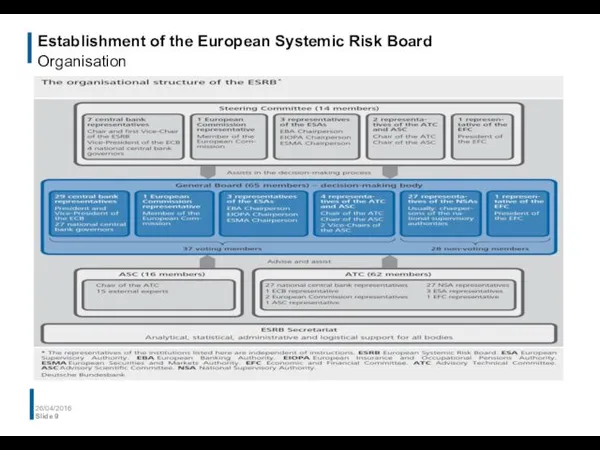

- 9. Establishment of the European Systemic Risk Board Organisation 26/04/2016 Slide

- 10. European Systemic Risk Board Tasks Responsible for macro-prudential oversight of the financial system within the EU

- 11. European Systemic Risk Board Tasks 26/04/2016 Slide (1) Input gathering and analysis (2) Assessment (3) Policy

- 12. Overview 26/04/2016 Slide Strengthened macro-prudential perspective of global committees and standard setters Establishment of the European

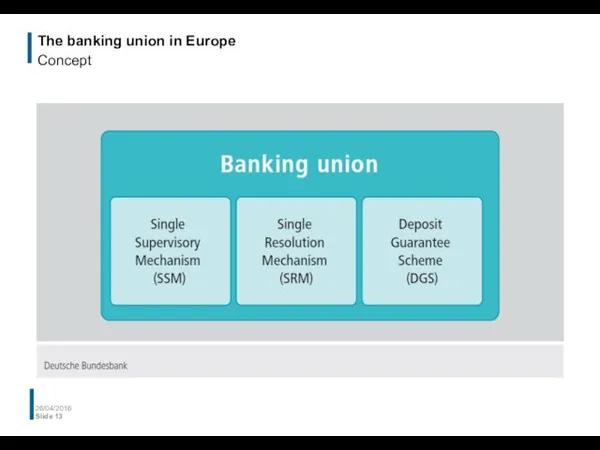

- 13. The banking union in Europe Concept 26/04/2016 Slide

- 14. Conceptual background of the banking union Lessons from the financial crisis Lessons from the financial crisis

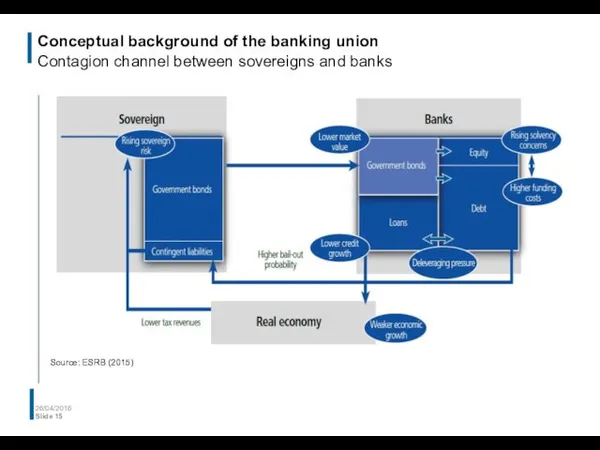

- 15. Conceptual background of the banking union Contagion channel between sovereigns and banks 26/04/2016 Slide Source: ESRB

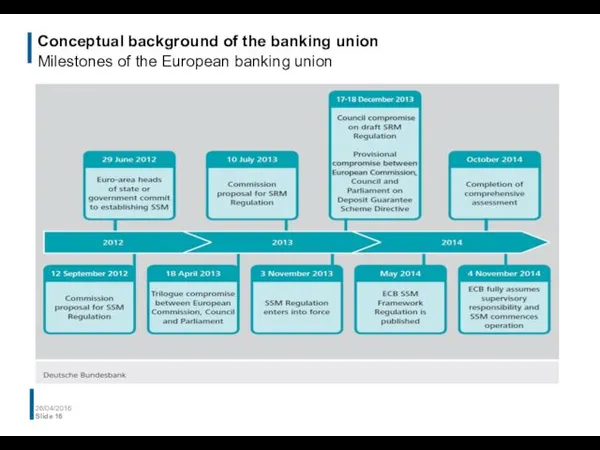

- 16. Conceptual background of the banking union Milestones of the European banking union 26/04/2016 Slide

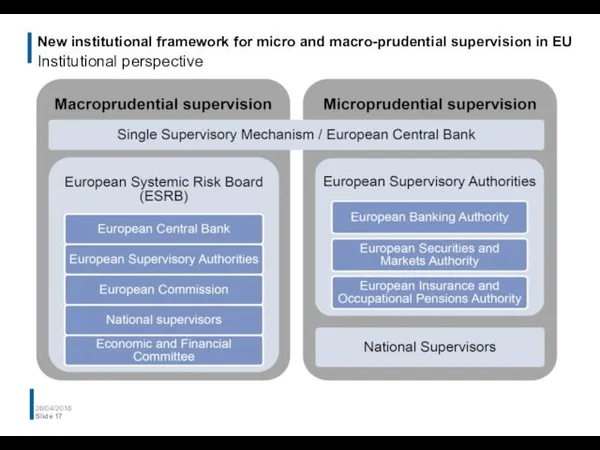

- 17. New institutional framework for micro and macro-prudential supervision in EU Institutional perspective 26/04/2016 Slide

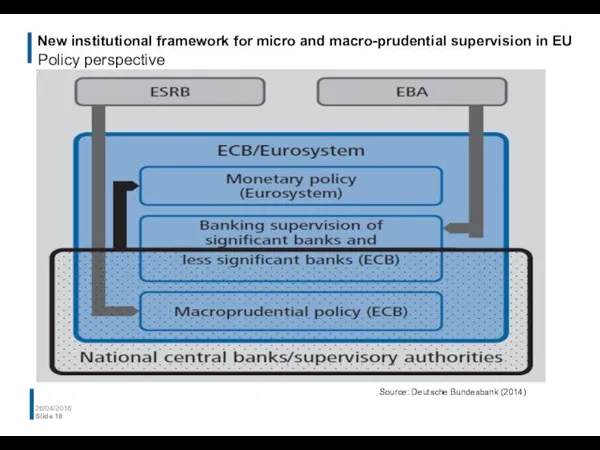

- 18. New institutional framework for micro and macro-prudential supervision in EU Policy perspective 26/04/2016 Slide Source: Deutsche

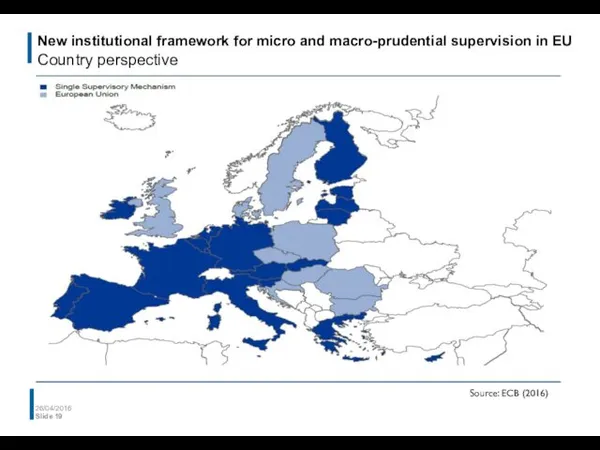

- 19. New institutional framework for micro and macro-prudential supervision in EU Country perspective 26/04/2016 Slide Source: ECB

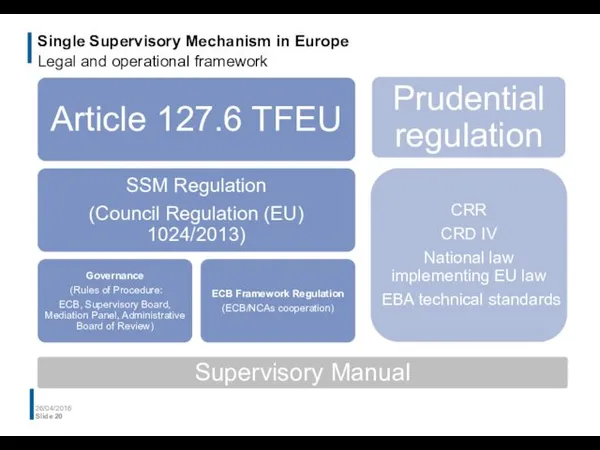

- 20. Single Supervisory Mechanism in Europe Legal and operational framework 26/04/2016 Slide

- 21. Single supervisory mechanism in Europe Division of tasks between national and European level 26/04/2016 Slide

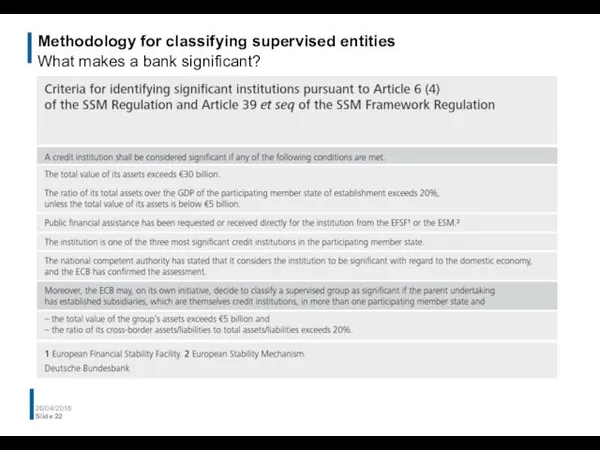

- 22. Methodology for classifying supervised entities What makes a bank significant? 26/04/2016 Slide

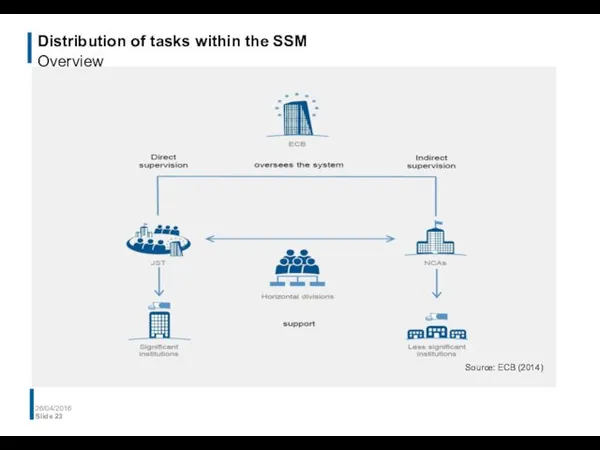

- 23. Distribution of tasks within the SSM Overview 26/04/2016 Slide Source: ECB (2014)

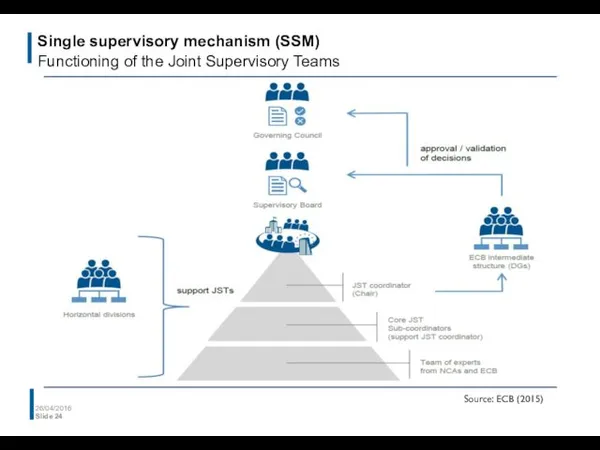

- 24. Single supervisory mechanism (SSM) Functioning of the Joint Supervisory Teams 26/04/2016 Slide Source: ECB (2015)

- 25. Single supervisory mechanism (SSM) Significant supervised entities in Germany 26/04/2016 Slide

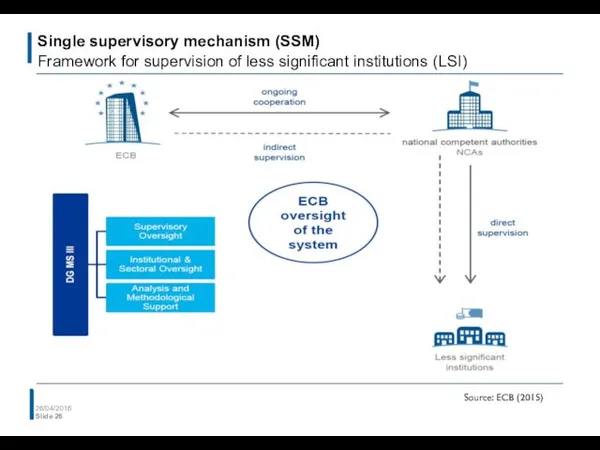

- 26. Single supervisory mechanism (SSM) Framework for supervision of less significant institutions (LSI) 26/04/2016 Slide Source: ECB

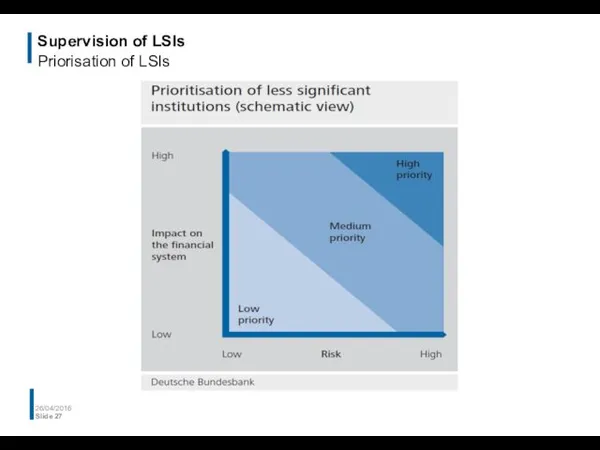

- 27. Supervision of LSIs Priorisation of LSIs 26/04/2016 Slide

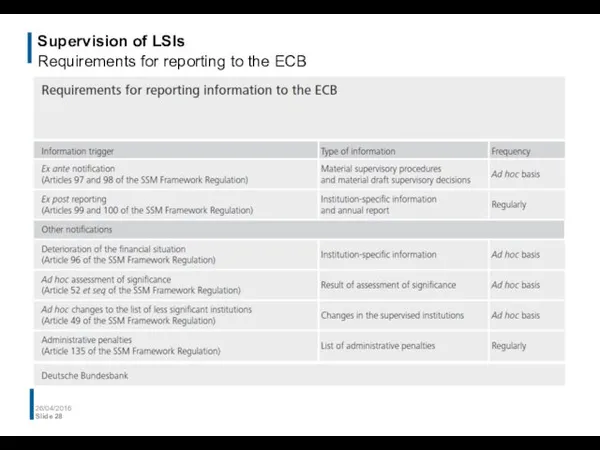

- 28. Supervision of LSIs Requirements for reporting to the ECB 26/04/2016 Slide

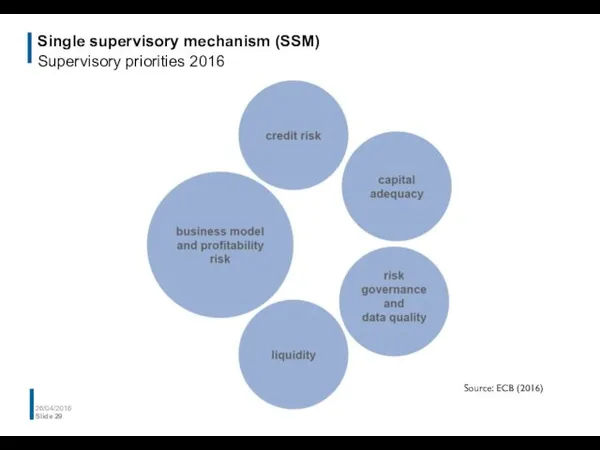

- 29. Single supervisory mechanism (SSM) Supervisory priorities 2016 26/04/2016 Slide Source: ECB (2016)

- 30. Overview 26/04/2016 Slide Strengthened macro-prudential perspective of global committees and standard setters Establishment of the European

- 31. European Central Bank as a macro-prudential authority Macroprudential policy and oversight in Europe: EU, ECB and

- 32. European Central Bank as a macro-prudential authority Macroprudential policy in Europe: the role of the ECB

- 33. European Central Bank as a macro-prudential authority Macroprudential oversight in Europe: the role of the ESRB

- 34. Overview 26/04/2016 Slide Strengthened macro-prudential perspective of global committees and standard setters Establishment of the European

- 35. Résumé Institutional set-up financial stability – European perspective 26/04/2016 Slide Source: German Council of Economic Experts

- 36. References Council Regulation (EU) No 1024/2013 of 15 October 2013, L287/63 Deutsche Bundesbank, Monthly Report, various

- 38. Скачать презентацию

Учетные регистры, формы бухгалтерского учета. Организация бухгалтерского учета и учетная политика предприятия

Учетные регистры, формы бухгалтерского учета. Организация бухгалтерского учета и учетная политика предприятия Важные изменения 2018 в налогах, взносах и бухучете

Важные изменения 2018 в налогах, взносах и бухучете Проект поддержки местных инициатив (ППМИ)

Проект поддержки местных инициатив (ППМИ) Expedite. Month of December

Expedite. Month of December Финансы населения и их влияние на экономическое развитие

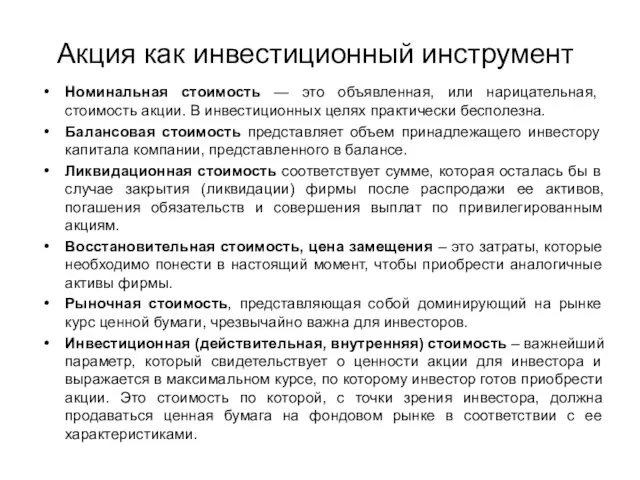

Финансы населения и их влияние на экономическое развитие Акция как инвестиционный инструмент

Акция как инвестиционный инструмент Налог на доходы физических лиц (НДФЛ)

Налог на доходы физических лиц (НДФЛ) Новые продукты по банковским картам

Новые продукты по банковским картам Методы определения сметной стоимости строительства

Методы определения сметной стоимости строительства Инвентаризация: назначение и порядок её проведения, учета и оформления результатов

Инвентаризация: назначение и порядок её проведения, учета и оформления результатов Рабочая тетрадь участника

Рабочая тетрадь участника Центральный банк РФ

Центральный банк РФ Деятельность Фонда социального страхования

Деятельность Фонда социального страхования Инвестиции

Инвестиции Региональные налоги

Региональные налоги Счета и двойная запись

Счета и двойная запись Ֆինանսական կառավարում

Ֆինանսական կառավարում Управление инвестиционной деятельностью компании

Управление инвестиционной деятельностью компании Метод кумулятивного построения. (Лекция 5)

Метод кумулятивного построения. (Лекция 5) Сущность лизинга и его роль в материально-техническом обеспечении строительных предприятий

Сущность лизинга и его роль в материально-техническом обеспечении строительных предприятий Зарплатный проект в рамках Пакетов решений Alfa Smart

Зарплатный проект в рамках Пакетов решений Alfa Smart Дипломная работа. Разработка и реализация инвестиционного проекта по строительству жилищного комплекса

Дипломная работа. Разработка и реализация инвестиционного проекта по строительству жилищного комплекса Бухгалтерский баланс и методика его анализа

Бухгалтерский баланс и методика его анализа Облік і калькулювання повних і змінних витрат (тема 6)

Облік і калькулювання повних і змінних витрат (тема 6) Порядок учета территориальными органами Федерального казначейства бюджетных и денежных обязательств в РФ

Порядок учета территориальными органами Федерального казначейства бюджетных и денежных обязательств в РФ Учет денежных средств

Учет денежных средств 1С:Зарплата и управление персоналом

1С:Зарплата и управление персоналом Clasificarea asigurarilor, elementele asigurarii

Clasificarea asigurarilor, elementele asigurarii