Содержание

- 2. Learning Objectives Identify and describe the primary and secondary securities markets. Trade securities using a broker.

- 3. Securities Markets A place where you buy and sell securities. Includes stocks and bonds. Securities are

- 4. Primary Markets Place where new securities are traded. 2 types of primary market offerings: Initial public

- 5. Primary Markets Primary market activities require the help of an investment banker to serve as the

- 6. Primary Markets Tombstone ads are placed in newspapers to announce the offering and provide details. A

- 7. Secondary Markets - Stocks Previously-issued securities trade in the secondary markets. Secondary markets can be either:

- 8. Secondary Markets - Stocks There are 9 organized exchanges in the U.S. National Exchanges: New York

- 9. Secondary Markets - Stocks New York Stock Exchange (NYSE) – also known as the “Big Board”

- 10. Secondary Markets - Stocks Members of the NYSE occupy “seats” with the number fixed at 1366.

- 11. Secondary Markets - Stocks The American Stock Exchange (AMEX) is the second largest organized U.S. exchange,

- 12. Secondary Markets - Stocks The Regional Stock Exchanges trade securities of local and regional firms. Have

- 13. Secondary Markets - Stocks The over-the-counter (OTC) market links dealers, has no listing requirements. The OTC

- 14. Secondary Markets - Stocks In 1971, the National Association of Securities Dealers Automated Quotations system (NASDAQ)

- 15. Secondary Markets - Bonds While some bonds trade at the NYSE, most trading is done through

- 16. International Markets Babylonians introduced debt financing as far back as 2000 B.C. The world bond market

- 17. International Markets How can you buy international stocks? Some foreign shares trade on U.S. exchanges. Go

- 18. International Markets International stocks can be traded through American Depository Receipts (ADRs). The foreign stock is

- 19. Regulation of the Securities Markets Aim is to protect investors so that all have a fair

- 20. Regulation of the Securities Markets Securities Act of 1933 Disclosure of relevant information on IPO’s and

- 21. Regulation of the Securities Markets Self-Regulation – much day-to-day market regulation, left to the securities industry,

- 22. The Role of the Specialist Maintains a fair and orderly market. Assigned to a stock, acts

- 23. Order Characteristics Order Size Odd lots 1-99 shares Round lots 100 shares Time Periods Day orders

- 24. Types of Orders Market Orders – buy or sell immediately at the best price available. Limit

- 25. Short Selling Short selling – the more the price drops, the more money your make. Borrow

- 26. Short Selling Most trading involves buying a stock low and selling it high – making money

- 27. Types of Brokers Full-Service Brokers – paid commissions based on sales volume. Broker gives advice to

- 28. Types of Brokers Deep Discount Brokers – in 1994, they began executing trades for up to

- 29. Cash Versus Margin Accounts Cash Accounts Investor pays in full. Payment due in 3 business days.

- 30. Registration: Street Name or Your Name Securities can be registered in your name or “street name.”

- 31. Joint Accounts Joint Tenancy with Right of Survivorship – when one owner dies, the other receives

- 32. Tips for Online Investing Checklist 12.3 Online trading is quick, but online investing takes time. Set

- 33. Online Trading Day traders trade with a very short-term time horizon. Goal is to ride momentum.

- 34. Online Trading Remember: Be prepared to suffer severe losses. Don’t confuse it with investing. Don’t believe

- 36. Скачать презентацию

Государственный бюджет зарубежных стран. Франция

Государственный бюджет зарубежных стран. Франция Подготовка информации для оценки эффективности

Подготовка информации для оценки эффективности Бюджет для граждан 2019. Внутригородское муниципальное образование Санкт-Петербурга муниципальный округ Академическое

Бюджет для граждан 2019. Внутригородское муниципальное образование Санкт-Петербурга муниципальный округ Академическое Platinum Bank. Банк и банковские продукты

Platinum Bank. Банк и банковские продукты Ко-бренды. Кобрендовые кредитные карты. Банк Тинькофф

Ко-бренды. Кобрендовые кредитные карты. Банк Тинькофф О субсидиях субъектам МСП на возмещение части затрат, связанных с осуществлением ими предпринимательской деятельности (2018 год)

О субсидиях субъектам МСП на возмещение части затрат, связанных с осуществлением ими предпринимательской деятельности (2018 год) Принципы международного налогообложения

Принципы международного налогообложения Impuestos Locales

Impuestos Locales Plant and intangible assets. (Chapter 9)

Plant and intangible assets. (Chapter 9) Бухгалтерский учет и анализ движения денежных средств

Бухгалтерский учет и анализ движения денежных средств Система регионального управления и территориального планирования в РФ (Разработка программ и проектов на региональном уровне)

Система регионального управления и территориального планирования в РФ (Разработка программ и проектов на региональном уровне) Налог на доходы физических лиц

Налог на доходы физических лиц Javne finansije. Lekcija 9

Javne finansije. Lekcija 9 Способы принудительного исполнения налоговой обязанности

Способы принудительного исполнения налоговой обязанности Продукты и услуги ПАО АК БАРС Банк

Продукты и услуги ПАО АК БАРС Банк Audit of business solutions

Audit of business solutions Оборотные средства предприятия

Оборотные средства предприятия Банктік қызмет көрсетудің негізгі спектрлеріне талдау жасау

Банктік қызмет көрсетудің негізгі спектрлеріне талдау жасау Interest Rates and Monetary Policy

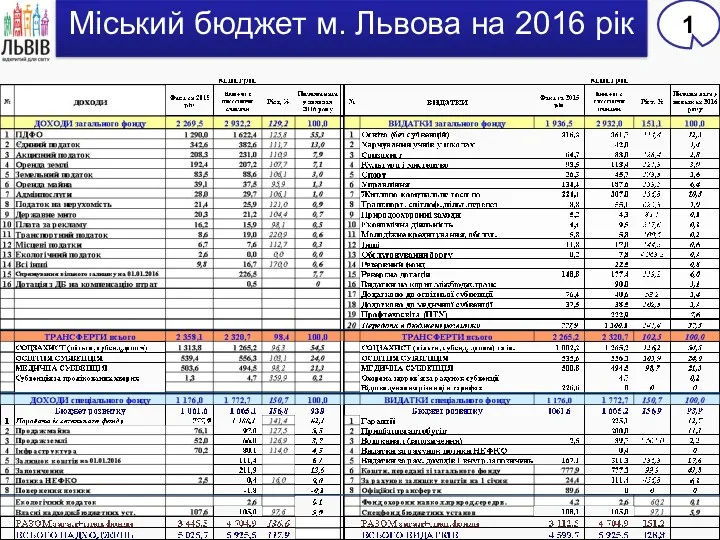

Interest Rates and Monetary Policy Міський бюджет м. Львова на 2016 рік

Міський бюджет м. Львова на 2016 рік Финансовая стабильность и макропруденциальное регулирование. Тема 6

Финансовая стабильность и макропруденциальное регулирование. Тема 6 The role of Swiss franc in the international monetary system

The role of Swiss franc in the international monetary system Развитие финансово-кредитных отношений в XVIII веке. (Тема 5)

Развитие финансово-кредитных отношений в XVIII веке. (Тема 5) Банковская система РФ

Банковская система РФ Государственный (муниципальный) кредит и государственный (муниципальный) долг

Государственный (муниципальный) кредит и государственный (муниципальный) долг Программа КриптоЮнит

Программа КриптоЮнит Доходы и расходы. Затраты и цены. Раздельный учет и отчет об исполнении контрактов по ГОЗ. Порядок индексации цен

Доходы и расходы. Затраты и цены. Раздельный учет и отчет об исполнении контрактов по ГОЗ. Порядок индексации цен Об участии в национальном проекте Производительность труда и поддержка занятости

Об участии в национальном проекте Производительность труда и поддержка занятости