Содержание

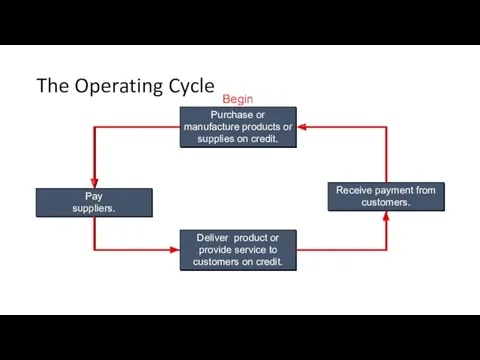

- 2. The Operating Cycle Purchase or manufacture products or supplies on credit. Deliver product or provide service

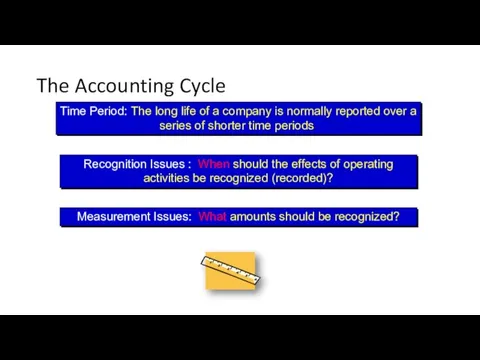

- 3. The Accounting Cycle Time Period: The long life of a company is normally reported over a

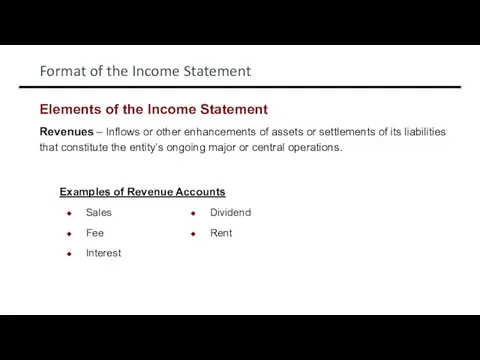

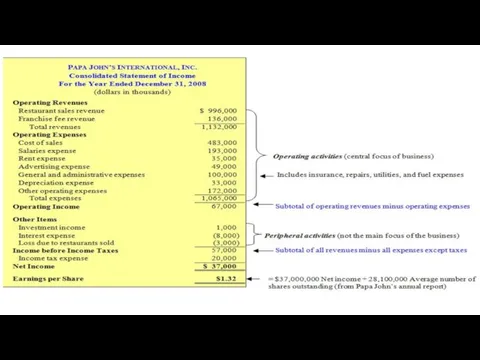

- 4. Format of the Income Statement Revenues – Inflows or other enhancements of assets or settlements of

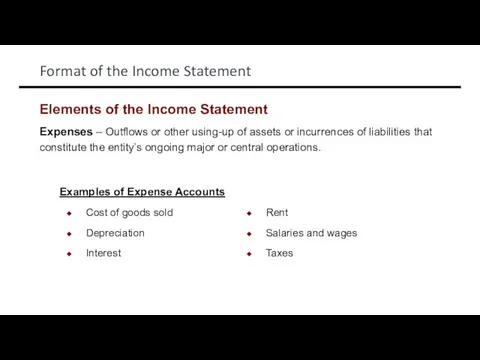

- 5. Format of the Income Statement Expenses – Outflows or other using-up of assets or incurrences of

- 6. Format of the Income Statement Gains and losses can result from sale of investments or plant

- 8. Recognition of operating activities CASH BASIS ACCOUNTING records revenues when cash is received and expenses when

- 9. Revenue principle Under the revenue principle, four criteria or conditions must normally be met for revenue

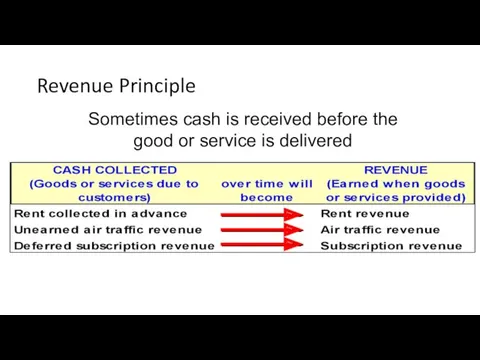

- 10. Revenue Principle Sometimes cash is received before the good or service is delivered

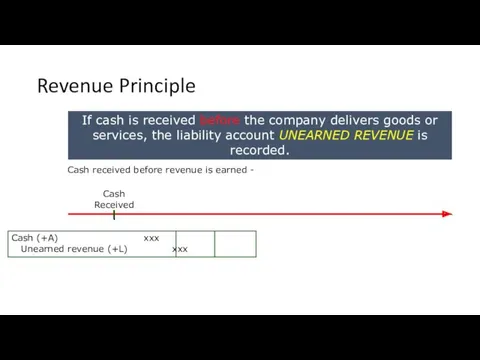

- 11. Revenue Principle If cash is received before the company delivers goods or services, the liability account

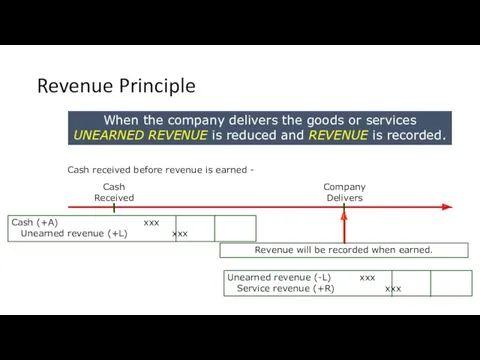

- 12. Revenue Principle When the company delivers the goods or services UNEARNED REVENUE is reduced and REVENUE

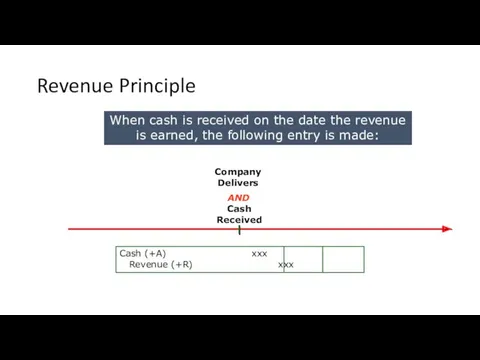

- 13. Revenue Principle When cash is received on the date the revenue is earned, the following entry

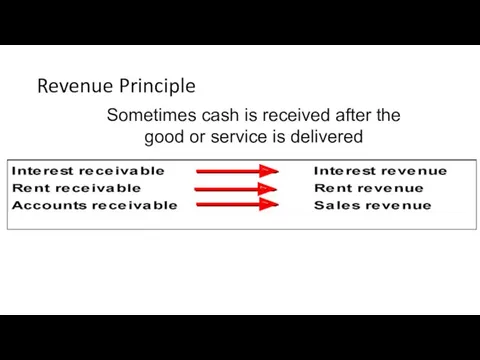

- 14. Revenue Principle Sometimes cash is received after the good or service is delivered

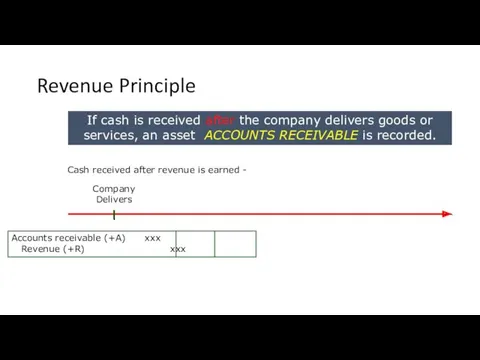

- 15. Revenue Principle If cash is received after the company delivers goods or services, an asset ACCOUNTS

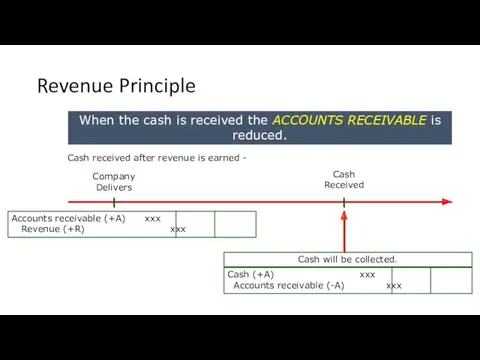

- 16. Revenue Principle Cash Received Cash received after revenue is earned - Company Delivers When the cash

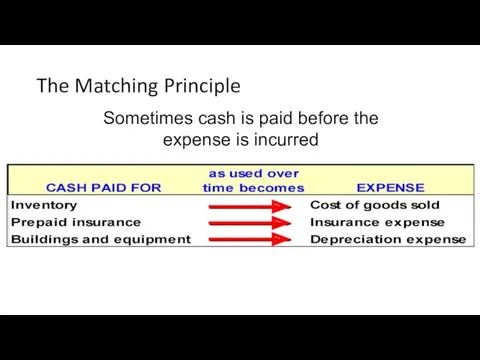

- 17. The Matching Principle Resources consumed to earn revenues (i.e.expenses) in an accounting period should be recorded

- 18. The Matching Principle Sometimes cash is paid before the expense is incurred

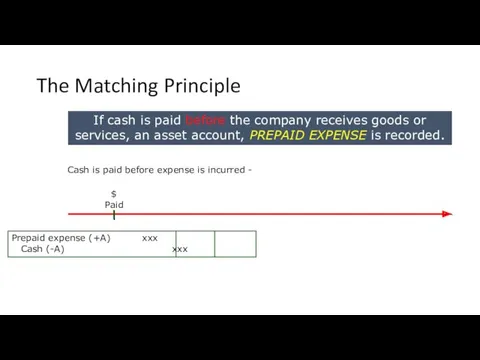

- 19. The Matching Principle If cash is paid before the company receives goods or services, an asset

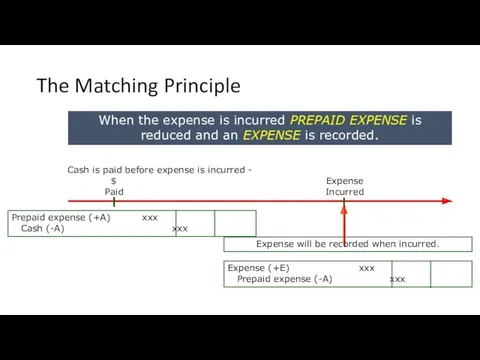

- 20. The Matching Principle Expense Incurred When the expense is incurred PREPAID EXPENSE is reduced and an

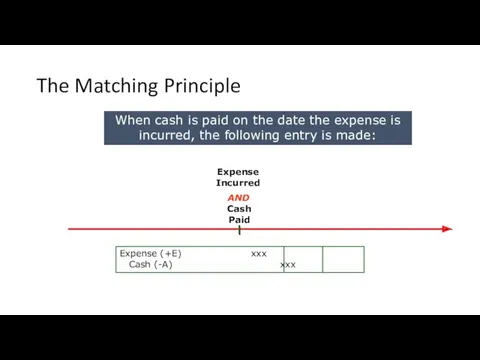

- 21. The Matching Principle When cash is paid on the date the expense is incurred, the following

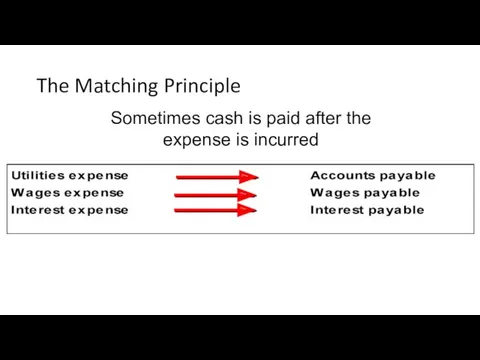

- 22. The Matching Principle Sometimes cash is paid after the expense is incurred

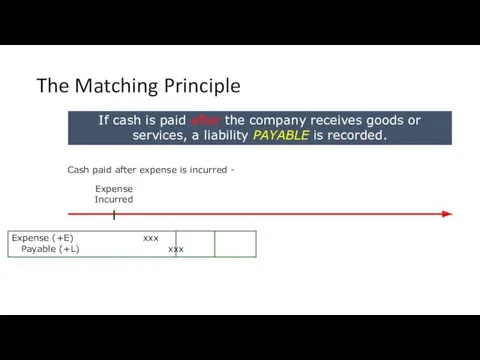

- 23. The Matching Principle If cash is paid after the company receives goods or services, a liability

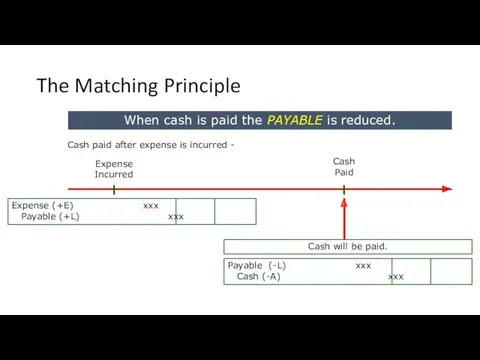

- 24. The Matching Principle Cash Paid When cash is paid the PAYABLE is reduced. Cash paid after

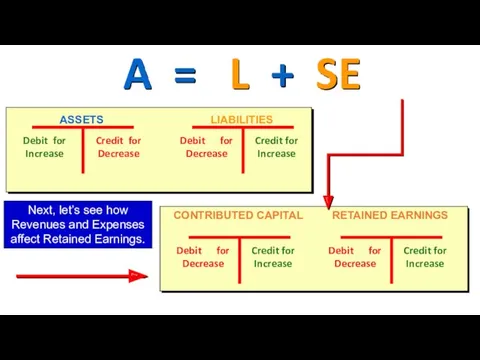

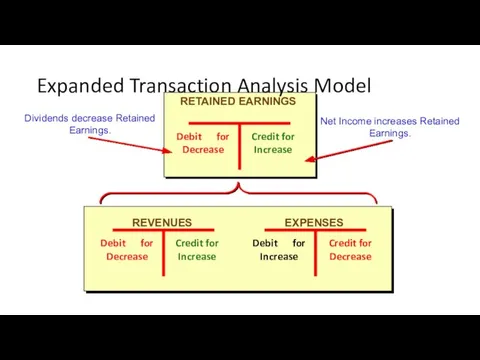

- 25. A = L + SE Next, let’s see how Revenues and Expenses affect Retained Earnings.

- 26. Expanded Transaction Analysis Model Dividends decrease Retained Earnings. Net Income increases Retained Earnings.

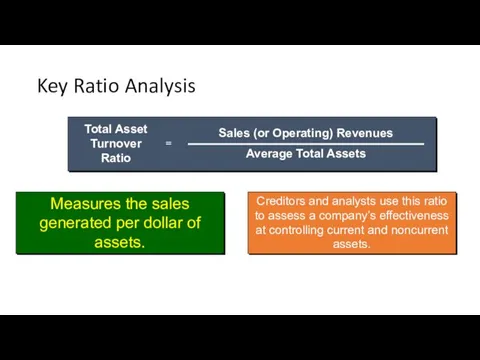

- 27. Key Ratio Analysis Measures the sales generated per dollar of assets. Creditors and analysts use this

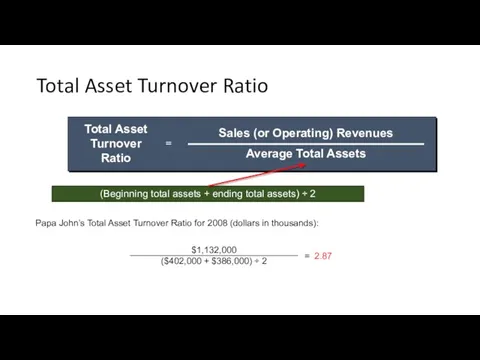

- 28. Total Asset Turnover Ratio (Beginning total assets + ending total assets) ÷ 2 Papa John’s Total

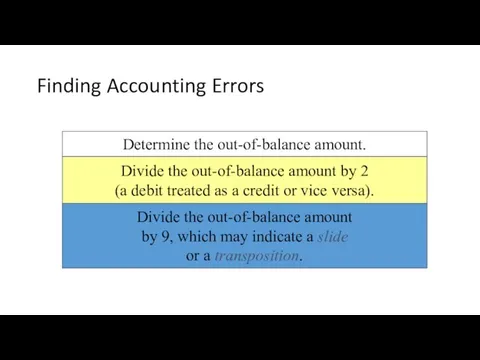

- 29. Finding Accounting Errors Determine the out-of-balance amount. Divide the out-of-balance amount by 2 (a debit treated

- 30. Example Papa John’s restaurants sold pizza to customers for $36,000 cash and sold $30,000 in supplies

- 31. Example Papa John’s commissaries ordered and received $29,000 in supplies, paying $9,000 in cash and owing

- 32. Example Papa John’s sold land with an historical cost of $1,000 for $4,000 cash. Papa John’s

- 34. Скачать презентацию

Бухгалтерское дело в условиях реформирования учета и отчетности в России

Бухгалтерское дело в условиях реформирования учета и отчетности в России Государственный бюджет. 3 класс

Государственный бюджет. 3 класс Фандрайзинг в научных исследованиях. Лекция 6

Фандрайзинг в научных исследованиях. Лекция 6 Бухгалтерский учет материалов

Бухгалтерский учет материалов Модели формирования портфеля инвестиций

Модели формирования портфеля инвестиций ОТЧЁТ о прохождении производственной практики в Управлении Федерального казначейства по Брянской области

ОТЧЁТ о прохождении производственной практики в Управлении Федерального казначейства по Брянской области Основные направления реализации Стратегии повышения финансовой грамотности в Российской Федерации

Основные направления реализации Стратегии повышения финансовой грамотности в Российской Федерации Предмет и система финансового права

Предмет и система финансового права Банковская система

Банковская система Structuring. Transaction Framework

Structuring. Transaction Framework Фондовый рынок

Фондовый рынок Кредитная карта ЛокоБанк. Универсальный коммерческий банк

Кредитная карта ЛокоБанк. Универсальный коммерческий банк Сложные моменты при включении в реестр требований кредиторов. (Лекция 2)

Сложные моменты при включении в реестр требований кредиторов. (Лекция 2) Бухгалтерский учет в сельскохозяйственных кооперативах

Бухгалтерский учет в сельскохозяйственных кооперативах Методы дисконтирования денежных потоков

Методы дисконтирования денежных потоков Банк и небанковские финансово-кредитные организации

Банк и небанковские финансово-кредитные организации Ogólne zasady stosowania ustawy o dyscyplinie finansów publicznyc

Ogólne zasady stosowania ustawy o dyscyplinie finansów publicznyc Основы финансовых расчетов

Основы финансовых расчетов Организация учета при переходе на Единый налоговый платеж и Единый налоговый счет с 1 января 2023 года

Организация учета при переходе на Единый налоговый платеж и Единый налоговый счет с 1 января 2023 года Daň z přidané hodnoty

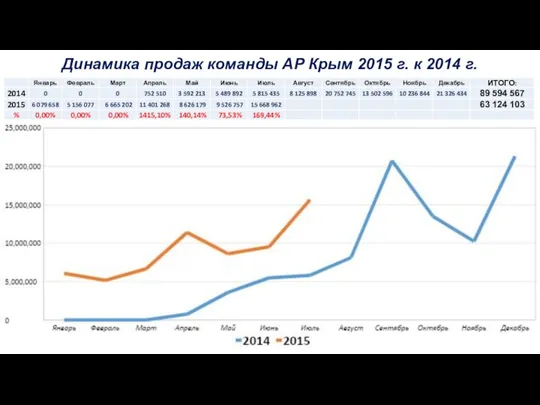

Daň z přidané hodnoty Динамика продаж Команды АР Крым

Динамика продаж Команды АР Крым Карта рассрочки Халва

Карта рассрочки Халва Теория кредитных рисков

Теория кредитных рисков Обучение по программе: Порядок ведения бухгалтерского учёта в соответствии с требованиями № 612-П

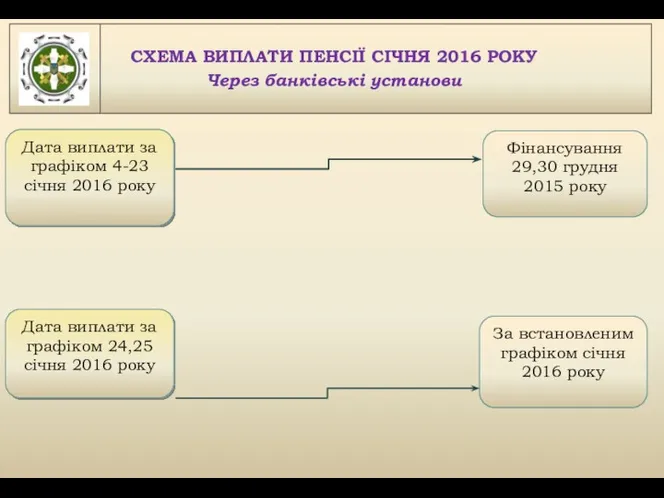

Обучение по программе: Порядок ведения бухгалтерского учёта в соответствии с требованиями № 612-П Схема виплати пенсії січня 2016 року

Схема виплати пенсії січня 2016 року Расчеты с бюджетом и внебюджетными фондами

Расчеты с бюджетом и внебюджетными фондами Разработка системы ценообразования для продукции фирмы

Разработка системы ценообразования для продукции фирмы Государственное регулирование страховой деятельности

Государственное регулирование страховой деятельности