Содержание

- 2. Agenda Overview Perspective Creating the structure Covenants Amsterdam Institute of Finance May, 2008

- 3. Overview Amsterdam Institute of Finance May, 2008

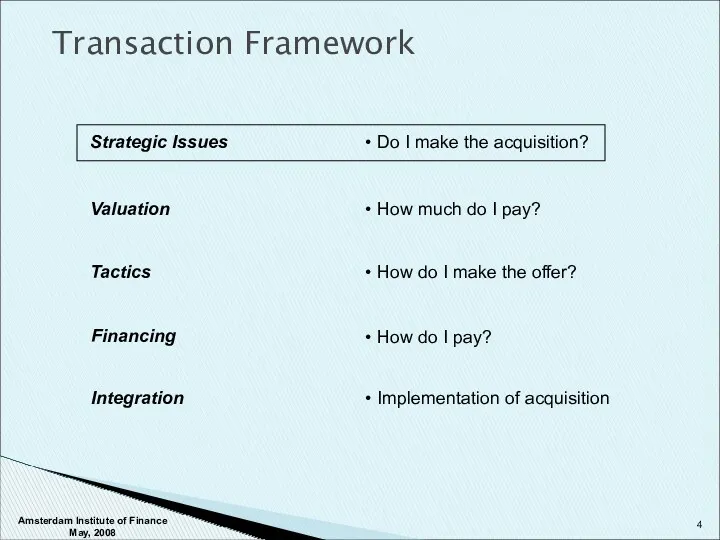

- 4. Transaction Framework Strategic Issues Do I make the acquisition? Valuation How much do I pay? Financing

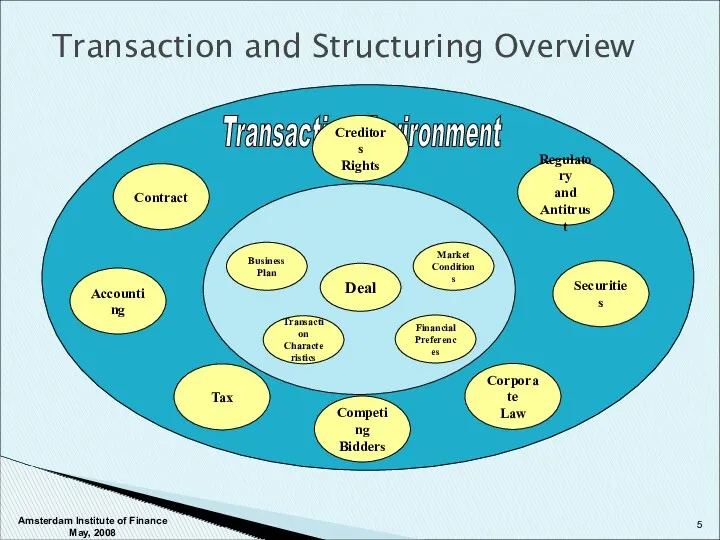

- 5. Transaction and Structuring Overview Accounting Tax Corporate Law Securities Regulatory and Antitrust Transaction Environment Contract Structuring

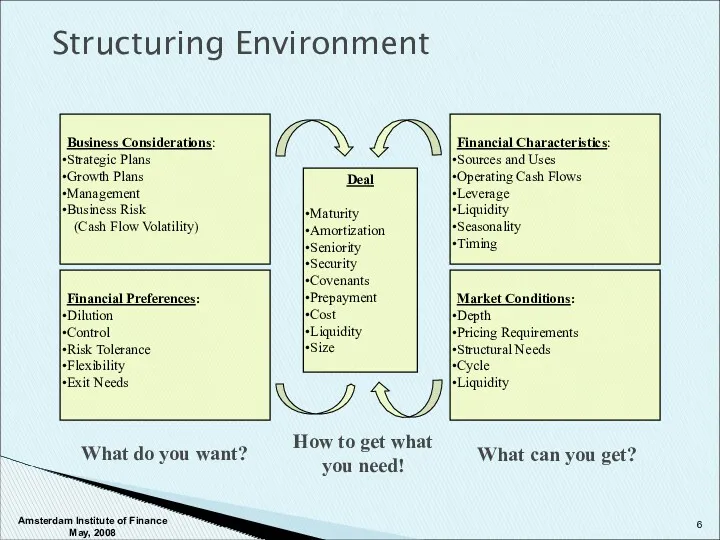

- 6. Structuring Environment Financial Preferences: Dilution Control Risk Tolerance Flexibility Exit Needs Market Conditions: Depth Pricing Requirements

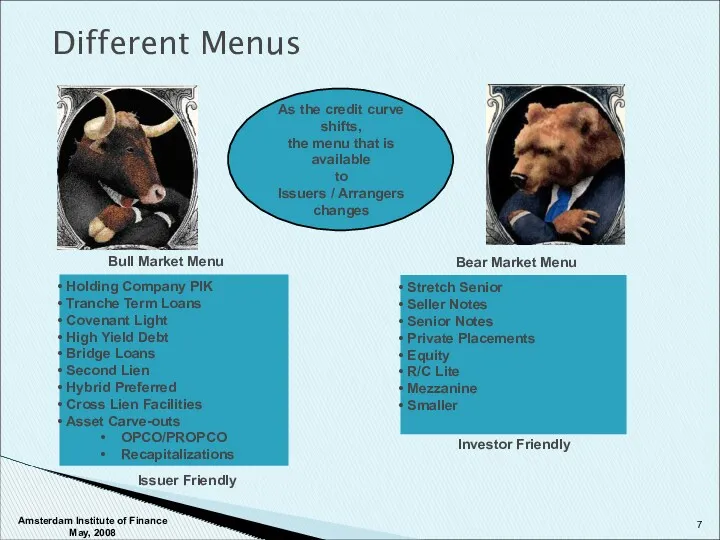

- 7. Different Menus Bull Market Menu Bear Market Menu As the credit curve shifts, the menu that

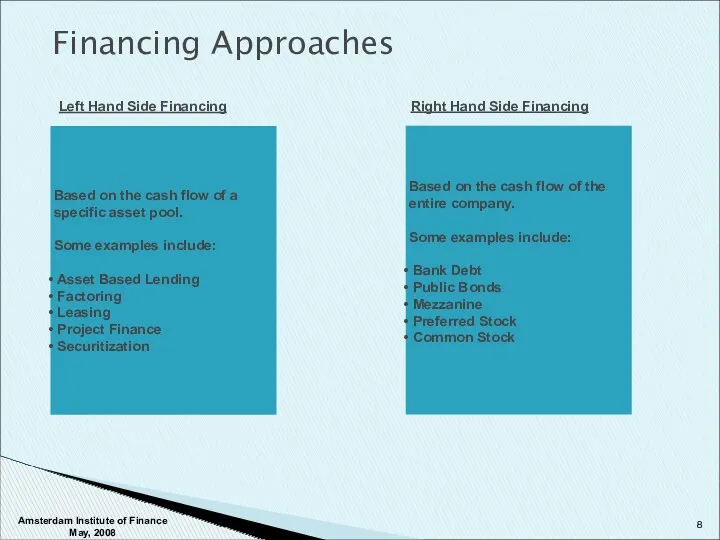

- 8. Financing Approaches Left Hand Side Financing Right Hand Side Financing Based on the cash flow of

- 9. Perspective Amsterdam Institute of Finance May, 2008

- 10. Capital Market Specific Factors Credit Specific Factors Customer Objectives Valuation Structuring Perspective Amsterdam Institute of Finance

- 11. Acceptable leverage levels Interest Rate Amortization Acceptable tenor of senior debt Asset coverage Size of issue

- 12. Public Debt vs. Private Debt Relative Value Analysis Domestic vs. International Issuance Fixed vs. Floating Rate

- 13. Amount of available cash flow Reliability of cash flow Credibility of projections Credit Specific Factors Amsterdam

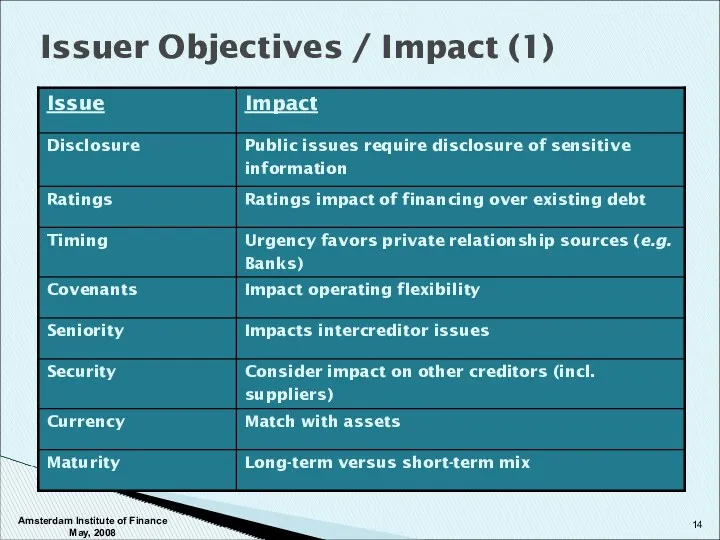

- 14. Issuer Objectives / Impact (1) Amsterdam Institute of Finance May, 2008

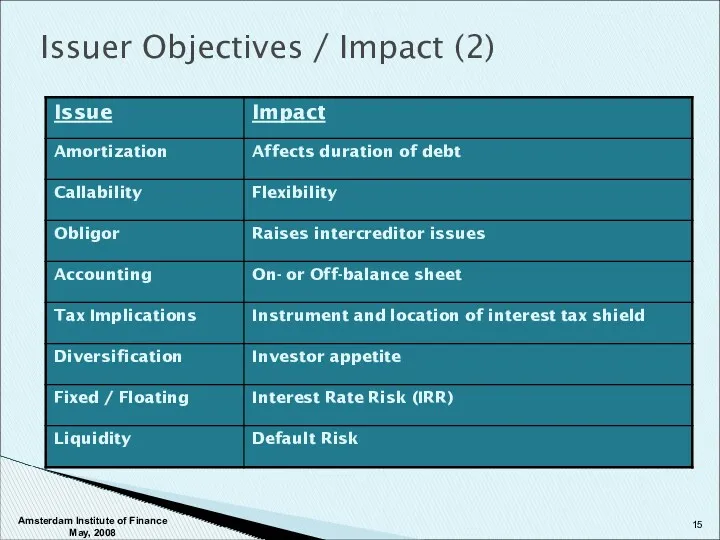

- 15. Issuer Objectives / Impact (2) Amsterdam Institute of Finance May, 2008

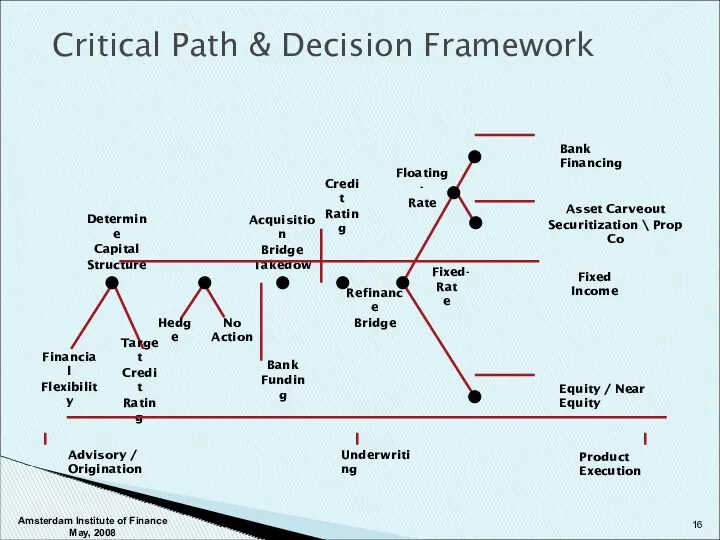

- 16. Critical Path & Decision Framework Financial Flexibility Target Credit Rating Determine Capital Structure Hedge No Action

- 17. Creating the Structure Amsterdam Institute of Finance May, 2008

- 18. Rule of Thumb Measures Balance Sheet Model Cash Flow Model Detailed Model Matching markets to the

- 19. Deal Financial Arithmetic Amsterdam Institute of Finance May, 2008

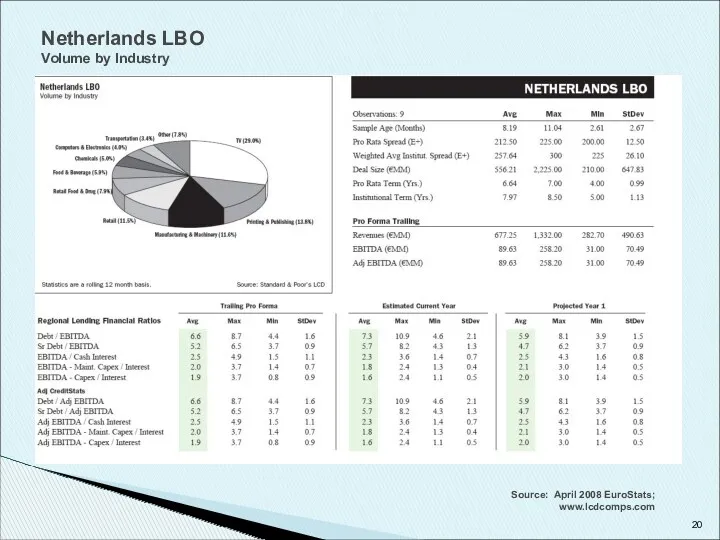

- 20. Netherlands LBO Volume by Industry Source: April 2008 EuroStats; www.lcdcomps.com

- 21. Purchase Price Minimum/Maximum Recapitalization Dividend Debt Refinancing Callability Premiums Tax Issues Expenses Other Uses Financing Need

- 22. Revolver Tied to advance against current assets Crossing liens Term Loan A Macro: Ratio of 3-4x

- 23. Current Asset approach Use standard advance rates Accounts Receivable 80% Inventory 60% PP&E 40% Consider the

- 24. Term Loans = Maximum Senior Debt - Revolver Focus is on Free Operating Cash Flow Market

- 25. Typical bank financings as structured as follows: Revolving Credit Term Loan A (amortising) Term Loans B

- 26. Long Term Debt = Max Total Debt - Max Senior Secured Debt Senior unsecured Sub Debt

- 27. Subordination Senior lenders are concerned with the implications of having high yield investors at the table

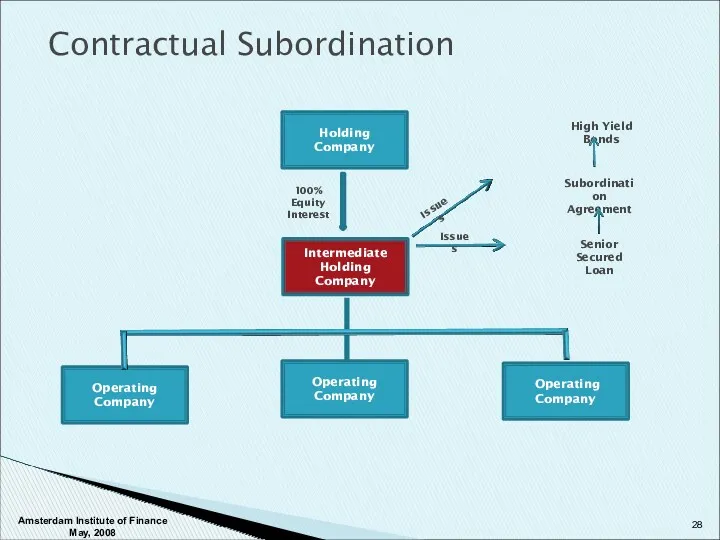

- 28. Contractual Subordination Holding Company Intermediate Holding Company Operating Company Operating Company Operating Company 100% Equity Interest

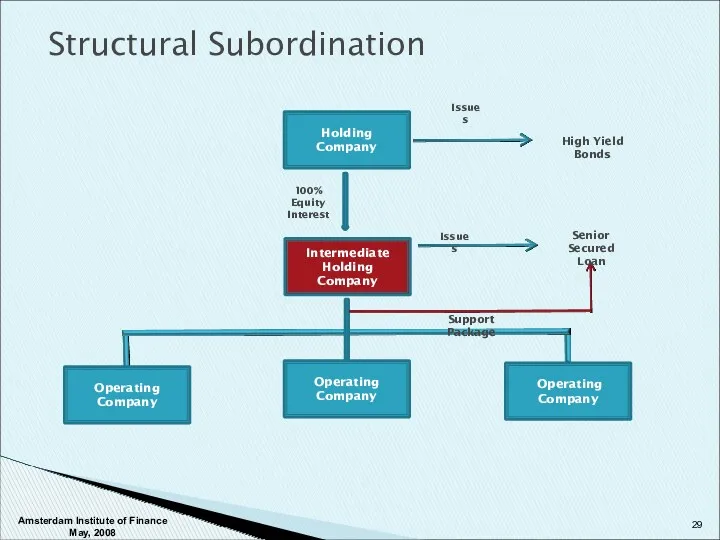

- 29. Structural Subordination Holding Company Intermediate Holding Company Operating Company Operating Company Operating Company 100% Equity Interest

- 30. Retranche Increase Pricing Lower Leverage Lower Purchase Price Seller Paper Increase Equity Senior Notes to cover

- 31. Covenants Amsterdam Institute of Finance May, 2008

- 32. PURPOSE: maintain the original deal WHY Agency problem due to asymmetric information Adverse Selection Moral Hazard

- 33. Categories Affirmative The maintenance, preservation and insurance of corporate assets and the compliance of environmental, ERISA

- 34. There are no standard covenants. They must be tailor fit for each deal and loan structure.

- 35. First-lien leveraged loans covenant statistics: Average number and distribution Excludes covenant-lite deals Amsterdam Institute of Finance

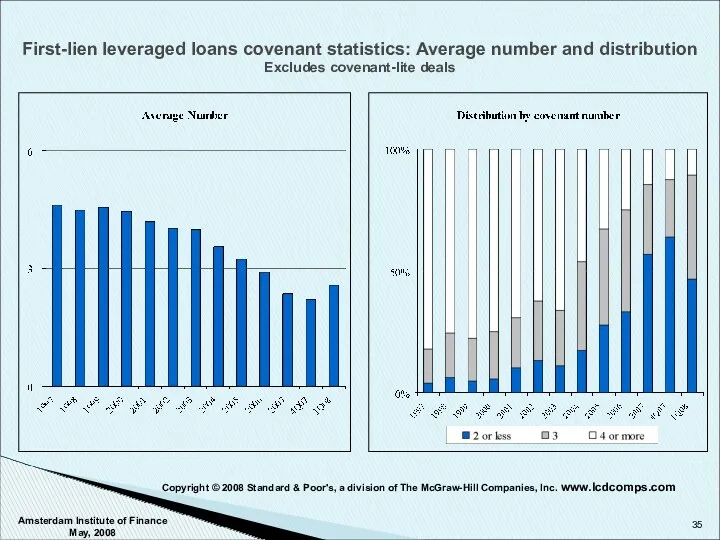

- 36. Amsterdam Institute of Finance May, 2008 Incidence of key covenants in first-lien leveraged loans Excludes covenant-lite

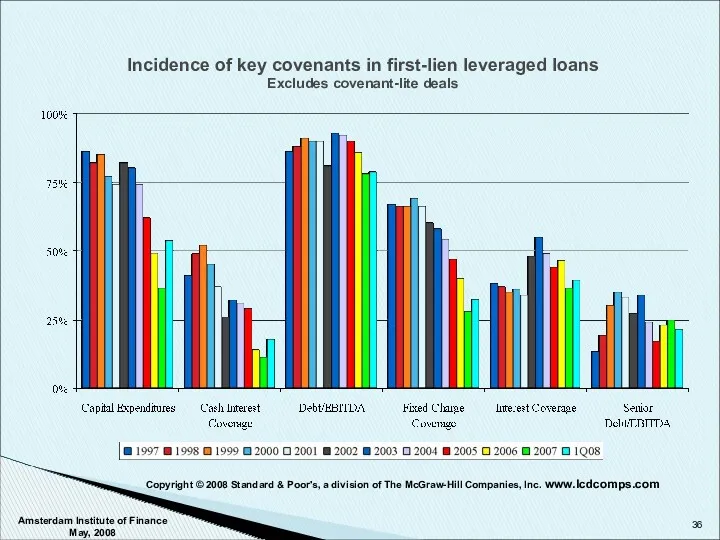

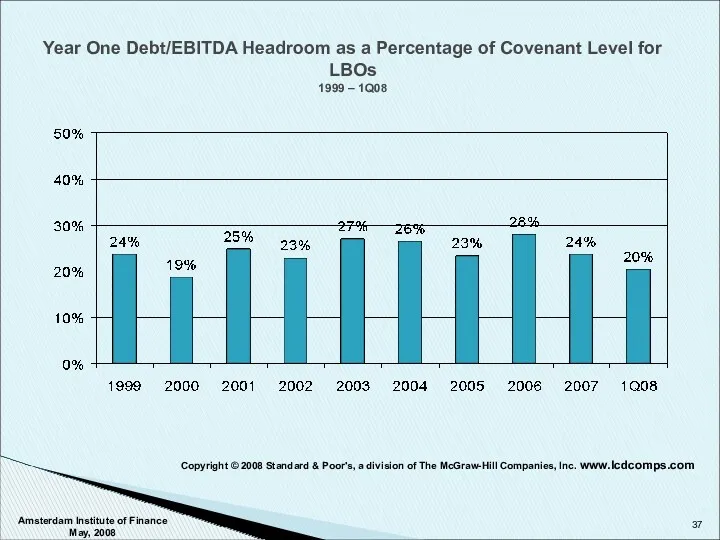

- 37. Amsterdam Institute of Finance May, 2008 Year One Debt/EBITDA Headroom as a Percentage of Covenant Level

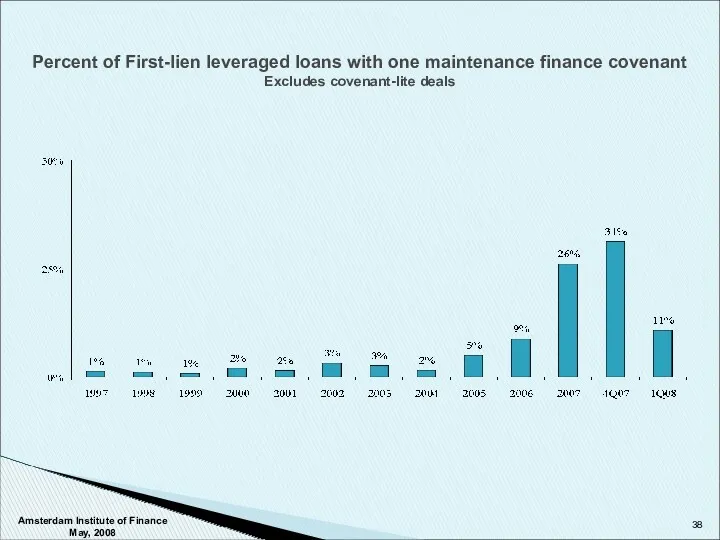

- 38. Amsterdam Institute of Finance May, 2008 Percent of First-lien leveraged loans with one maintenance finance covenant

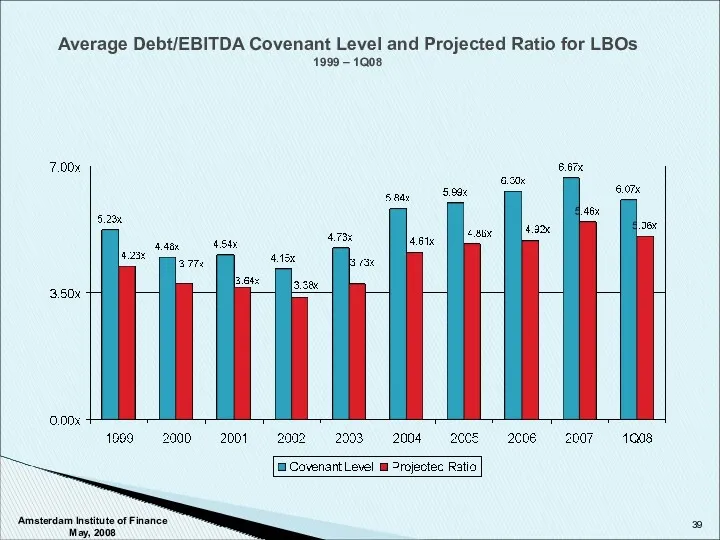

- 39. Average Debt/EBITDA Covenant Level and Projected Ratio for LBOs 1999 – 1Q08 Amsterdam Institute of Finance

- 40. Covenant Levels and Issues Covenants are negotiated between the lender and borrower. Covenant levels will affect

- 41. Translating Capital Structure and Debt Capacity into a Detailed Financing Structure. Conclusion Amsterdam Institute of Finance

- 42. Project Gear Amsterdam Institute of Finance May, 2008

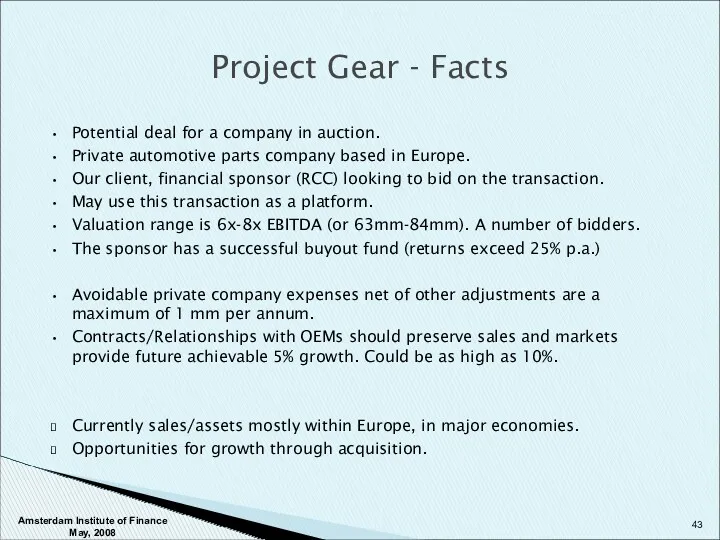

- 43. Project Gear - Facts Potential deal for a company in auction. Private automotive parts company based

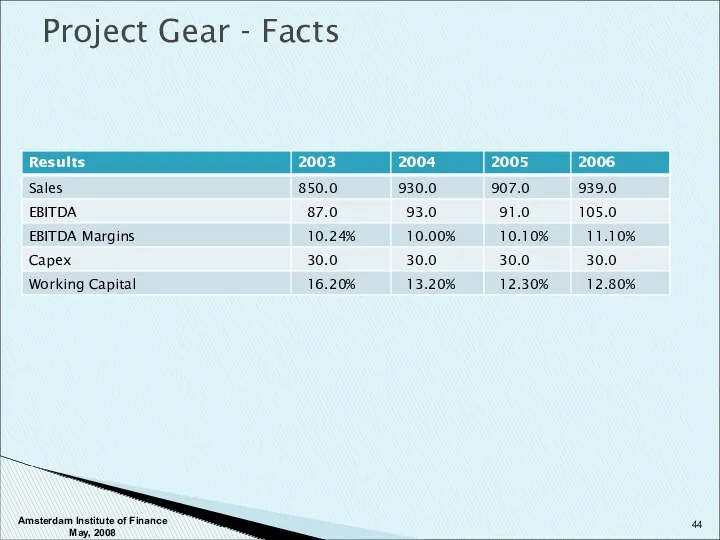

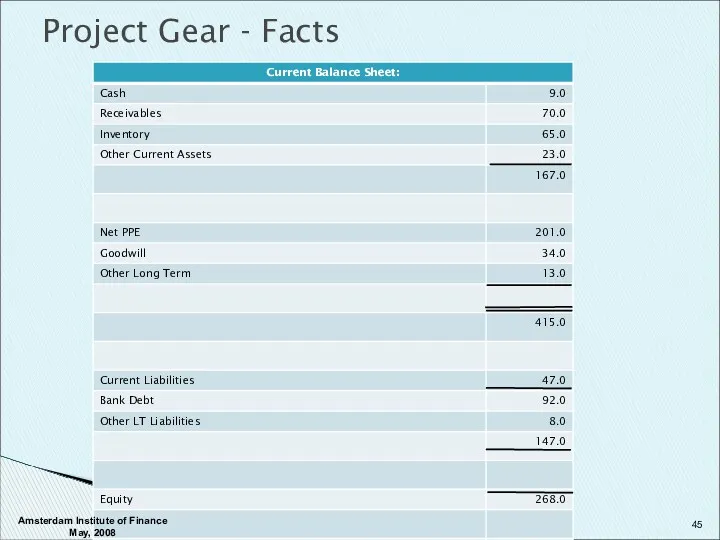

- 44. Project Gear - Facts Amsterdam Institute of Finance May, 2008

- 45. Project Gear - Facts Amsterdam Institute of Finance May, 2008

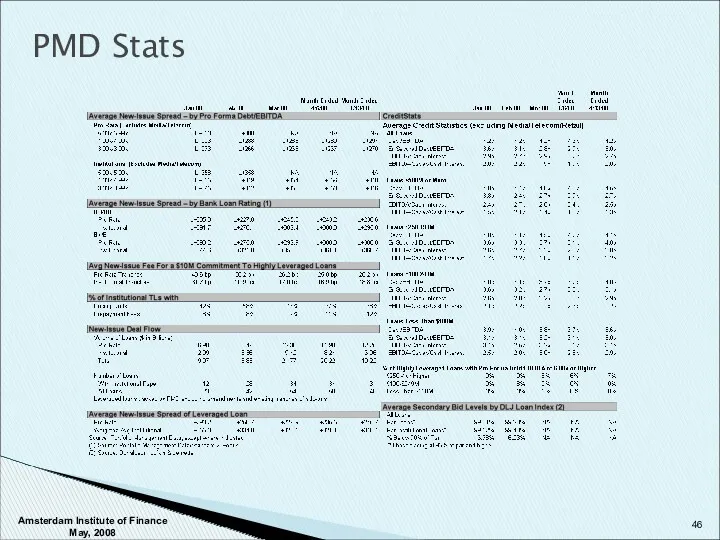

- 46. PMD Stats Amsterdam Institute of Finance May, 2008

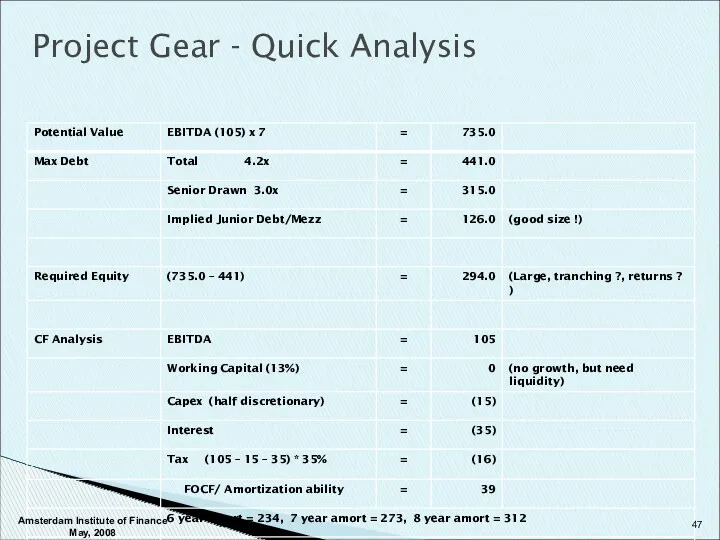

- 47. Project Gear - Quick Analysis Amsterdam Institute of Finance May, 2008

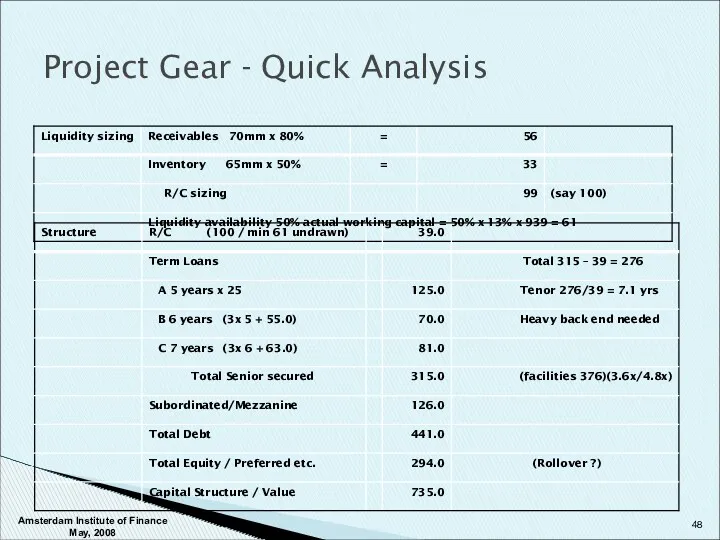

- 48. Project Gear - Quick Analysis Amsterdam Institute of Finance May, 2008

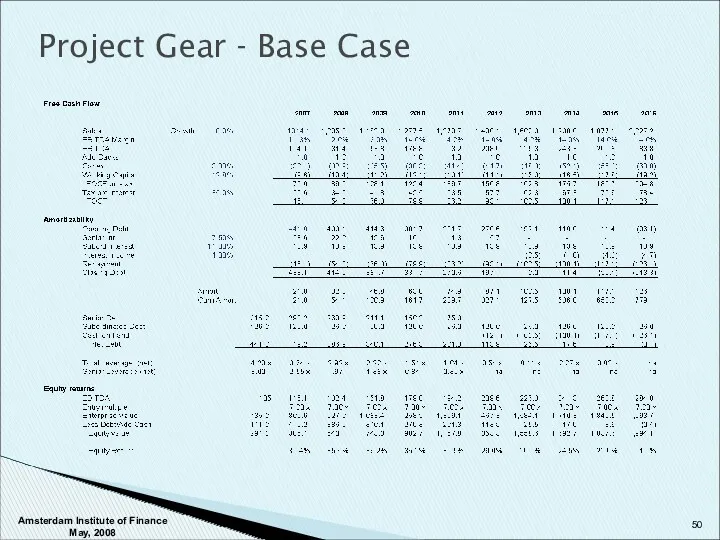

- 49. Project Gear - Base Case Assumptions : 8 % growth Margins gradually improve to 14% Allow

- 50. Project Gear - Base Case Amsterdam Institute of Finance May, 2008

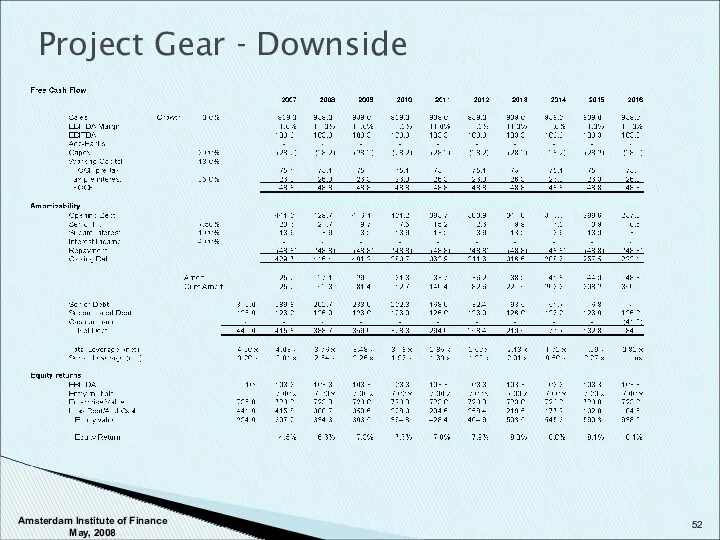

- 51. Project Gear - Downside Assumptions : 0% growth Margins flat (slight decline) to 11% Do not

- 52. Project Gear - Downside Amsterdam Institute of Finance May, 2008

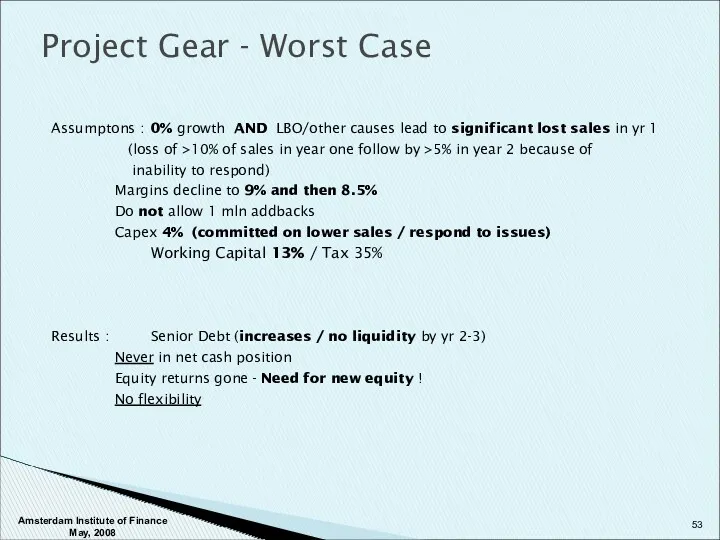

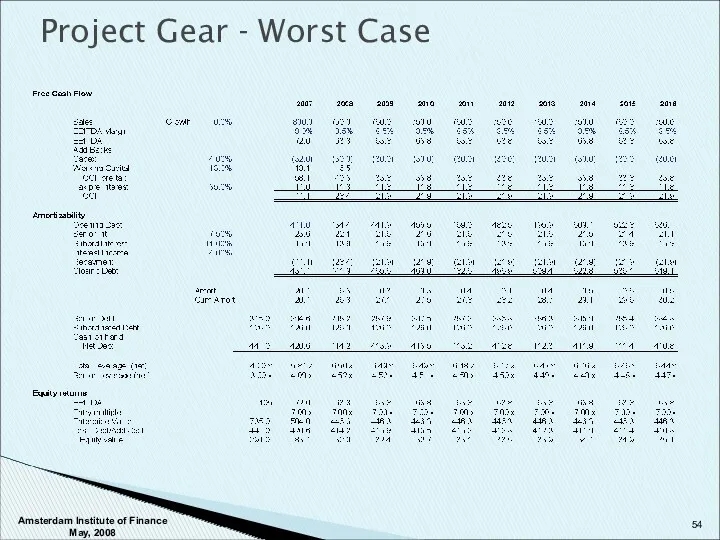

- 53. Project Gear - Worst Case Assumptons : 0% growth AND LBO/other causes lead to significant lost

- 54. Project Gear - Worst Case Amsterdam Institute of Finance May, 2008

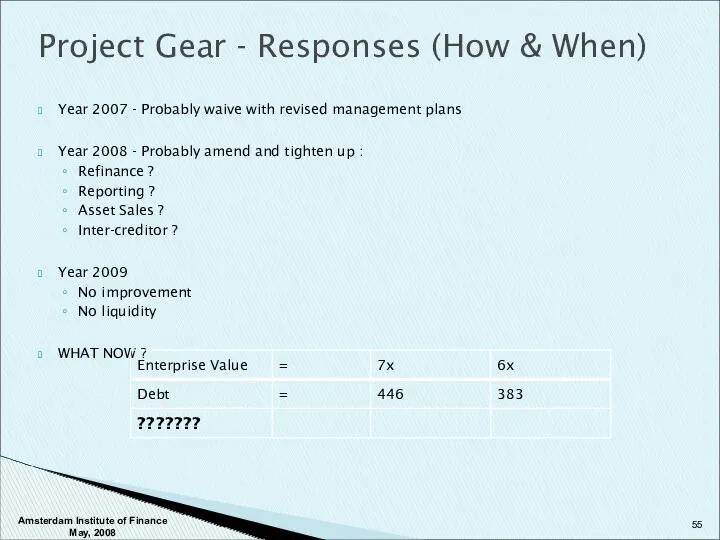

- 55. Project Gear - Responses (How & When) Year 2007 - Probably waive with revised management plans

- 57. Скачать презентацию

Сутність грошей та їх функції. Теорії грошей. (Тема 1)

Сутність грошей та їх функції. Теорії грошей. (Тема 1) Финансовые ресурсы предприятия и их источники, направления и использование

Финансовые ресурсы предприятия и их источники, направления и использование Мошенничество на рынке ценных бумаг

Мошенничество на рынке ценных бумаг Платежные сервисы. Применение ККТ в сфере ЖКХ

Платежные сервисы. Применение ККТ в сфере ЖКХ Контрольно-счетная палата Москвы

Контрольно-счетная палата Москвы Методы продаж банковских продуктов и услуг

Методы продаж банковских продуктов и услуг Жалақы қорынан міндетті ақша ұстап қалу. Жалақыны есептеу тәртібі

Жалақы қорынан міндетті ақша ұстап қалу. Жалақыны есептеу тәртібі Что такое деньги. 3 класс

Что такое деньги. 3 класс Сущность и формы кредита. Тема 4

Сущность и формы кредита. Тема 4 Личные финансы: от экономии к инвестициям. Непостоянные доходы

Личные финансы: от экономии к инвестициям. Непостоянные доходы Заполнение налоговой декларации

Заполнение налоговой декларации Трейдинг как привилегия

Трейдинг как привилегия Оценка эффективности коммерческой деятельности предприятия

Оценка эффективности коммерческой деятельности предприятия The finances of the company. Financial statements of the company

The finances of the company. Financial statements of the company ТАС Family - финансовая защита бюджета семьи

ТАС Family - финансовая защита бюджета семьи Лекция 2. Классификация инвестиций

Лекция 2. Классификация инвестиций Анализ тенденций развития валютного рынка

Анализ тенденций развития валютного рынка Халықаралық валюта жүйесі

Халықаралық валюта жүйесі Деньги, инфляция, процентные ставки, валютный курс

Деньги, инфляция, процентные ставки, валютный курс Налог на добавленную стоимость

Налог на добавленную стоимость Налоги и вычеты

Налоги и вычеты Финансовые коэффициенты

Финансовые коэффициенты Оценка финансового состояния организации (на примере ООО Агромашснаб г. Черкесска)

Оценка финансового состояния организации (на примере ООО Агромашснаб г. Черкесска) Инвестиционная безопасность коммерческой организации

Инвестиционная безопасность коммерческой организации Финансовое планирование и методы прогнозирования

Финансовое планирование и методы прогнозирования Фундаментальный анализ ценных бумаг

Фундаментальный анализ ценных бумаг Что поменять в учете из-за новых стандартов: ФСБУ Аренда

Что поменять в учете из-за новых стандартов: ФСБУ Аренда Монетарная политика

Монетарная политика