Содержание

- 2. Lecture 5. Investment criteria

- 3. How should a firm make an investment decision What assets do we buy? What is the

- 4. Capital Budgeting: The process of planning for purchases of long-term assets. Example: Suppose our firm must

- 5. Decision-making Criteria in Capital Budgeting How do we decide if a capital investment project should be

- 6. Decision-making Criteria in Capital Budgeting The ideal evaluation method should: include all cash flows that occur

- 7. Decision-making Criteria in Capital Budgeting Firms invest in 2 categories of projects: Independent projects – do

- 8. Techniques in Capital Budgeting Payback period Discounted Payback Period Net Present Value (NPV) Profitability Index (PI)

- 9. 1) Payback Period The payback method simply measures how long (in years and/or months) it takes

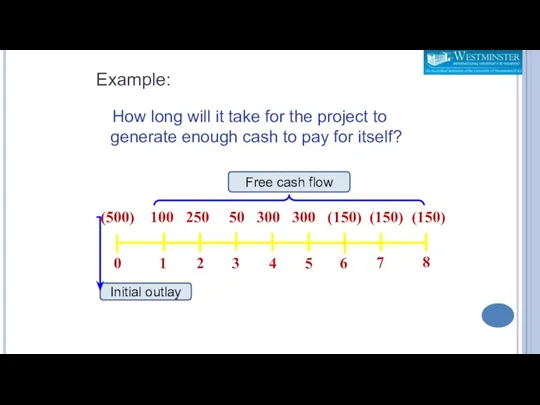

- 10. How long will it take for the project to generate enough cash to pay for itself?

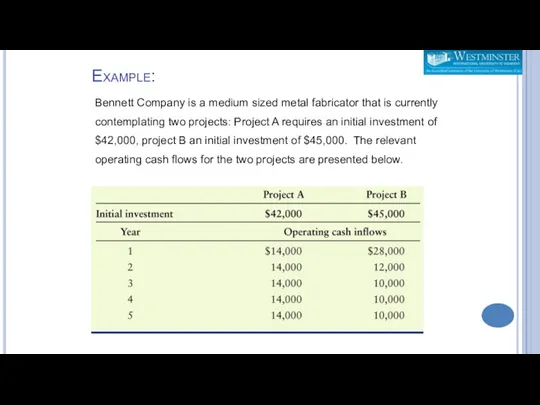

- 11. Bennett Company is a medium sized metal fabricator that is currently contemplating two projects: Project A

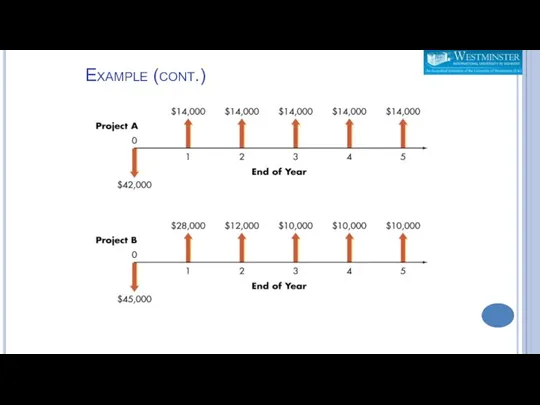

- 12. Example (cont.)

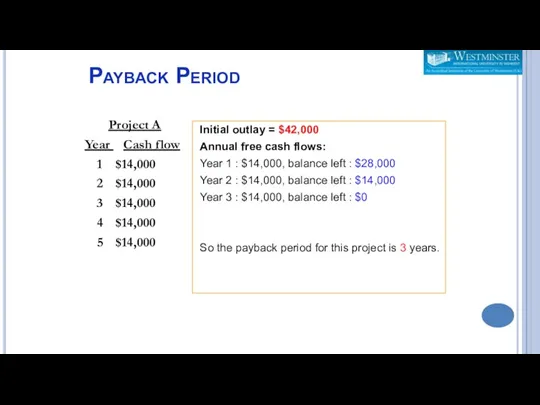

- 13. Payback Period Project A Year Cash flow 1 $14,000 2 $14,000 3 $14,000 4 $14,000 5

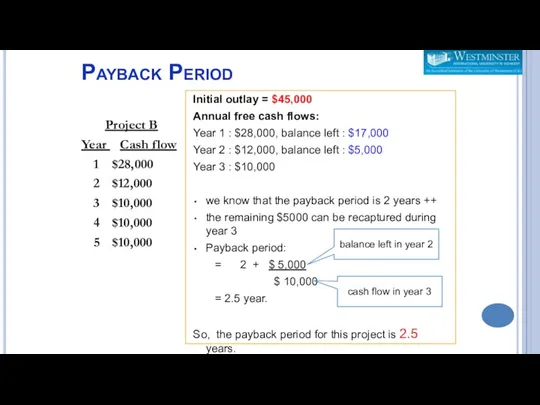

- 14. Payback Period Project B Year Cash flow 1 $28,000 2 $12,000 3 $10,000 4 $10,000 5

- 15. Payback Period Is the payback period good? Is it acceptable? Firms that use this method will

- 16. Pros and Cons of Payback Periods The payback method is widely used by large firms to

- 17. Pros and Cons of Payback Periods (cont.) One major weakness of the payback method is that

- 18. 2) Discounted Payback Period The number of years needed to recover initial cash outlay from the

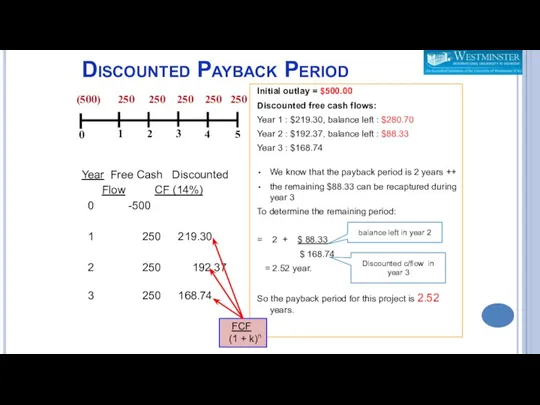

- 19. Discounted Payback Period Year Free Cash Discounted Flow CF (14%) 0 -500 1 250 219.30 2

- 20. Discounted Payback Period Discounted payback period is 2.52 years. Is it acceptable? ACCEPT if discounted payback

- 21. Discounted Payback Period Advantages: Uses free cash flows Easy to calculate and to understand Considers time

- 22. Other Methods 3) Net Present Value (NPV) 4) Profitability Index (PI) 5) Internal Rate of Return

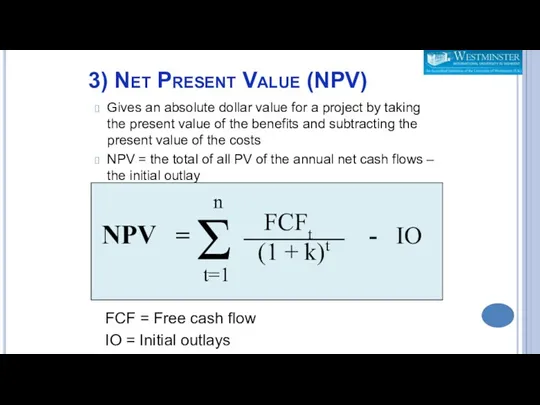

- 23. 3) Net Present Value (NPV) Gives an absolute dollar value for a project by taking the

- 24. Net Present Value (NPV) Decision rule : ACCEPT if NPV is positive { NPV > 0

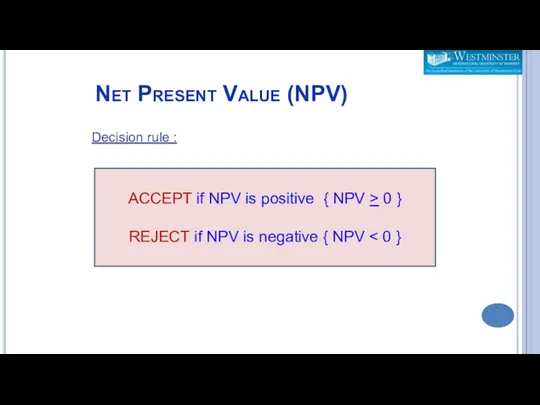

- 25. Find the PV for every cash flows discounted @ the investors required rate of return Sum

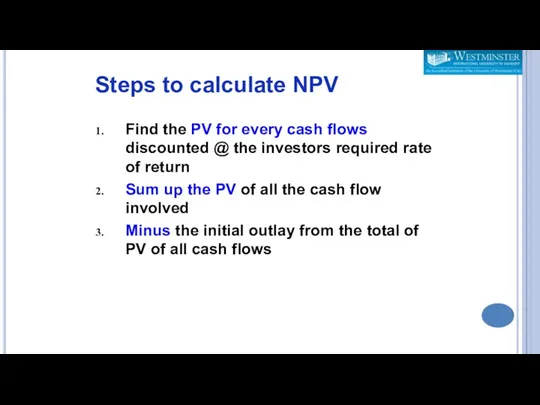

- 26. NPV Example Suppose we are considering a capital investment that costs $250,000 and provides annual net

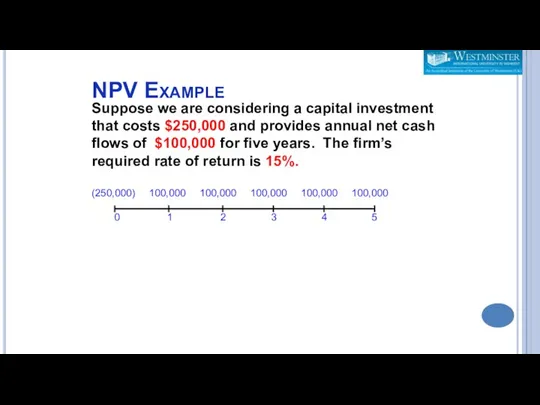

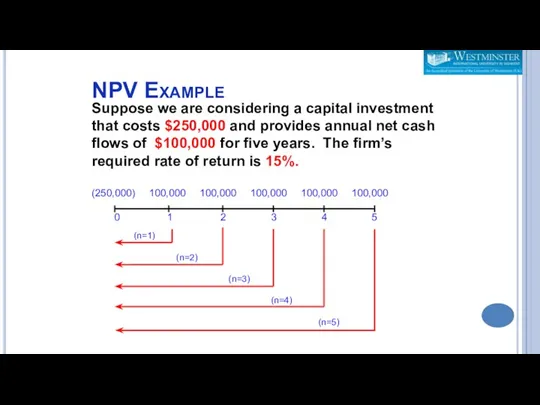

- 27. NPV Example Suppose we are considering a capital investment that costs $250,000 and provides annual net

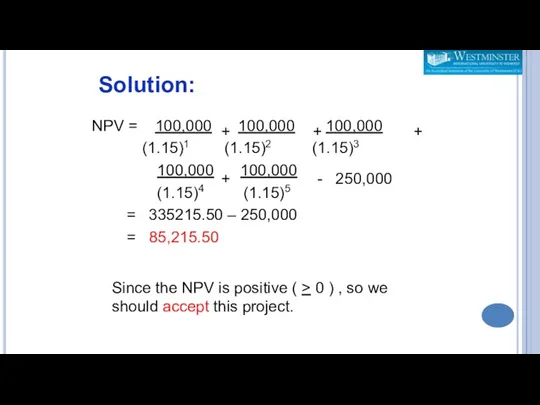

- 28. NPV = 100,000 100,000 100,000 (1.15)1 (1.15)2 (1.15)3 100,000 100,000 (1.15)4 (1.15)5 = 335215.50 – 250,000

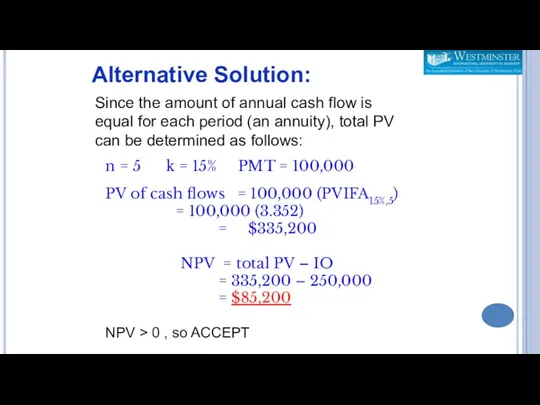

- 29. n = 5 k = 15% PMT = 100,000 PV of cash flows = 100,000 (PVIFA15%,5)

- 30. Net Present Value Advantages: Uses free cash flows Recognizes the time value of money Consistent with

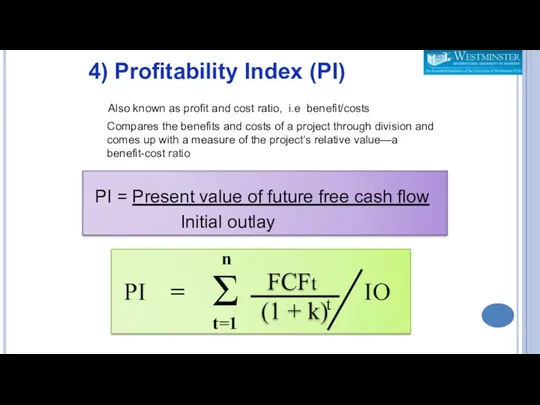

- 31. Also known as profit and cost ratio, i.e benefit/costs Compares the benefits and costs of a

- 32. Profitability Index (PI) Decision rule : ACCEPT if PI is greater than or equal to one

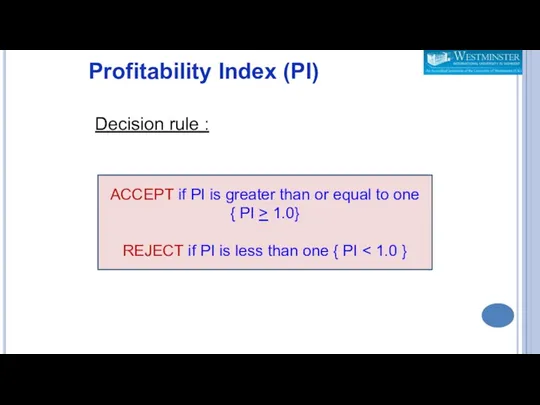

- 33. Profitability Index Advantages: Uses free cash flows Recognizes the time value of money Consistent with the

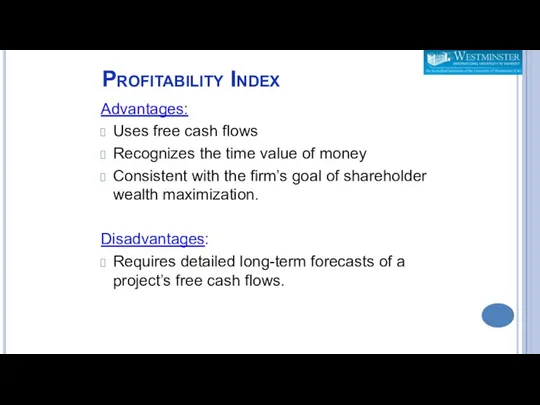

- 34. Emerald Corp. is considering an investment with a cost of $350,000 and future benefits of $100,000

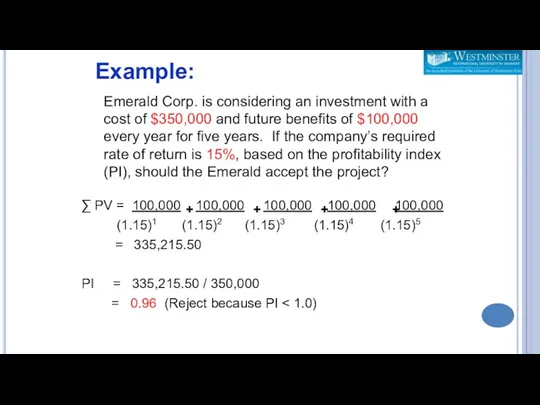

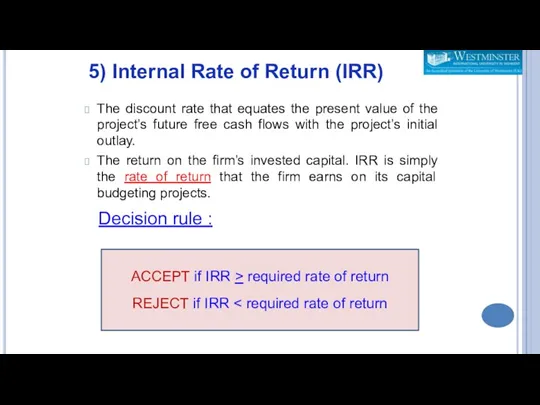

- 35. The discount rate that equates the present value of the project’s future free cash flows with

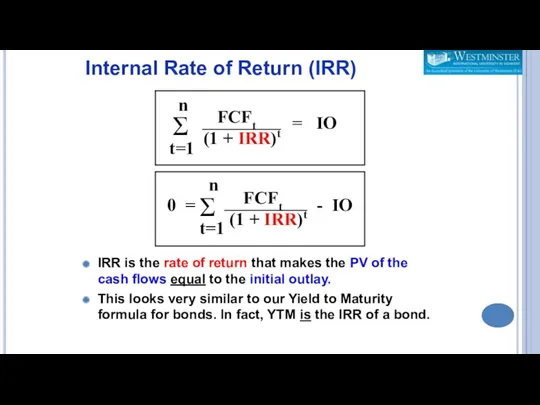

- 36. IRR is the rate of return that makes the PV of the cash flows equal to

- 37. Calculating IRR Bennett Company is a medium sized metal fabricator that is currently contemplating two projects:

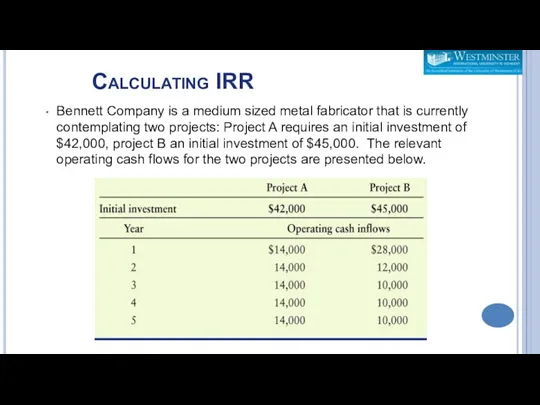

- 38. Solution: -$42,000 $14,000 $14,000 $14,000 $14,000 $14,000 -$45,000 $28,000 $12,000 $10,000 $10,000 $10,000 $45,000 NPVB= $

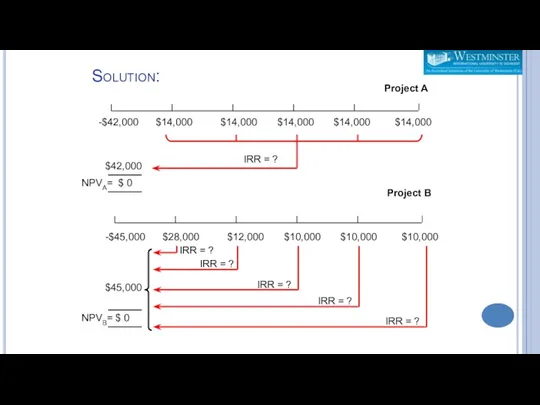

- 39. Method: trial and error Choose one rate and calculate the NPV using that rate. If your

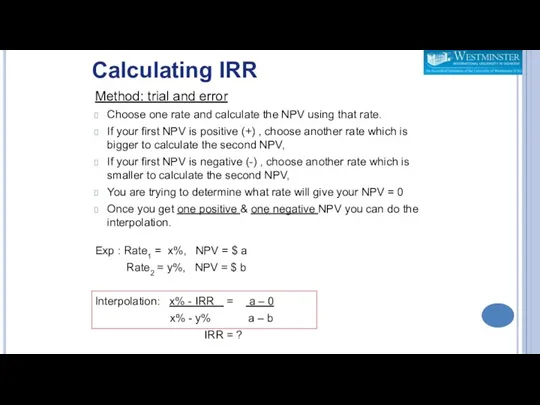

- 40. Solution: -$42,000 $14,000 $14,000 $14,000 $14,000 $14,000 NPVA= $ 0 $42,000 IRR = ? Project A

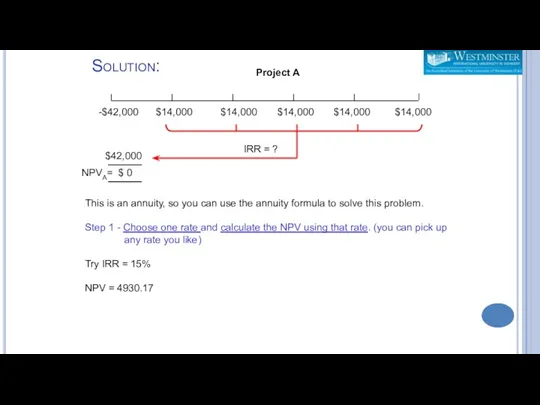

- 41. Solution: -$42,000 $14,000 $14,000 $14,000 $14,000 $14,000 NPVA= $ 0 $42,000 IRR = ? Project A

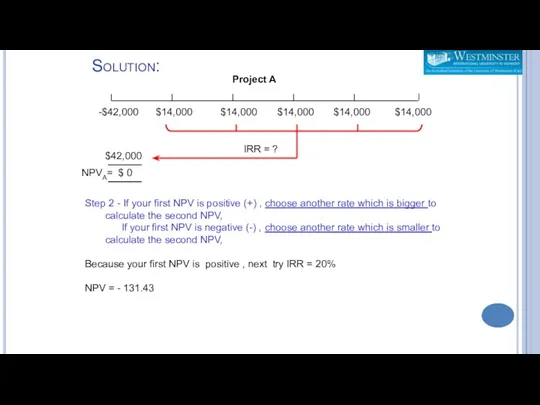

- 42. Solution: -$42,000 $14,000 $14,000 $14,000 $14,000 $14,000 NPVA= $ 0 $42,000 IRR = ? Project A

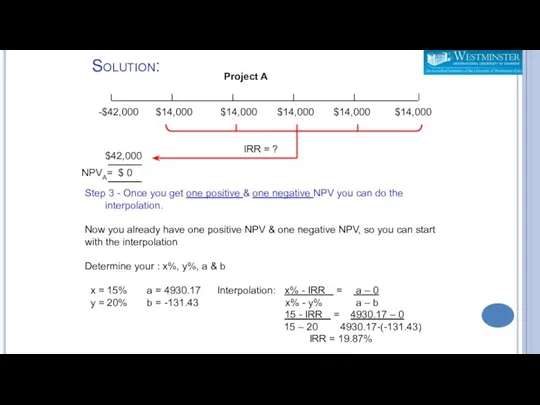

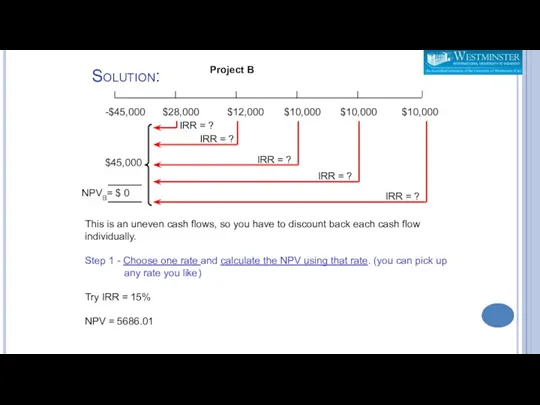

- 43. Solution: -$45,000 $28,000 $12,000 $10,000 $10,000 $10,000 $45,000 NPVB= $ 0 IRR = ? IRR =

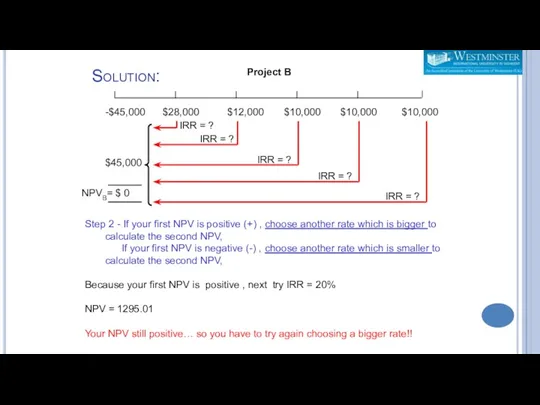

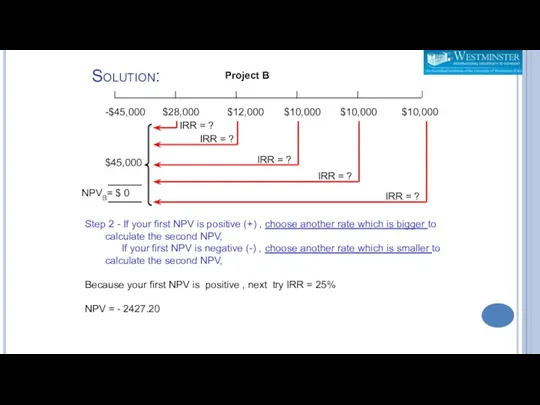

- 44. Solution: -$45,000 $28,000 $12,000 $10,000 $10,000 $10,000 $45,000 NPVB= $ 0 IRR = ? IRR =

- 45. Solution: -$45,000 $28,000 $12,000 $10,000 $10,000 $10,000 $45,000 NPVB= $ 0 IRR = ? IRR =

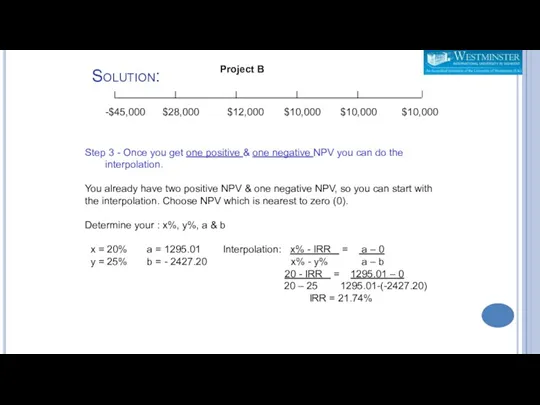

- 46. Solution: -$45,000 $28,000 $12,000 $10,000 $10,000 $10,000 Project B Step 3 - Once you get one

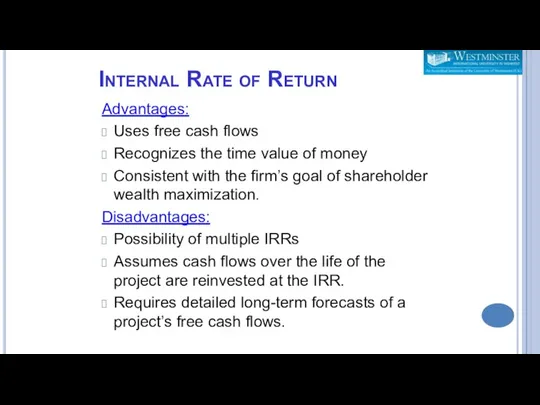

- 47. Internal Rate of Return Advantages: Uses free cash flows Recognizes the time value of money Consistent

- 48. IRR is a good decision-making tool as long as cash flows are conventional. (- + +

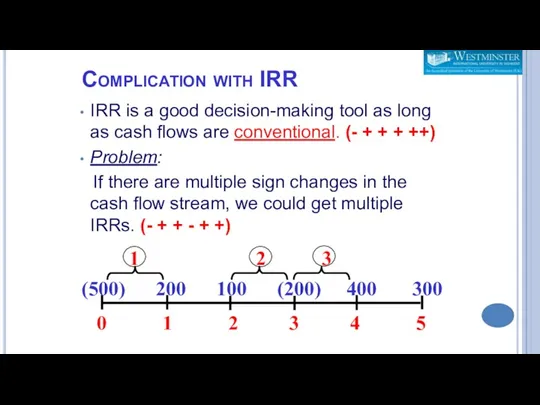

- 49. Modified Internal Rate of Return (MIRR) IRR assumes that all cash flows are reinvested at the

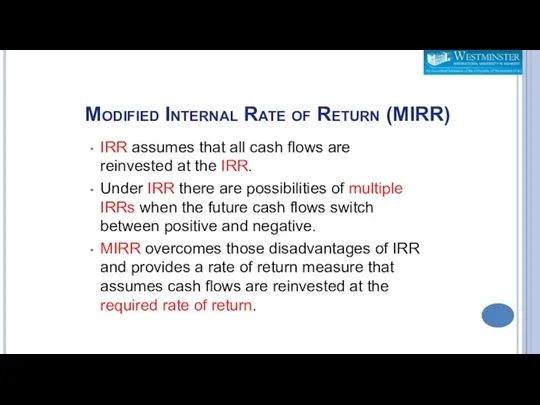

- 50. Modified Internal Rate of Return (MIRR)

- 52. Скачать презентацию

Актуальные проблемы налогового контроля в РФ

Актуальные проблемы налогового контроля в РФ Анализ капитальных вложений

Анализ капитальных вложений Банк қызметінің құқықтық негіздері

Банк қызметінің құқықтық негіздері Методика SIGMA

Методика SIGMA Фонд развития промышленности Республики Карелия

Фонд развития промышленности Республики Карелия Бизнес-планирование инновационных проектов

Бизнес-планирование инновационных проектов Лекция 16. Японские свечи

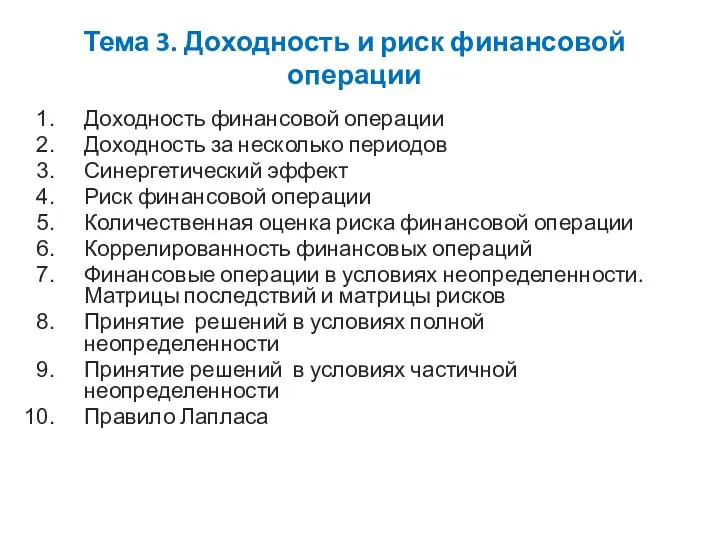

Лекция 16. Японские свечи Доходность и риск финансовой операции

Доходность и риск финансовой операции Денежная система

Денежная система Оценка гудвилла

Оценка гудвилла Изменения в налоговом законодательстве с 2023 года: Введение Единого налогового платежа

Изменения в налоговом законодательстве с 2023 года: Введение Единого налогового платежа Аналіз джерел формування капіталу. Лекція 5

Аналіз джерел формування капіталу. Лекція 5 Управление стоимостью компании

Управление стоимостью компании Вклад Альянса ФМС УрФО в развитие местных сообществ

Вклад Альянса ФМС УрФО в развитие местных сообществ Оборотные средства гостиничного предприятия

Оборотные средства гостиничного предприятия Налог на доходы физических лиц (НДФЛ)

Налог на доходы физических лиц (НДФЛ) Семейный бюджет

Семейный бюджет Концептуальні основи оподаткування

Концептуальні основи оподаткування Фінансові посередники. Сутність фінансових посередників та їх функції. Суб'єкти банківської системи. (Тема 3)

Фінансові посередники. Сутність фінансових посередників та їх функції. Суб'єкти банківської системи. (Тема 3) Сущность портфеля ценных бумаг и портфельного инвестирования. (Тема 1)

Сущность портфеля ценных бумаг и портфельного инвестирования. (Тема 1) Activity-Based Costing and Activity-Based Management

Activity-Based Costing and Activity-Based Management Президентские гранты для ННО

Президентские гранты для ННО Салық салу саласындағы мемлекеттік басқару түсінігі,маңызы,міндеттері

Салық салу саласындағы мемлекеттік басқару түсінігі,маңызы,міндеттері Региональная бюджетная система

Региональная бюджетная система Налог на добавленную стоимость

Налог на добавленную стоимость Такафул – исламское страхование

Такафул – исламское страхование ТОО КазМунайГаз-Сервис. Активы компании

ТОО КазМунайГаз-Сервис. Активы компании Фінансові інвестиції

Фінансові інвестиції