Содержание

- 2. Topics Covered Markowitz Portfolio Theory Risk and Return Relationship Testing the CAPM CAPM Alternatives

- 3. Markowitz Portfolio Theory Combining stocks into portfolios can reduce standard deviation, below the level obtained from

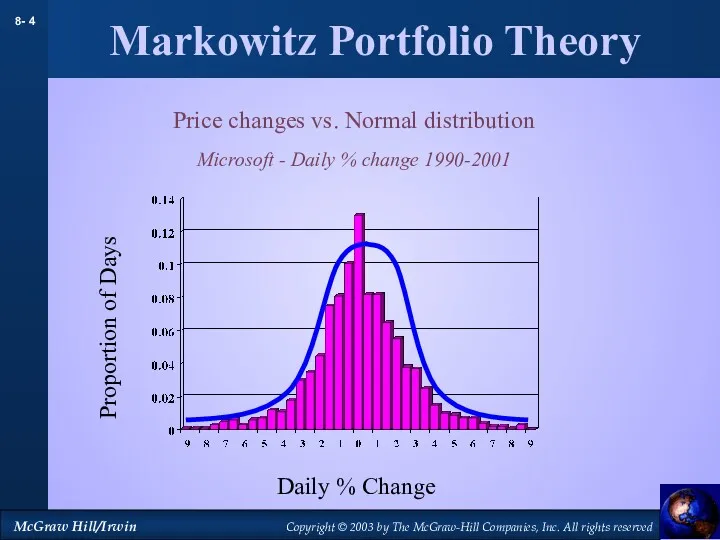

- 4. Markowitz Portfolio Theory Price changes vs. Normal distribution Microsoft - Daily % change 1990-2001 Proportion of

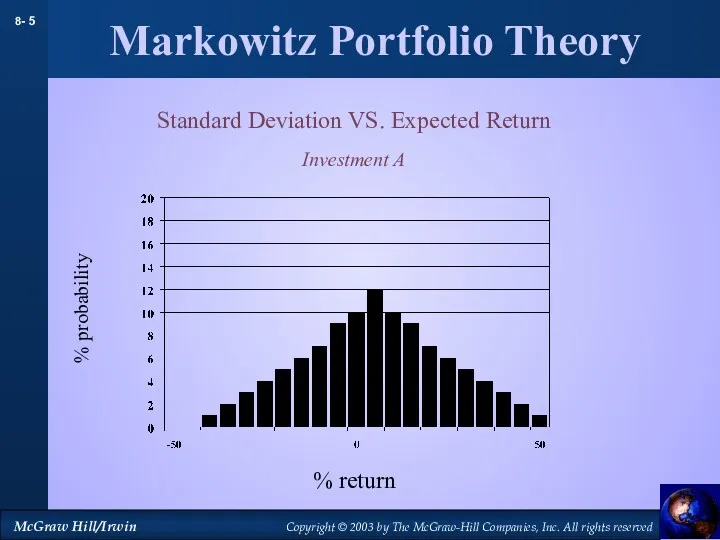

- 5. Markowitz Portfolio Theory Standard Deviation VS. Expected Return Investment A % probability % return

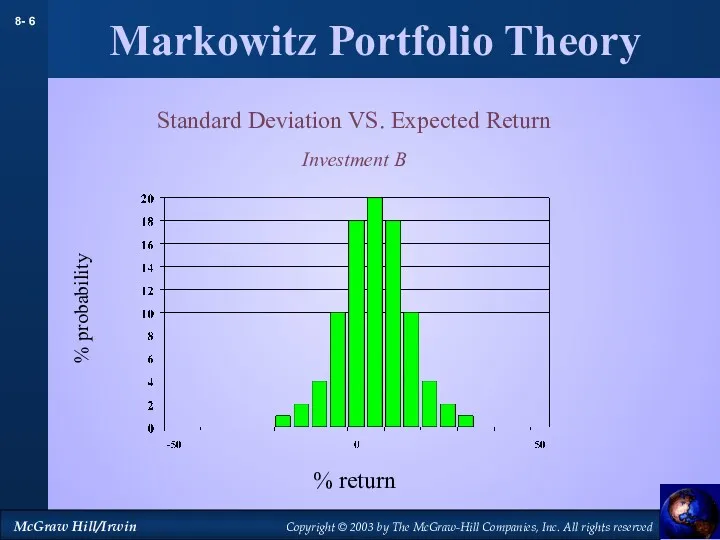

- 6. Markowitz Portfolio Theory Standard Deviation VS. Expected Return Investment B % probability % return

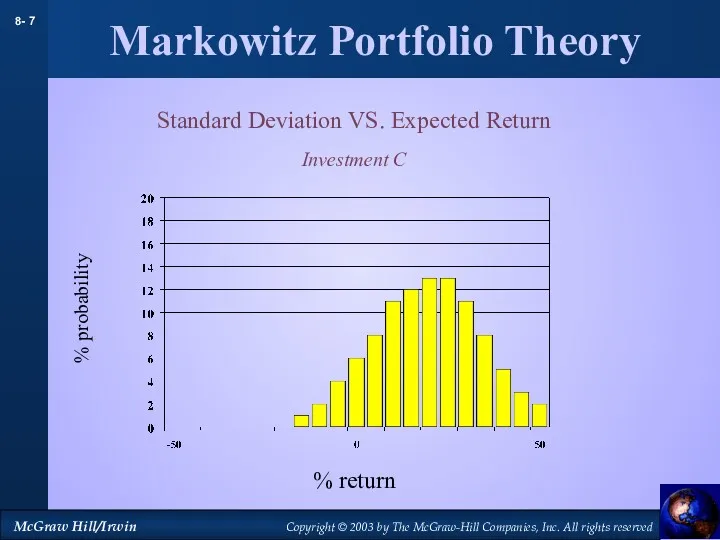

- 7. Markowitz Portfolio Theory Standard Deviation VS. Expected Return Investment C % probability % return

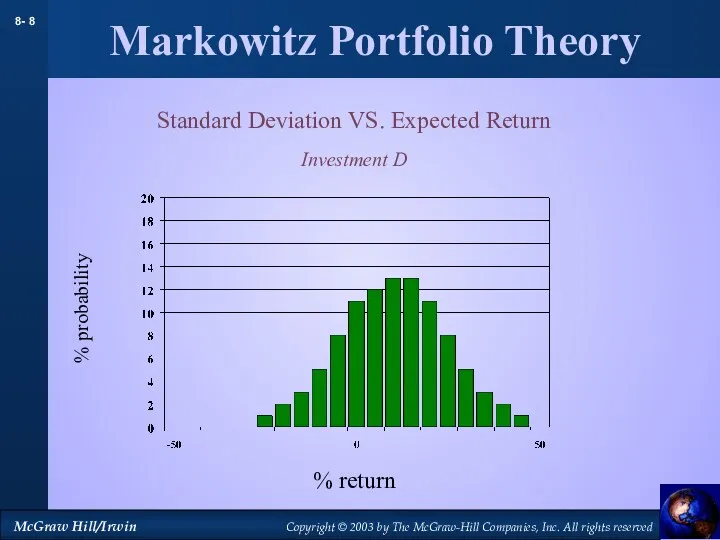

- 8. Markowitz Portfolio Theory Standard Deviation VS. Expected Return Investment D % probability % return

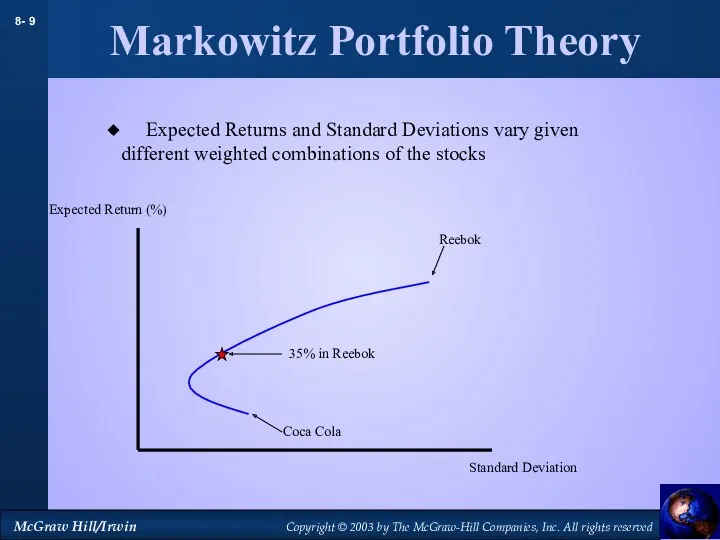

- 9. Markowitz Portfolio Theory Coca Cola Reebok Standard Deviation Expected Return (%) 35% in Reebok Expected Returns

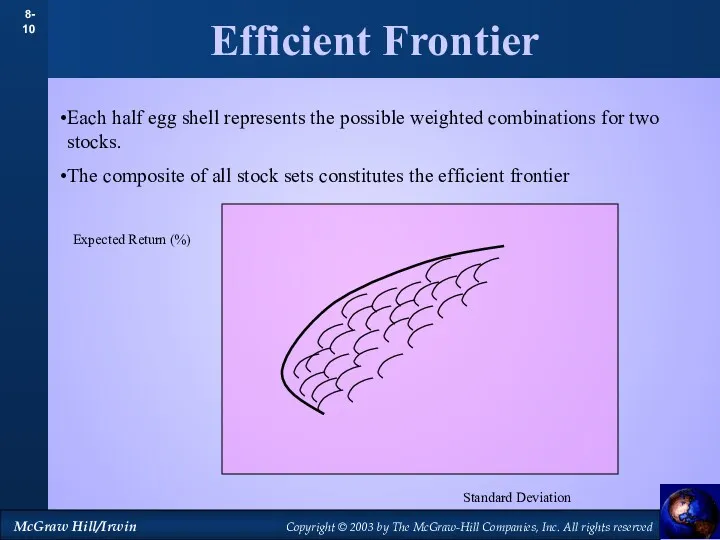

- 10. Efficient Frontier Standard Deviation Expected Return (%) Each half egg shell represents the possible weighted combinations

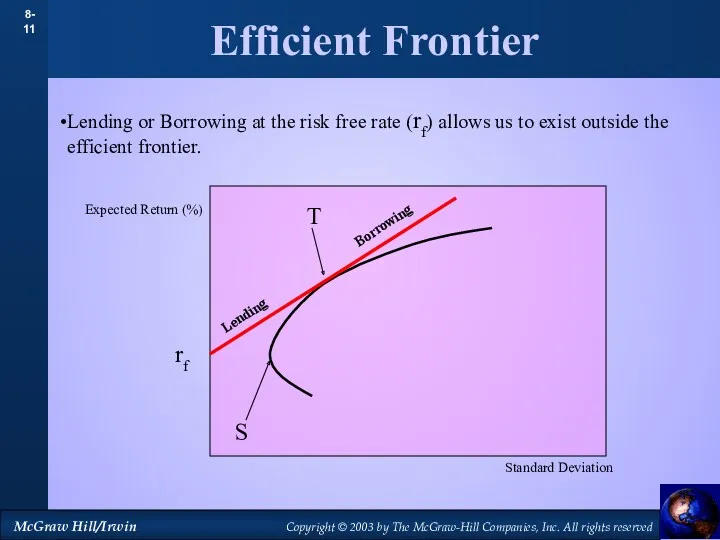

- 11. Efficient Frontier Standard Deviation Expected Return (%) Lending or Borrowing at the risk free rate (rf)

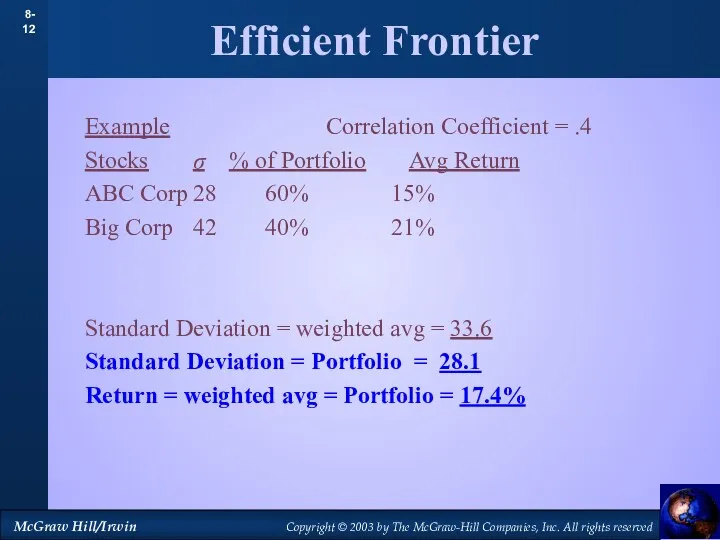

- 12. Efficient Frontier Example Correlation Coefficient = .4 Stocks σ % of Portfolio Avg Return ABC Corp

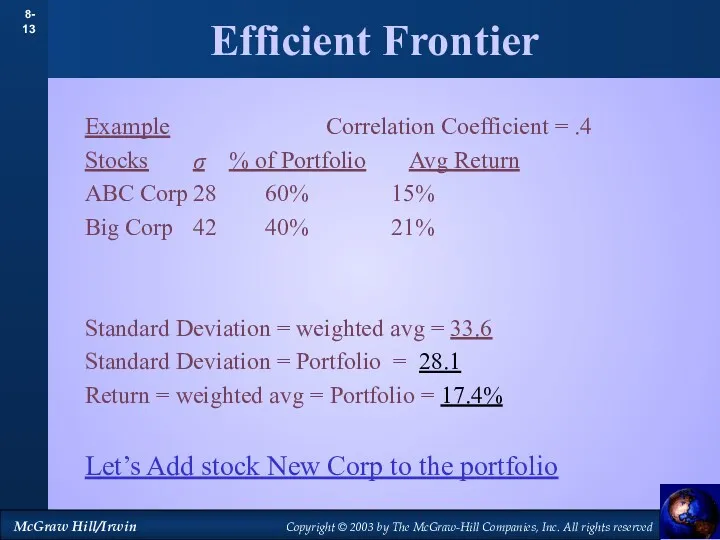

- 13. Efficient Frontier Example Correlation Coefficient = .4 Stocks σ % of Portfolio Avg Return ABC Corp

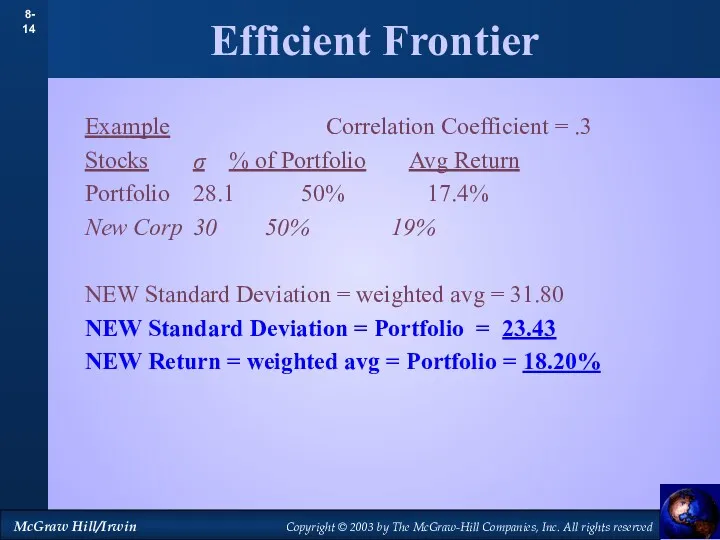

- 14. Efficient Frontier Example Correlation Coefficient = .3 Stocks σ % of Portfolio Avg Return Portfolio 28.1

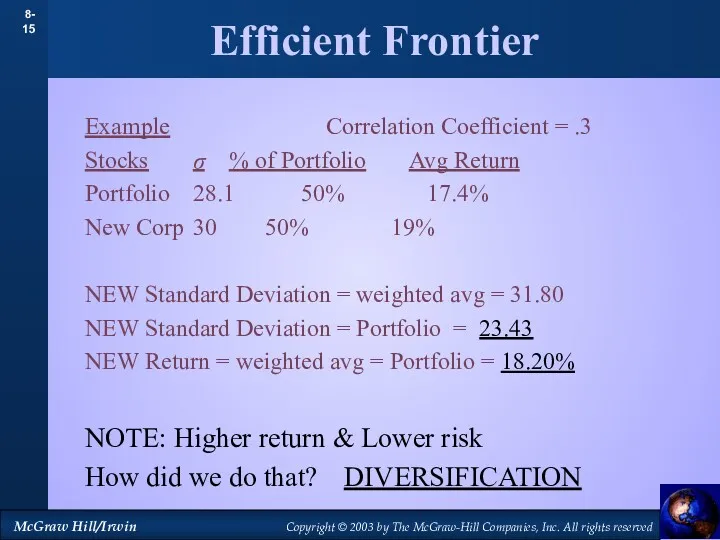

- 15. Efficient Frontier Example Correlation Coefficient = .3 Stocks σ % of Portfolio Avg Return Portfolio 28.1

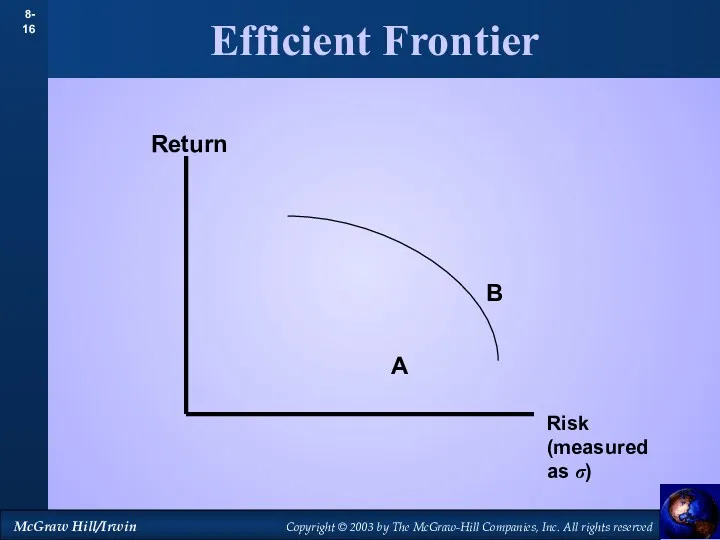

- 16. Efficient Frontier A B Return Risk (measured as σ)

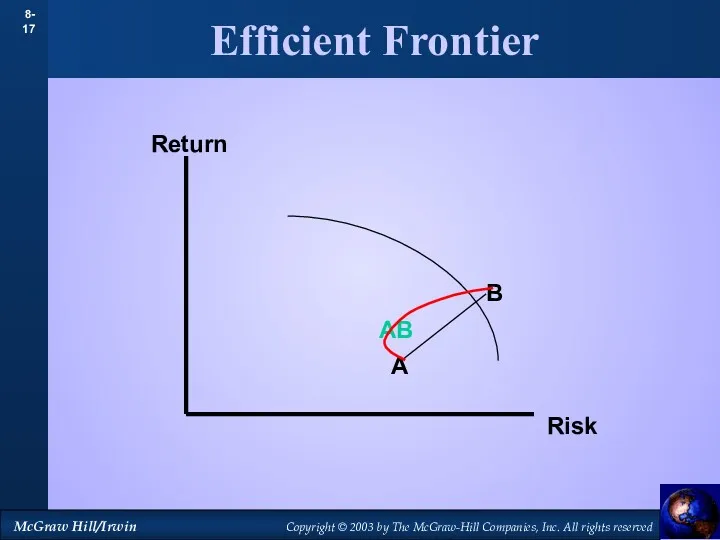

- 17. Efficient Frontier A B Return Risk AB

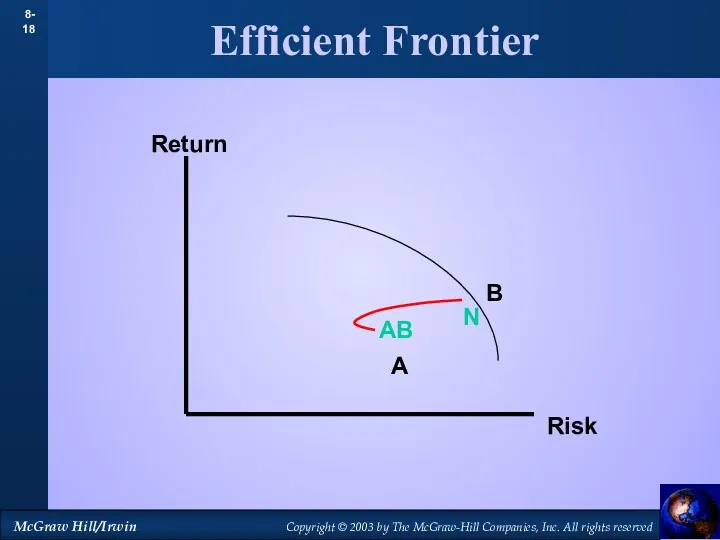

- 18. Efficient Frontier A B N Return Risk AB

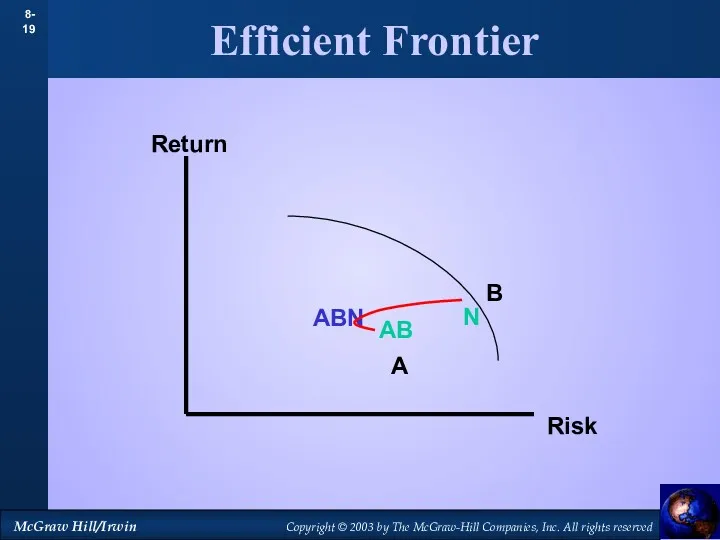

- 19. Efficient Frontier A B N Return Risk AB ABN

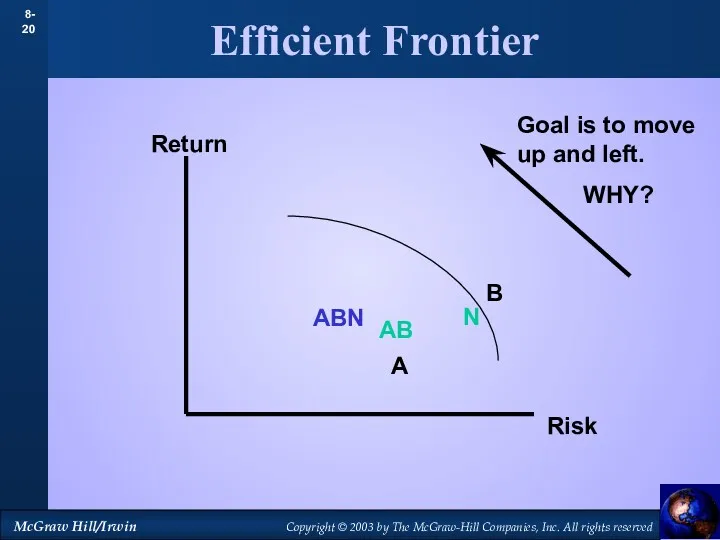

- 20. Efficient Frontier A B N Return Risk AB Goal is to move up and left. WHY?

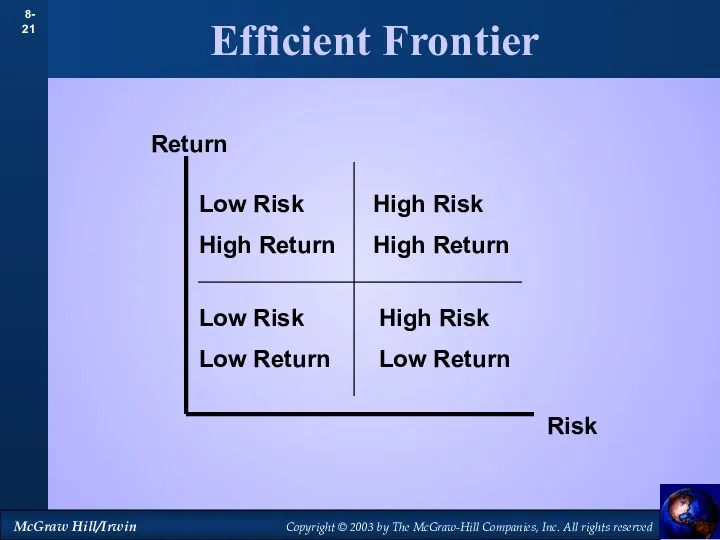

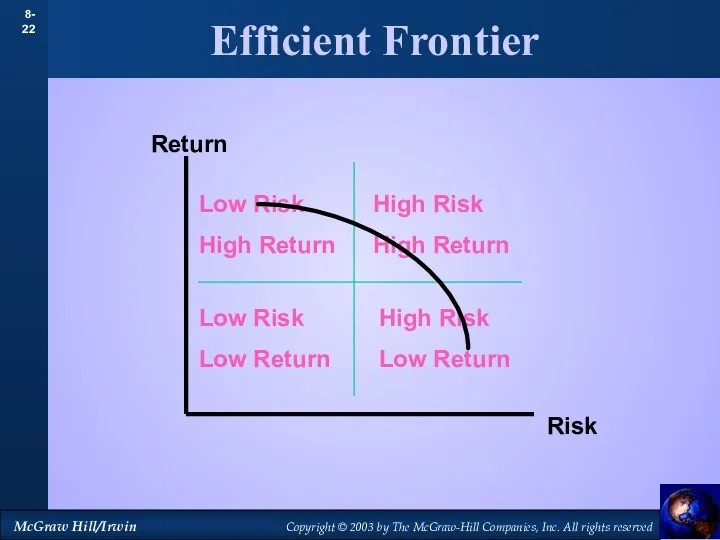

- 21. Efficient Frontier Return Risk Low Risk High Return High Risk High Return Low Risk Low Return

- 22. Efficient Frontier Return Risk Low Risk High Return High Risk High Return Low Risk Low Return

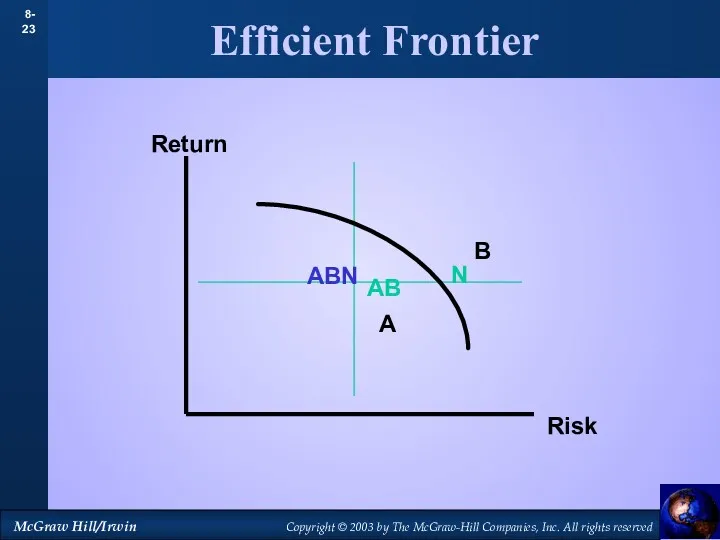

- 23. Efficient Frontier Return Risk A B N AB ABN

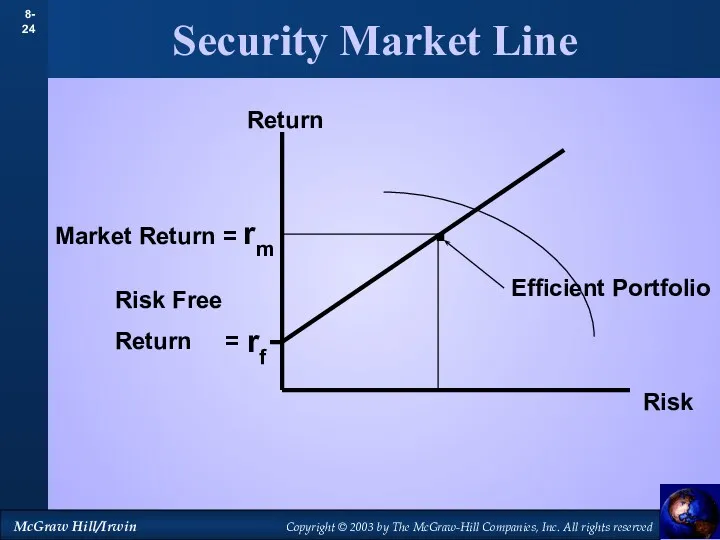

- 24. Security Market Line Return Risk . rf Risk Free Return = Efficient Portfolio

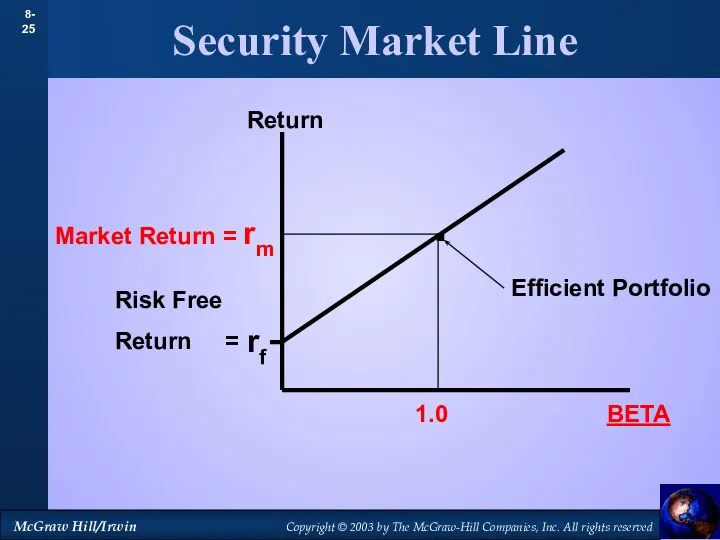

- 25. Security Market Line Return . rf Risk Free Return = Efficient Portfolio BETA 1.0

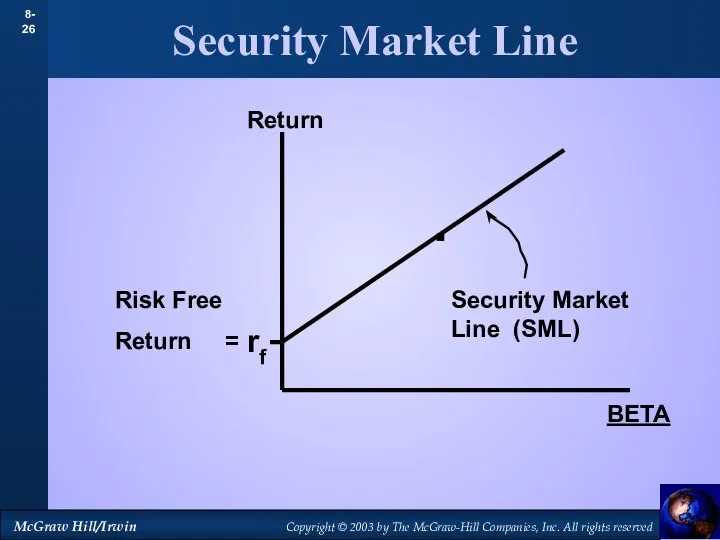

- 26. Security Market Line Return . rf Risk Free Return = BETA Security Market Line (SML)

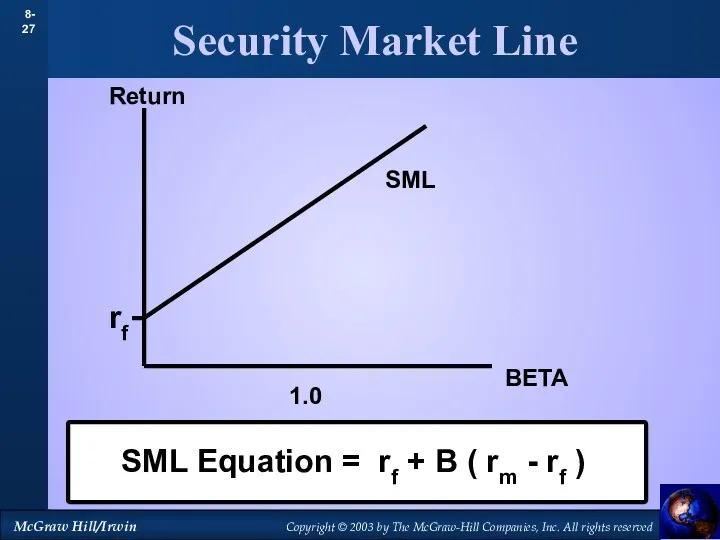

- 27. Security Market Line Return BETA rf 1.0 SML SML Equation = rf + B ( rm

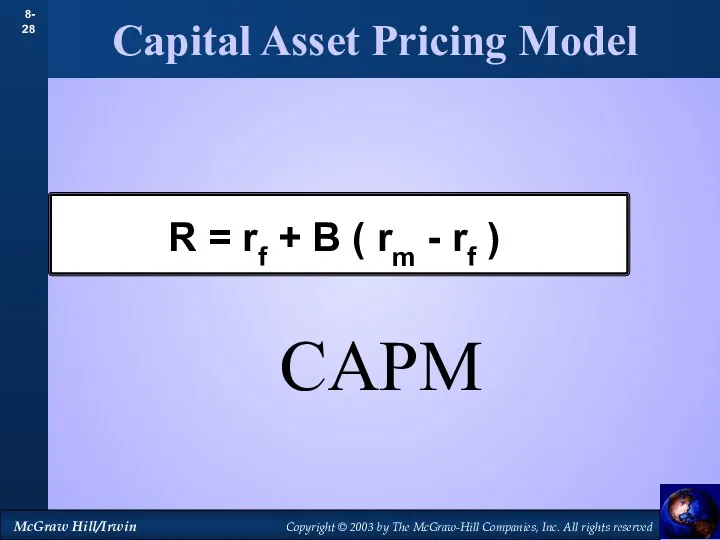

- 28. Capital Asset Pricing Model R = rf + B ( rm - rf ) CAPM

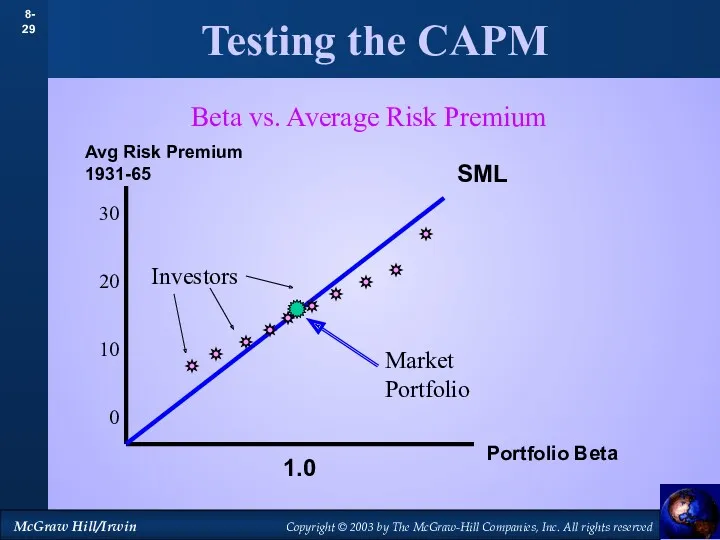

- 29. Testing the CAPM Avg Risk Premium 1931-65 Portfolio Beta 1.0 SML 30 20 10 0 Investors

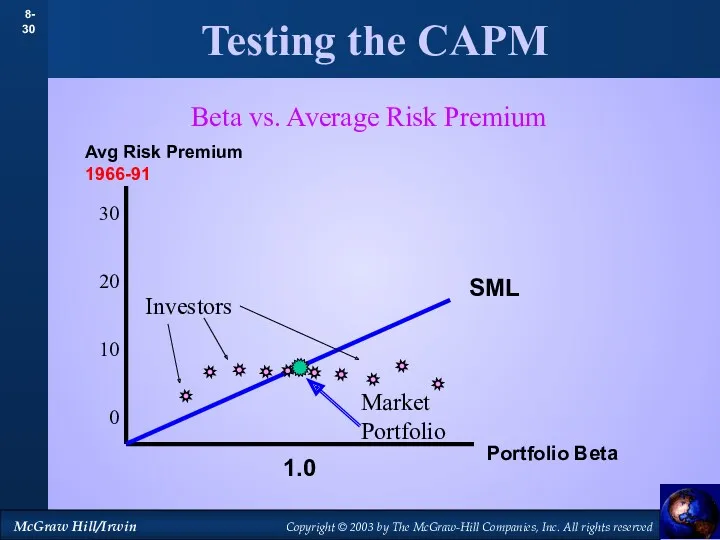

- 30. Testing the CAPM Avg Risk Premium 1966-91 Portfolio Beta 1.0 SML 30 20 10 0 Investors

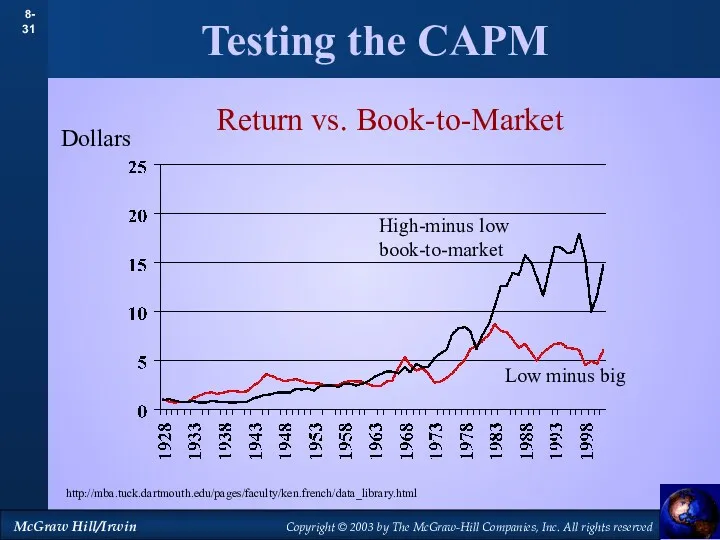

- 31. Testing the CAPM High-minus low book-to-market Return vs. Book-to-Market Dollars Low minus big http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

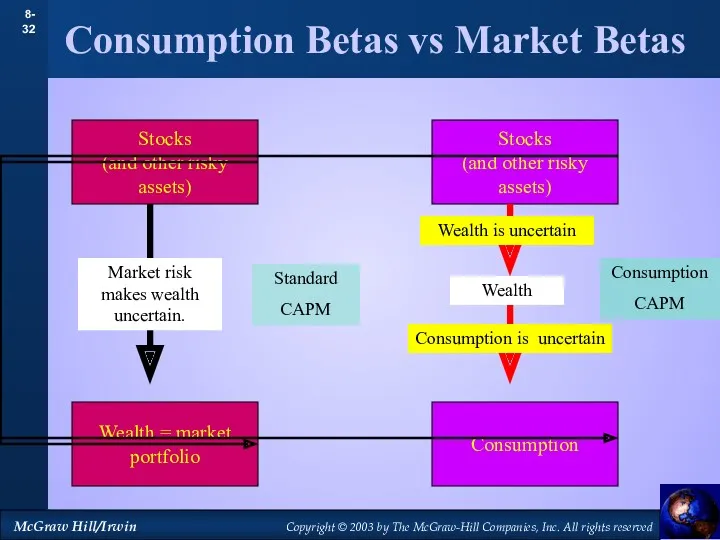

- 32. Consumption Betas vs Market Betas Stocks (and other risky assets) Wealth = market portfolio

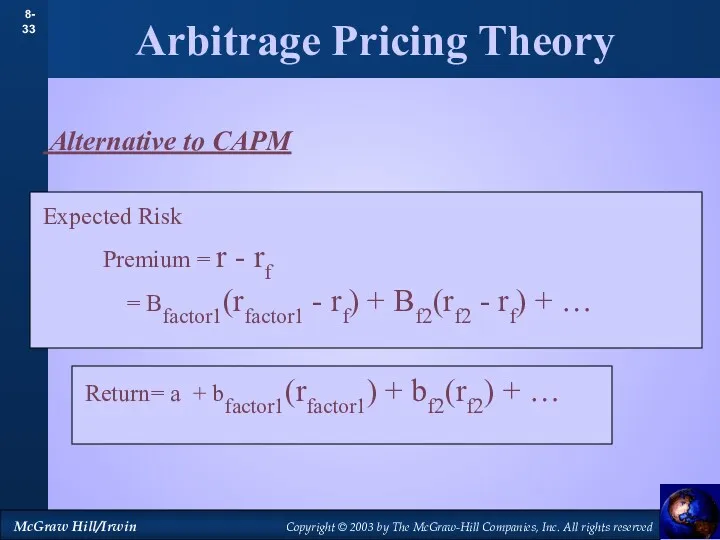

- 33. Arbitrage Pricing Theory Alternative to CAPM Expected Risk Premium = r - rf = Bfactor1(rfactor1 -

- 35. Скачать презентацию

Structuring. Transaction Framework

Structuring. Transaction Framework Контрольно-кассовые машины

Контрольно-кассовые машины Школа инвестиций НИУ-ВШЭ: программа и преимущества

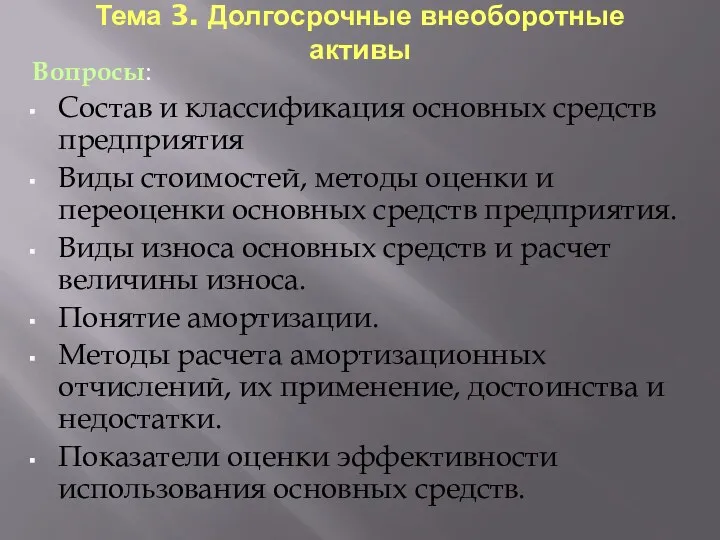

Школа инвестиций НИУ-ВШЭ: программа и преимущества Долгосрочные внеоборотные активы

Долгосрочные внеоборотные активы Экологический сбор

Экологический сбор Базы оценки, отличные от рыночной стоимости

Базы оценки, отличные от рыночной стоимости Налог на доходы физических лиц

Налог на доходы физических лиц Счета бухгалтерского учета и план счетов

Счета бухгалтерского учета и план счетов Государственные и муниципальные финансы как элемент финансово-кредитной системы

Государственные и муниципальные финансы как элемент финансово-кредитной системы International, national and contractual frameworks of investment protection. Class 2

International, national and contractual frameworks of investment protection. Class 2 Основы организации бухгалтерского учета в кредитных организациях

Основы организации бухгалтерского учета в кредитных организациях Повышенная стипендия за достижения в научно-исследовательской деятельности

Повышенная стипендия за достижения в научно-исследовательской деятельности Баланс как основная форма финансовой отчетности. Часть 2. Пассив

Баланс как основная форма финансовой отчетности. Часть 2. Пассив Стандарты аудиторской деятельности, регулирующие форму, содержание, предоставление аудиторского заключения

Стандарты аудиторской деятельности, регулирующие форму, содержание, предоставление аудиторского заключения Доллар США

Доллар США Введение налога на профессиональный доход для самозанятых граждан

Введение налога на профессиональный доход для самозанятых граждан Земельный налог

Земельный налог Организация бюджетного процесса в поселении. (Тема 4.6)

Организация бюджетного процесса в поселении. (Тема 4.6) Бухгалтерская (финансовая) отчетность

Бухгалтерская (финансовая) отчетность Эмиссия ценных бумаг. (Тема 6)

Эмиссия ценных бумаг. (Тема 6) Финансовая система, характеристика звеньев. Тема 4

Финансовая система, характеристика звеньев. Тема 4 Сметное дело. Методы составления смет и сметной документации. (Лекция 11)

Сметное дело. Методы составления смет и сметной документации. (Лекция 11) Эволюция мировой валютной системы и современные валютные проблемы. Лекция 3

Эволюция мировой валютной системы и современные валютные проблемы. Лекция 3 Финансовая работа в первичной профсоюзной организации

Финансовая работа в первичной профсоюзной организации Поддержка малого и среднего предпринимательства в Московской области в 2018 году

Поддержка малого и среднего предпринимательства в Московской области в 2018 году Государственный бюджет. Тест №50. 3 класс

Государственный бюджет. Тест №50. 3 класс Изменения в налоговом законодательстве с 2023 года: Введение Единого налогового платежа

Изменения в налоговом законодательстве с 2023 года: Введение Единого налогового платежа Валютные курсы и эффективность экспортных и импортных операций. Страхование валютных рисков. Хеджирование

Валютные курсы и эффективность экспортных и импортных операций. Страхование валютных рисков. Хеджирование