Содержание

- 2. is a product of activity (including works, services) intended for sale or exchange. The product

- 3. THE COST OF GOODS SOLD The cost of goods sold refers to the carrying value of

- 4. THE COST OF GOODS FOR RESALE The cost of goods purchased for resale includes purchase price

- 5. Since the financial statements of aims such period costs as purchasing Department, warehouse, and other operational

- 6. Identification of the agreement In some cases, the cost of goods sold may be identified with

- 7. Certain identification. Under this method, special items and costs tracked for each item. This may require

- 8. Method of "first come - first out" (FIFO) assumes that goods purchased or produced first are

- 9. LIFO Dollar value. With this change LIFO increase or decrease in the LIFO reserve are determined

- 11. Скачать презентацию

Слайд 2

is a product of activity (including works, services) intended for sale

is a product of activity (including works, services) intended for sale

or exchange.

The product

Слайд 3

THE COST OF GOODS SOLD

The cost of goods sold refers to

THE COST OF GOODS SOLD

The cost of goods sold refers to

the carrying value of goods sold during a particular period.

Many companies sell the goods they have bought or produced. When the goods are purchased or produced, the costs associated with such goods are capitalized as part of inventory of goods. These costs are considered as an expense in the period the business recognizes income from sale of goods.

Cost of goods sold may be the same or different for accounting and tax purposes, depending on the rules of special jurisdiction.

Слайд 4

THE COST OF GOODS FOR RESALE

The cost of goods purchased

THE COST OF GOODS FOR RESALE

The cost of goods purchased

for resale includes purchase price and all other costs of acquisition, excluding any discounts.

Additional costs may include freight paid to acquire the goods, customs duties, sales or use taxes that are not recoverable paid on the materials used and fee paid for the acquisition.

Слайд 5

Since the financial statements of aims such period costs as

Since the financial statements of aims such period costs as

purchasing Department, warehouse, and other operational costs not normally treated as part of inventory or cost of goods sold.

The costs of sale, packaging and shipment of goods to customers are considered as operating costs associated with the sale. International accounting standards require that certain improper costs, such as those associated with the ability without work, considered as an expense and not part of the inventory.

The costs of sale, packaging and shipment of goods to customers are considered as operating costs associated with the sale. International accounting standards require that certain improper costs, such as those associated with the ability without work, considered as an expense and not part of the inventory.

Слайд 6

Identification of the agreement

In some cases, the cost of goods

Identification of the agreement

In some cases, the cost of goods

sold may be identified with the goods sold. Usually, however, identity of goods is lost between the time of purchase or manufacture and the time of sale. The definition which the goods were sold, and the cost of those goods, requires either identifying the goods or using the agreement to adopt, what products were sold. This may be referred to as an assumption of the cost flow assumption or identification of the equipment or the agreement. The following methods are available in many jurisdictions for the connection costs with goods sold and goods still on hand:

Слайд 7

Certain identification. Under this method, special items and costs tracked for

Certain identification. Under this method, special items and costs tracked for

each item. This may require considerable recordkeeping. This method cannot be used where goods or items are indistinguishable or fungible.

The average cost. The average cost method relies on average unit cost to calculate cost of units sold and ending inventory. Several changes on the calculation can be used, including weighted average and moving average.

The average cost. The average cost method relies on average unit cost to calculate cost of units sold and ending inventory. Several changes on the calculation can be used, including weighted average and moving average.

Слайд 8

Method of "first come - first out" (FIFO) assumes that goods

Method of "first come - first out" (FIFO) assumes that goods

purchased or produced first are sold first. Costs of inventory per unit or item are determined at the time when made or purchased. The oldest cost (i.e., first in) is then matched against revenue and assigned to cost of goods sold.

The method "last in - first out" (LIFO) - change FIFO. Some systems allow to determine the cost of goods, the time when purchased or made, but assigning costs to goods sold under the assumption that the goods made or acquired last are sold first. Costs of specific goods acquired or made, added to the Fund expenses for the type of goods. Under this system, the business may maintain costs under FIFO but track the repayment in the form of a LIFO reserve. Such reserve (an asset or an asset of a rebel) is the difference in the cost of inventory under the FIFO and LIFO assumptions. This amount may differ for financial reporting and tax purposes in the United States.

The method "last in - first out" (LIFO) - change FIFO. Some systems allow to determine the cost of goods, the time when purchased or made, but assigning costs to goods sold under the assumption that the goods made or acquired last are sold first. Costs of specific goods acquired or made, added to the Fund expenses for the type of goods. Under this system, the business may maintain costs under FIFO but track the repayment in the form of a LIFO reserve. Such reserve (an asset or an asset of a rebel) is the difference in the cost of inventory under the FIFO and LIFO assumptions. This amount may differ for financial reporting and tax purposes in the United States.

Слайд 9

LIFO Dollar value. With this change LIFO increase or decrease in

LIFO Dollar value. With this change LIFO increase or decrease in

the LIFO reserve are determined based on the dollar value and not quantity.

Retail method of inventory. Resellers of goods may use this method to simplify record keeping. The estimated cost of goods on hand at the end of the period - cost of goods acquired to the retail value of the goods times the retail value of goods on hand. The cost of goods acquired includes beginning inventory, previously valued plus purchases. Cost of goods sold is then beginning inventory plus purchases less the calculated cost of goods on hand at the end of the period.

Retail method of inventory. Resellers of goods may use this method to simplify record keeping. The estimated cost of goods on hand at the end of the period - cost of goods acquired to the retail value of the goods times the retail value of goods on hand. The cost of goods acquired includes beginning inventory, previously valued plus purchases. Cost of goods sold is then beginning inventory plus purchases less the calculated cost of goods on hand at the end of the period.

Банк, как система одного окна. Промсвязьбанк

Банк, как система одного окна. Промсвязьбанк Развитие денежных и финансовых отношений в XV-XVI веках. (Тема 3)

Развитие денежных и финансовых отношений в XV-XVI веках. (Тема 3) Тәуекел осындай жағымсыз нәтижелерді алу ықтималдығы

Тәуекел осындай жағымсыз нәтижелерді алу ықтималдығы Примеры успешного краудсорсинга

Примеры успешного краудсорсинга Финансовая устойчивость, платежеспособность и рентабельность предприятия ИГиТ

Финансовая устойчивость, платежеспособность и рентабельность предприятия ИГиТ Государственная финансовая система. Бюджетно-налоговая политика

Государственная финансовая система. Бюджетно-налоговая политика Денежные потоки инвестиционного проекта. Критерии оценки инвестиций

Денежные потоки инвестиционного проекта. Критерии оценки инвестиций Методические приемы ревизии и контроля

Методические приемы ревизии и контроля Форма расчета 6-НДФЛ, порядок заполнения и форматы

Форма расчета 6-НДФЛ, порядок заполнения и форматы Top-10 мировых криптобирж за 6 месяцев 2019 года

Top-10 мировых криптобирж за 6 месяцев 2019 года Прибыль организации. Тема 5

Прибыль организации. Тема 5 Javne finansije. Lekcija 10

Javne finansije. Lekcija 10 Банковские и страховые продукты

Банковские и страховые продукты Определение ожидаемой доходности бизнеса (ставки дисконтирования)

Определение ожидаемой доходности бизнеса (ставки дисконтирования) Социальная защита и социальное страхование

Социальная защита и социальное страхование Цели и задачи управления государственным долгом

Цели и задачи управления государственным долгом Зарплатный проект. Альфа-Банк сегодня

Зарплатный проект. Альфа-Банк сегодня Бюджет для граждан к отчету об исполнении Юрьевецкого бюджета района за 2018 год

Бюджет для граждан к отчету об исполнении Юрьевецкого бюджета района за 2018 год Финансовые рынки

Финансовые рынки Sequence of accounts & aggregates: practice part

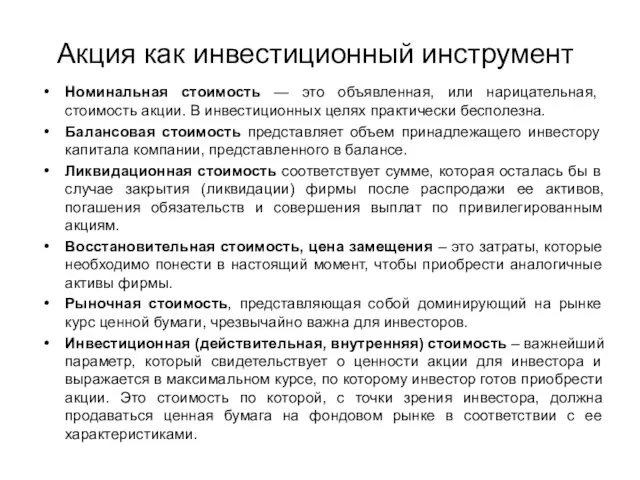

Sequence of accounts & aggregates: practice part Акция как инвестиционный инструмент

Акция как инвестиционный инструмент Основы бюджетных отношений

Основы бюджетных отношений Сервисы

Сервисы Тема 3. Общегосударственный финансовый контроль. Тема 3.2. Органы осуществляющие общегосударственный контроль и их сфера надзора

Тема 3. Общегосударственный финансовый контроль. Тема 3.2. Органы осуществляющие общегосударственный контроль и их сфера надзора Исследовательская работа: Выгодно ли жить на съемной квартире или лучше взять в её ипотеку?

Исследовательская работа: Выгодно ли жить на съемной квартире или лучше взять в её ипотеку? Облигации, их виды и особенности

Облигации, их виды и особенности Государственные меры социальной поддержки населения в период распространения короновирусной инфекции (2019-nCoV)

Государственные меры социальной поддержки населения в период распространения короновирусной инфекции (2019-nCoV) Финансовые рынки

Финансовые рынки