Содержание

- 2. WHAT IS A SHARE? A share is defined as, “a share in the share capital of

- 3. CLASSES OF SHARES Preference Shares It offers a fixed rate of dividend. Right to get capital

- 4. TYPES OF PREFERENCE SHARES 1. Cumulative Preference Shares Fixed rate of dividend is guaranteed. At the

- 5. 2. Redeemable Preference Shares Allows the issuer to buy back shares after a fixed period of

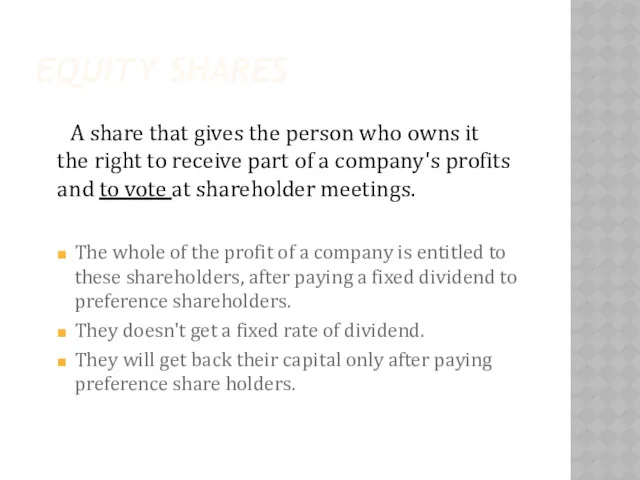

- 6. EQUITY SHARES A share that gives the person who owns it the right to receive part

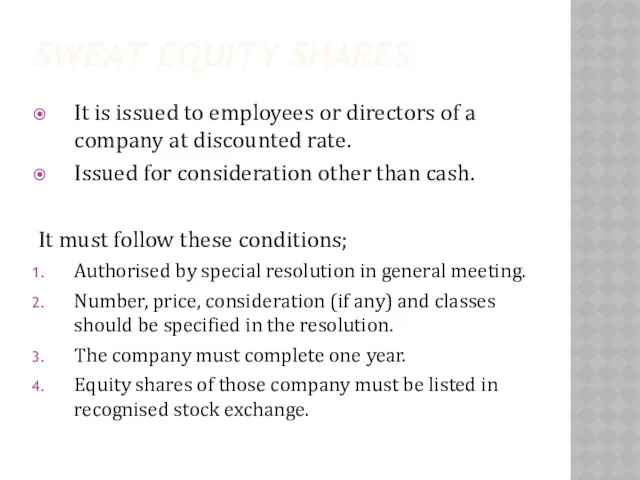

- 7. SWEAT EQUITY SHARES It is issued to employees or directors of a company at discounted rate.

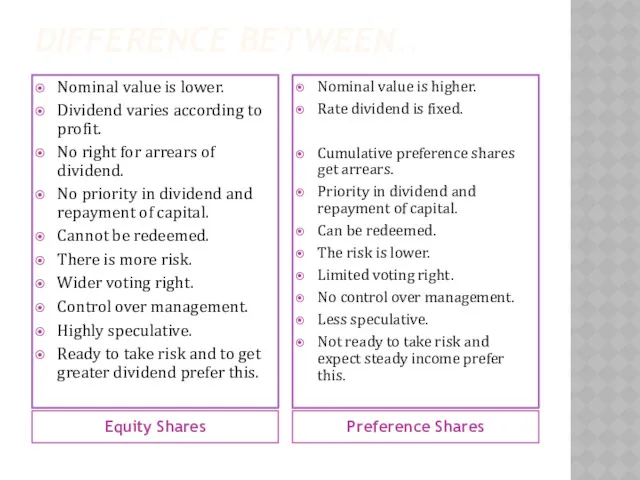

- 8. DIFFERENCE BETWEEN.. Equity Shares Preference Shares Nominal value is lower. Dividend varies according to profit. No

- 10. Скачать презентацию

Финансовый анализ деятельности предприятия, пути и методы его улучшения

Финансовый анализ деятельности предприятия, пути и методы его улучшения Научные гранты и конкурсы

Научные гранты и конкурсы Виды бухгалтерского учета. Учет основных средств

Виды бухгалтерского учета. Учет основных средств Банковские карты как один из видов банковских продуктов. Проблемы и перспективы их использования в коммерческом банке

Банковские карты как один из видов банковских продуктов. Проблемы и перспективы их использования в коммерческом банке Подготовка к взрослой жизни. Повышение финансовой грамотности

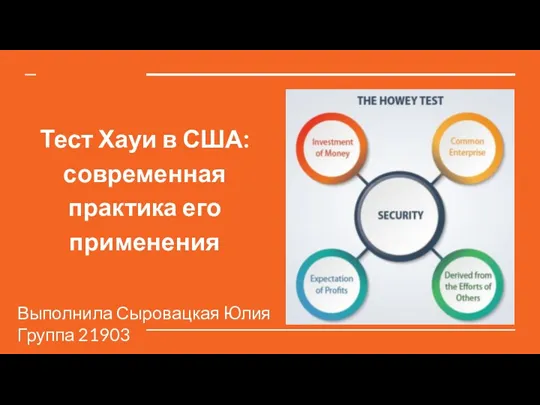

Подготовка к взрослой жизни. Повышение финансовой грамотности Тест Хауи в США: современная практика его применения

Тест Хауи в США: современная практика его применения Ақша ағымын дисконттау әдістері

Ақша ағымын дисконттау әдістері Тест по бухгалтерскому учету

Тест по бухгалтерскому учету Игровой турнир Без копейки рубля не бывает

Игровой турнир Без копейки рубля не бывает Бухгалтерский учет в системе управления организацией, его предмет и метод

Бухгалтерский учет в системе управления организацией, его предмет и метод Ценовая политика предприятия

Ценовая политика предприятия Учет неопределенности и риска. Тема 10

Учет неопределенности и риска. Тема 10 Использование опыта налогообложения нефтегазовых компаний Норвегии при создании системы налогообложения отрасли в России

Использование опыта налогообложения нефтегазовых компаний Норвегии при создании системы налогообложения отрасли в России Разумные инвестиции. Простые правила

Разумные инвестиции. Простые правила Ақша-несие саясаты

Ақша-несие саясаты Программы страхования для заемщиков потребительских кредитов Почта Банк

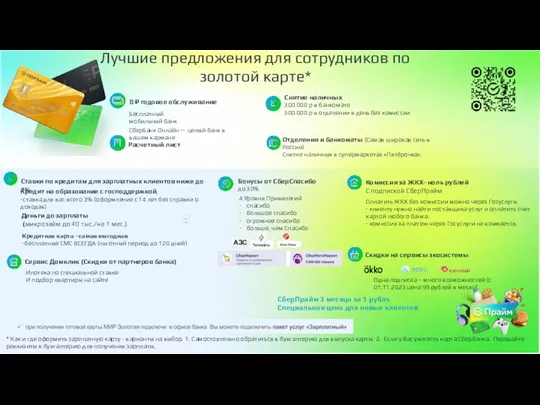

Программы страхования для заемщиков потребительских кредитов Почта Банк Лучшие предложения для сотрудников по золотой карте

Лучшие предложения для сотрудников по золотой карте Понятие бюджетной системы

Понятие бюджетной системы Лизинговая компания в Республике Казахстан АО Лизинг Групп

Лизинговая компания в Республике Казахстан АО Лизинг Групп Учет источников собственных средств кредитной организации

Учет источников собственных средств кредитной организации Программа страхования от несчастных случаев для партнеров компании

Программа страхования от несчастных случаев для партнеров компании Происхождение, сущность и виды денег. (Лекция 1)

Происхождение, сущность и виды денег. (Лекция 1) Платформа Тинькофф

Платформа Тинькофф Доходність інвестованих коштів в підприємство

Доходність інвестованих коштів в підприємство Страхование в туризме. Правила и рекомендации

Страхование в туризме. Правила и рекомендации Оценка зданий и сооружений

Оценка зданий и сооружений Учет затрат на производство и калькулирование себестоимости продукции

Учет затрат на производство и калькулирование себестоимости продукции Оборотные средства предприятия

Оборотные средства предприятия