Содержание

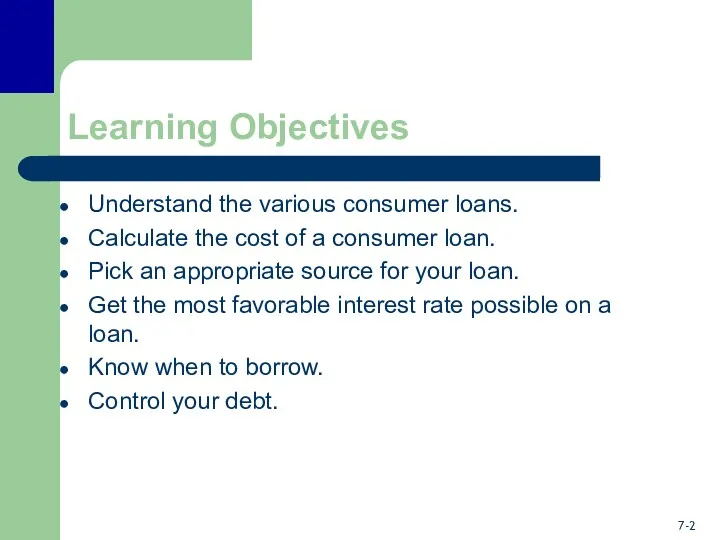

- 2. Learning Objectives Understand the various consumer loans. Calculate the cost of a consumer loan. Pick an

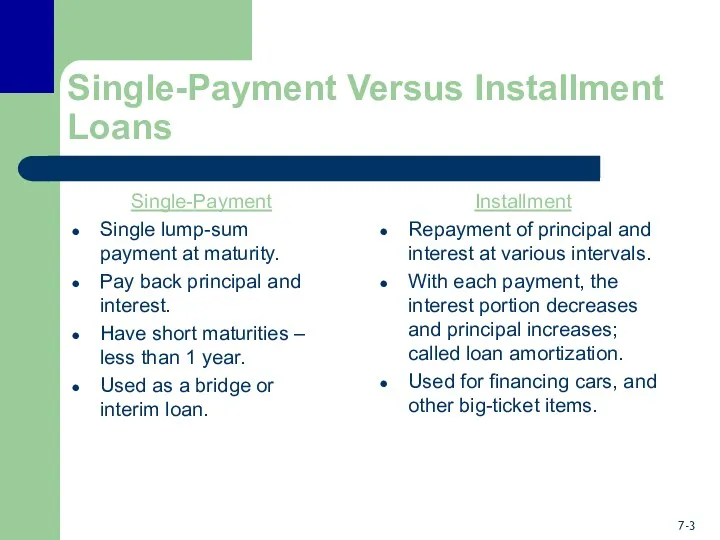

- 3. Single-Payment Versus Installment Loans Single-Payment Single lump-sum payment at maturity. Pay back principal and interest. Have

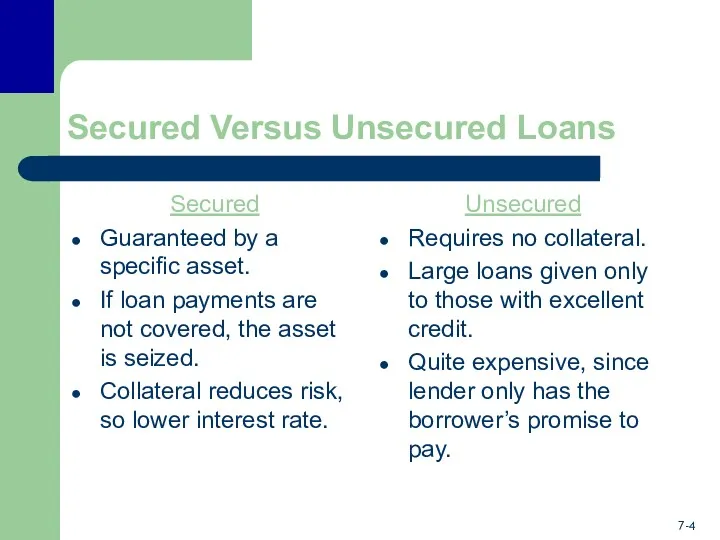

- 4. Secured Versus Unsecured Loans Secured Guaranteed by a specific asset. If loan payments are not covered,

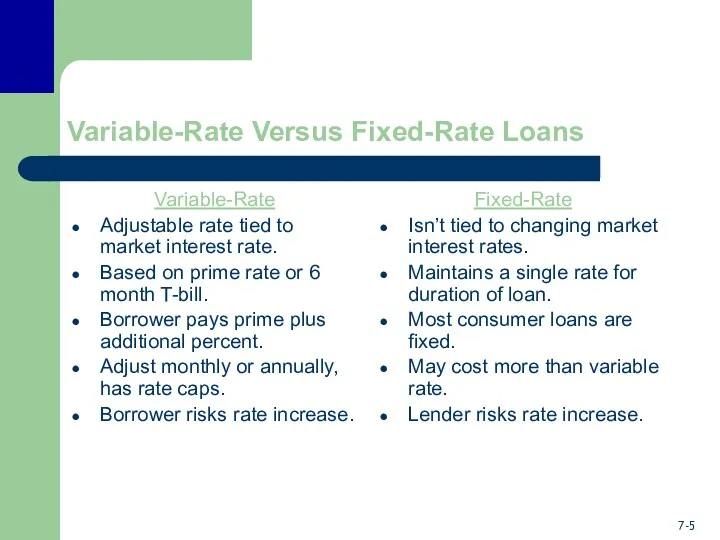

- 5. Variable-Rate Versus Fixed-Rate Loans Variable-Rate Adjustable rate tied to market interest rate. Based on prime rate

- 6. The Loan Contract Security agreement states if purchased item will be used as collateral. Note states

- 7. The Loan Contract Insurance Agreement Clause Must purchase insurance to pay off loan if death. Acceleration

- 8. Special Types of Consumer Loans Home Equity Loans – secured loan using equity in home as

- 9. Special Types of Consumer Loans Student Loans – low, federally subsidized interest, based on financial need

- 10. Special Types of Consumer Loans Automobile Loans – loan secured by auto. Duration usually for 24,

- 11. Cost and Early Payment of Consumer Loans Truth in Lending Act requires written notification of total

- 12. Cost and Early Payment of Consumer Loans Finance charges include all costs associated with the loan:

- 13. Payday Loans Payday loans: Given by check cashing companies. Aimed at those who need money until

- 14. Cost of Single-Payment Loans Two ways loans are made: Simple Interest Method: Interest = principal x

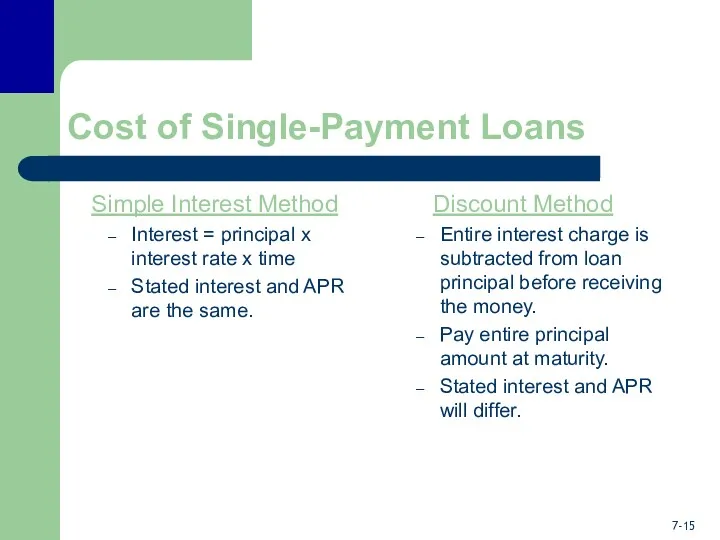

- 15. Cost of Single-Payment Loans Simple Interest Method Interest = principal x interest rate x time Stated

- 16. Cost of Installment Loans Repayment of both interest and principal occurs at regular intervals. Payment levels

- 17. Cost of Installment Loans Simple Interest Method Most common method of calculating payments. Monthly payments are

- 18. Early Payment If installment loan is repaid early, determine amount of principal still owed. Most common

- 19. Relationship of Payment, Interest Rate, and Term of the Loan How does the duration of loan

- 20. Sources of Consumer Loans Inexpensive sources: The least expensive source of funds is your family. Home

- 21. Sources of Consumer Loans More Expensive Sources: Credit unions, S&L’s, and commercial banks. Exact cost depends

- 22. How and When to Borrow How do you get a favorable rate? Have a strong credit

- 23. How and When to Borrow Borrow If: After-tax cost of borrowing Pay Cash If: After-tax cost

- 24. How and When to Borrow When you borrow to invest: Hope to receive an income stream

- 25. Controlling Your Use of Debt Determine how much debt you can comfortably handle. This changes during

- 26. Controlling Your Use of Debt Debt Limit Ratio measures the percentage of take-home pay committed to

- 27. Controlling Your Use of Debt 28/36 Rule A good credit risk when mortgage payments are below

- 28. Debt Resolution Rule Debt resolution rule helps control debt obligation, excluding borrowing for education and home

- 29. What To Do If You Can’t Pay Your Bills Go to creditors to get help resolving

- 30. What To Do If You Can’t Pay Your Bills Personal bankruptcy doesn’t wipe out all obligations.

- 31. Chapter 13: The Wage Earner Plan To file for Chapter 13, you must have: Regular income

- 32. Chapter 7: Straight Bankruptcy Allows individuals who don’t have any chance of repaying debts to eliminate

- 34. Скачать презентацию

Основы бизнес-аналитики. Лекция 11. Сбалансированная система показателей

Основы бизнес-аналитики. Лекция 11. Сбалансированная система показателей Финансы, денежное обращение и кредит

Финансы, денежное обращение и кредит Бюджет для граждан города Курска

Бюджет для граждан города Курска Бизнес-планирование

Бизнес-планирование Місце фінансового ринку в фінансовій системі

Місце фінансового ринку в фінансовій системі Что такое банковская карта? Чем отличается дебетовая карта от кредитной?

Что такое банковская карта? Чем отличается дебетовая карта от кредитной? Единая форма Сведения для ведения индивидуального (персонифицированного) учета и сведения о начисленных страховых взносах

Единая форма Сведения для ведения индивидуального (персонифицированного) учета и сведения о начисленных страховых взносах Финансы и финансовая деятельность государства

Финансы и финансовая деятельность государства Самозанятость

Самозанятость Финансовая система Германии

Финансовая система Германии Финансовый анализ: анализ состояния предприятия; анализ доходов и финансовых результатов деятельности предприятия

Финансовый анализ: анализ состояния предприятия; анализ доходов и финансовых результатов деятельности предприятия 1С Документооборот 8

1С Документооборот 8 Понятие, предмет, метод, источники и система финансового права

Понятие, предмет, метод, источники и система финансового права Налоги как экономико-правовая категория

Налоги как экономико-правовая категория Довірчі (трастові) операції комерційних банків

Довірчі (трастові) операції комерційних банків Технология и специфика организации и проведения государственного и муниципального финансового контроля

Технология и специфика организации и проведения государственного и муниципального финансового контроля Зачем и как заниматься коммерциализацией результатов НИОКР в ВУЗе

Зачем и как заниматься коммерциализацией результатов НИОКР в ВУЗе Банки. Банковская система

Банки. Банковская система Международные валютно-финансовые отношения

Международные валютно-финансовые отношения Тема: Податки і податкове право в Україні

Тема: Податки і податкове право в Україні Методы калькулирования себестоимости в управленческом учете

Методы калькулирования себестоимости в управленческом учете Общие положения денежного содержания сотрудников МЧС России

Общие положения денежного содержания сотрудников МЧС России Особенности развития аудита в Великобритании

Особенности развития аудита в Великобритании Облигации. Сущность, классификация, инвестиционные характеристики

Облигации. Сущность, классификация, инвестиционные характеристики Физический износ: сущность, виды, особенности расчета

Физический износ: сущность, виды, особенности расчета Порядок составления, рассмотрения и утверждения проектов бюджетов

Порядок составления, рассмотрения и утверждения проектов бюджетов Materiālā atbildība

Materiālā atbildība Краудфандинг - система финансирования ваших проектов

Краудфандинг - система финансирования ваших проектов