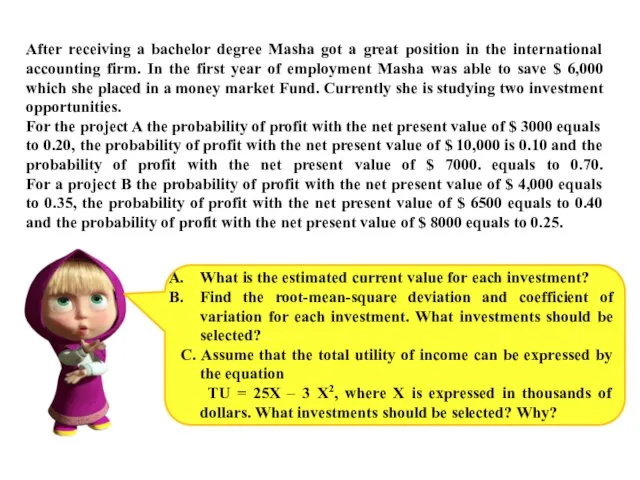

After receiving a bachelor degree Masha got a great position in

the international accounting firm. In the first year of employment Masha was able to save $ 6,000 which she placed in a money market Fund. Currently she is studying two investment opportunities.

For the project A the probability of profit with the net present value of $ 3000 equals to 0.20, the probability of profit with the net present value of $ 10,000 is 0.10 and the probability of profit with the net present value of $ 7000. equals to 0.70.

For a project B the probability of profit with the net present value of $ 4,000 equals to 0.35, the probability of profit with the net present value of $ 6500 equals to 0.40 and the probability of profit with the net present value of $ 8000 equals to 0.25.

What is the estimated current value for each investment?

Find the root-mean-square deviation and coefficient of variation for each investment. What investments should be selected?

C. Assume that the total utility of income can be expressed by the equation

TU = 25X – 3 X2, where X is expressed in thousands of dollars. What investments should be selected? Why?

Стратегический менеджмент

Стратегический менеджмент Управление кадровой безопасностью организации

Управление кадровой безопасностью организации Семь простых инструментов управления качеством

Семь простых инструментов управления качеством Interview preparation

Interview preparation Основы теории и практики управления проектами

Основы теории и практики управления проектами Концепции управления персоналом

Концепции управления персоналом Організація роботи партнерів. Соціальне партнерство

Організація роботи партнерів. Соціальне партнерство Українська модель управління корпораціями в ГРБ

Українська модель управління корпораціями в ГРБ Бережливое производство

Бережливое производство Подготовка структурных подразделений КФУ к сертификации. Система менеджмента качества

Подготовка структурных подразделений КФУ к сертификации. Система менеджмента качества Нормативно-правові засади туристської діяльності. Тема 2

Нормативно-правові засади туристської діяльності. Тема 2 Введение в проектное управление

Введение в проектное управление Набор, отбор и найм персонала

Набор, отбор и найм персонала Стратегическое планирование

Стратегическое планирование Managementul proiectelor. Particularităţile proiectului. (Partea 2)

Managementul proiectelor. Particularităţile proiectului. (Partea 2) Көшбасшылық дегеніміз не. Көшбасшы деген кім

Көшбасшылық дегеніміз не. Көшбасшы деген кім Информационное, техническое и правовое обеспечение. Значение системы управления персоналом

Информационное, техническое и правовое обеспечение. Значение системы управления персоналом Управление персоналом: место и роль в системе управления предприятием и организациями

Управление персоналом: место и роль в системе управления предприятием и организациями Управление качеством на основе стандартов ИСО

Управление качеством на основе стандартов ИСО Деловая ситуация. Корпорация EG

Деловая ситуация. Корпорация EG Персоналды басқарудың 21 ғасыр технологиялары

Персоналды басқарудың 21 ғасыр технологиялары Транспортная классификация грузов и грузовых перевозок

Транспортная классификация грузов и грузовых перевозок Организация системы современного учета на фармацевтическом торговом предприятии. (Тема 1)

Организация системы современного учета на фармацевтическом торговом предприятии. (Тема 1) Korporacje międzynarodowe. Wykład II. Historia korporacji międzynarodowych

Korporacje międzynarodowe. Wykład II. Historia korporacji międzynarodowych Принципы решения хорошо структурированных проблем

Принципы решения хорошо структурированных проблем Качество. Управление качеством

Качество. Управление качеством Стратегический анализ предприятия

Стратегический анализ предприятия Менеджмент туралы

Менеджмент туралы