Содержание

- 2. After studying Chapter 10, you should be able to: List the key factors that can be

- 3. Accounts Receivable and Inventory Management Credit and Collection Policies Analyzing the Credit Applicant Inventory Management and

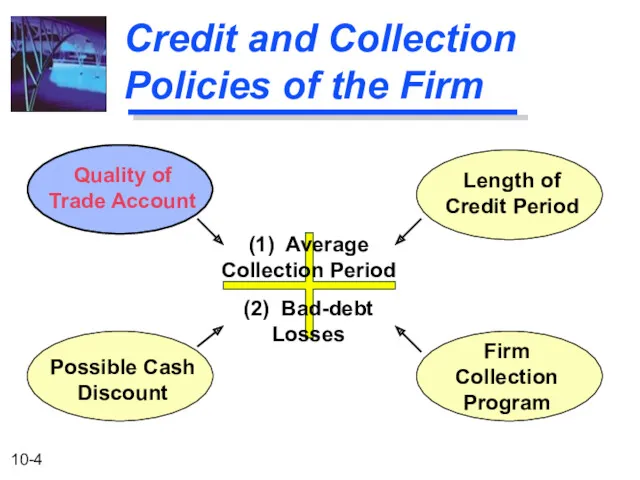

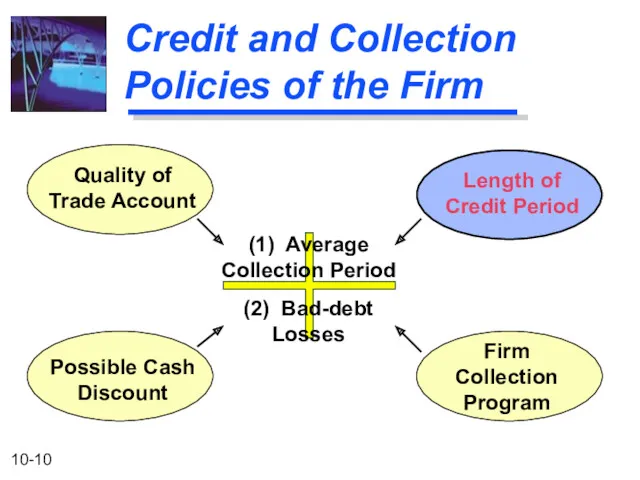

- 4. Credit and Collection Policies of the Firm (1) Average Collection Period (2) Bad-debt Losses Quality of

- 5. Credit Standards The financial manager should continually lower the firm’s credit standards as long as profitability

- 6. Credit Standards A larger credit department Additional clerical work Servicing additional accounts Bad-debt losses Opportunity costs

- 7. Example of Relaxing Credit Standards Basket Wonders is not operating at full capacity and wants to

- 8. Example of Relaxing Credit Standards Additional annual credit sales of $120,000 and an average collection period

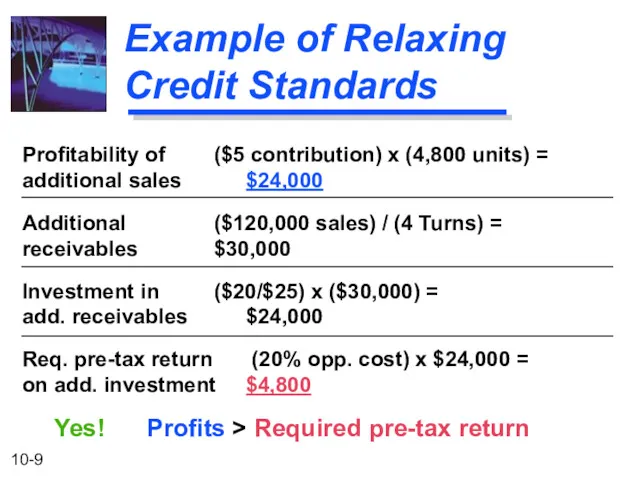

- 9. Example of Relaxing Credit Standards Profitability of ($5 contribution) x (4,800 units) = additional sales $24,000

- 10. Credit and Collection Policies of the Firm (1) Average Collection Period (2) Bad-debt Losses Quality of

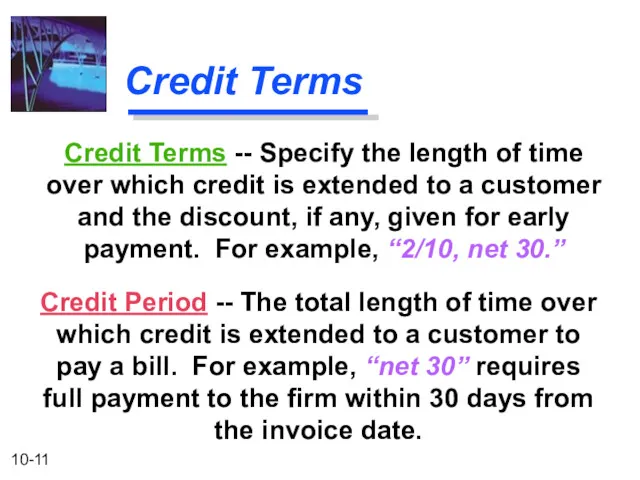

- 11. Credit Terms Credit Period -- The total length of time over which credit is extended to

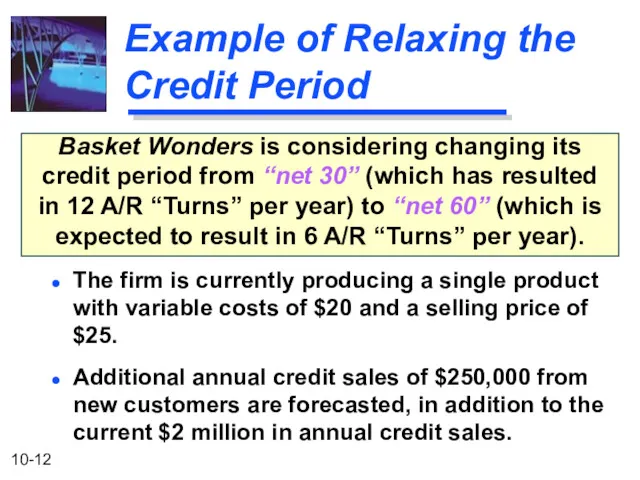

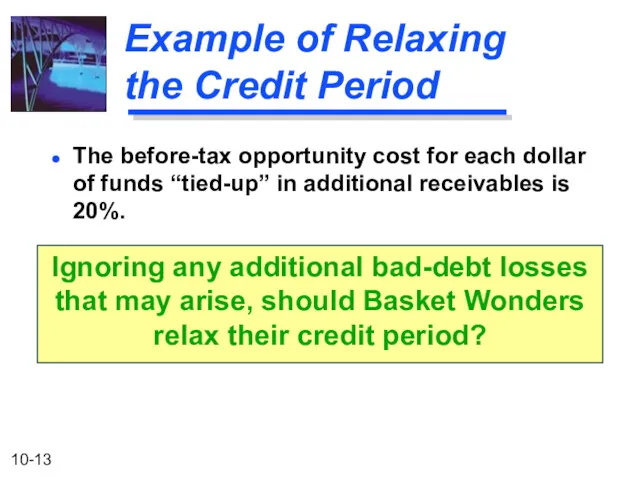

- 12. Example of Relaxing the Credit Period Basket Wonders is considering changing its credit period from “net

- 13. Example of Relaxing the Credit Period The before-tax opportunity cost for each dollar of funds “tied-up”

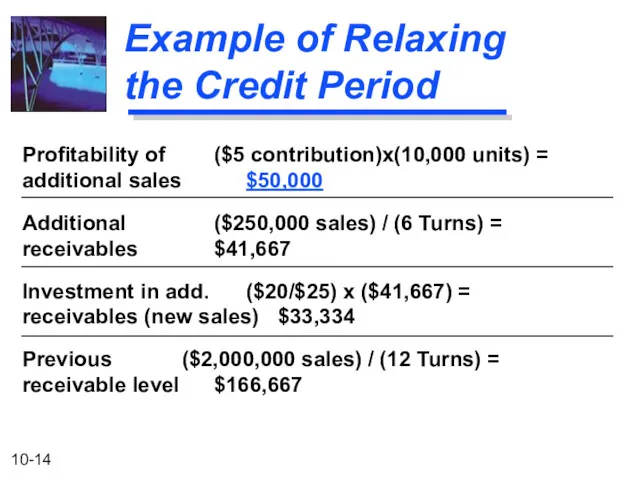

- 14. Example of Relaxing the Credit Period Profitability of ($5 contribution)x(10,000 units) = additional sales $50,000 Additional

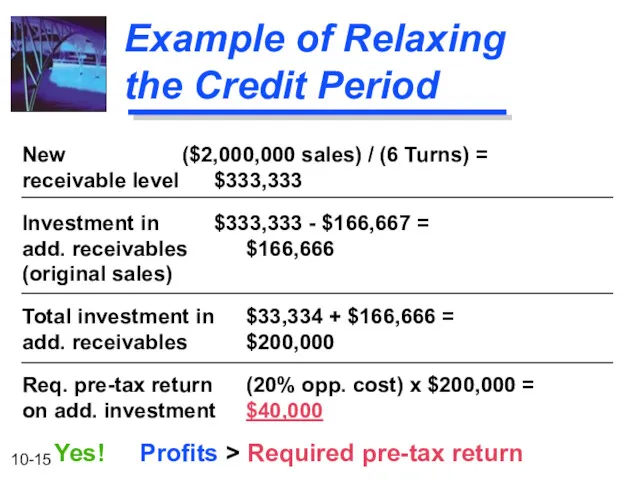

- 15. Example of Relaxing the Credit Period New ($2,000,000 sales) / (6 Turns) = receivable level $333,333

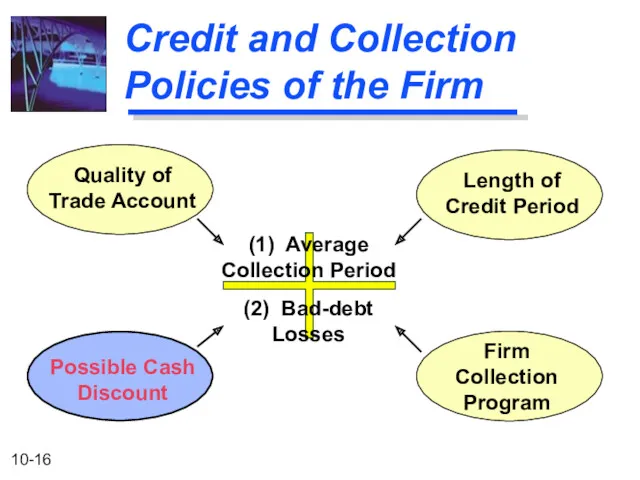

- 16. Credit and Collection Policies of the Firm (1) Average Collection Period (2) Bad-debt Losses Quality of

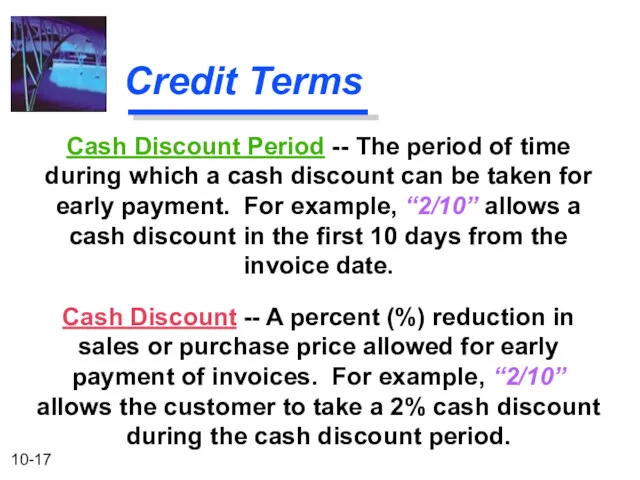

- 17. Credit Terms Cash Discount -- A percent (%) reduction in sales or purchase price allowed for

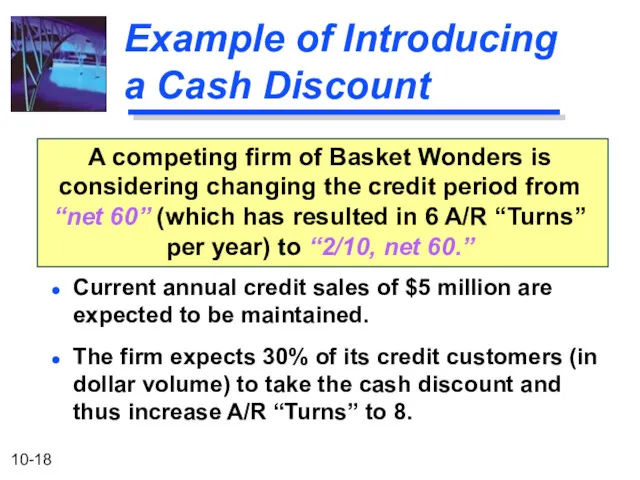

- 18. Example of Introducing a Cash Discount A competing firm of Basket Wonders is considering changing the

- 19. The before-tax opportunity cost for each dollar of funds “tied-up” in additional receivables is 20%. Ignoring

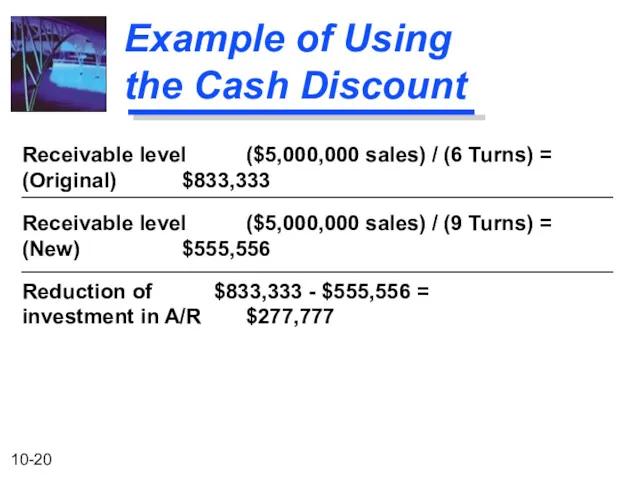

- 20. Example of Using the Cash Discount Receivable level ($5,000,000 sales) / (6 Turns) = (Original) $833,333

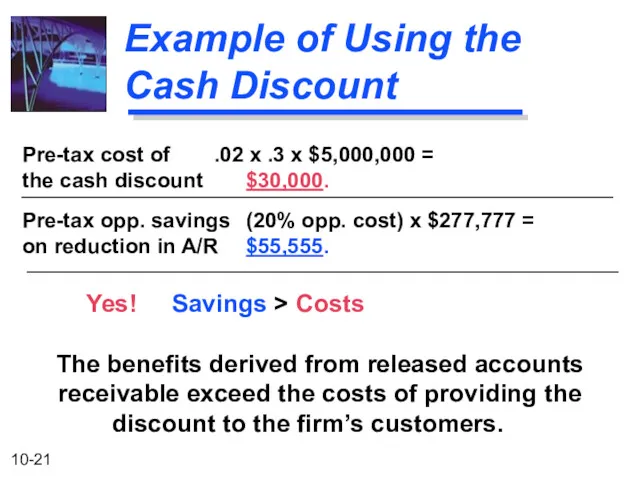

- 21. Pre-tax cost of .02 x .3 x $5,000,000 = the cash discount $30,000. Pre-tax opp. savings

- 22. Inventory Management and Control Raw-materials inventory Work-in-process inventory In-transit inventory Finished-goods inventory Inventories form a link

- 23. Inventory Management and Control Purchasing Production scheduling Efficient servicing of customer demands Inventories provide flexibility for

- 24. Appropriate Level of Inventories Employ a cost-benefit analysis Compare the benefits of economies of production, purchasing,

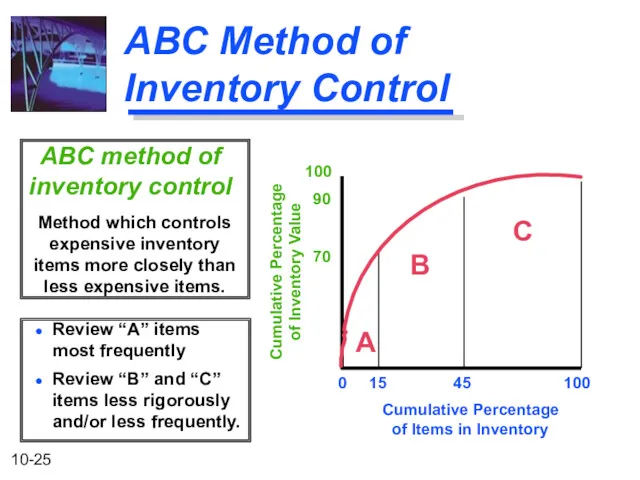

- 25. ABC Method of Inventory Control Method which controls expensive inventory items more closely than less expensive

- 26. How Much to Order? Forecast usage Ordering cost Carrying cost The optimal quantity to order depends

- 27. Ordering costs The variable costs can include: the cost of preparing a purchase requisition, the cost

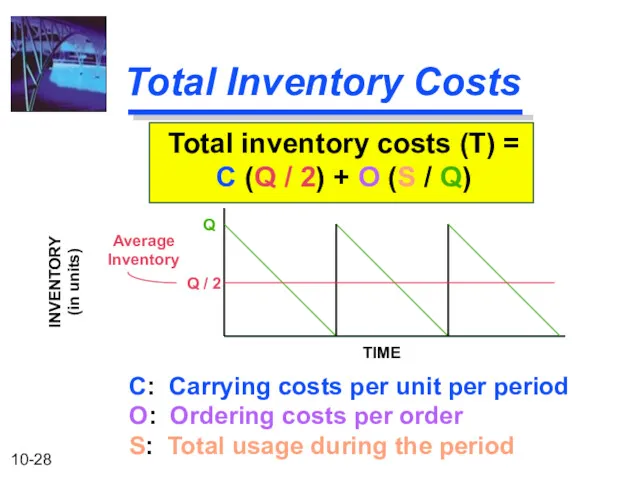

- 28. Total Inventory Costs C: Carrying costs per unit per period O: Ordering costs per order S:

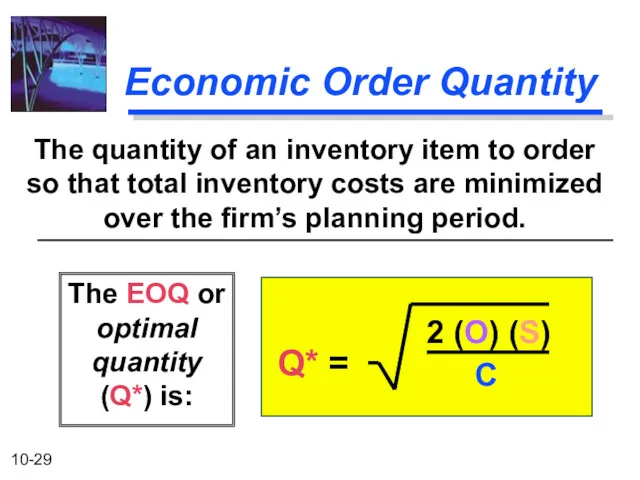

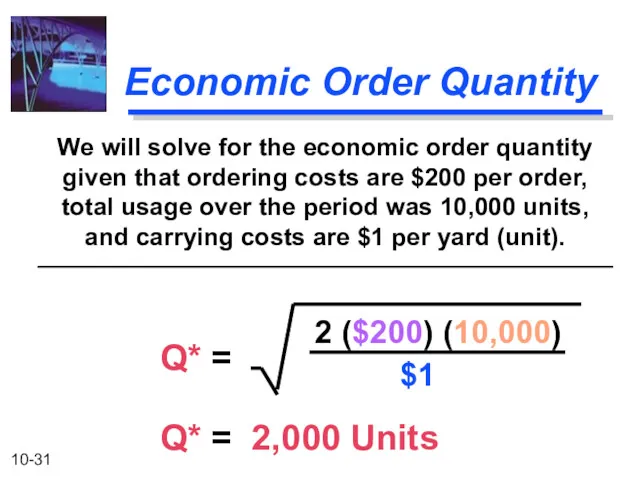

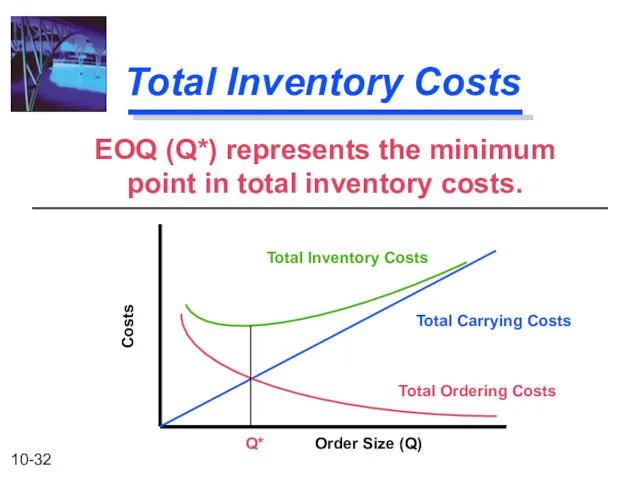

- 29. Economic Order Quantity The EOQ or optimal quantity (Q*) is: The quantity of an inventory item

- 30. Example of the Economic Order Quantity Basket Wonders is attempting to determine the economic order quantity

- 31. Economic Order Quantity We will solve for the economic order quantity given that ordering costs are

- 32. Total Inventory Costs EOQ (Q*) represents the minimum point in total inventory costs. Total Inventory Costs

- 33. When to Order? Order Point -- The quantity to which inventory must fall in order to

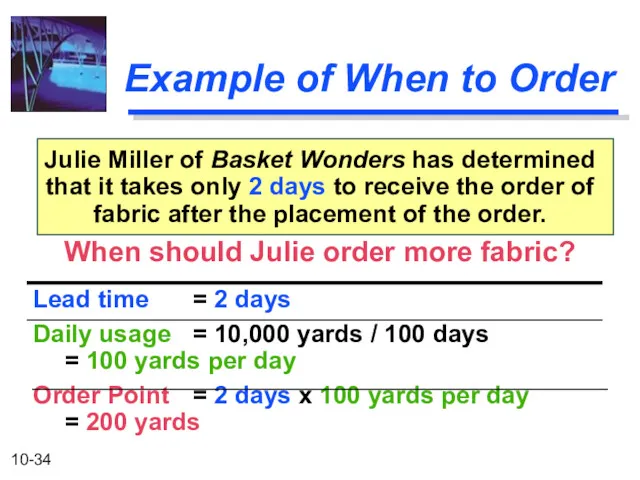

- 34. Example of When to Order Julie Miller of Basket Wonders has determined that it takes only

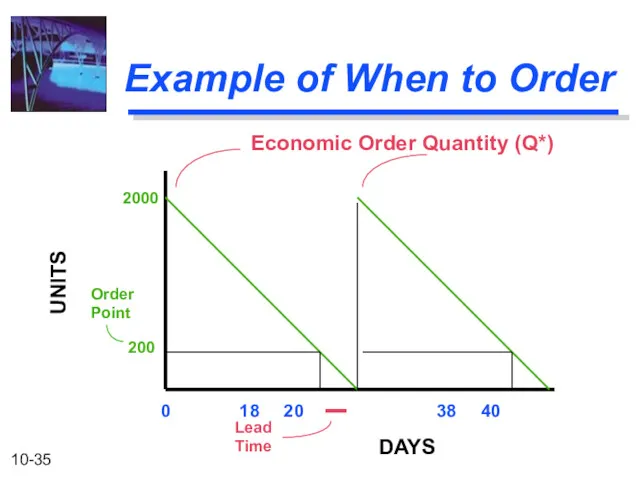

- 35. Example of When to Order 0 18 20 38 40 Lead Time 200 2000 Order Point

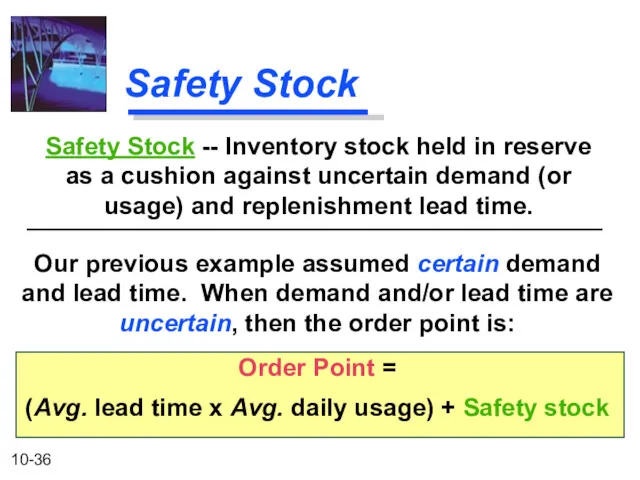

- 36. Safety Stock Our previous example assumed certain demand and lead time. When demand and/or lead time

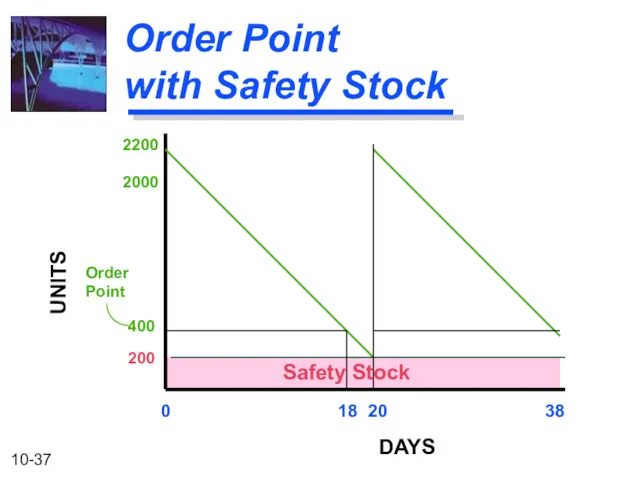

- 37. Order Point with Safety Stock 0 18 20 38 400 2000 Order Point UNITS DAYS 2200

- 38. Order Point with Safety Stock UNITS DAYS Safety Stock Actual lead time is 3 days! (at

- 39. How Much Safety Stock? Amount of uncertainty in inventory demand Amount of uncertainty in the lead

- 40. Just-in-Time A very accurate production and inventory information system Highly efficient purchasing Reliable suppliers Efficient inventory-handling

- 42. Скачать презентацию

Автозащита Базовый. Страхование на случай причинения вреда по вине третьих лиц, не имеющих полиса ОСАГО

Автозащита Базовый. Страхование на случай причинения вреда по вине третьих лиц, не имеющих полиса ОСАГО Личные финансы: от экономии к инвестициям. Непостоянные доходы

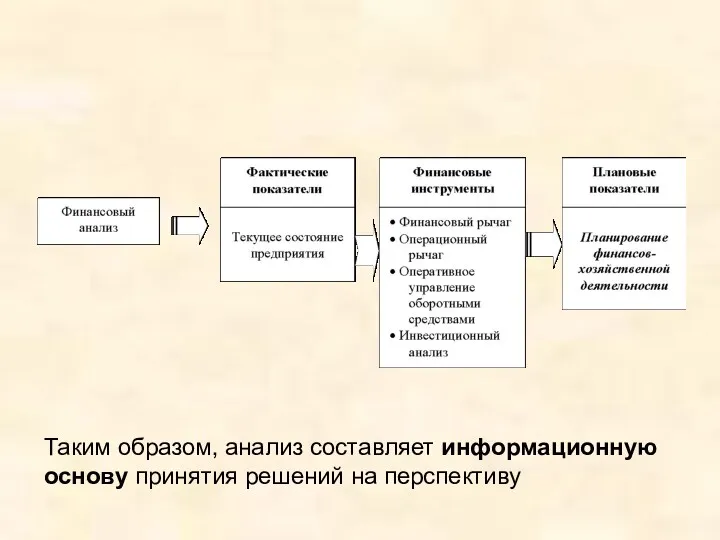

Личные финансы: от экономии к инвестициям. Непостоянные доходы Финансовый анализ

Финансовый анализ Расчет ставки дисконтирования

Расчет ставки дисконтирования Как банки создают деньги

Как банки создают деньги План-график закупок для обеспечения государственных и муниципальных нужд на финансовый год

План-график закупок для обеспечения государственных и муниципальных нужд на финансовый год Ревизия затрат на производство. Тема 6

Ревизия затрат на производство. Тема 6 Государственный бюджетный контроль. Цели, задачи и меры, применяемые при нарушении бюджетного законодательства

Государственный бюджетный контроль. Цели, задачи и меры, применяемые при нарушении бюджетного законодательства Является ли электронная платежная система банком?

Является ли электронная платежная система банком? Счета бухгалтерского учета и двойная запись

Счета бухгалтерского учета и двойная запись Бухгалтерский учет в кредитных организациях. (Тема 1)

Бухгалтерский учет в кредитных организациях. (Тема 1) Учет затрат на производство

Учет затрат на производство Неопределенность и риск: общие понятия и методы учета

Неопределенность и риск: общие понятия и методы учета Манипулирование ценами и использование инсайдерской информации на рынке ценных бумаг

Манипулирование ценами и использование инсайдерской информации на рынке ценных бумаг Структура и стоимость капитала

Структура и стоимость капитала Практика применения механизмов инициативного бюджетирования на муниципальном уровне

Практика применения механизмов инициативного бюджетирования на муниципальном уровне Риск и доходность на финансовых рынках

Риск и доходность на финансовых рынках Федеральная налоговая служба

Федеральная налоговая служба Имущество организации

Имущество организации Государственный бюджет и налоги

Государственный бюджет и налоги Фонд Русский мир. Гранты

Фонд Русский мир. Гранты Управление заемным капиталом

Управление заемным капиталом Задачи бюджетного учета

Задачи бюджетного учета Специализированные кредитно-финансовые институты

Специализированные кредитно-финансовые институты Жалақы және оның түрлері

Жалақы және оның түрлері Банковский кредит

Банковский кредит Карта рассрочки Халва. Совкомбанк

Карта рассрочки Халва. Совкомбанк Основы организации финансов организаций и домашних хозяйств

Основы организации финансов организаций и домашних хозяйств