Слайд 2

Plan

Introduction

I. Cost calculation

II. costing production

III. cost effectiveness assessment

Conclusion

LIterature

Слайд 3

Introduction

By way of inclusion in the cost of all costs are

divided into direct and indirect. Direct can be accurately and the only way related to the cost of the manufactured product or other object of calculation. As a rule, these include the costs of raw materials used for production, as well as the cost of labor of the main production personnel, which are recorded in account 20 "Primary production".

Слайд 4

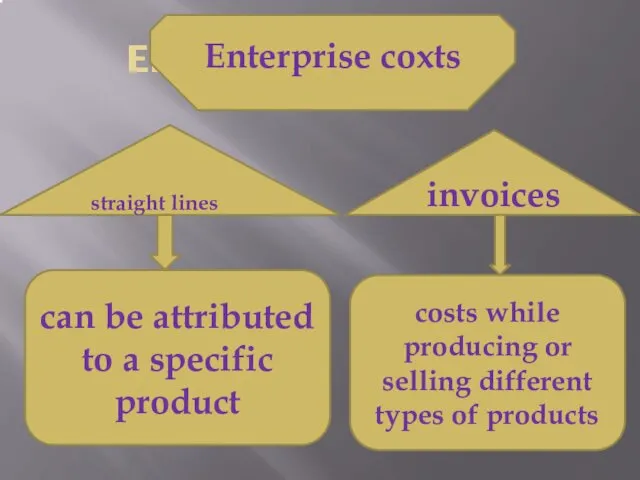

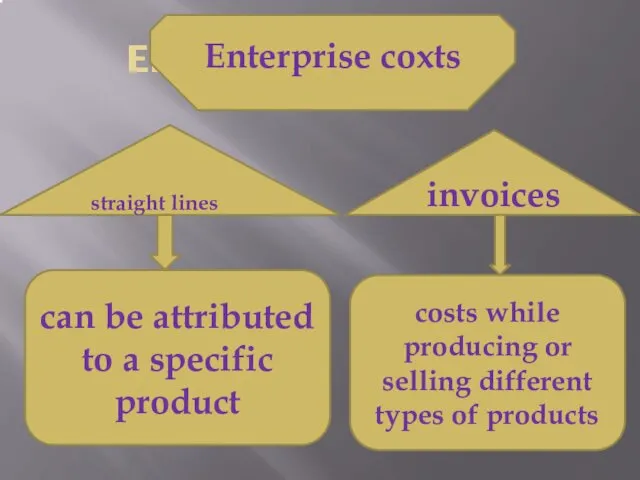

Enterprise costs

Enterprise coxts

straight lines

invoices

can be attributed to a specific product

costs

while producing or selling different types of products

Слайд 5

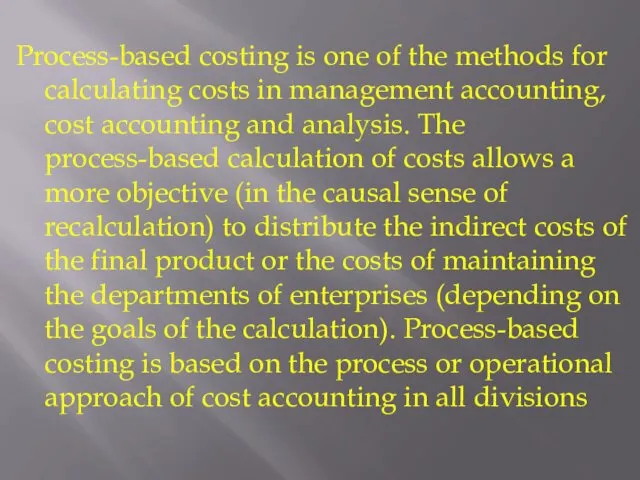

Process-based costing is one of the methods for calculating costs in

management accounting, cost accounting and analysis. The process-based calculation of costs allows a more objective (in the causal sense of recalculation) to distribute the indirect costs of the final product or the costs of maintaining the departments of enterprises (depending on the goals of the calculation). Process-based costing is based on the process or operational approach of cost accounting in all divisions

Слайд 6

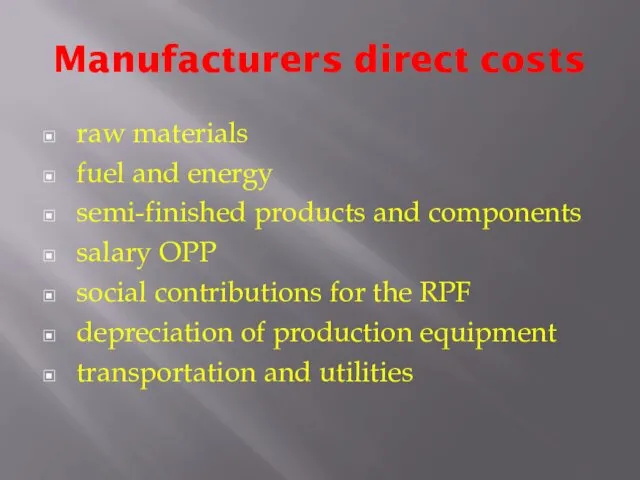

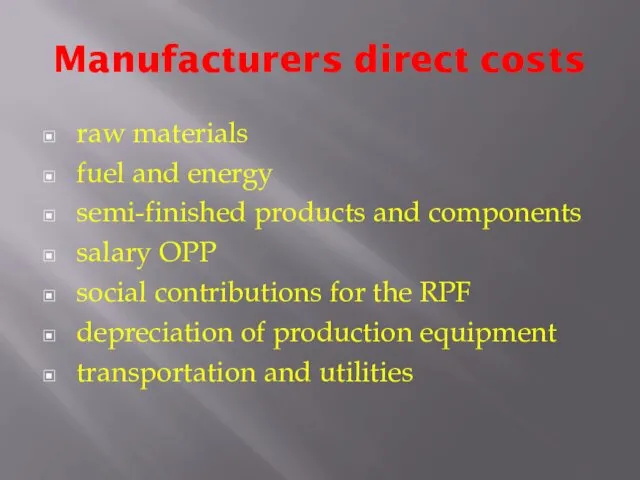

Manufacturers direct costs

raw materials

fuel and energy

semi-finished products and components

salary OPP

social contributions

for the RPF

depreciation of production equipment

transportation and utilities

Слайд 7

overheаd

manufacturing

managerial

general business

trading

Слайд 8

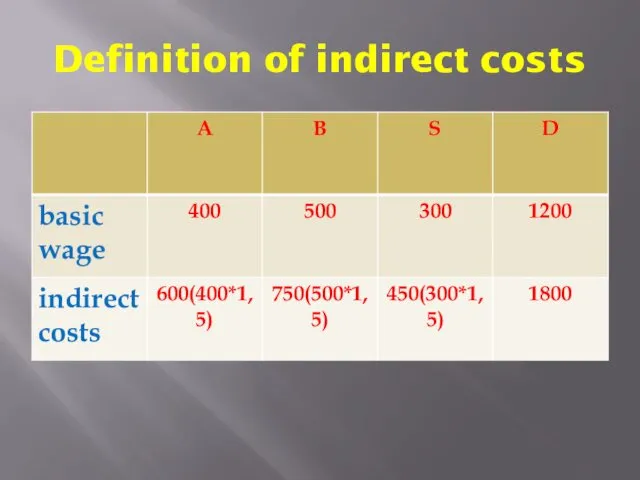

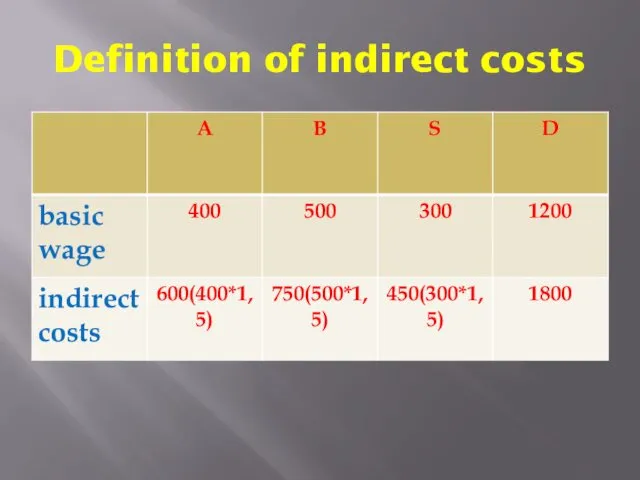

Definition of indirect costs

Слайд 9

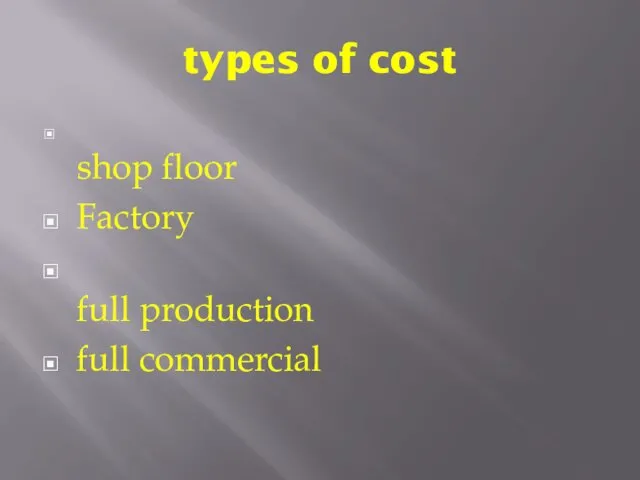

types of cost

shop floor

Factory

full production

full commercial

Слайд 10

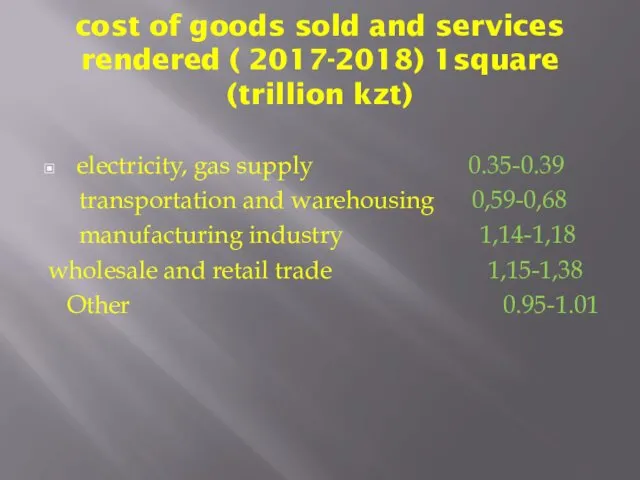

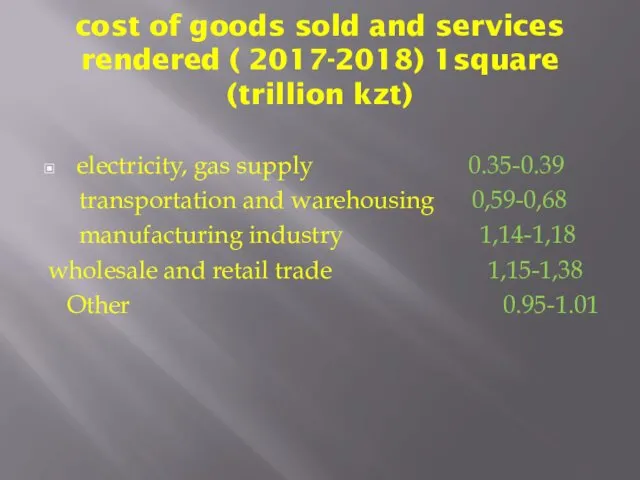

cost of goods sold and services rendered ( 2017-2018) 1square (trillion

kzt)

electricity, gas supply 0.35-0.39

transportation and warehousing 0,59-0,68

manufacturing industry 1,14-1,18

wholesale and retail trade 1,15-1,38

Other 0.95-1.01

Слайд 11

Conclusion

Initially, a list of all operations in certain departments of the

enterprise, which are performed by employees of these departments. Then from the individual operations are compiled the integrated processes of the enterprise. The costs of each process have at least a temporary connection with the final product or unit costs. Predetermined (measured) time to carry out each operation and taking into account the number of such operations in the processes and their relationship with the final product are the foundation of the distribution of costs per unit cost of the final product or unit cost of the resource (unit). Planning and calculation is easier to implement based on more economically sound business processes.

Слайд 12

Literature

Handbook of economist-mechanical engineer Izd.2 (1977) - [c.177, c.178, c.202]

Handbook of

economist engineering company (1971) - [p.271]

Актуальные проблемы налогового контроля в РФ

Актуальные проблемы налогового контроля в РФ Анализ капитальных вложений

Анализ капитальных вложений Банк қызметінің құқықтық негіздері

Банк қызметінің құқықтық негіздері Методика SIGMA

Методика SIGMA Фонд развития промышленности Республики Карелия

Фонд развития промышленности Республики Карелия Бизнес-планирование инновационных проектов

Бизнес-планирование инновационных проектов Лекция 16. Японские свечи

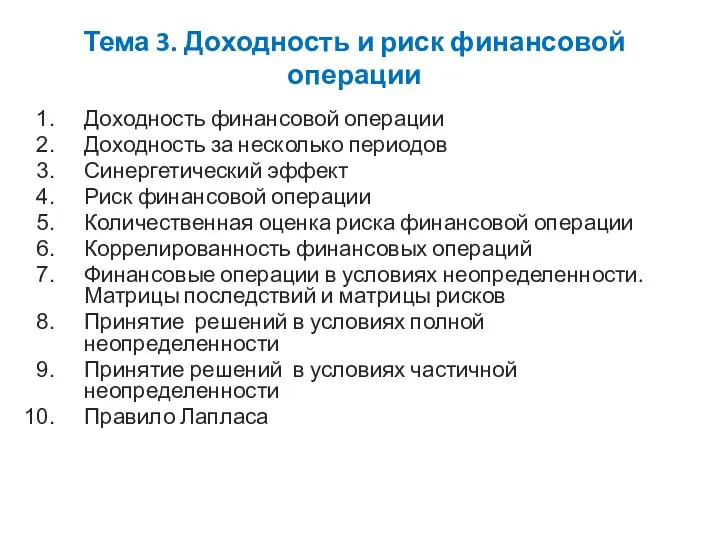

Лекция 16. Японские свечи Доходность и риск финансовой операции

Доходность и риск финансовой операции Денежная система

Денежная система Оценка гудвилла

Оценка гудвилла Изменения в налоговом законодательстве с 2023 года: Введение Единого налогового платежа

Изменения в налоговом законодательстве с 2023 года: Введение Единого налогового платежа Аналіз джерел формування капіталу. Лекція 5

Аналіз джерел формування капіталу. Лекція 5 Управление стоимостью компании

Управление стоимостью компании Вклад Альянса ФМС УрФО в развитие местных сообществ

Вклад Альянса ФМС УрФО в развитие местных сообществ Оборотные средства гостиничного предприятия

Оборотные средства гостиничного предприятия Налог на доходы физических лиц (НДФЛ)

Налог на доходы физических лиц (НДФЛ) Семейный бюджет

Семейный бюджет Концептуальні основи оподаткування

Концептуальні основи оподаткування Фінансові посередники. Сутність фінансових посередників та їх функції. Суб'єкти банківської системи. (Тема 3)

Фінансові посередники. Сутність фінансових посередників та їх функції. Суб'єкти банківської системи. (Тема 3) Сущность портфеля ценных бумаг и портфельного инвестирования. (Тема 1)

Сущность портфеля ценных бумаг и портфельного инвестирования. (Тема 1) Activity-Based Costing and Activity-Based Management

Activity-Based Costing and Activity-Based Management Президентские гранты для ННО

Президентские гранты для ННО Салық салу саласындағы мемлекеттік басқару түсінігі,маңызы,міндеттері

Салық салу саласындағы мемлекеттік басқару түсінігі,маңызы,міндеттері Региональная бюджетная система

Региональная бюджетная система Налог на добавленную стоимость

Налог на добавленную стоимость Такафул – исламское страхование

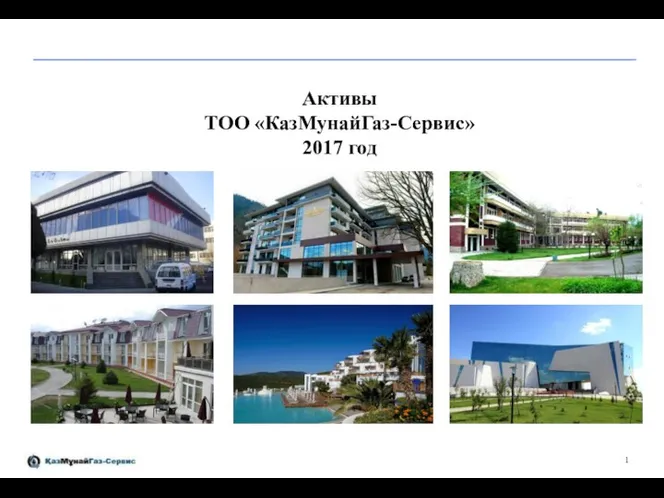

Такафул – исламское страхование ТОО КазМунайГаз-Сервис. Активы компании

ТОО КазМунайГаз-Сервис. Активы компании Фінансові інвестиції

Фінансові інвестиції