Содержание

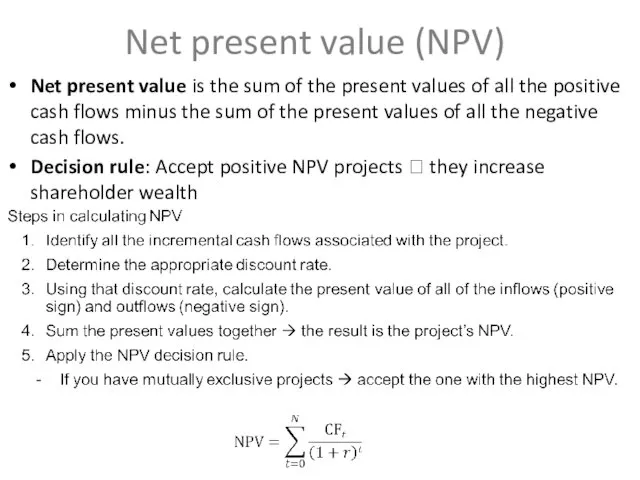

- 2. Net present value (NPV) Net present value is the sum of the present values of all

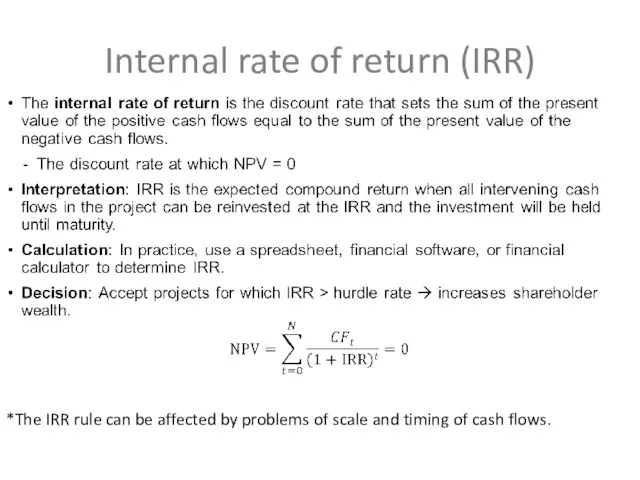

- 3. Internal rate of return (IRR) *The IRR rule can be affected by problems of scale and

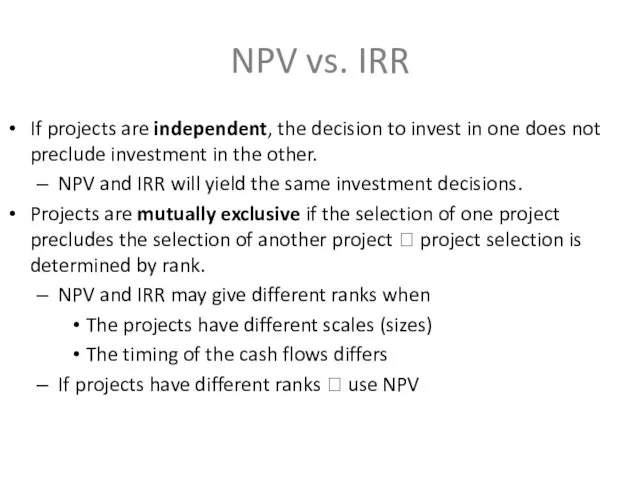

- 4. NPV vs. IRR If projects are independent, the decision to invest in one does not preclude

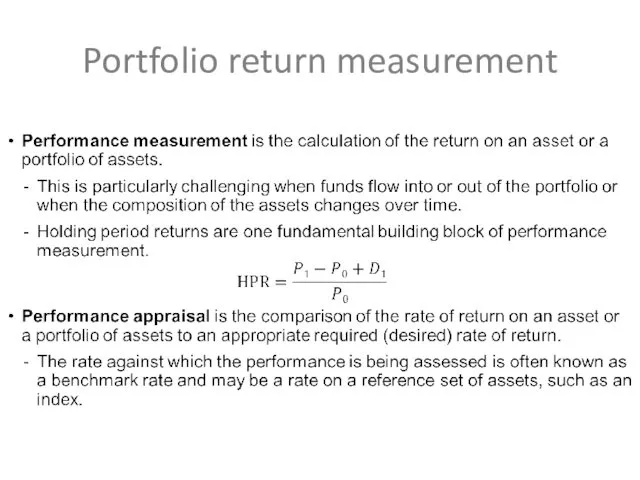

- 5. Portfolio return measurement

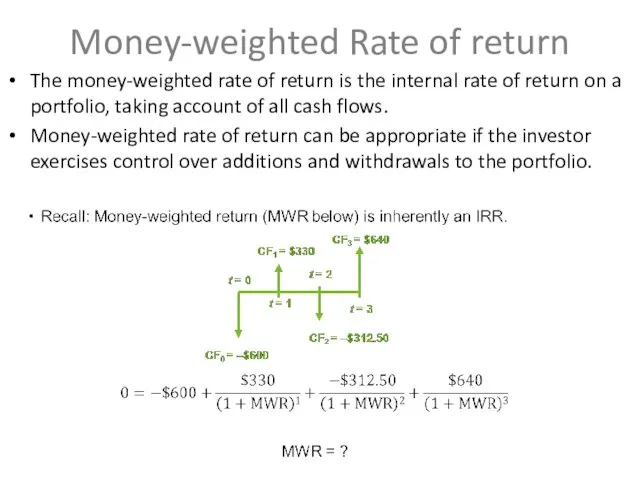

- 6. Money-weighted Rate of return The money-weighted rate of return is the internal rate of return on

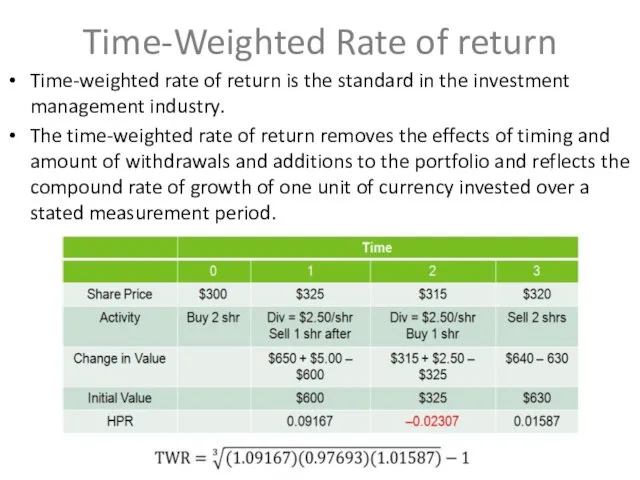

- 7. Time-Weighted Rate of return Time-weighted rate of return is the standard in the investment management industry.

- 8. TWR vs. MWR Money-weighted returns place greater weight on those periods in which investment is higher

- 9. Differing Money market Yields Instruments that mature in less than a year a known as money

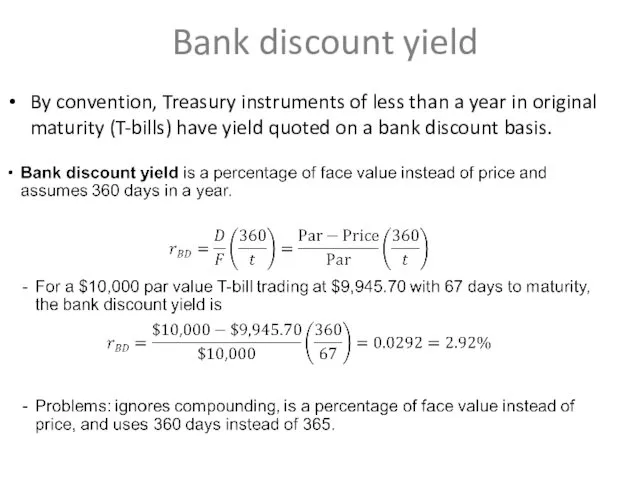

- 10. Bank discount yield By convention, Treasury instruments of less than a year in original maturity (T-bills)

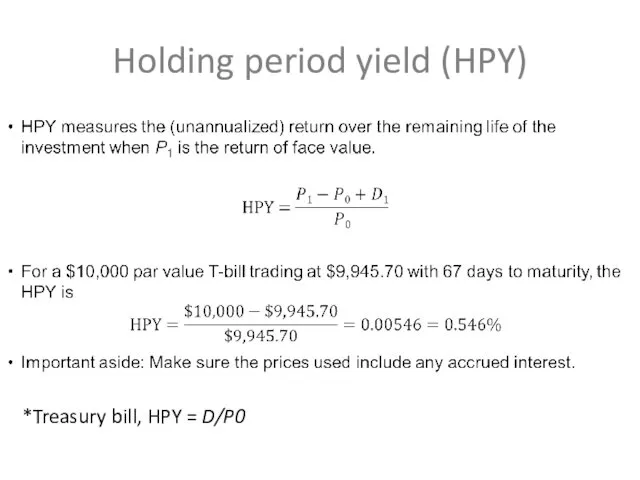

- 11. Holding period yield (HPY) *Treasury bill, HPY = D/P0

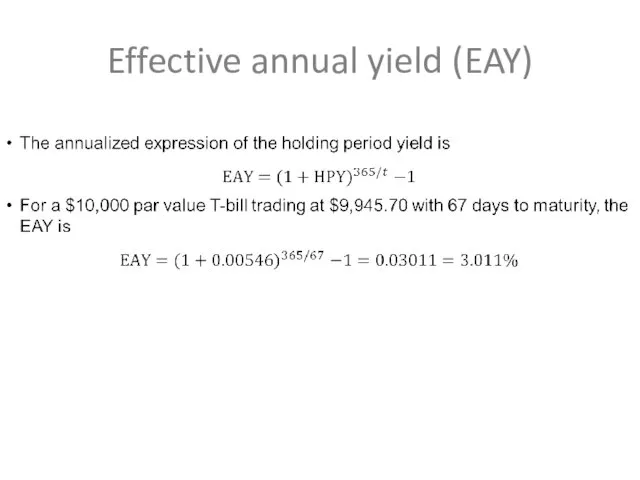

- 12. Effective annual yield (EAY)

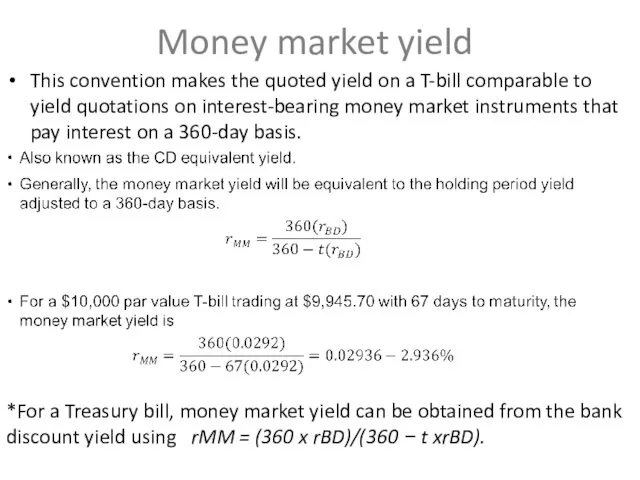

- 13. Money market yield This convention makes the quoted yield on a T-bill comparable to yield quotations

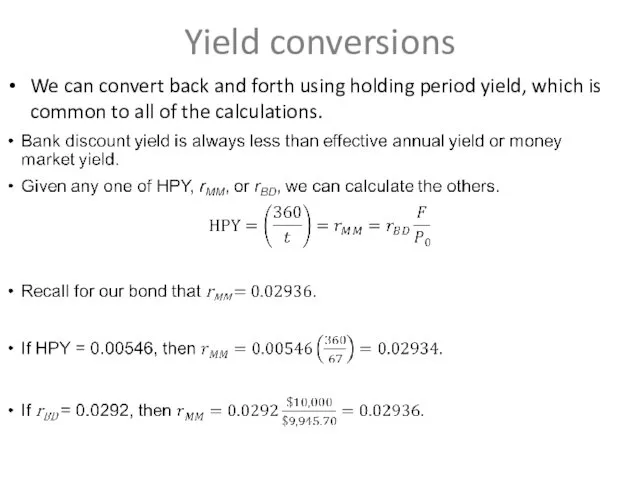

- 14. Yield conversions We can convert back and forth using holding period yield, which is common to

- 16. Скачать презентацию

Расчет ставки дисконтирования

Расчет ставки дисконтирования Исполнение бюджета Юрьевецкого городского поселения Юрьевецкого муниципального района за 2017 год

Исполнение бюджета Юрьевецкого городского поселения Юрьевецкого муниципального района за 2017 год Отчет главы Сосьвинского городского округа

Отчет главы Сосьвинского городского округа Метод F.I.F.O

Метод F.I.F.O Управление личными финансами

Управление личными финансами Ночной аудит отеля

Ночной аудит отеля Налоговая система РФ

Налоговая система РФ Финансовый менеджмент (корпоративные финансы).Тема 8. Управление инвестиционной деятельностью фирмы

Финансовый менеджмент (корпоративные финансы).Тема 8. Управление инвестиционной деятельностью фирмы Судебно-правовая бухгалтерия. Счета бухгалтерского учёта и бухгалтерская проводка. Тема 3

Судебно-правовая бухгалтерия. Счета бухгалтерского учёта и бухгалтерская проводка. Тема 3 Прибыль. Экономическая сущность прибыли

Прибыль. Экономическая сущность прибыли Оформление документов для бухгалтерии

Оформление документов для бухгалтерии Упрощенная система налогообложения (УСН)

Упрощенная система налогообложения (УСН) Программы поддержки инновационного бизнеса

Программы поддержки инновационного бизнеса Биткоины. Что такое Bitcoins

Биткоины. Что такое Bitcoins QIWI-Кошелек на номер телефона. Быстрые выплаты таксистам

QIWI-Кошелек на номер телефона. Быстрые выплаты таксистам Базовые концепции финансового менеджмента

Базовые концепции финансового менеджмента Себестоимость продукции. Эффективность производственнохозяйственной деятельности предприятия

Себестоимость продукции. Эффективность производственнохозяйственной деятельности предприятия Финансирование системы образования

Финансирование системы образования История возникновения Монгольской валюты “Тугрик”

История возникновения Монгольской валюты “Тугрик” Учет и анализ реализации готовой продукции

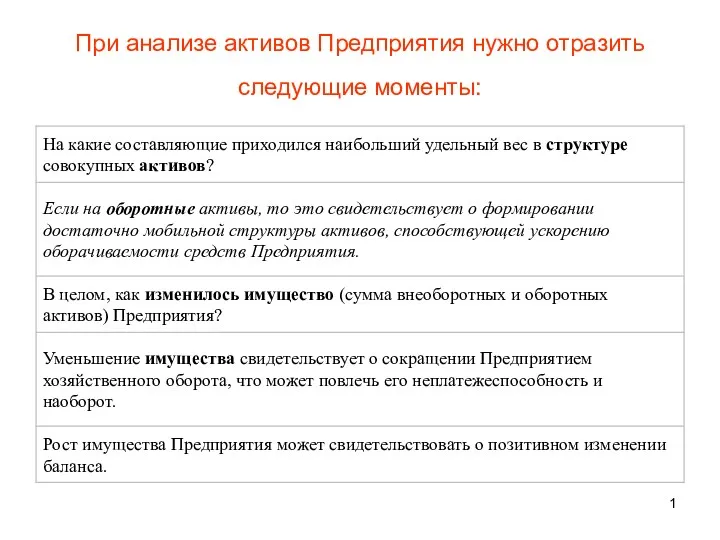

Учет и анализ реализации готовой продукции Анализ активов предприятия

Анализ активов предприятия Павлова Наталия вкр

Павлова Наталия вкр Деньги и их функции. 7 класс

Деньги и их функции. 7 класс Кредит - жизнь в долг или способ удовлетворения потребностей

Кредит - жизнь в долг или способ удовлетворения потребностей Учет расходов коммерческого банка на примере ПАО Сбербанк России

Учет расходов коммерческого банка на примере ПАО Сбербанк России The finances of the company. Financial statements of the company

The finances of the company. Financial statements of the company Подведение итогов за 9 месяцев 2017 года

Подведение итогов за 9 месяцев 2017 года Налоговый контроль за физическими лицами в России

Налоговый контроль за физическими лицами в России