Содержание

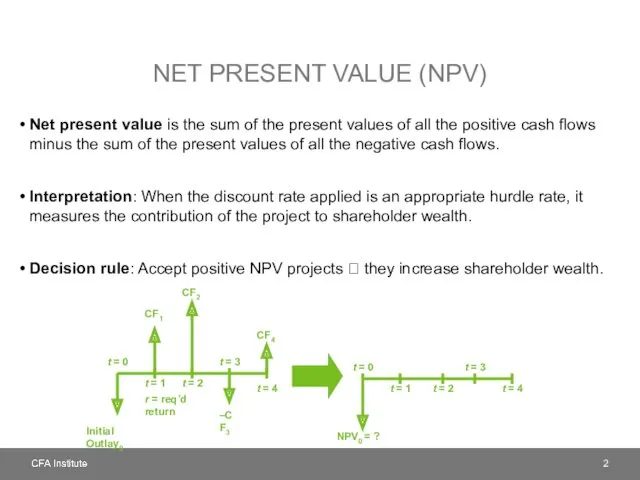

- 2. NET PRESENT VALUE (NPV) Net present value is the sum of the present values of all

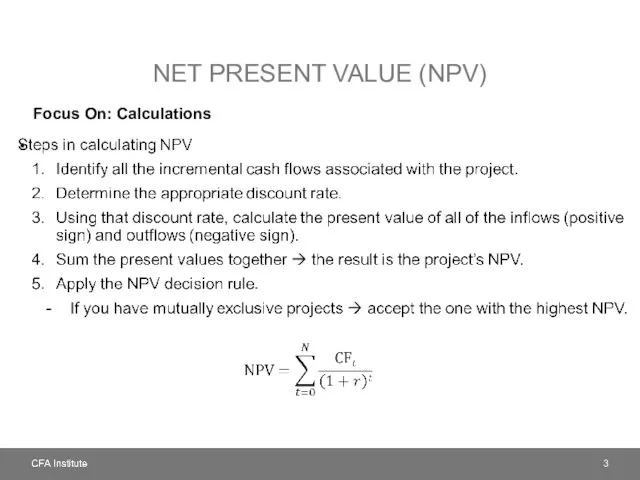

- 3. NET PRESENT VALUE (NPV) Focus On: Calculations

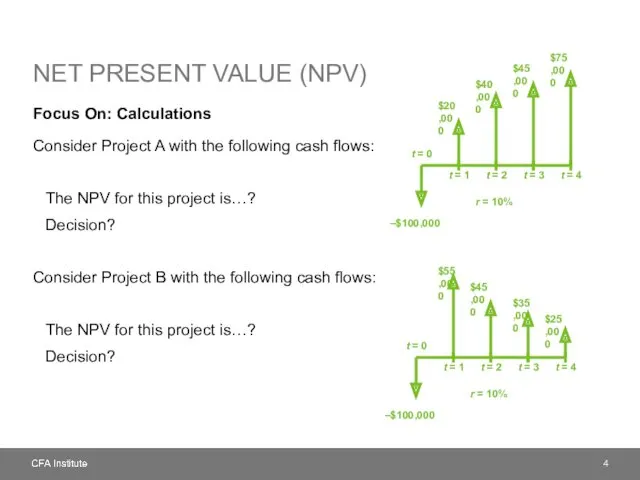

- 4. NET PRESENT VALUE (NPV) Focus On: Calculations Consider Project A with the following cash flows: The

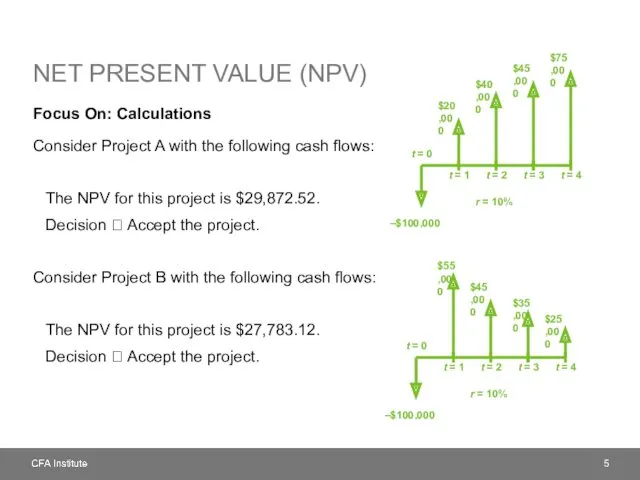

- 5. NET PRESENT VALUE (NPV) Focus On: Calculations Consider Project A with the following cash flows: The

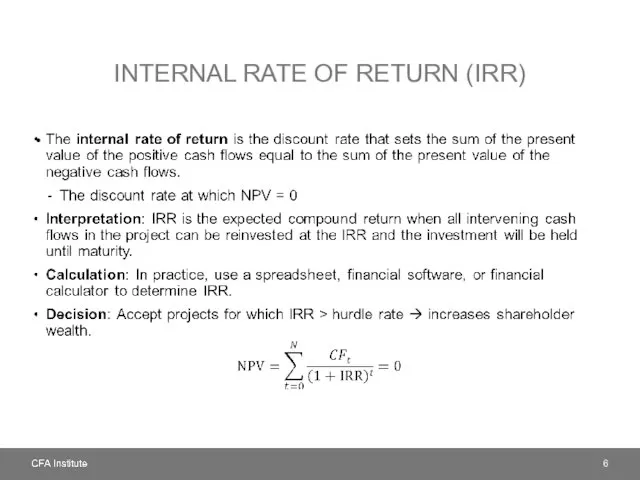

- 6. INTERNAL RATE OF RETURN (IRR)

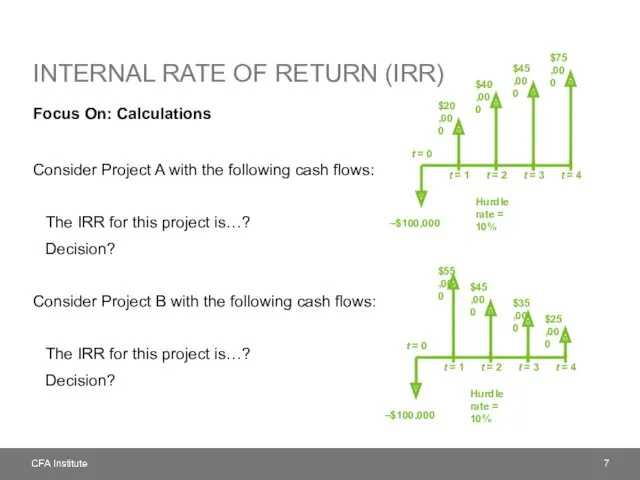

- 7. INTERNAL RATE OF RETURN (IRR) Focus On: Calculations Consider Project A with the following cash flows:

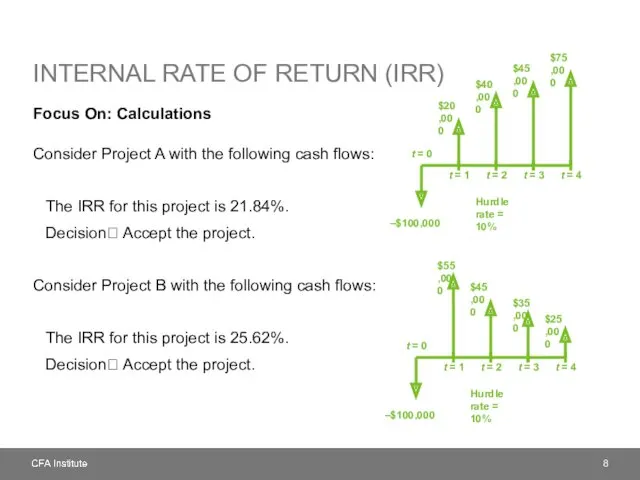

- 8. INTERNAL RATE OF RETURN (IRR) Focus On: Calculations Consider Project A with the following cash flows:

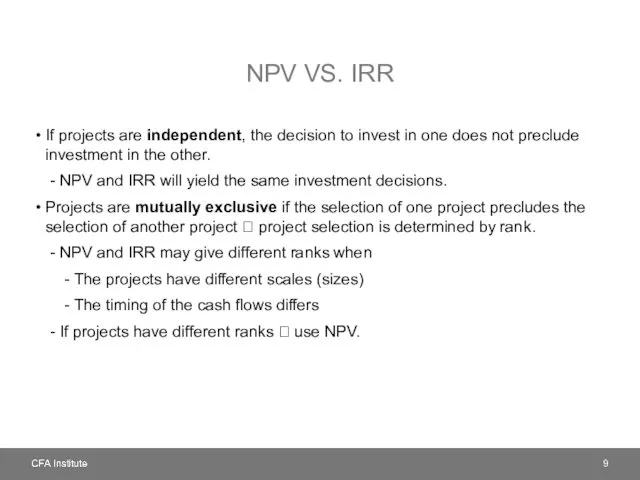

- 9. NPV VS. IRR If projects are independent, the decision to invest in one does not preclude

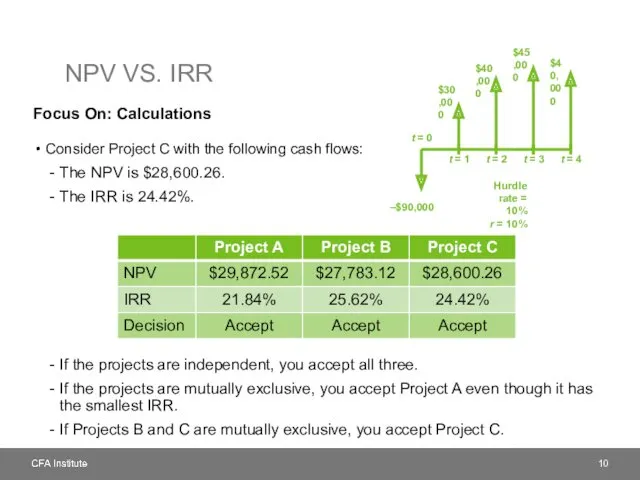

- 10. NPV VS. IRR Focus On: Calculations Consider Project C with the following cash flows: The NPV

- 11. IRR CHALLENGES IRR is a very appealing measure because it is intuitive; we all understand (or

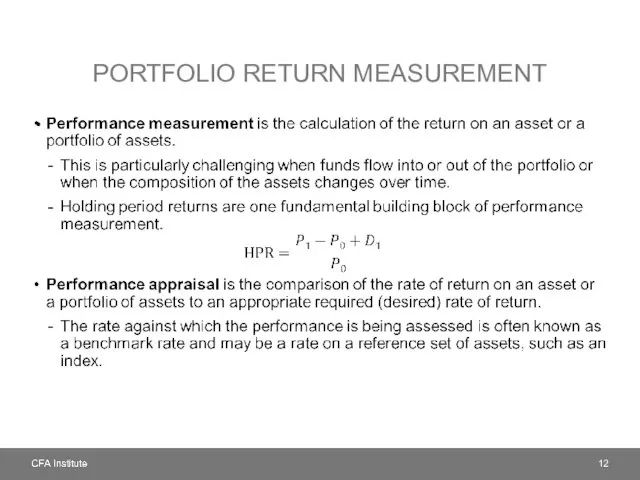

- 12. PORTFOLIO RETURN MEASUREMENT

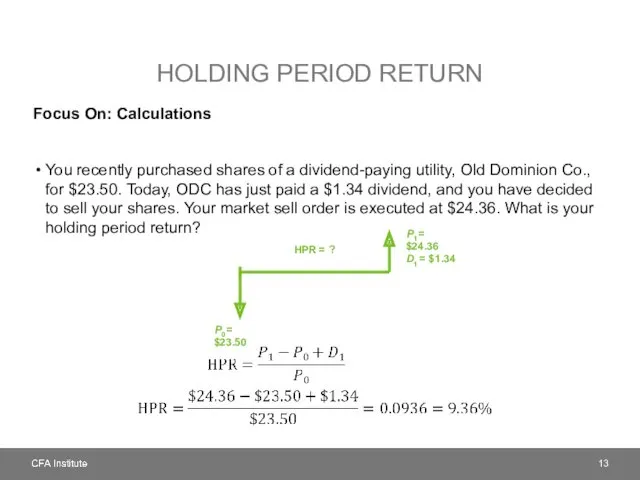

- 13. HOLDING PERIOD RETURN Focus On: Calculations You recently purchased shares of a dividend-paying utility, Old Dominion

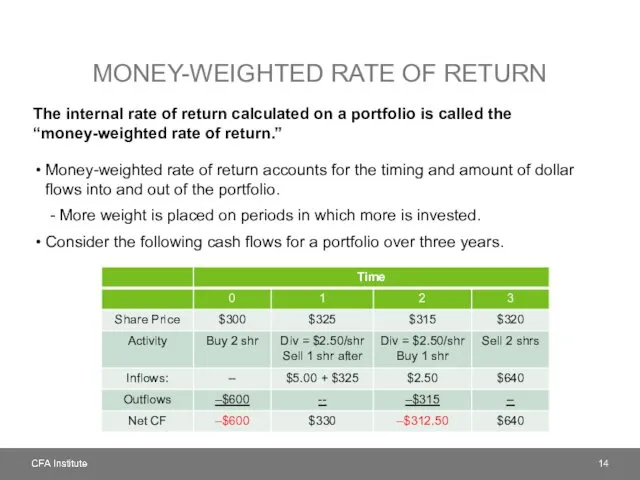

- 14. MONEY-WEIGHTED RATE OF RETURN The internal rate of return calculated on a portfolio is called the

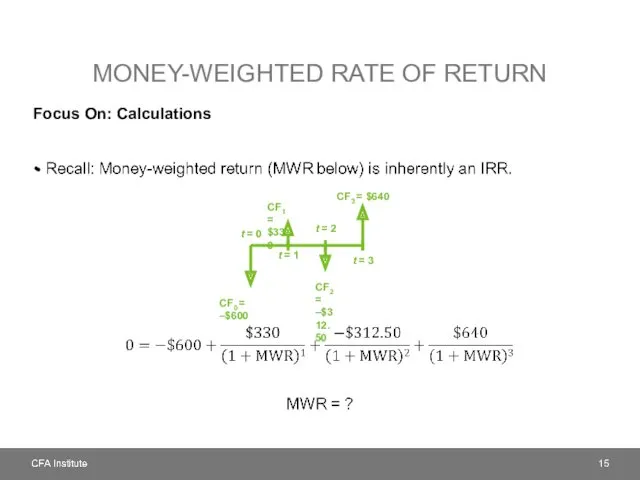

- 15. MONEY-WEIGHTED RATE OF RETURN Focus On: Calculations

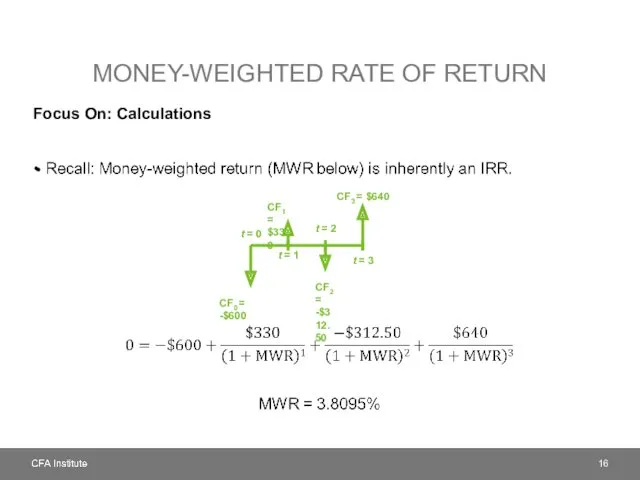

- 16. MONEY-WEIGHTED RATE OF RETURN Focus On: Calculations

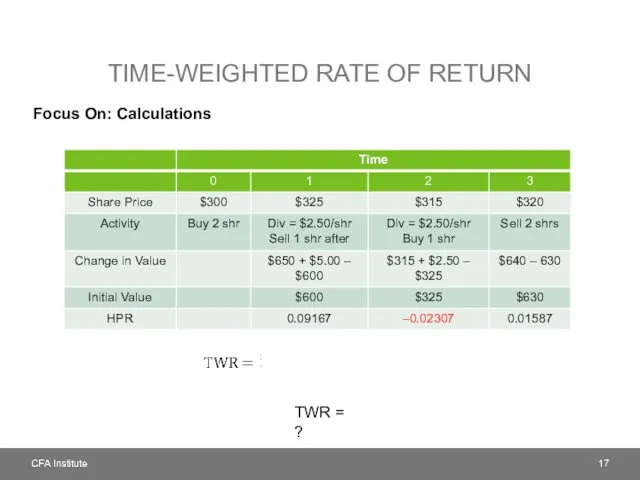

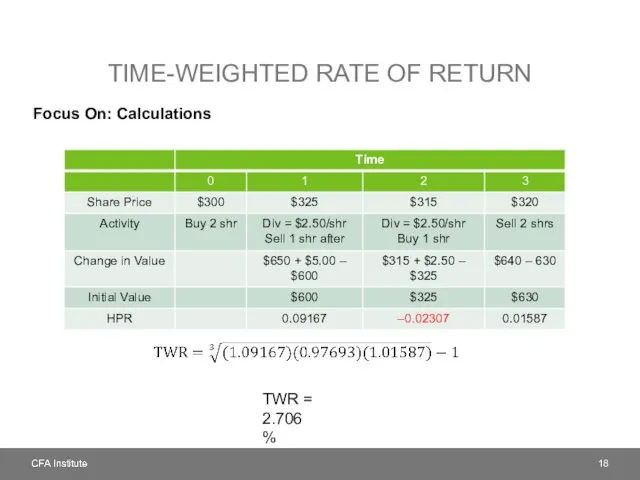

- 17. TIME-WEIGHTED RATE OF RETURN Focus On: Calculations TWR = ?

- 18. TIME-WEIGHTED RATE OF RETURN Focus On: Calculations TWR = 2.706%

- 19. TWR VS. MWR Money-weighted returns place greater weight on those periods in which investment is higher

- 20. DIFFERING MONEY MARKET YIELDS Instruments that mature in less than a year are known as money

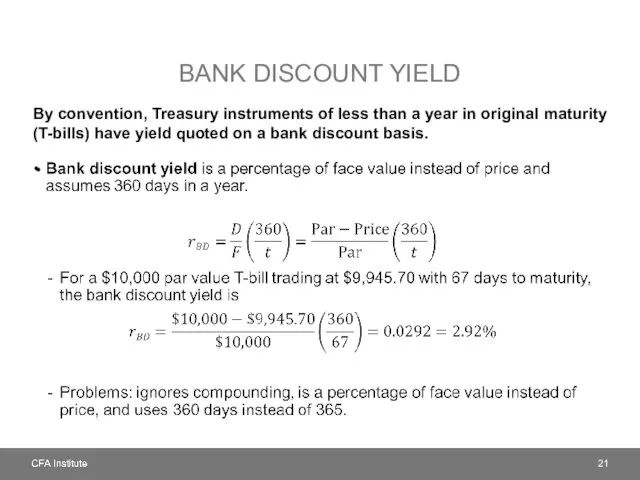

- 21. BANK DISCOUNT YIELD By convention, Treasury instruments of less than a year in original maturity (T-bills)

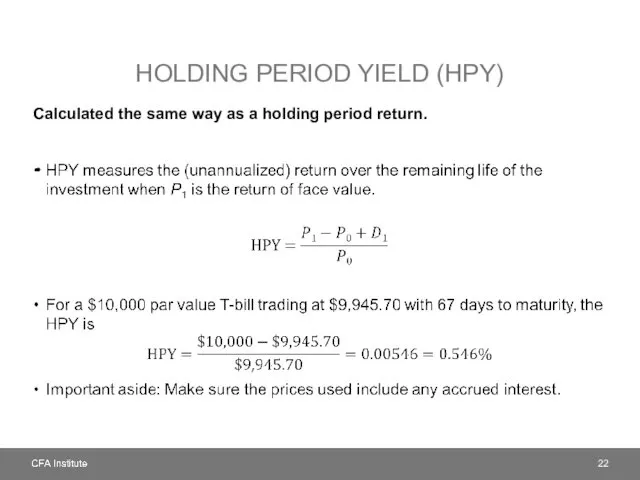

- 22. HOLDING PERIOD YIELD (HPY) Calculated the same way as a holding period return.

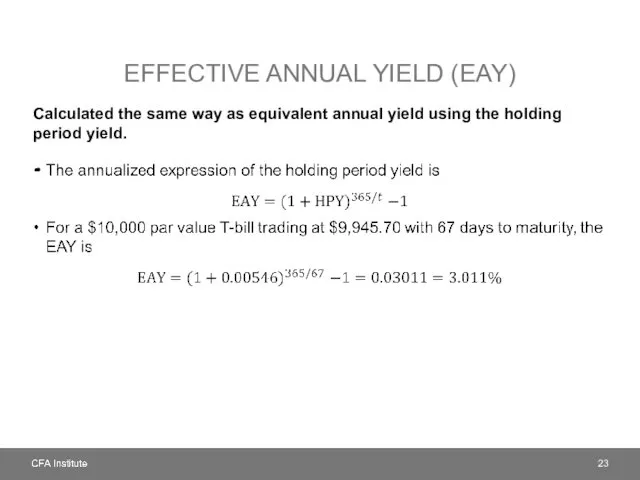

- 23. EFFECTIVE ANNUAL YIELD (EAY) Calculated the same way as equivalent annual yield using the holding period

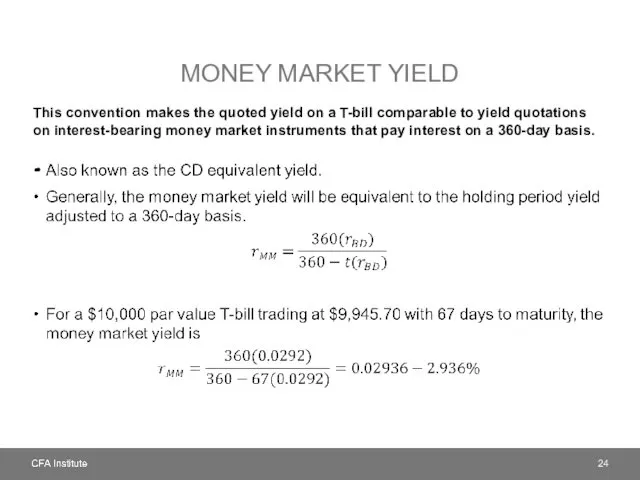

- 24. MONEY MARKET YIELD This convention makes the quoted yield on a T-bill comparable to yield quotations

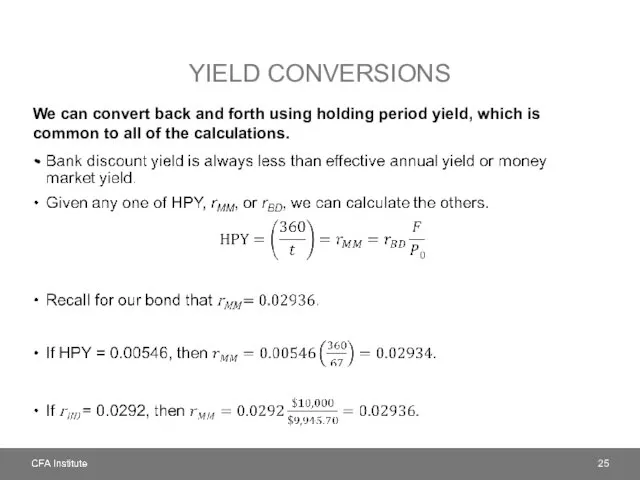

- 25. YIELD CONVERSIONS We can convert back and forth using holding period yield, which is common to

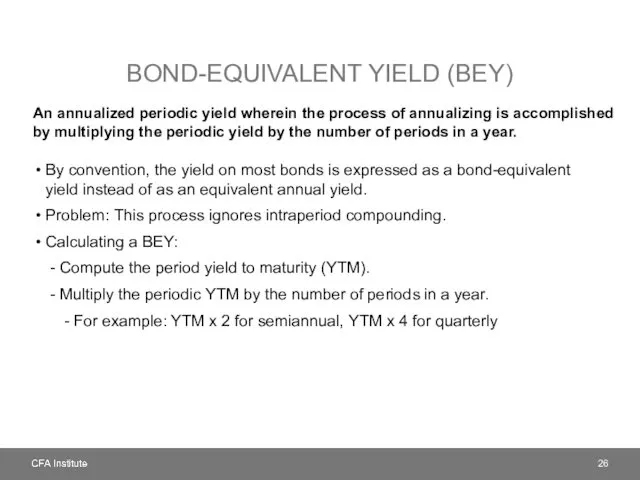

- 26. BOND-EQUIVALENT YIELD (BEY) An annualized periodic yield wherein the process of annualizing is accomplished by multiplying

- 28. Скачать презентацию

Недержавне пенсійне страхування: стан та перспективи розвитку

Недержавне пенсійне страхування: стан та перспективи розвитку Денежная эмиссия и выпуск денег в хозяйственный оборот

Денежная эмиссия и выпуск денег в хозяйственный оборот Учет денежных средств

Учет денежных средств Корпорация табысының қалыптасуы мен бөлінуі және тиімді пайдалануы

Корпорация табысының қалыптасуы мен бөлінуі және тиімді пайдалануы Анализ и оценка эффективности инструментов денежно-кредитной политики Банка России

Анализ и оценка эффективности инструментов денежно-кредитной политики Банка России Халықаралық қаржылық есеп стандарттары

Халықаралық қаржылық есеп стандарттары Блокчейн ICO и экономика будущего

Блокчейн ICO и экономика будущего Группа Всемирного банка

Группа Всемирного банка Определение стоимости недвижимого имущества

Определение стоимости недвижимого имущества Стратегия будущего ''Формируем достойную пенсию''

Стратегия будущего ''Формируем достойную пенсию'' Финансы и Управление финансами

Финансы и Управление финансами УралСиб Банк

УралСиб Банк Налоги на прибыль

Налоги на прибыль Расчёт с бюджетом по налогам

Расчёт с бюджетом по налогам Ценные бумаги кредитных организаций

Ценные бумаги кредитных организаций Зарплатный проект в рамках Пакетов решений Alfa Smart

Зарплатный проект в рамках Пакетов решений Alfa Smart Функції грошей

Функції грошей Фундаментальный анализ финансовых рынков

Фундаментальный анализ финансовых рынков Бухгалтерский баланс

Бухгалтерский баланс Видаткова частина бюджету України

Видаткова частина бюджету України Дивидендная политика различных компаний (3). ПАО МАГНИТ

Дивидендная политика различных компаний (3). ПАО МАГНИТ Понятие бюджета. Роль государственного бюджета в осуществлении социально-экономических задач государства

Понятие бюджета. Роль государственного бюджета в осуществлении социально-экономических задач государства Бизнес-стратегия. Финансовая модель проекта. Финансовый анализ компании

Бизнес-стратегия. Финансовая модель проекта. Финансовый анализ компании Оформление онлайн-займов

Оформление онлайн-займов Бухгатерлік есеп және салық салу негіздері

Бухгатерлік есеп және салық салу негіздері Государственный бюджет

Государственный бюджет Учет производственных запасов предприятия. Тема 4

Учет производственных запасов предприятия. Тема 4 Финансовые технологии в управлении фирмой. Производные финансовые инструменты

Финансовые технологии в управлении фирмой. Производные финансовые инструменты