Содержание

- 2. Financial analysis is the study of the main indicators of the financial condition and financial performance

- 3. Financial analysis includes analysis of the assets and liabilities of the organization, its solvency, liquidity, financial

- 4. The main components of the financial - economic analysis of the enterprise are accounting analysis; horizontal

- 5. Horizontal analysis is comparing reporting indicators with indicators of previous periods. Vertical analysis is carried out

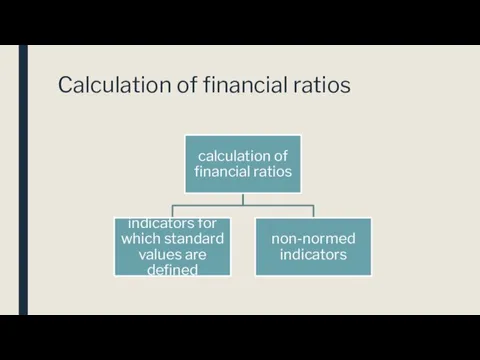

- 6. Calculation of financial ratios

- 7. Altman Z-score The Z-score formula for predicting bankruptcy was published in 1968 by Edward I. Altman

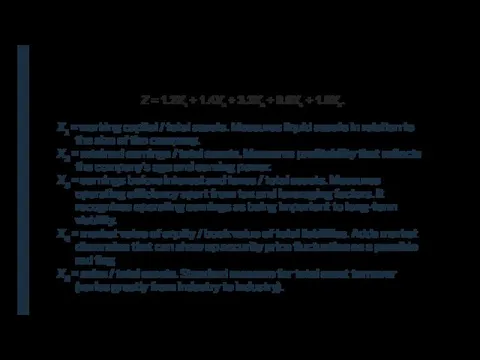

- 8. Z = 1.2X1 + 1.4X2 + 3.3X3 + 0.6X4 + 1.0X5. X1 = working capital /

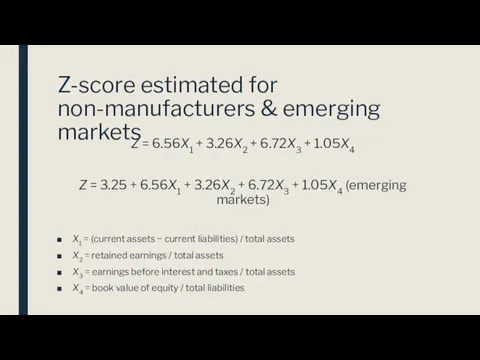

- 9. Z-score estimated for non-manufacturers & emerging markets Z = 6.56X1 + 3.26X2 + 6.72X3 + 1.05X4

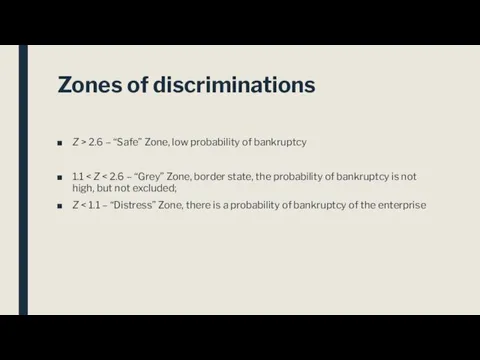

- 10. Zones of discriminations Z > 2.6 – “Safe” Zone, low probability of bankruptcy 1.1 Z

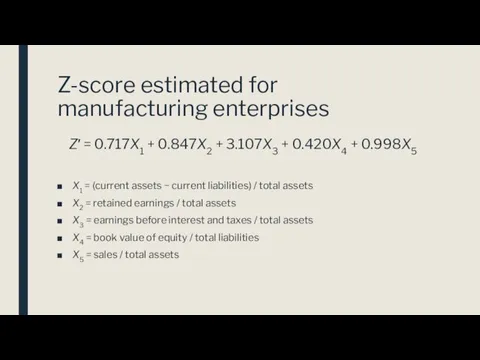

- 11. Z-score estimated for manufacturing enterprises Z′ = 0.717X1 + 0.847X2 + 3.107X3 + 0.420X4 + 0.998X5

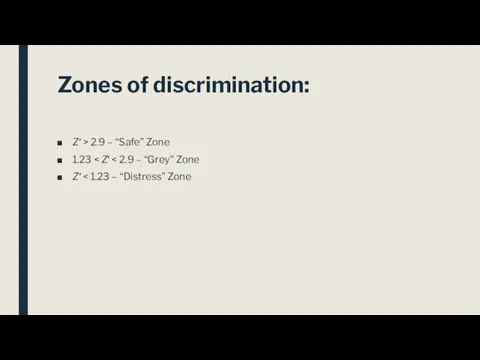

- 12. Zones of discrimination: Z′ > 2.9 – “Safe” Zone 1.23 Z′

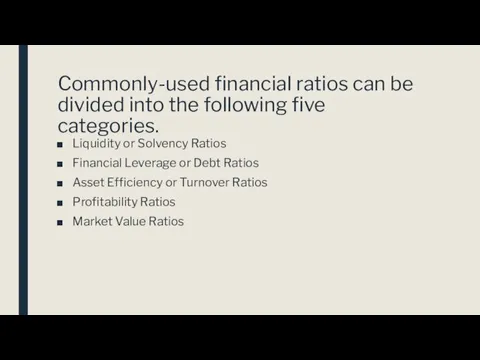

- 13. Commonly-used financial ratios can be divided into the following five categories. Liquidity or Solvency Ratios Financial

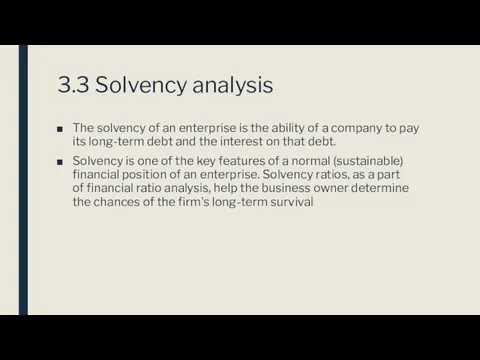

- 14. 3.3 Solvency analysis The solvency of an enterprise is the ability of a company to pay

- 15. The solvency of the company consists of two factors:

- 16. In the analysis of the first factor, the organization has net assets (equity). If the organization

- 17. If an organization has positive net assets, this does not indicate its good solvency. It is

- 18. There are several different solvency ratios, some of them technical and of use primarily to auditors

- 19. 2) The Equity Ratio explains how much of the company is owned by its investors. The

- 20. The Equity Ratio = 100000/150000 = 0,67 As you can see, ratio is .67. This means

- 21. 3) Interest Earned measures a company's ability meet its long-term debt obligations. It's calculated by dividing

- 22. A ratio of less than one indicates that a business may not be in a position

- 23. The solvency of the company in terms of asset liquidity is analyzed by means of special

- 25. Скачать презентацию

Определение рентабельности аптечной организации

Определение рентабельности аптечной организации Школьная карта. Для родителей

Школьная карта. Для родителей Формирование и учет финансовых результатов деятельности страховых организаций. Тема 6

Формирование и учет финансовых результатов деятельности страховых организаций. Тема 6 Банковская система

Банковская система Транспортный налог в Челябинской области на 2016 год

Транспортный налог в Челябинской области на 2016 год Учет труда и заработной платы. Тема 8

Учет труда и заработной платы. Тема 8 Денежные потоки предприятия и управление ими

Денежные потоки предприятия и управление ими Концептуальные модели и факторы создания стоимости предприятия

Концептуальные модели и факторы создания стоимости предприятия Финансово-правовые нормы, их особенности, виды и структура

Финансово-правовые нормы, их особенности, виды и структура Мошенничество на финансовых рынках

Мошенничество на финансовых рынках Развитие страхового рынка в зарубежных странах

Развитие страхового рынка в зарубежных странах ФСБУ 25/2018 Бухгалтерский учёт аренды

ФСБУ 25/2018 Бухгалтерский учёт аренды Выпускная квалификационная работа: Оценка и повышение финансовой устойчивости организации

Выпускная квалификационная работа: Оценка и повышение финансовой устойчивости организации Программа Максимум АО Страховая компания МетЛайф

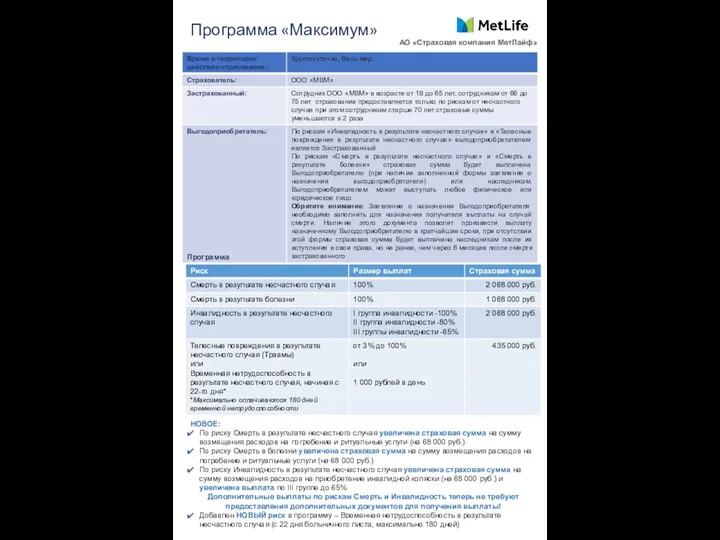

Программа Максимум АО Страховая компания МетЛайф Жеке табыс салығы

Жеке табыс салығы Учет денежных средств

Учет денежных средств Задачи по корпоративным финансам

Задачи по корпоративным финансам Управління фінансовими ресурсами підприємства аграрного сектору

Управління фінансовими ресурсами підприємства аграрного сектору Роль и функции Центрального банка Российской Федерации

Роль и функции Центрального банка Российской Федерации Публічні доходи та публічні видатки

Публічні доходи та публічні видатки Франциядағы бухгалтерлік есеп

Франциядағы бухгалтерлік есеп Источники финансовых ресурсов предприятия

Источники финансовых ресурсов предприятия Need money to grow your business

Need money to grow your business Ипотечное кредитование ВТБ 24

Ипотечное кредитование ВТБ 24 Ценообразование и ценовая политика

Ценообразование и ценовая политика Оценка готовой продукции: аспект бухгалтерской отчётности

Оценка готовой продукции: аспект бухгалтерской отчётности Росбанк Premium Banking

Росбанк Premium Banking Урок финансовой грамотности

Урок финансовой грамотности