Содержание

- 2. Outline Defining Exchange Rate Measuring Exchange Rate Movements Appreciation/Depreciation of a currency Exchange Rate Equilibrium Factors

- 3. Key words and concepts Exchange rate Depreciation Appreciation Balance of payments Devaluation Revaluation Asset Capital mobility

- 4. What does it mean EXCHANGE RATE? Nominal exchange rate Spot rate Forward rate Bilateral exchange rate

- 5. Meaning of Nominal Exchange Rate Nominal exchange rate is the relative price of the currency of

- 6. Measuring Changes in Exchange Rates A decline in a local currency’s value is referred to as

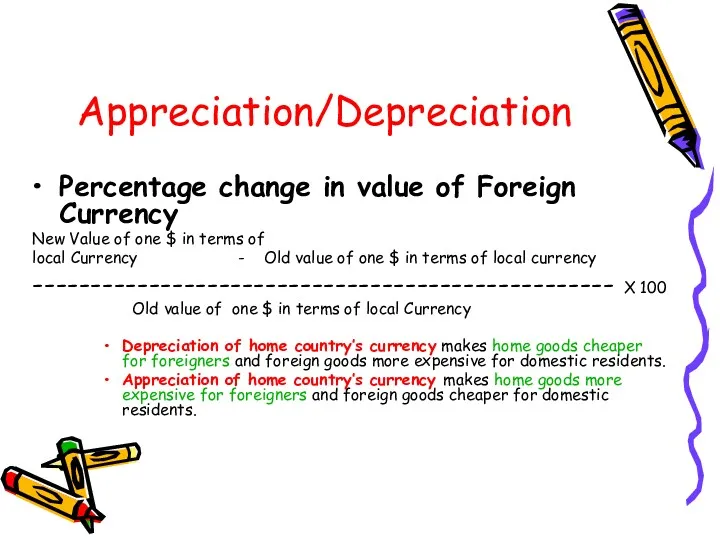

- 7. Appreciation/Depreciation Percentage change in value of Foreign Currency New Value of one $ in terms of

- 8. Exchange Rates and Relative Prices Import and export demands are influenced by relative prices. Appreciation of

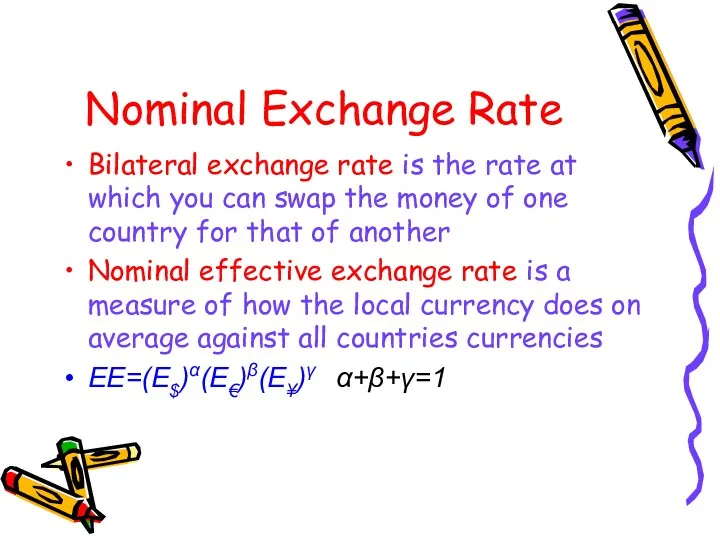

- 9. Nominal Exchange Rate Bilateral exchange rate is the rate at which you can swap the money

- 10. The importance of exchange rate Price unification of goods produced in different countries - they enable

- 11. The Foreign Exchange Market Exchange rates are determined in the foreign exchange market. The market in

- 12. The foreign exchange market is the mechanism by which participants: transfer purchasing power across countries; obtain

- 13. Spot Rates and Forward Rates Spot exchange rates Apply to exchange currencies “on the spot” Forward

- 14. Exchange Rate Equilibrium Forces of Demand and Supply Demand for foreign currency negatively related to the

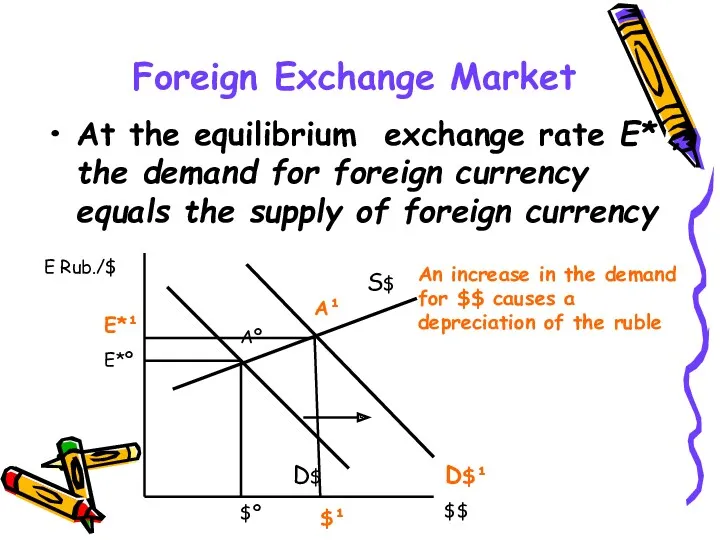

- 15. Foreign Exchange Market At the equilibrium exchange rate Е* , the demand for foreign currency equals

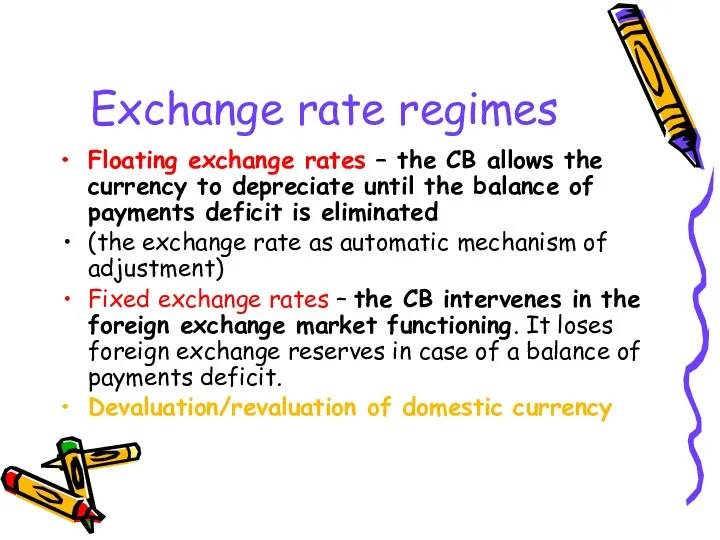

- 16. Exchange rate regimes Floating exchange rates – the CB allows the currency to depreciate until the

- 17. Real Exchange Rate The real exchange rate (RER) is the relative price of the goods of

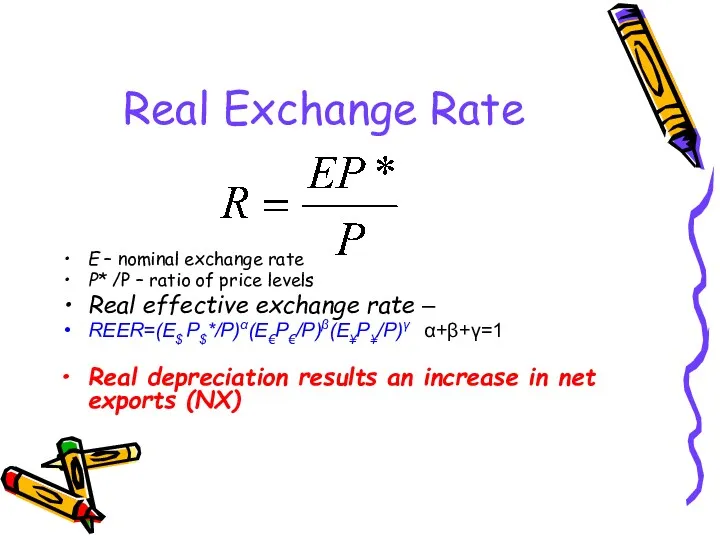

- 18. Real Exchange Rate E – nominal exchange rate Р* /P – ratio of price levels Real

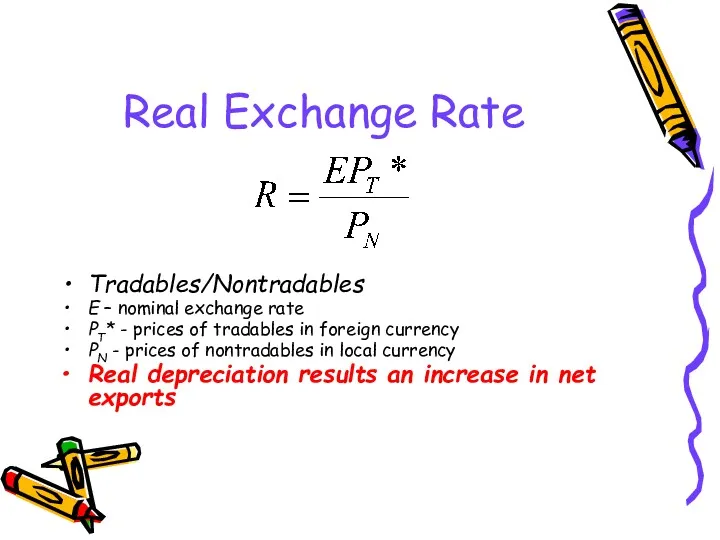

- 19. Real Exchange Rate Tradables/Nontradables E – nominal exchange rate РT* - prices of tradables in foreign

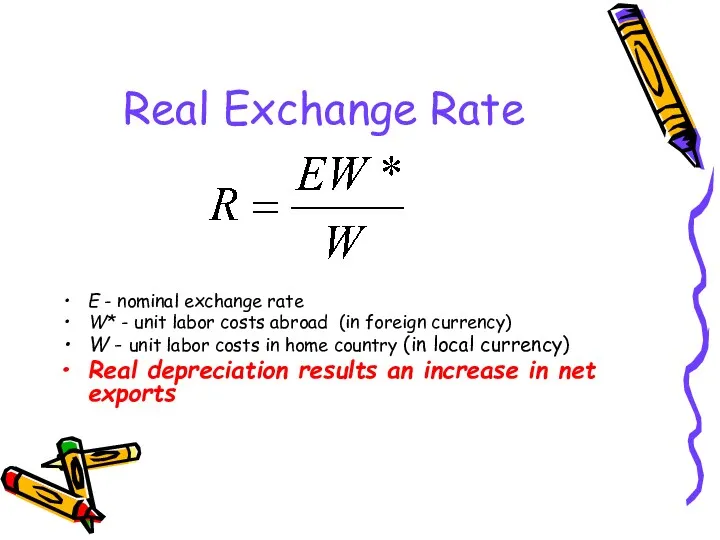

- 20. Real Exchange Rate E - nominal exchange rate W* - unit labor costs abroad (in foreign

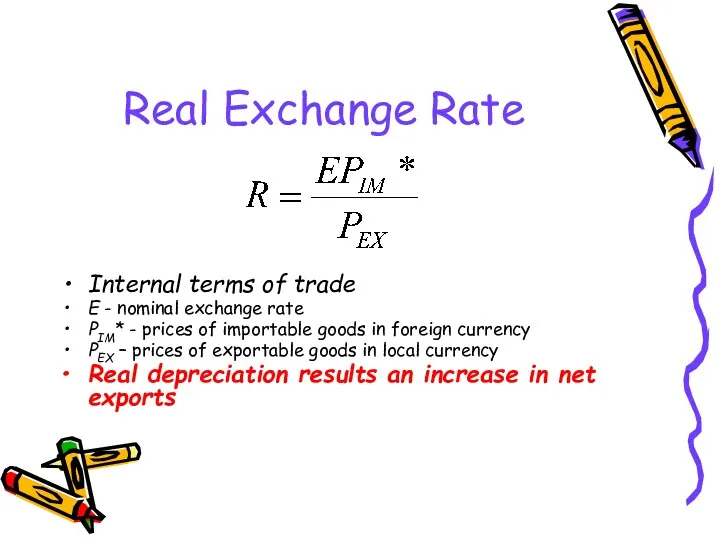

- 21. Real Exchange Rate Internal terms of trade E - nominal exchange rate РIM* - prices of

- 22. Why the RER matters Real variable RER determines the allocation of resources Impact on the competitiveness

- 23. Current Account Theories

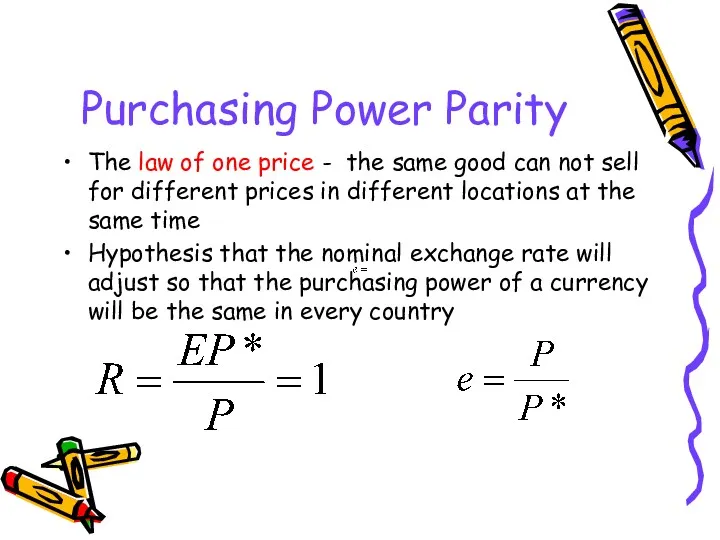

- 24. Purchasing Power Parity The law of one price - the same good can not sell for

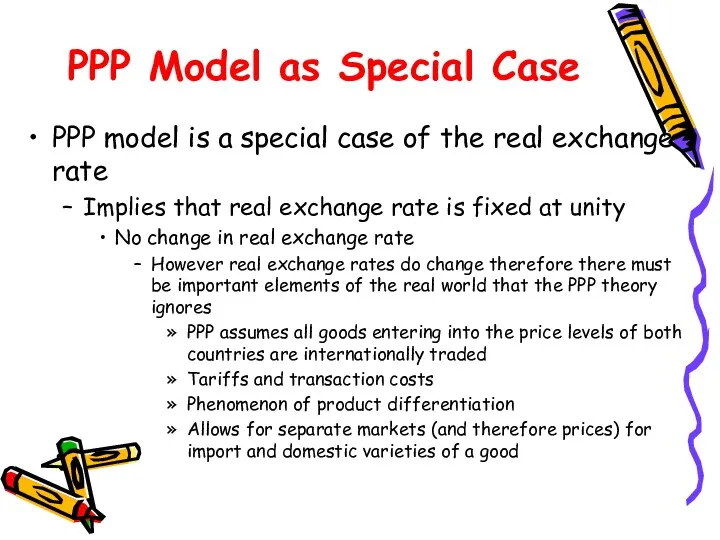

- 25. PPP Model as Special Case PPP model is a special case of the real exchange rate

- 26. PPP Model as Special Case Real exchange rate equation captures reality at any point in time

- 27. Exchange Rates in the LR PPP holds Relative prices are constant. Therefore, the real exchange rate

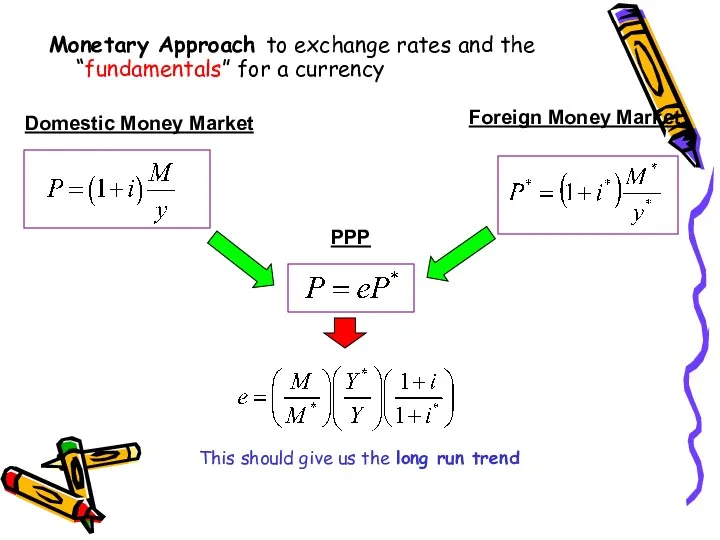

- 28. Monetary Approach to exchange rates and the “fundamentals” for a currency Domestic Money Market PPP Foreign

- 29. Exchange Rates in the SR Commodity prices are fixed (PPP fails) UIP and Currency markets determine

- 30. Asset Market Theories

- 31. The demand for a foreign currency bank deposit is influenced by the same considerations that influence

- 32. Risk and Liquidity Savers care about two main characteristics of an asset other than its return:

- 33. Return, Risk, and Liquidity in the Foreign Exchange Market The demand for foreign currency assets depends

- 34. Interest Rates Market participants need two pieces of information in order to compare returns on different

- 35. Exchange Rates and Asset Returns The returns on deposits traded in the foreign exchange market depend

- 36. A Simple Rule The dollar rate of return on euro deposits is approximately the euro interest

- 37. The expected rate of return difference between dollar and euro deposits is: R$ = R€ +

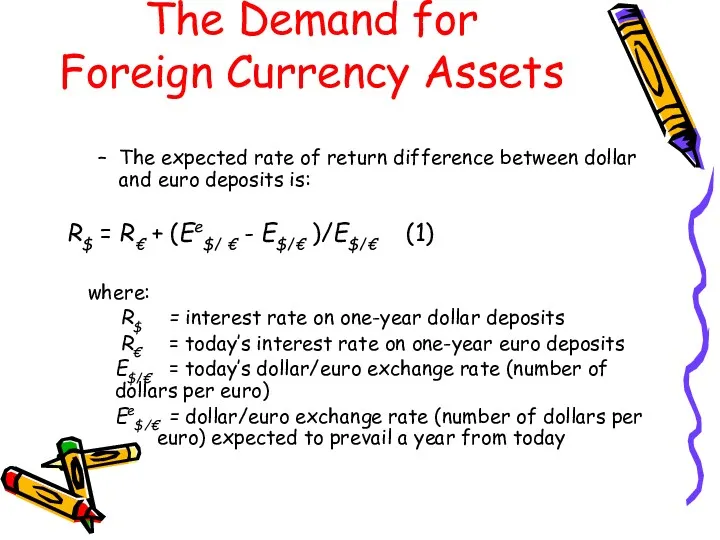

- 38. Uncovered Interest Rate Parity (UIP) A parity condition stating that the difference in interest rates between

- 39. Equilibrium in the Foreign Exchange Market Interest Parity: The Basic Equilibrium Condition The foreign exchange market

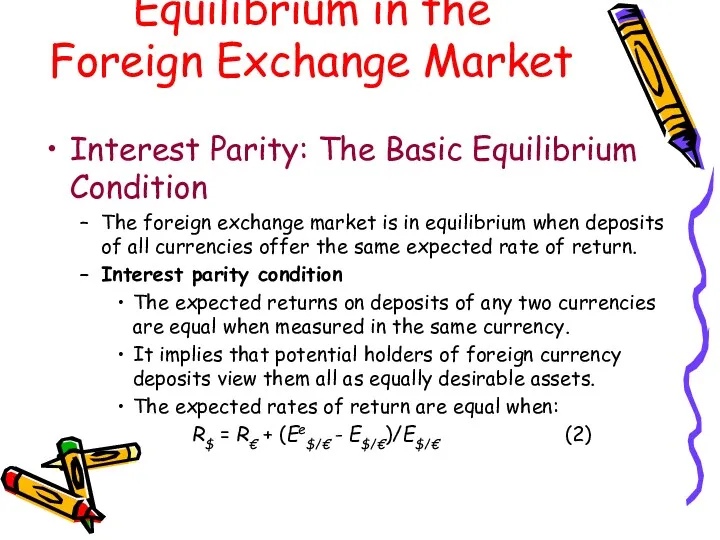

- 40. How Changes in the Current Exchange Rate Affect Expected Returns Depreciation of a country’s currency today

- 41. Today’s Dollar/Euro Exchange Rate and the Expected Dollar Return on Euro Deposits When Ee$/€ = $1.05

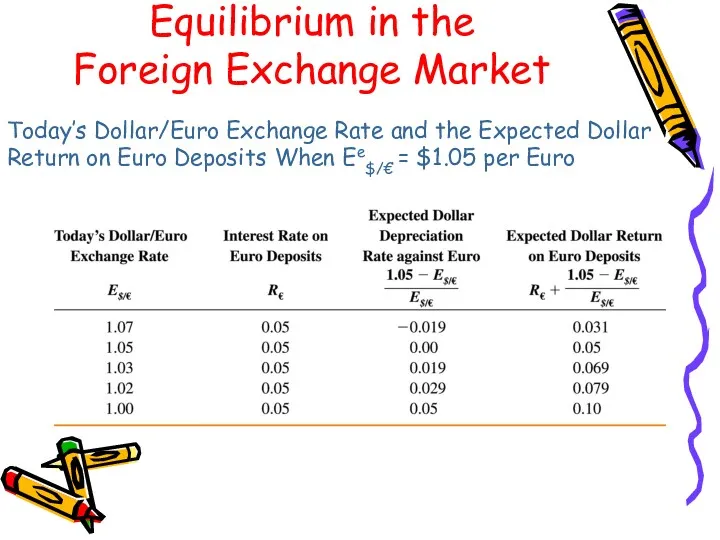

- 42. The Relation Between the Current Dollar/Euro Exchange Rate and the Expected Dollar Return on Euro Deposits

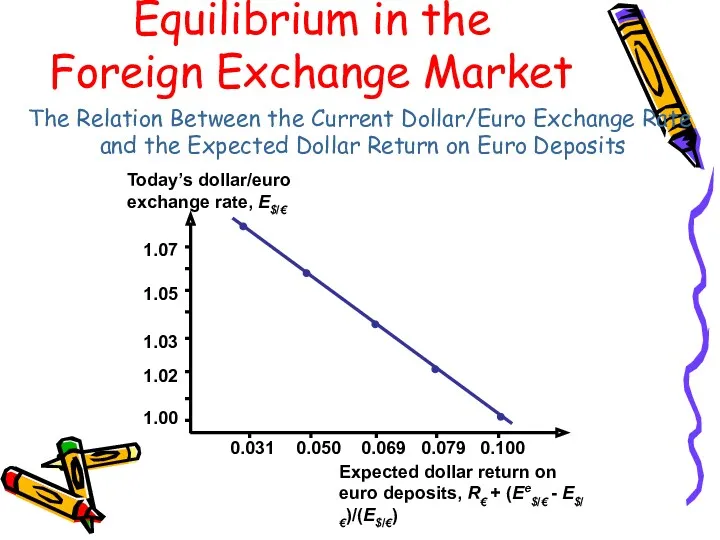

- 43. The Equilibrium Exchange Rate Exchange rates always adjust to maintain interest parity. Assume that the dollar

- 44. Determination of the Equilibrium Dollar/Euro Exchange Rate Equilibrium in the Foreign Exchange Market

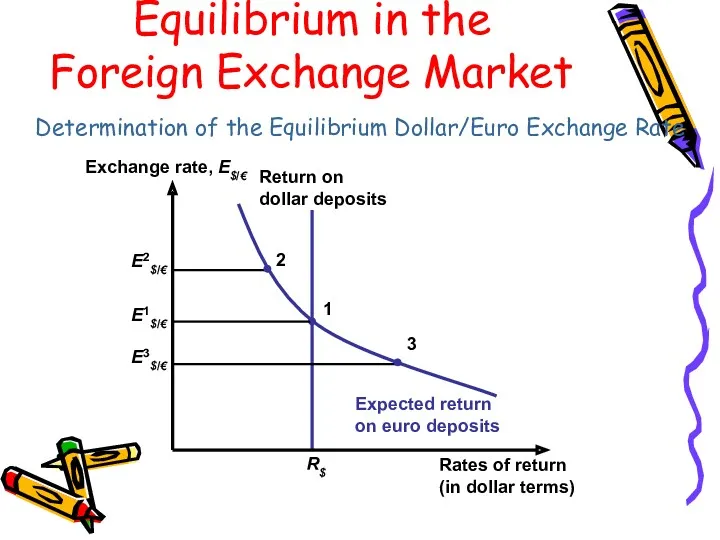

- 45. The Effect of Changing Interest Rates on the Current Exchange Rate An increase in the interest

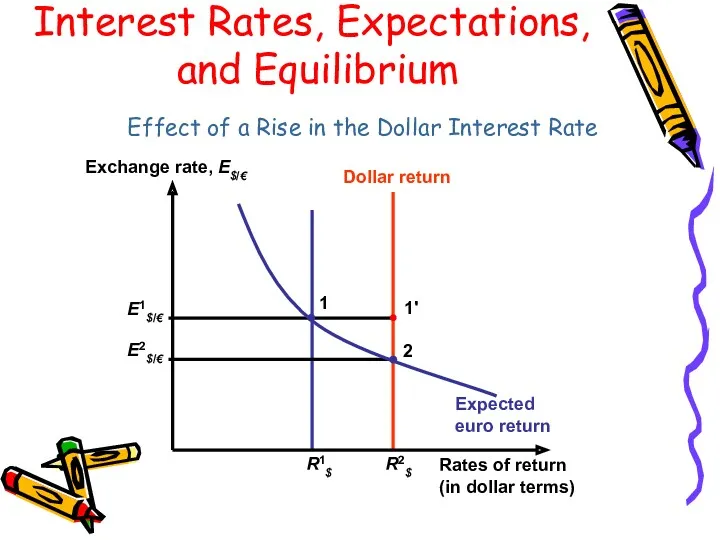

- 46. Effect of a Rise in the Dollar Interest Rate Interest Rates, Expectations, and Equilibrium

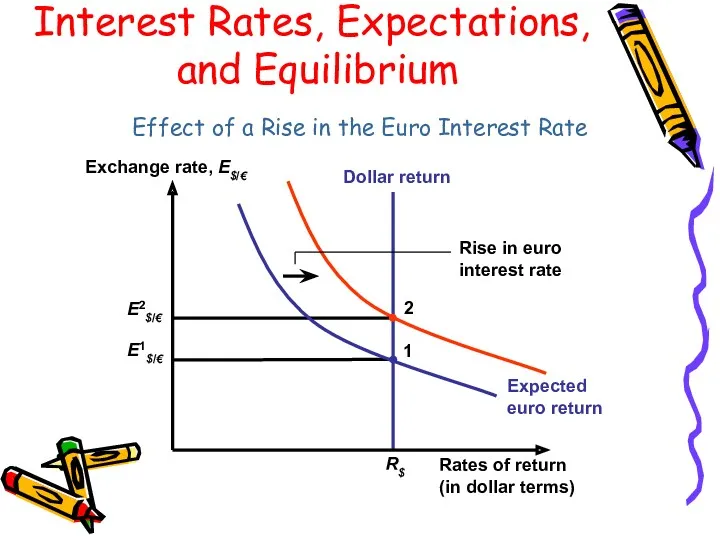

- 47. Effect of a Rise in the Euro Interest Rate Interest Rates, Expectations, and Equilibrium

- 48. The Effect of Changing Expectations on the Current Exchange Rate A rise in the expected future

- 49. Factors that influence the Exchange Rate Expectations of the Market Political Events Relative Inflation Rates Relative

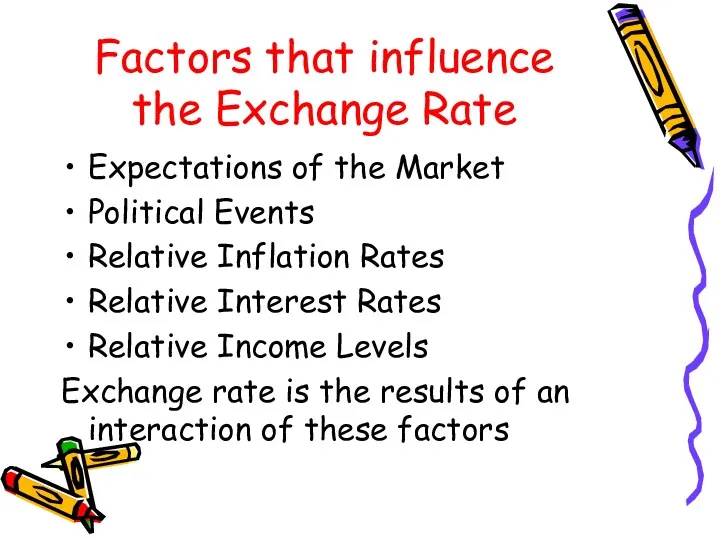

- 50. Outcomes Models of exchange rate determination based on macroeconomic fundamentals have not had much success in

- 52. Скачать презентацию

Капитан Грантов. Основы грантрайтинга

Капитан Грантов. Основы грантрайтинга Structuring. Transaction Framework

Structuring. Transaction Framework История денег

История денег Организация и совершенствование финансового менеджмента на предприятии

Организация и совершенствование финансового менеджмента на предприятии Bank of England

Bank of England Доходы, расходы и прибыль организации

Доходы, расходы и прибыль организации Ақша қаражаттар қозғалысы

Ақша қаражаттар қозғалысы Порядок работы с должниками ООО ТЭК-Энерго

Порядок работы с должниками ООО ТЭК-Энерго Основы кредитно-денежной политики

Основы кредитно-денежной политики Джерела фінансування інвестицій підприємства

Джерела фінансування інвестицій підприємства Разработка и внедрение электронных документов развитие

Разработка и внедрение электронных документов развитие Федеральный стандарт бухгалтерского учета для организаций государственного сектора События после отчетной даты

Федеральный стандарт бухгалтерского учета для организаций государственного сектора События после отчетной даты Учет денежных средств и расчетов. Кассовые операции. Учет труда и заработной платы в аптечной организации

Учет денежных средств и расчетов. Кассовые операции. Учет труда и заработной платы в аптечной организации Банковские услуги

Банковские услуги Финансовая система (тема 2)

Финансовая система (тема 2) Операції банків з обслуговування платіжного обігу. Безготівкові та готівкові розрахунки. Порядок відкриття рахунків в банках

Операції банків з обслуговування платіжного обігу. Безготівкові та готівкові розрахунки. Порядок відкриття рахунків в банках Bank RBK

Bank RBK Понятие и назначение финансов

Понятие и назначение финансов Стратегии ценообразования банковских услуг

Стратегии ценообразования банковских услуг Новая продуктовая линейка АО Микрофинансовая компания Пермского края при финансовой поддержке Правительства Пермского края

Новая продуктовая линейка АО Микрофинансовая компания Пермского края при финансовой поддержке Правительства Пермского края Объекты учета затрат в системе управленческого учета. (Лекция 3)

Объекты учета затрат в системе управленческого учета. (Лекция 3) Дидактические игры по формированию основ финансовой грамотности у детей старшего дошкольного возраста

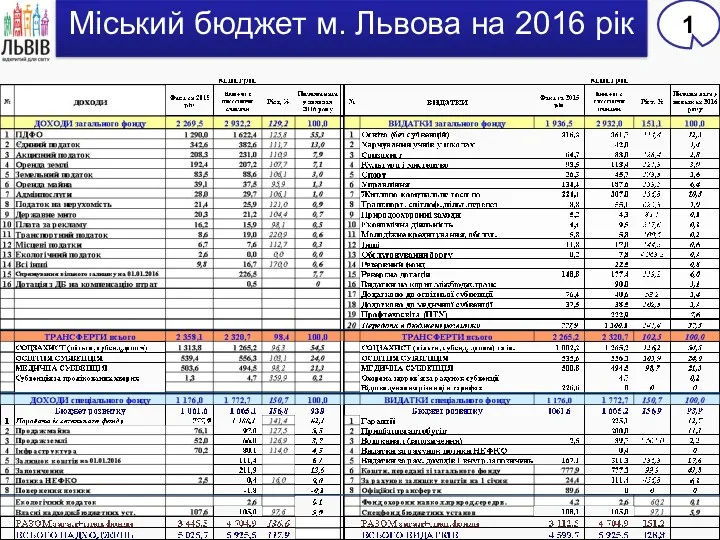

Дидактические игры по формированию основ финансовой грамотности у детей старшего дошкольного возраста Міський бюджет м. Львова на 2016 рік

Міський бюджет м. Львова на 2016 рік Корректировка плана МТО ООО Таргин

Корректировка плана МТО ООО Таргин Надёжность и гарантии. Страховая компания Metlife Alico в Украине

Надёжность и гарантии. Страховая компания Metlife Alico в Украине Формирование бюджетов ОГВ и ОМСУ

Формирование бюджетов ОГВ и ОМСУ Всемирные (международные) экономические отношения

Всемирные (международные) экономические отношения Бухгалтерский баланс

Бухгалтерский баланс