Содержание

- 2. Liquidity Ratios Liquidity reflects the ability of a company to meet its short-term obligations using assets

- 3. Liquidity Ratios Current assets are often referred to as working capital because these assets represent the

- 4. Measures of liquidity Liquidity is the ability to satisfy the company’s short-term obligations using assets that

- 5. Measures of liquidity Generally, the larger these liquidity ratios, the better the ability of the company

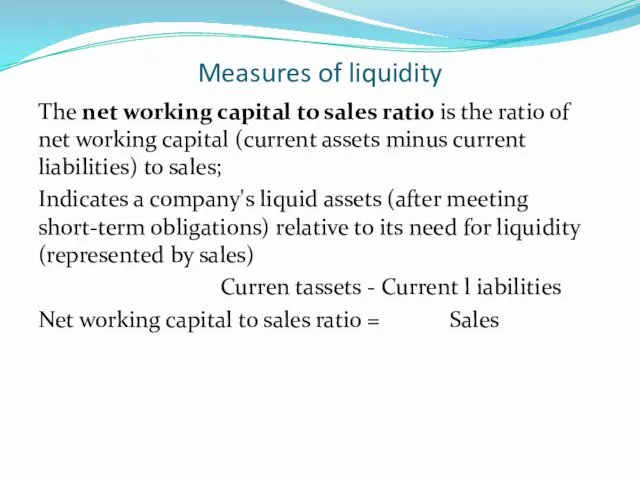

- 6. Measures of liquidity The net working capital to sales ratio is the ratio of net working

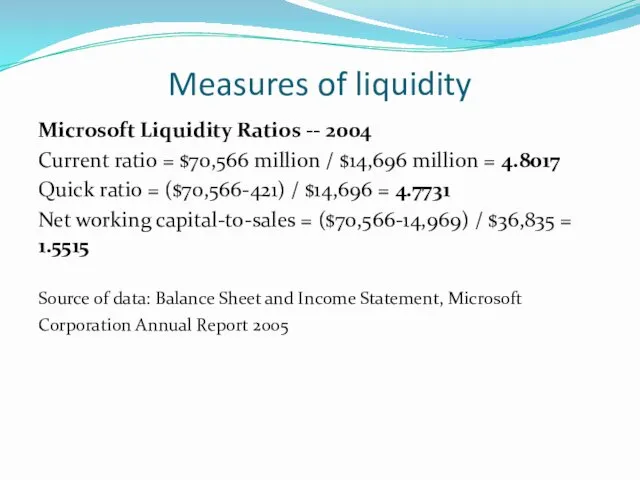

- 7. Measures of liquidity Microsoft Liquidity Ratios -- 2004 Current ratio = $70,566 million / $14,696 million

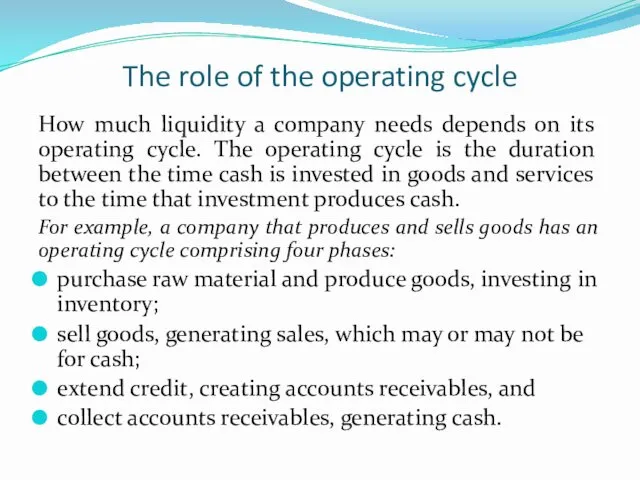

- 9. The role of the operating cycle How much liquidity a company needs depends on its operating

- 10. The role of the operating cycle A company with a long operating cycle may have more

- 11. Solvency Analysis A company’s business risk is determined, in large part, from the company’s line of

- 12. Solvency Analysis There are two types of solvency ratios: component percentages and coverage ratios. Component percentages

- 14. Скачать презентацию

Министерство финансов Калининградской области Программа Повышение финансовой грамотности населения

Министерство финансов Калининградской области Программа Повышение финансовой грамотности населения Налоговая система в РФ

Налоговая система в РФ Развитие дискаунтеров на розничном рынке (зарубежная практика)

Развитие дискаунтеров на розничном рынке (зарубежная практика) Fitting the Pieces Together

Fitting the Pieces Together Управление денежными средствами

Управление денежными средствами Loans and Credits

Loans and Credits Понятие долгосрочных инвестиций и капитального строительства. Участники капитального строительства

Понятие долгосрочных инвестиций и капитального строительства. Участники капитального строительства Оборотные средства: состав и классификация

Оборотные средства: состав и классификация Цели, функции, основные направления и процедуры внутреннего аудита цикла затрат

Цели, функции, основные направления и процедуры внутреннего аудита цикла затрат Развитие финансово-кредитных отношений в XVIII веке. (Тема 5)

Развитие финансово-кредитных отношений в XVIII веке. (Тема 5) Методологические принципы федерального статистического наблюдения за затратами на производство и реализацию товаров

Методологические принципы федерального статистического наблюдения за затратами на производство и реализацию товаров Понятие риск-аппетита и толерантности к риску, основные отличия использования

Понятие риск-аппетита и толерантности к риску, основные отличия использования Правовое регулирование расчетов

Правовое регулирование расчетов Особенности оценки рыночной стоимости коммерческого банка

Особенности оценки рыночной стоимости коммерческого банка Анализ финансового состояния ООО Весна и разработка мероприятий по его улучшению

Анализ финансового состояния ООО Весна и разработка мероприятий по его улучшению Принципы организации финансов организаций (предприятий)

Принципы организации финансов организаций (предприятий) Introduction to business. Lecture 3

Introduction to business. Lecture 3 Фото валют разных стран

Фото валют разных стран Международные стандарты финансовой отчетности

Международные стандарты финансовой отчетности Развитие некоммерческого сектора в Самарской области на основе современных тенденций

Развитие некоммерческого сектора в Самарской области на основе современных тенденций Памятка для клиентов ВСП

Памятка для клиентов ВСП

Экологическое право. Плата за природные ресурсы в России

Экологическое право. Плата за природные ресурсы в России Меншікті капиталды қаржылық талдау. Лекция 6

Меншікті капиталды қаржылық талдау. Лекция 6 Финансовый сервис. Ипотека. Финансирование бизнеса

Финансовый сервис. Ипотека. Финансирование бизнеса Основы аудита

Основы аудита Налоговая система России

Налоговая система России Программы: международная кредитная мобильность и совместные магистерские степени (Key Action 1). Возможности для Беларуси

Программы: международная кредитная мобильность и совместные магистерские степени (Key Action 1). Возможности для Беларуси