Содержание

- 2. The Nature of Derivatives A derivative is an instrument whose value depends on the values of

- 3. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 4. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 5. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

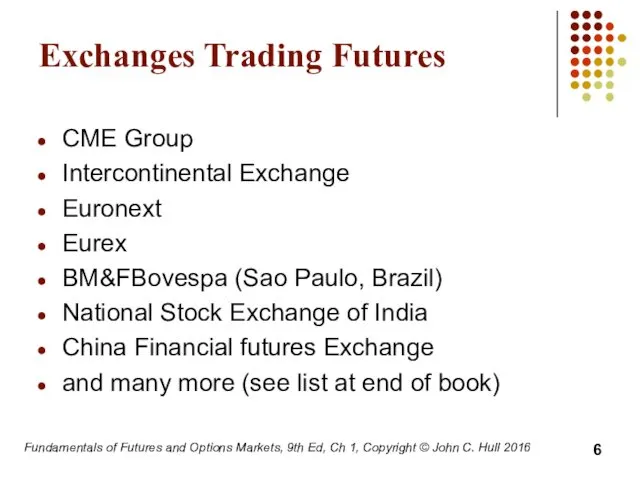

- 6. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 7. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 8. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

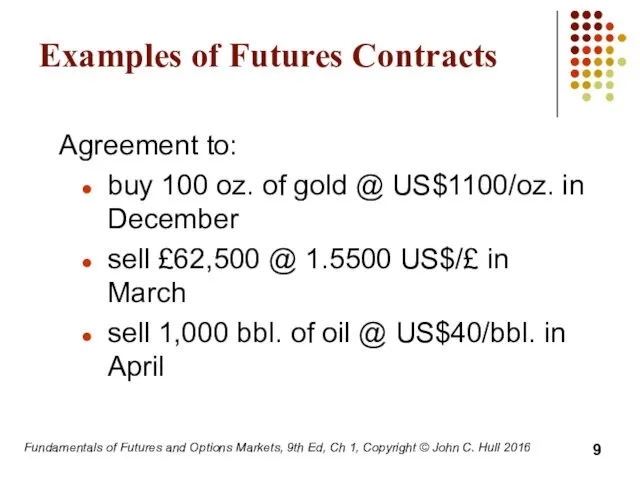

- 9. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 10. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 11. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 12. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

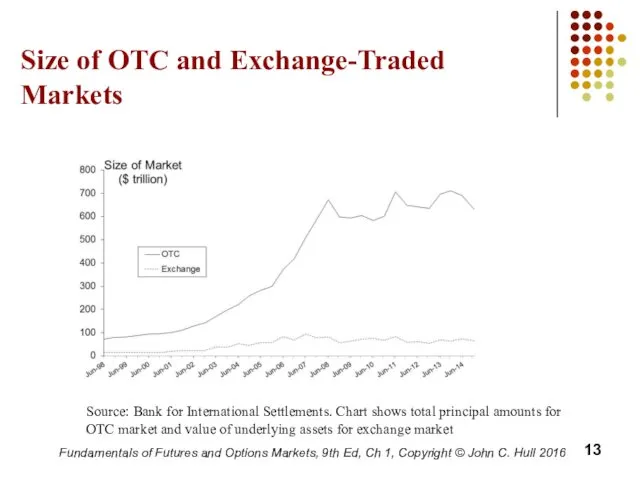

- 13. Size of OTC and Exchange-Traded Markets Fundamentals of Futures and Options Markets, 9th Ed, Ch 1,

- 14. The Lehman Bankruptcy case Lehman’s filed for bankruptcy on September 15, 2008. This was the biggest

- 15. New Regulations for OTC Market The OTC market is becoming more like the exchange-traded market. New

- 16. Systemic Risk New regulations were introduced because of concerns about systemic risk OTC transactions between financial

- 17. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 18. Forward Price The forward price for a contract is the delivery price that would be applicable

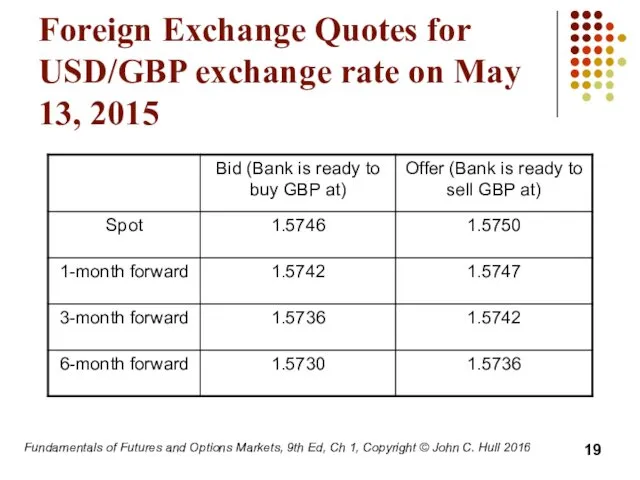

- 19. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 20. Example On May 13, 2015 the treasurer of a corporation might enter into a long forward

- 21. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 22. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 23. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 24. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

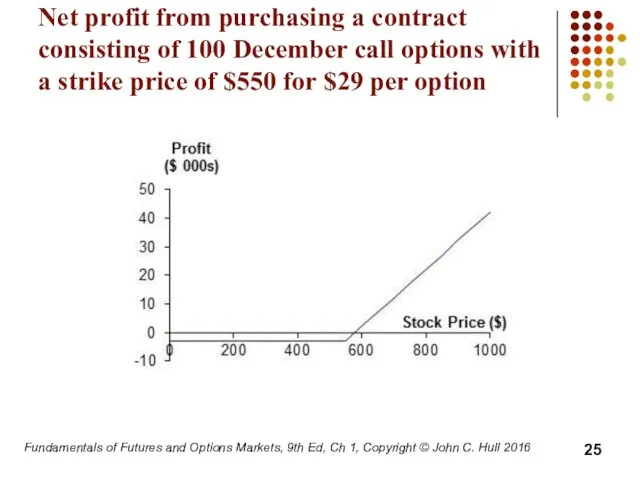

- 25. Net profit from purchasing a contract consisting of 100 December call options with a strike price

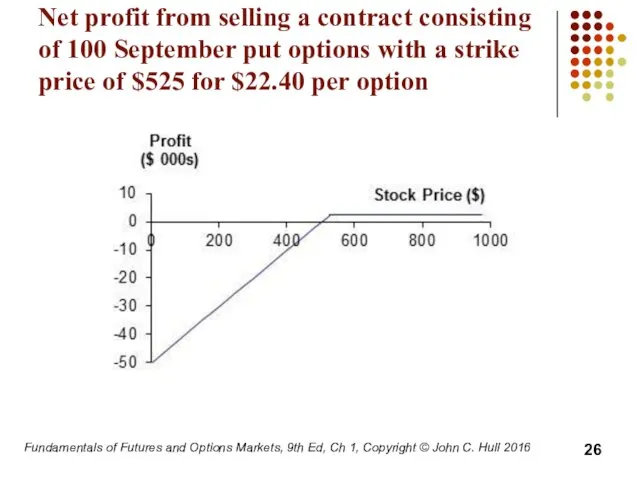

- 26. Net profit from selling a contract consisting of 100 September put options with a strike price

- 27. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 28. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 29. Three Reasons for Trading Derivatives: Hedging, Speculation, and Arbitrage Hedge funds trade derivatives for all three

- 30. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 31. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 32. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 33. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

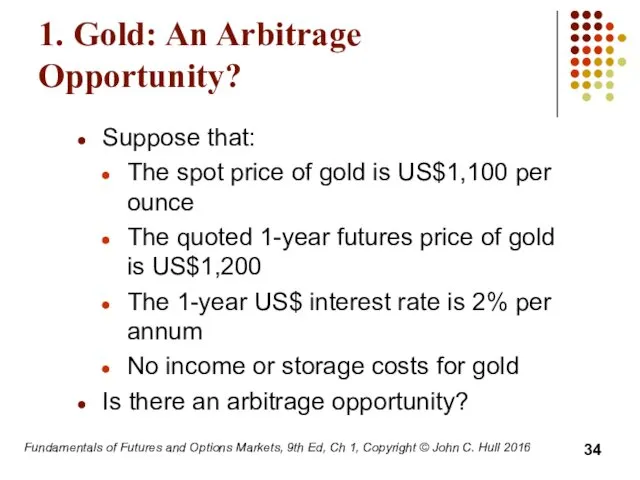

- 34. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

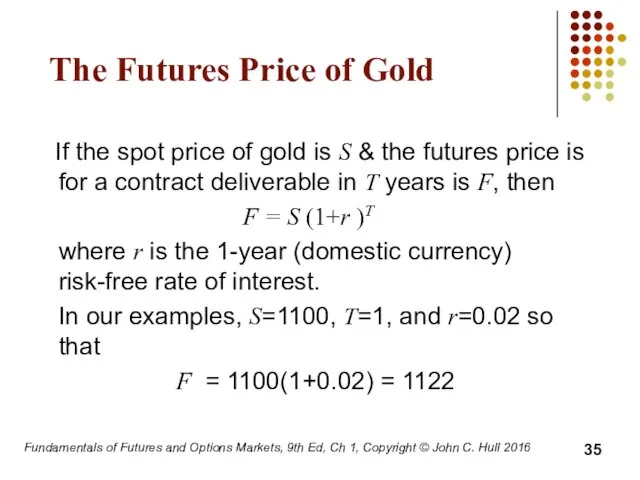

- 35. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

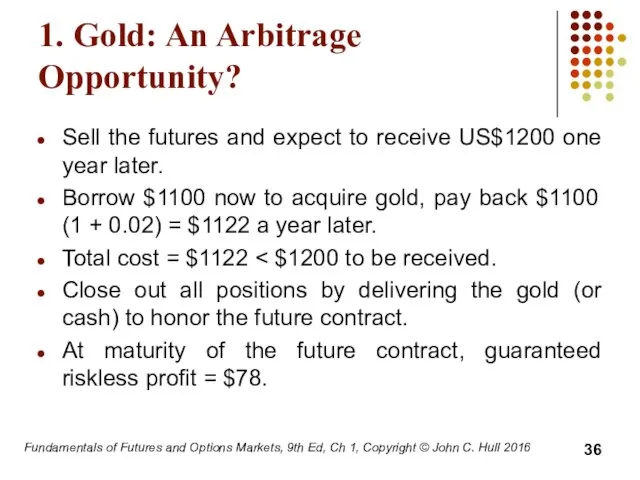

- 36. 1. Gold: An Arbitrage Opportunity? Sell the futures and expect to receive US$1200 one year later.

- 37. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 38. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

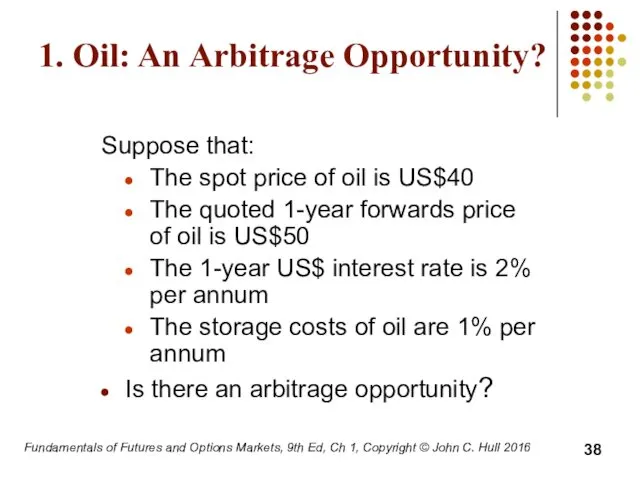

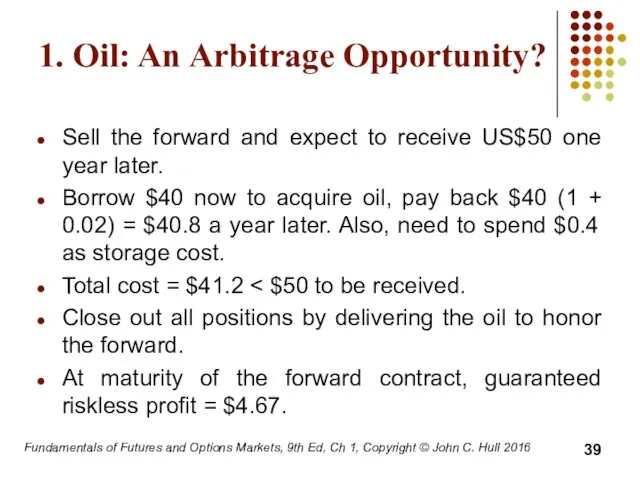

- 39. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

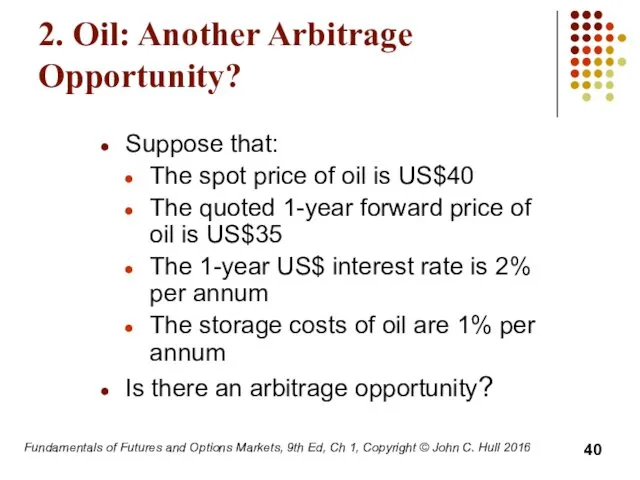

- 40. Fundamentals of Futures and Options Markets, 9th Ed, Ch 1, Copyright © John C. Hull 2016

- 42. Скачать презентацию

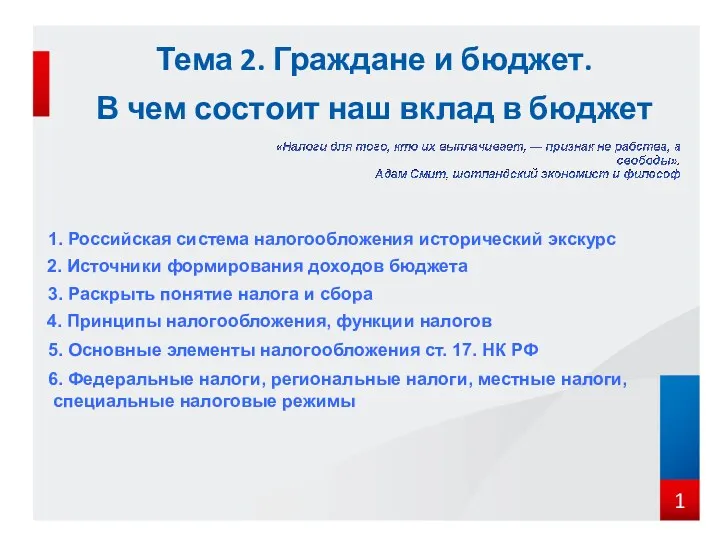

Граждане и бюджет. Принципы налогообложения, функции налогов. (Тема 2)

Граждане и бюджет. Принципы налогообложения, функции налогов. (Тема 2) Налог на добавленную стоимость (НДС). Часть 2

Налог на добавленную стоимость (НДС). Часть 2 История становления социального обеспечения в России

История становления социального обеспечения в России Налог на доходы физических лиц

Налог на доходы физических лиц Как взять ипотеку и не остаться без штанов

Как взять ипотеку и не остаться без штанов Анализ показателей деловой активности организации

Анализ показателей деловой активности организации Финансовые рынки (1 лекция)

Финансовые рынки (1 лекция) План счетов

План счетов Нормативное правовое регулирование осуществления полномочий Федерального казначейства РФ в 2020 году

Нормативное правовое регулирование осуществления полномочий Федерального казначейства РФ в 2020 году Тенденции развития современной финансовой науки

Тенденции развития современной финансовой науки Fundamental Considerations. What drives structure

Fundamental Considerations. What drives structure Формирование Выписок/Отчетов в ЭБ ПУР (КС)

Формирование Выписок/Отчетов в ЭБ ПУР (КС) Сутність, механізм розробки та реалізації стратегії міжнародної конкуренто- спроможності підприємства

Сутність, механізм розробки та реалізації стратегії міжнародної конкуренто- спроможності підприємства Финансирование инновационной деятельности

Финансирование инновационной деятельности Әлеуметтік салық пен әлеуметтік аударымдар бойынша бюджет пен есеп айырысу

Әлеуметтік салық пен әлеуметтік аударымдар бойынша бюджет пен есеп айырысу Региональные налоги

Региональные налоги Метод Pert и управление проектами

Метод Pert и управление проектами Возможности программ Фонда содействия инновациям

Возможности программ Фонда содействия инновациям Понятие и роль налогов

Понятие и роль налогов Новые федеральные стандарты бухгалтерского учёта

Новые федеральные стандарты бухгалтерского учёта Деньги и их функции

Деньги и их функции Формирование и развитие банковской системы, как объекта государственного управления. (Тема 1)

Формирование и развитие банковской системы, как объекта государственного управления. (Тема 1) Разработка методик оценки затрат на ИБ

Разработка методик оценки затрат на ИБ Orange Social Venture Prize Jordan

Orange Social Venture Prize Jordan Финансовый анализ. Формулировка понятия. Факторы и факторный анализ. Этапы и цели

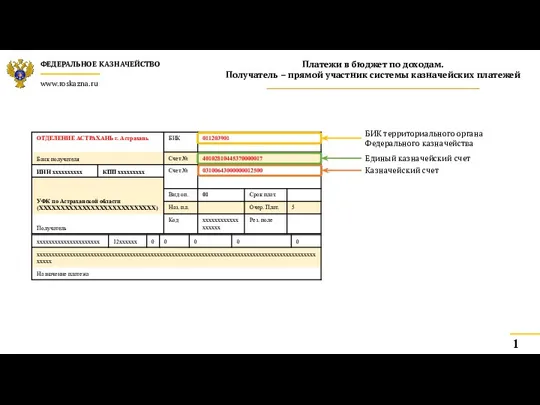

Финансовый анализ. Формулировка понятия. Факторы и факторный анализ. Этапы и цели Платежи в бюджет по доходам. Пример заполнения платежных поручений. Федеральное казначейство г. Астрахань

Платежи в бюджет по доходам. Пример заполнения платежных поручений. Федеральное казначейство г. Астрахань Сущность, функции и роль финансов в общественном воспроизводстве

Сущность, функции и роль финансов в общественном воспроизводстве Оценка экологических и социальных рисков при кредитовании: опыт международных финансовых институтов

Оценка экологических и социальных рисков при кредитовании: опыт международных финансовых институтов