Содержание

- 2. Minority the portion of a subsidiary corporation's stock that is not owned by the parent corporation.

- 3. Balance Sheet. Fixed assets Investment Property Intangible assets Financial assets Investment using the equity method Inventories

- 4. Fixed assets a long-term tangible piece of property that a firm owns and uses in the

- 5. Investment property (IAS 40) Investment property is property (land or a building or part of a

- 6. Intangible assets (IAS 38) non-monetary assets which are without physical substance and identifiable (either being separable

- 7. Financial assets (IAS 39, IFRS 9) A financial asset is a tangible liquid asset that derives

- 8. Investment using the equity method http://www.investopedia.com/terms/e/equitymethod.asp?ad=dirN&qo=investopediaSiteSearch&qsrc=0&o=40186

- 9. Inventories (IAS 2) Inventories include: assets held for sale in the ordinary course of business (finished

- 10. Accounts receivable Accounts receivable refers to the outstanding invoices a company has or the money the

- 11. Cash and cash equivalents (IAS 7) Cash and cash equivalents refer to the line item on

- 12. Deferred and current tax assets Deferred tax asset is an accounting term that refers to a

- 13. Deferred and current tax liabilities A deferred tax liability is an account on a company's balance

- 14. Provision for contingent liabilities A contingent liability is a potential liability that may occur, depending on

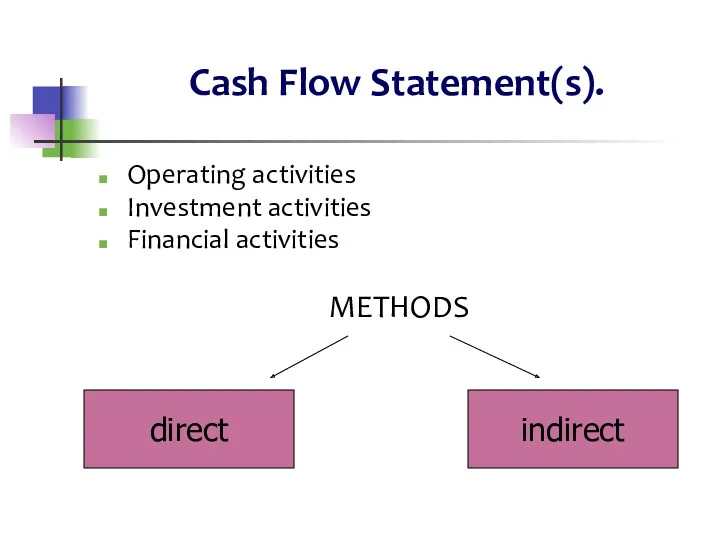

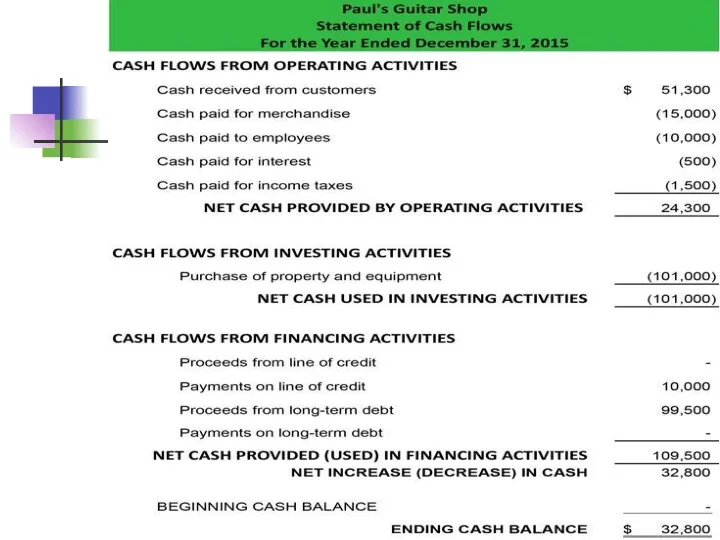

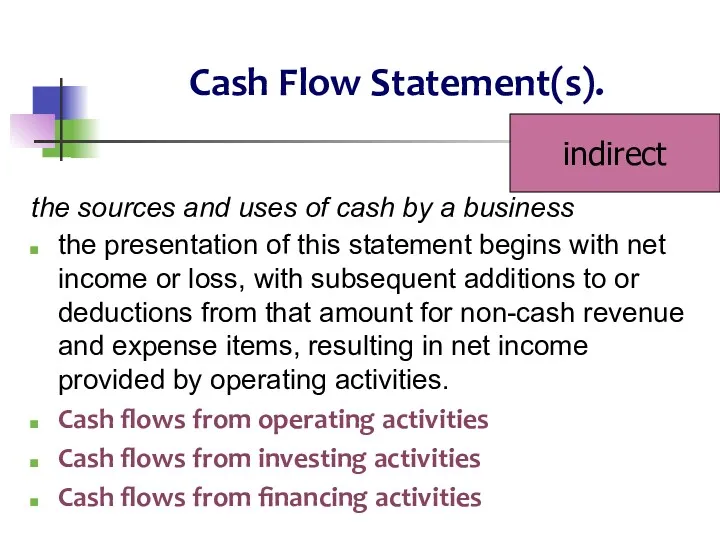

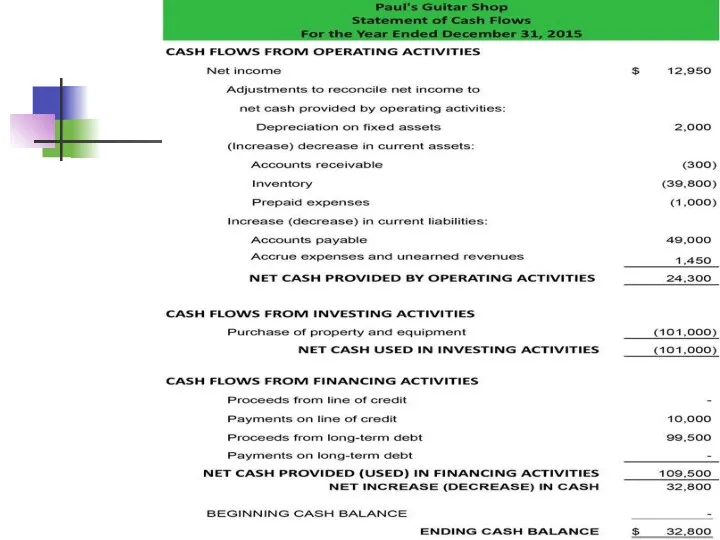

- 15. Cash Flow Statement(s). Operating activities Investment activities Financial activities METHODS direct indirect

- 16. Cash Flow Statement(s). the specific cash flows associated with items that affect cash flow Cash collected

- 18. Cash Flow Statement(s). the sources and uses of cash by a business the presentation of this

- 20. Statement of Changes in Own Equity. Basic approach Profit / loss for the period Profit /

- 22. Скачать презентацию

Налог на доходы физических лиц

Налог на доходы физических лиц Античне страхування

Античне страхування Кроссворд по финансовой грамотности дошкольников 5-7 лет

Кроссворд по финансовой грамотности дошкольников 5-7 лет Судебные споры, банкротство и субсидиарная ответственность в финансовом секторе

Судебные споры, банкротство и субсидиарная ответственность в финансовом секторе Денежные фонды и резервы организации

Денежные фонды и резервы организации Структура и содержание внешнеторгового контракта

Структура и содержание внешнеторгового контракта Страхование в банковском секторе. Проблемы и меры по усовершенствованию

Страхование в банковском секторе. Проблемы и меры по усовершенствованию Оплата труда

Оплата труда Таможенные платежи в ЕАЭС: общая характеристика и назначение

Таможенные платежи в ЕАЭС: общая характеристика и назначение Fortebank

Fortebank Зарплатный проект Росбанка

Зарплатный проект Росбанка Налоговый контроль

Налоговый контроль Аудит достоверности строк финансовой отчетности организации

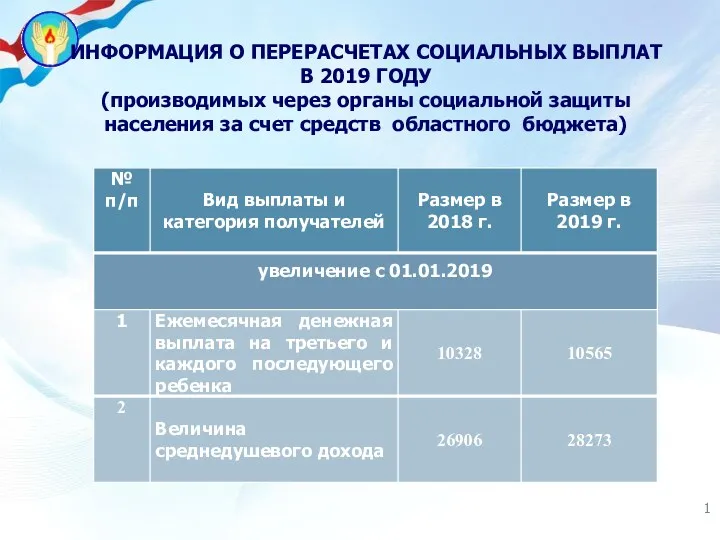

Аудит достоверности строк финансовой отчетности организации Информация о перерасчетах социальных выплат (через органы социальной защиты населения за счет средств областного бюджета)

Информация о перерасчетах социальных выплат (через органы социальной защиты населения за счет средств областного бюджета) Кредит - жизнь в долг или способ удовлетворения потребностей

Кредит - жизнь в долг или способ удовлетворения потребностей Основные принципы кадровой и социальной работы ПАО НК Роснефть

Основные принципы кадровой и социальной работы ПАО НК Роснефть Организация документооборота и внутреннего контроля в бухгалтерском учете коммерческого банка

Организация документооборота и внутреннего контроля в бухгалтерском учете коммерческого банка The world of money

The world of money Понятие налоговой системы и ее элементы

Понятие налоговой системы и ее элементы Аудит учета матариально-производственных запасов и готовой продукции

Аудит учета матариально-производственных запасов и готовой продукции Экономическая сущность и природа налогов

Экономическая сущность и природа налогов НДФЛ-2016. Внесение изменения в статью 218 части второй Налогового кодекса РФ

НДФЛ-2016. Внесение изменения в статью 218 части второй Налогового кодекса РФ Фінанси домогосподарств

Фінанси домогосподарств Қаржы нарығы және делдалдары

Қаржы нарығы және делдалдары Заработная плата и факторы, влияющие на ее размер

Заработная плата и факторы, влияющие на ее размер Организация финансов коммерческих организаций в современных условиях

Организация финансов коммерческих организаций в современных условиях Учёт денежных средств

Учёт денежных средств Price Equilibrium 11.2a

Price Equilibrium 11.2a