Слайд 2

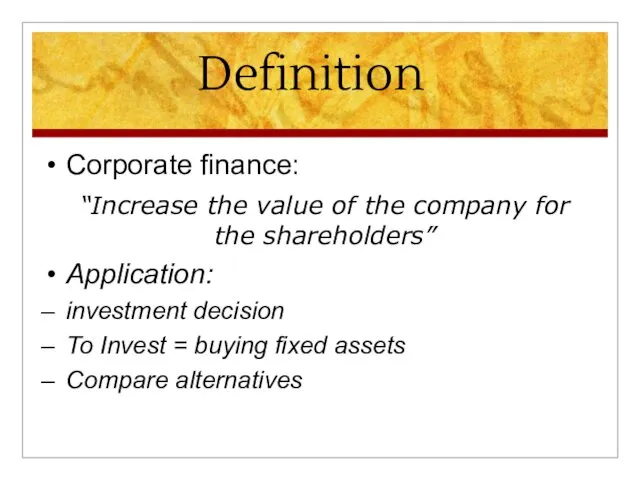

Definition

Corporate finance:

“Increase the value of the company for the shareholders”

Application:

investment decision

To Invest = buying fixed assets

Compare alternatives

Слайд 3

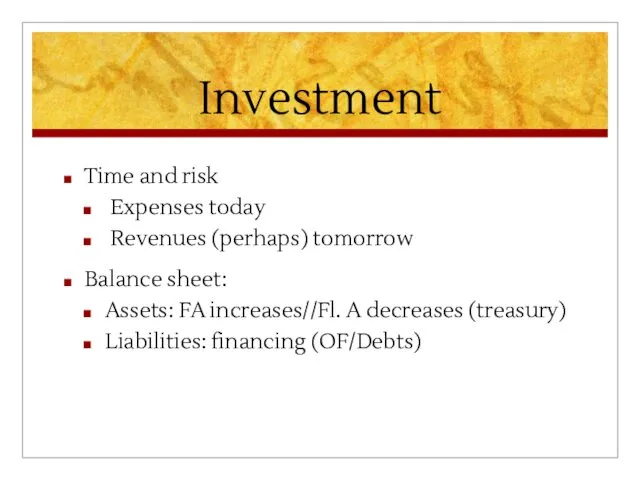

Investment

Time and risk

Expenses today

Revenues (perhaps) tomorrow

Balance sheet:

Assets: FA increases//Fl.

A decreases (treasury)

Liabilities: financing (OF/Debts)

Слайд 4

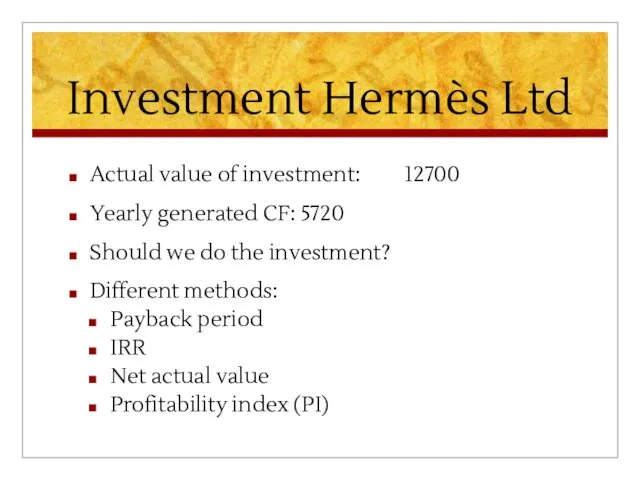

Investment Hermès Ltd

Actual value of investment: 12700

Yearly generated CF: 5720

Should we

do the investment?

Different methods:

Payback period

IRR

Net actual value

Profitability index (PI)

Слайд 5

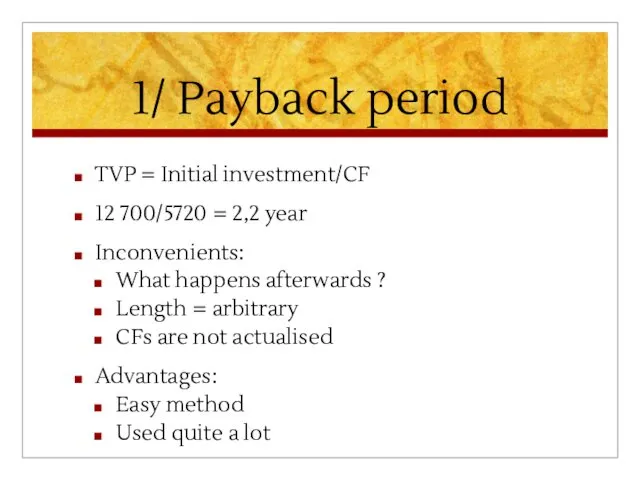

1/ Payback period

TVP = Initial investment/CF

12 700/5720 = 2,2 year

Inconvenients:

What happens

afterwards ?

Length = arbitrary

CFs are not actualised

Advantages:

Easy method

Used quite a lot

Слайд 6

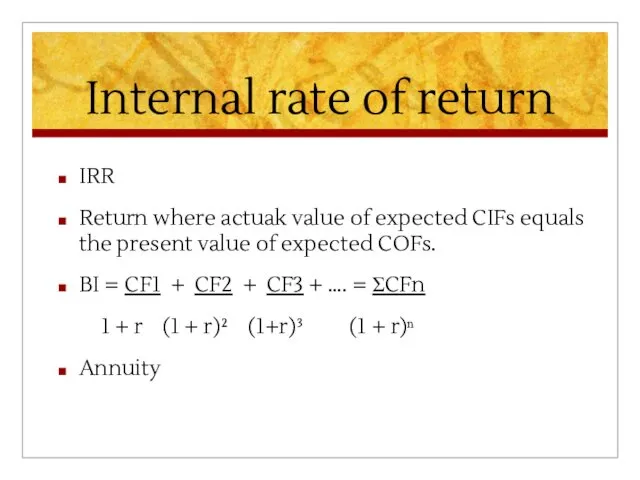

Internal rate of return

IRR

Return where actuak value of expected CIFs equals

the present value of expected COFs.

BI = CF1 + CF2 + CF3 + …. = ΣCFn

1 + r (1 + r)² (1+r)³ (1 + r)ⁿ

Annuity

Слайд 7

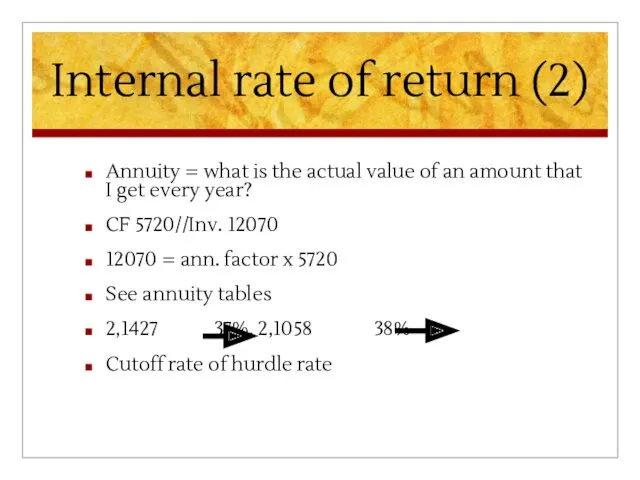

Internal rate of return (2)

Annuity = what is the actual value

of an amount that I get every year?

CF 5720//Inv. 12070

12070 = ann. factor x 5720

See annuity tables

2,1427 37%, 2,1058 38%

Cutoff rate of hurdle rate

Слайд 8

Internal Rate of Return (3)

Inconvenient of method:

Difficult to calculate

How to fix

cut-off rate

Advantages:

Easy to compare projects

Actualisation of returns

Слайд 9

3. Net actual value

Ex ante fixed minimum return (v)

COF ≥ CIF:

not invest

NAV = ΣCIF/(1 + v)ⁿ - ΣCOF/(1 + v)ⁿ

Suppose 40%: 5720 x ann. Factor (2,0352)

CIF – COF: 11641 – 12070 = negative

Inconvenient:

As complicated as IRR

Difficult to compare alternatives

How to fix v?

Слайд 10

4. Profitability index

Variation on same topic

PI = ΣCIF/(1 + v)ⁿ

ΣCOF/(1

+ v)ⁿ

If PI ≥ 1 then invest

Inconvenient: idem NAV

Exercise: calculate PI with required return of 35%.

Creditul. Conceptul şi funcţiile creditului

Creditul. Conceptul şi funcţiile creditului Формирование карточек укрупненных закупок. Саратовская область

Формирование карточек укрупненных закупок. Саратовская область Анализ финансового состояния и результатов деятельности фирмы. Сущность и методы финансового анализа. (Тема 3.1)

Анализ финансового состояния и результатов деятельности фирмы. Сущность и методы финансового анализа. (Тема 3.1) International financial reporting standards. Balance sheet

International financial reporting standards. Balance sheet Виды облигаций и их оценка

Виды облигаций и их оценка Методы дисконтирования денежных потоков

Методы дисконтирования денежных потоков Выездная налоговая проверка

Выездная налоговая проверка Концепция бухгалтерской отчетности в Российской Федерации и международной практике. Тема 1

Концепция бухгалтерской отчетности в Российской Федерации и международной практике. Тема 1 Как зарабатывать на конфискате От 50 000 рублей с каждой сделки

Как зарабатывать на конфискате От 50 000 рублей с каждой сделки Решение финансового кейса, разработанное командой Акулы бизнеса

Решение финансового кейса, разработанное командой Акулы бизнеса Слагаемые успеха в бизнесе

Слагаемые успеха в бизнесе К решению Совета народных депутатов Об утверждении бюджета Новоусманского муниципального района Воронежской области на 2017 год

К решению Совета народных депутатов Об утверждении бюджета Новоусманского муниципального района Воронежской области на 2017 год Практика применения механизмов инициативного бюджетирования на муниципальном уровне

Практика применения механизмов инициативного бюджетирования на муниципальном уровне Бюджет для граждан по утвержденному бюджету

Бюджет для граждан по утвержденному бюджету Бухгалтерский Учет кредитов и займов

Бухгалтерский Учет кредитов и займов Банковская гарантия

Банковская гарантия Порядок расчета премии по результатам деятельности сотрудников бизнес-направления АВТО за продажу договоров страхования

Порядок расчета премии по результатам деятельности сотрудников бизнес-направления АВТО за продажу договоров страхования Фонд развития промышленности Владимирской области

Фонд развития промышленности Владимирской области Понятие, предмет, метод, система и источники права социального обеспечения

Понятие, предмет, метод, система и источники права социального обеспечения Личная финансовая безопасность

Личная финансовая безопасность Дебетовая карта

Дебетовая карта Доходы (организации, предприятия)

Доходы (организации, предприятия) Нумизматика. Нумизматика терминіне

Нумизматика. Нумизматика терминіне Фундаментальный анализ финансовых рынков

Фундаментальный анализ финансовых рынков Рішення фінансових задач

Рішення фінансових задач Welcome to NICT CSP

Welcome to NICT CSP Управление финансами

Управление финансами Студенческий совет факультета ПМ-ПУ. Информационное собрание на тему: Повышенная академическая стипендия

Студенческий совет факультета ПМ-ПУ. Информационное собрание на тему: Повышенная академическая стипендия