Содержание

- 2. Contents American options The obstacle problem Discretisation methods Matlab results Recent insights and developments

- 3. 1. American options American options can be executed any time before expiry date, as opposed to

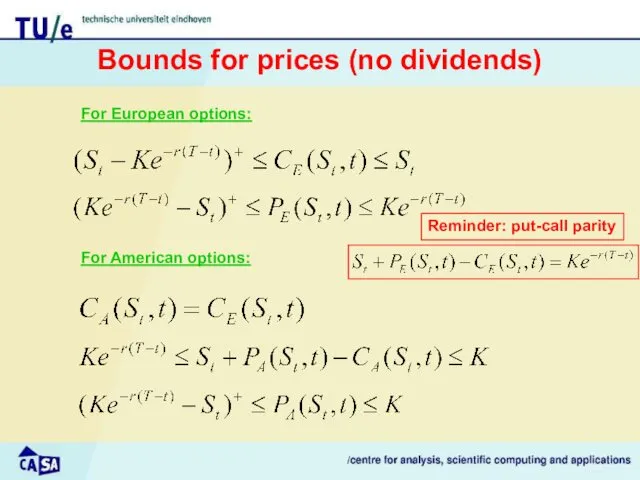

- 4. Bounds for prices (no dividends) For American options: For European options: Reminder: put-call parity

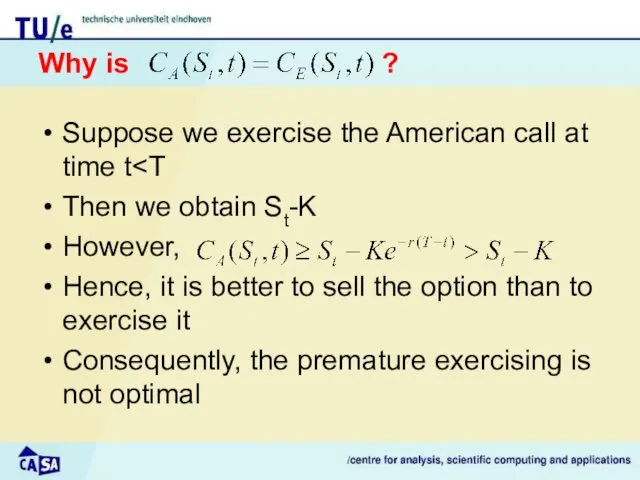

- 5. Why is ? Suppose we exercise the American call at time t Then we obtain St-K

- 6. What about put options? For put options, a similar reasoning shows that it may be advantageous

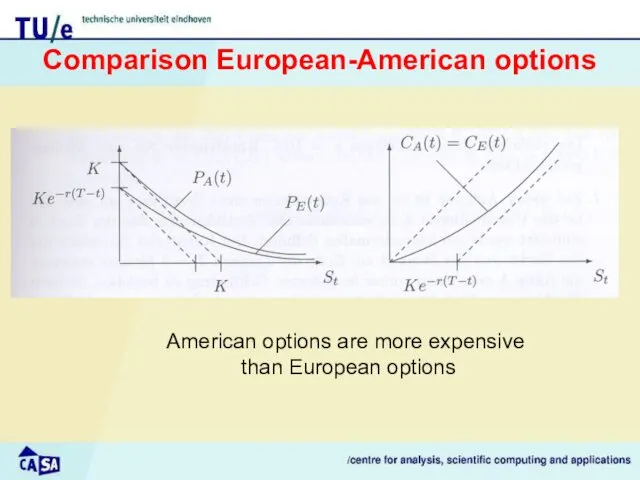

- 7. American options are more expensive than European options Comparison European-American options

- 8. An optimum time for exercising…. (1) Statement: There is Sf such that premature exercising is worthwhile

- 9. An optimum time for exercising…. (2) The value Sf depends on time, and it is termed

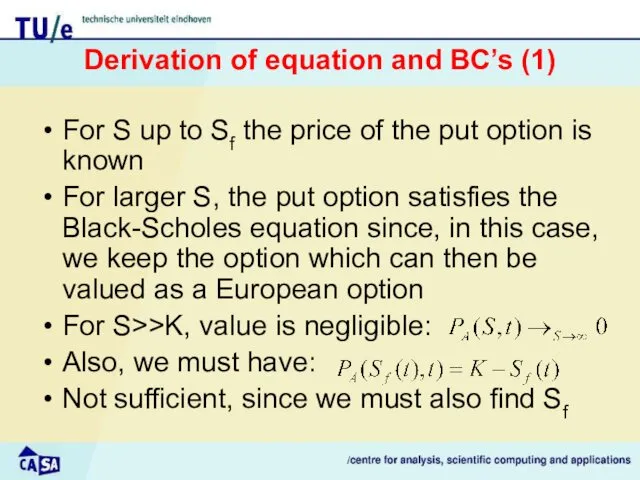

- 10. Derivation of equation and BC’s (1) For S up to Sf the price of the put

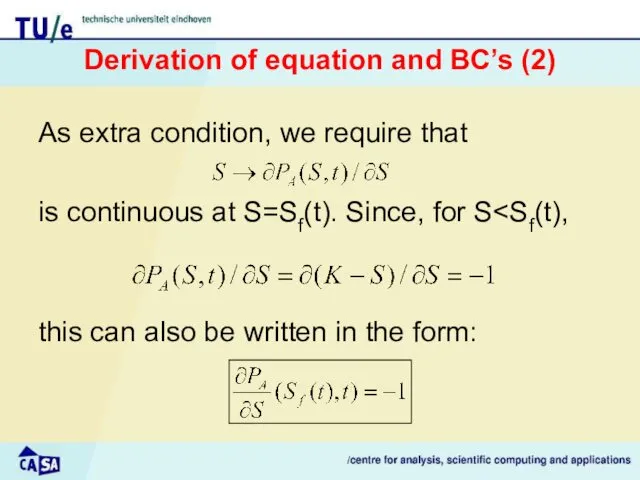

- 11. Derivation of equation and BC’s (2) As extra condition, we require that is continuous at S=Sf(t).

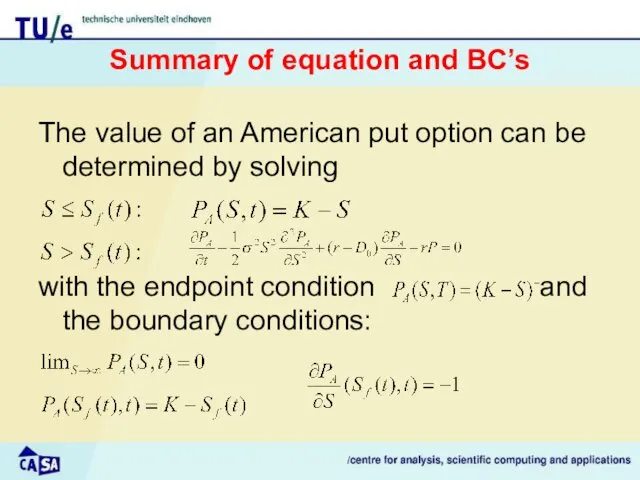

- 12. Summary of equation and BC’s The value of an American put option can be determined by

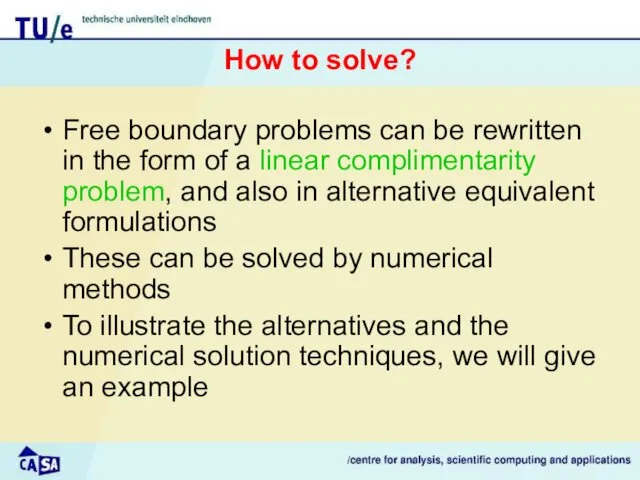

- 13. How to solve? Free boundary problems can be rewritten in the form of a linear complimentarity

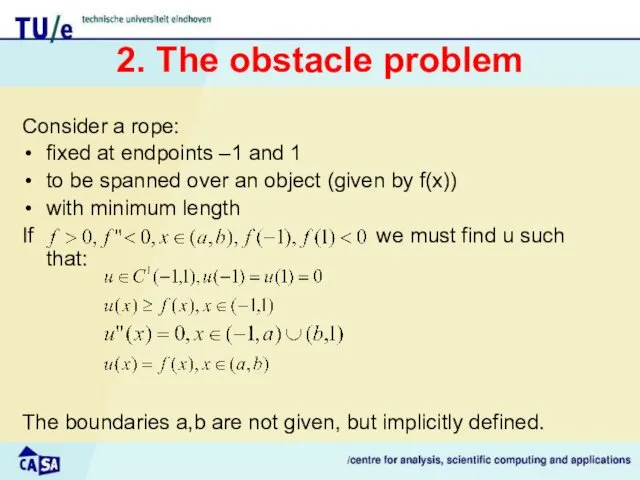

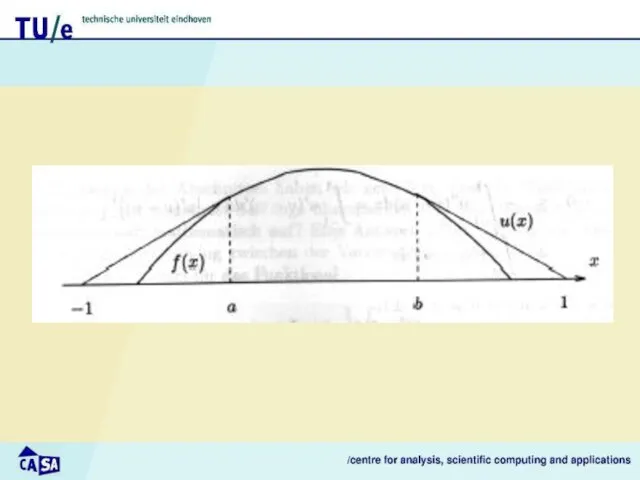

- 14. 2. The obstacle problem Consider a rope: fixed at endpoints –1 and 1 to be spanned

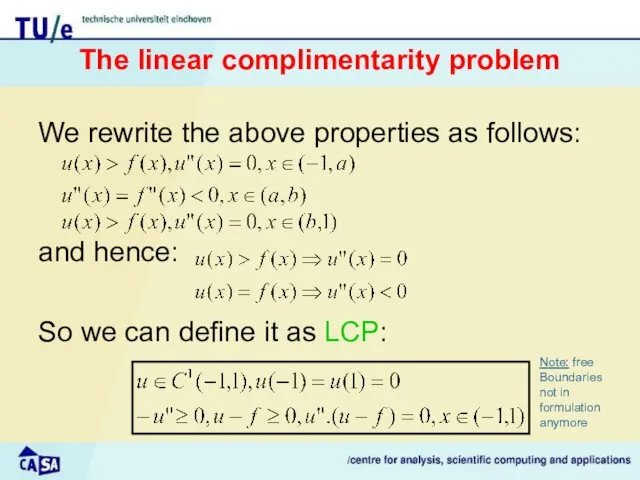

- 16. The linear complimentarity problem We rewrite the above properties as follows: and hence: So we can

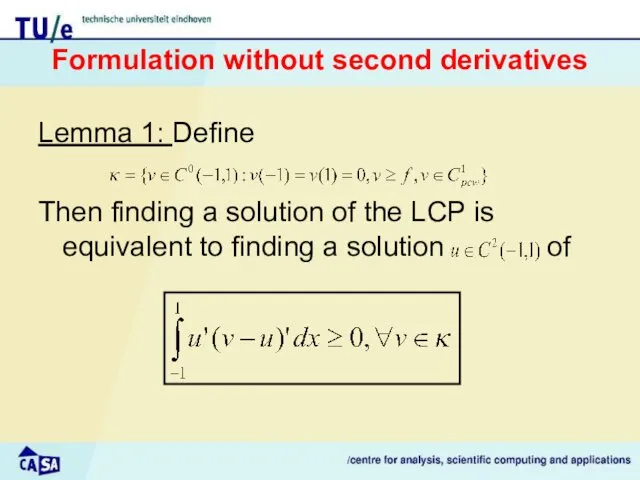

- 17. Formulation without second derivatives Lemma 1: Define Then finding a solution of the LCP is equivalent

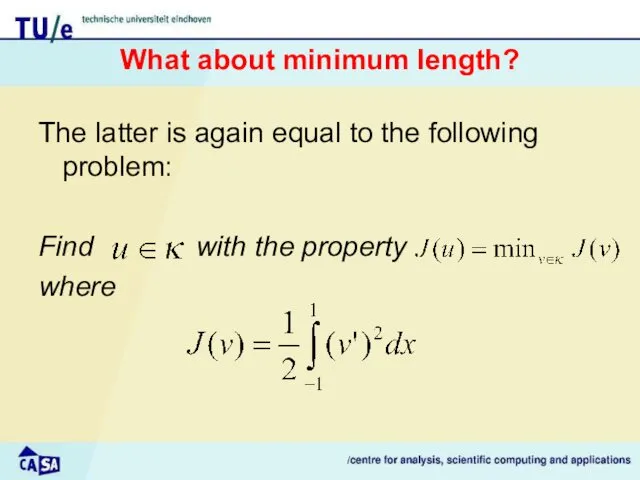

- 18. What about minimum length? The latter is again equal to the following problem: Find with the

- 19. Summarizing so far The obstacle problem can be formulated As a free boundary problem As a

- 20. 3. Discretisation methods

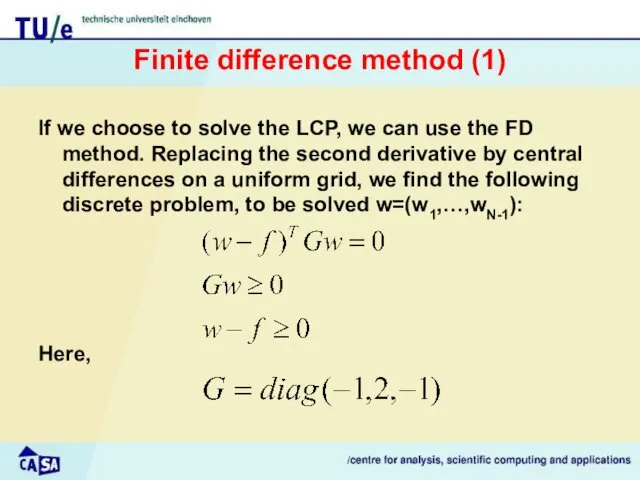

- 21. Finite difference method (1) If we choose to solve the LCP, we can use the FD

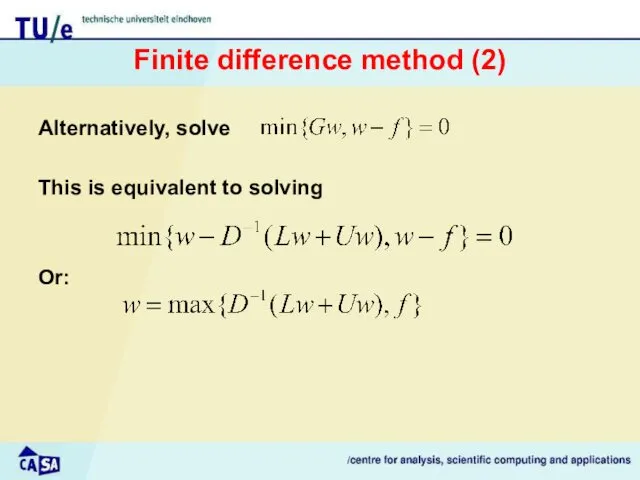

- 22. Finite difference method (2) Alternatively, solve This is equivalent to solving Or:

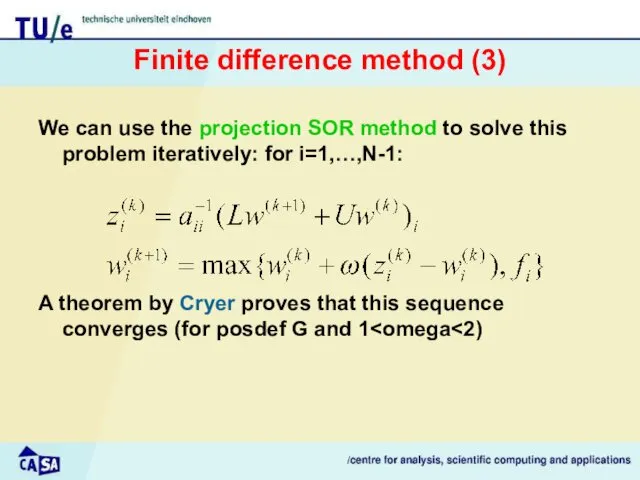

- 23. Finite difference method (3) We can use the projection SOR method to solve this problem iteratively:

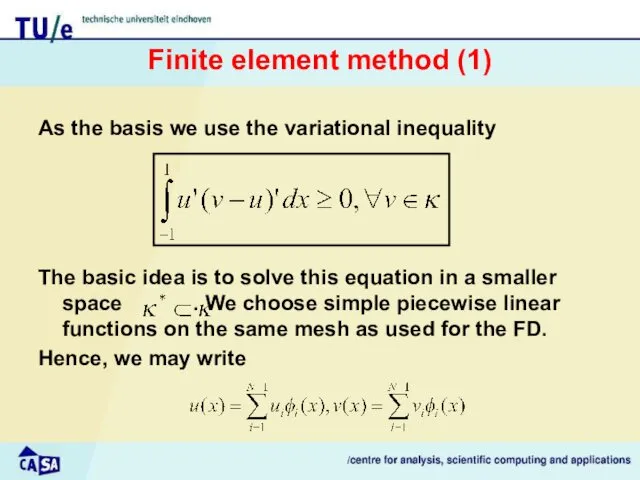

- 24. Finite element method (1) As the basis we use the variational inequality The basic idea is

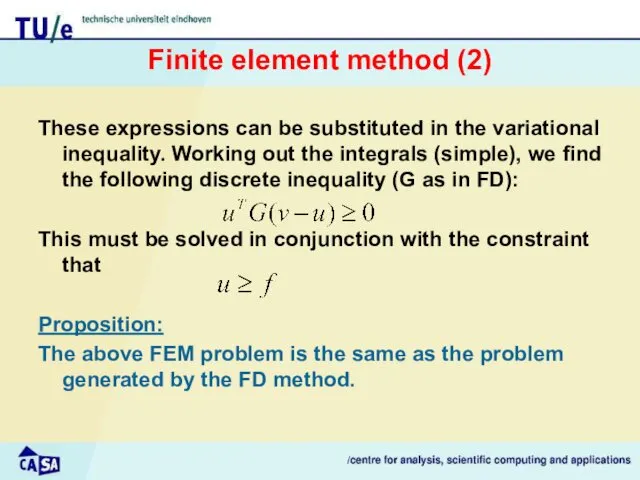

- 25. Finite element method (2) These expressions can be substituted in the variational inequality. Working out the

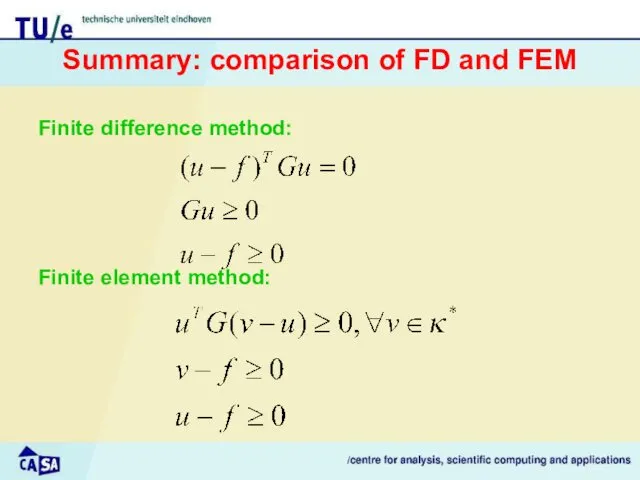

- 26. Summary: comparison of FD and FEM Finite difference method: Finite element method:

- 27. 4. Implementation in Matlab

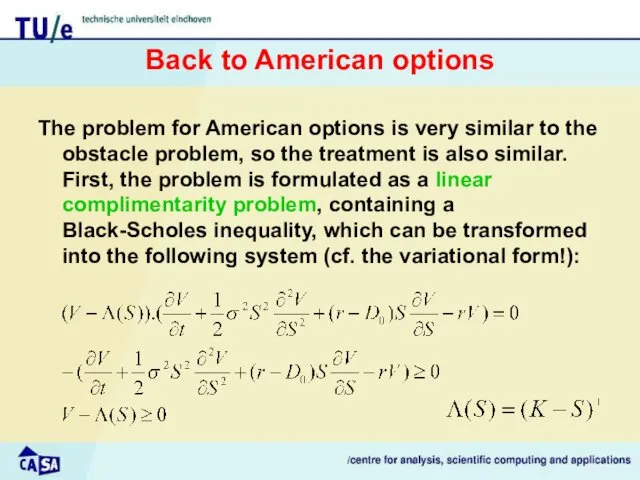

- 28. Back to American options The problem for American options is very similar to the obstacle problem,

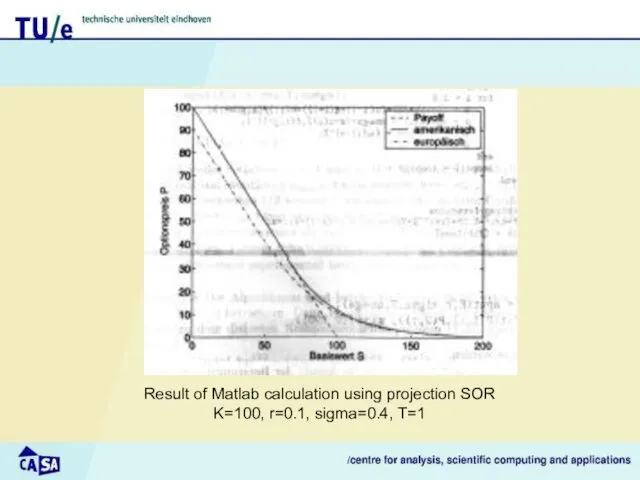

- 29. Result of Matlab calculation using projection SOR K=100, r=0.1, sigma=0.4, T=1

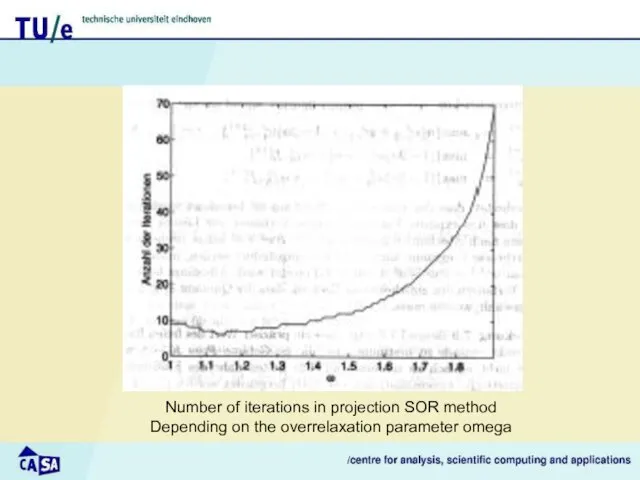

- 30. Number of iterations in projection SOR method Depending on the overrelaxation parameter omega

- 31. 5. Recent insights and developments

- 32. Historical account First widely-used methods using FD by Brennan and Schwartz (1977) and Cox et al.

- 33. Recent work (1) Some people concentrate on Monte Carlo methods to evaluate the discounted integrals of

- 35. Скачать презентацию

The theory of exchange rate determination

The theory of exchange rate determination Что такое деньги

Что такое деньги Собственные средства (капитал) банка

Собственные средства (капитал) банка Изменения в бухгалтерском учете учреждений бюджетной сферы вступающие в силу с 2023 года

Изменения в бухгалтерском учете учреждений бюджетной сферы вступающие в силу с 2023 года Зменения законодательства по вопросам персонифицированного учета

Зменения законодательства по вопросам персонифицированного учета Topic 1. Introduction to Finance

Topic 1. Introduction to Finance Студенческий совет факультета ПМ-ПУ. Информационное собрание на тему: Повышенная академическая стипендия

Студенческий совет факультета ПМ-ПУ. Информационное собрание на тему: Повышенная академическая стипендия Зарплатный проект

Зарплатный проект Основы аудита

Основы аудита Инвестиционная программа МУП Яргорэнергосбыт г. Ярославля по повышению качества горячего водоснабжения

Инвестиционная программа МУП Яргорэнергосбыт г. Ярославля по повышению качества горячего водоснабжения Учет расчетных операций

Учет расчетных операций Екологічний податок

Екологічний податок РКМЦ по Самарской области

РКМЦ по Самарской области Трейдинг как привилегия

Трейдинг как привилегия Портфели ценных бумаг

Портфели ценных бумаг Фандрайзинг с картинками

Фандрайзинг с картинками Анализ и оценка платежеспособности и ликвидности предприятия на примере ООО СМК Аудит

Анализ и оценка платежеспособности и ликвидности предприятия на примере ООО СМК Аудит Спортивный плюс. СК Благосостояние

Спортивный плюс. СК Благосостояние МСА 520 Аналитические процедуры

МСА 520 Аналитические процедуры Финансирование бизнеса

Финансирование бизнеса Предоставление мер социальной поддержки по оплате жилого помещения и коммунальных услуг работающим гражданам указанных в статье

Предоставление мер социальной поддержки по оплате жилого помещения и коммунальных услуг работающим гражданам указанных в статье Спрос на деньги. Денежно-кредитная политика

Спрос на деньги. Денежно-кредитная политика Место и роль платежных карт в системе безналичных расчетов

Место и роль платежных карт в системе безналичных расчетов Корпоративные финансы. Тема 1. Экономическая сущность и особенности корпоративных финансов

Корпоративные финансы. Тема 1. Экономическая сущность и особенности корпоративных финансов Результативность участия Краснокамского городского округа в конкурсе проектов инициативного бюджетирования

Результативность участия Краснокамского городского округа в конкурсе проектов инициативного бюджетирования Учет запасов. Оценка запасов. Учет поступления и выбытия запасов

Учет запасов. Оценка запасов. Учет поступления и выбытия запасов Финансы домашних хозяйств

Финансы домашних хозяйств Нематериальные активы

Нематериальные активы