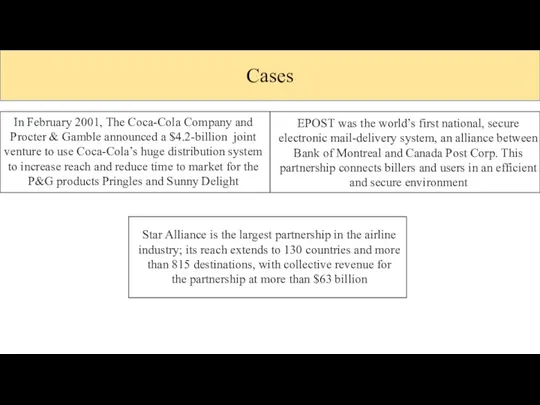

Cases

In February 2001, The Coca-Cola Company and Procter & Gamble announced

a $4.2-billion joint venture to use Coca-Cola’s huge distribution system to increase reach and reduce time to market for the P&G products Pringles and Sunny Delight

EPOST was the world’s first national, secure electronic mail-delivery system, an alliance between Bank of Montreal and Canada Post Corp. This partnership connects billers and users in an efficient and secure environment

Star Alliance is the largest partnership in the airline industry; its reach extends to 130 countries and more than 815 destinations, with collective revenue for the partnership at more than $63 billion

Тау самал'' тұрғын үй кешенінің электрэнергетикасы шығынын төмендетуді есептеу мен саралау

Тау самал'' тұрғын үй кешенінің электрэнергетикасы шығынын төмендетуді есептеу мен саралау Акцизы. Плательщики акциза

Акцизы. Плательщики акциза Фондовый рынок

Фондовый рынок Налоги и налогообложение

Налоги и налогообложение Кредиты и рассрочки

Кредиты и рассрочки Бюджетирование проекта. Основы фандрайзинга

Бюджетирование проекта. Основы фандрайзинга Анализ имущественного потенциала

Анализ имущественного потенциала Инвестиционная деятельность организации

Инвестиционная деятельность организации Учет выпуска и продажи готовой продукции

Учет выпуска и продажи готовой продукции The theory of exchange rate determination

The theory of exchange rate determination Cодержание электронной коммерции и электронного бизнеса

Cодержание электронной коммерции и электронного бизнеса Учёт материально-производственных запасов

Учёт материально-производственных запасов Поняття та економічна сутність інвестування

Поняття та економічна сутність інвестування Финансы государственного сектора экономики: понятие и структура

Финансы государственного сектора экономики: понятие и структура Администрация сельского поседения Сосновка. Об исполнении бюджета за 1 квартал 2023 г

Администрация сельского поседения Сосновка. Об исполнении бюджета за 1 квартал 2023 г Международный стандарт аудита 220. Контроль качества при проведении аудита финансовой отчетности

Международный стандарт аудита 220. Контроль качества при проведении аудита финансовой отчетности Понятие финансов и финансовой деятельности государства

Понятие финансов и финансовой деятельности государства Единый налог на вменённый доход для отдельных видов деятельности (ЕНВД)

Единый налог на вменённый доход для отдельных видов деятельности (ЕНВД) расходы

расходы Налоги и налогообложение

Налоги и налогообложение Почта Банк для СНТ

Почта Банк для СНТ Система права социального обеспечения. Общее понятие отрасли

Система права социального обеспечения. Общее понятие отрасли Затраты предприятия

Затраты предприятия Государственный кредит (государственные и муниципальные заимствования)

Государственный кредит (государственные и муниципальные заимствования) Валютный рынок FOREX. Технический анализ на рынке FOREX

Валютный рынок FOREX. Технический анализ на рынке FOREX Операции коммерческого банка с пластиковыми картами и их роль в обеспечении комплексного обслуживания клиентов

Операции коммерческого банка с пластиковыми картами и их роль в обеспечении комплексного обслуживания клиентов Доходы, расходы и прибыль организации

Доходы, расходы и прибыль организации Комплексная оценка эффективности финансовохозяйственной деятельности предприятия

Комплексная оценка эффективности финансовохозяйственной деятельности предприятия