Содержание

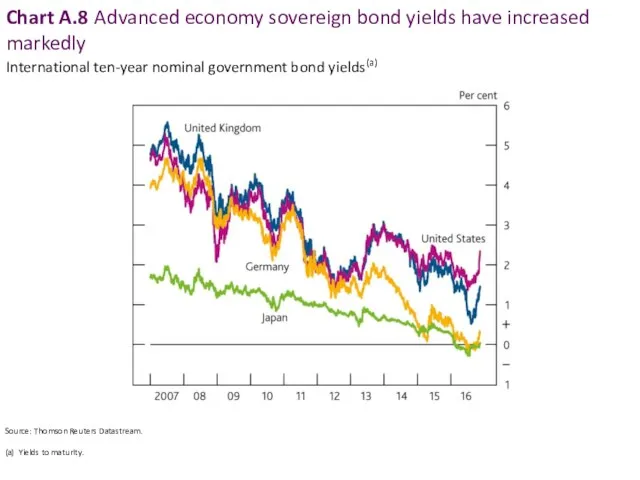

- 2. Chart A.8 Advanced economy sovereign bond yields have increased markedly Source: Thomson Reuters Datastream. (a) Yields

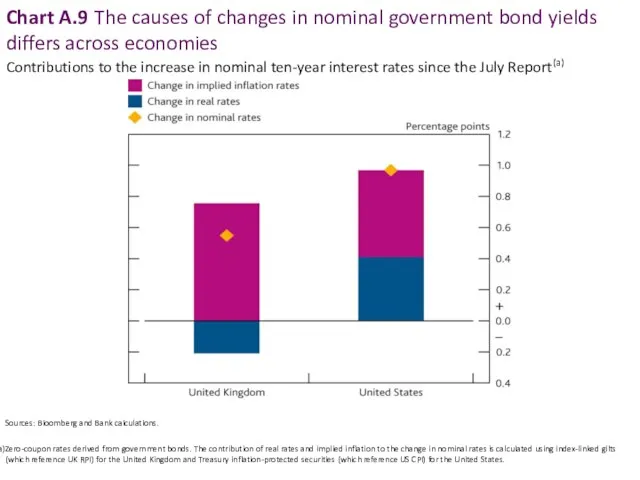

- 3. Chart A.9 The causes of changes in nominal government bond yields differs across economies Sources: Bloomberg

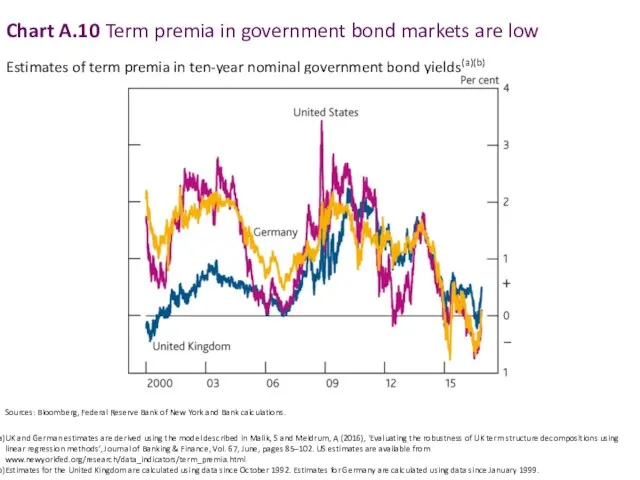

- 4. Chart A.10 Term premia in government bond markets are low Sources: Bloomberg, Federal Reserve Bank of

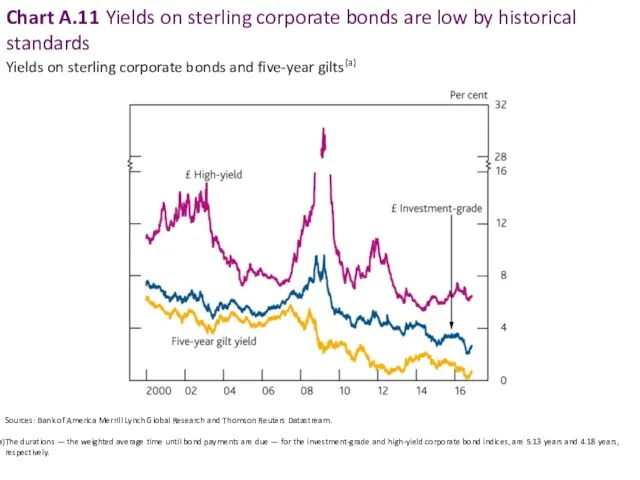

- 5. Chart A.11 Yields on sterling corporate bonds are low by historical standards Sources: Bank of America

- 7. Скачать презентацию

Chart A.8 Advanced economy sovereign bond yields have increased markedly

Source: Thomson

Chart A.8 Advanced economy sovereign bond yields have increased markedly

Source: Thomson

International ten-year nominal government bond yields(a)

Chart A.9 The causes of changes in nominal government bond yields

Chart A.9 The causes of changes in nominal government bond yields

Sources: Bloomberg and Bank calculations.

Zero-coupon rates derived from government bonds. The contribution of real rates and implied inflation to the change in nominal rates is calculated using index-linked gilts (which reference UK RPI) for the United Kingdom and Treasury inflation-protected securities (which reference US CPI) for the United States.

Contributions to the increase in nominal ten-year interest rates since the July Report(a)

Chart A.10 Term premia in government bond markets are low

Sources: Bloomberg,

Chart A.10 Term premia in government bond markets are low

Sources: Bloomberg,

UK and German estimates are derived using the model described in Malik, S and Meldrum, A (2016), ‘Evaluating the robustness of UK term structure decompositions using linear regression methods’, Journal of Banking & Finance, Vol. 67, June, pages 85–102. US estimates are available from www.newyorkfed.org/research/data_indicators/term_premia.html

Estimates for the United Kingdom are calculated using data since October 1992. Estimates for Germany are calculated using data since January 1999.

Estimates of term premia in ten-year nominal government bond yields(a)(b)

Chart A.11 Yields on sterling corporate bonds are low by historical

Chart A.11 Yields on sterling corporate bonds are low by historical

Sources: Bank of America Merrill Lynch Global Research and Thomson Reuters Datastream.

The durations — the weighted average time until bond payments are due — for the investment-grade and high-yield corporate bond indices, are 5.13 years and 4.18 years, respectively.

Yields on sterling corporate bonds and five-year gilts(a)

ОСАГО. Порядок работы в рамках Мобильного приёма документов

ОСАГО. Порядок работы в рамках Мобильного приёма документов Бизнес-ангелы

Бизнес-ангелы Тема: Податок на доходи фізичних осіб в україні (пдфо)

Тема: Податок на доходи фізичних осіб в україні (пдфо) Қазақстан Республикасында лотерея. Лотереяны өткізу тәсіліне қарай екі түрі бар

Қазақстан Республикасында лотерея. Лотереяны өткізу тәсіліне қарай екі түрі бар Правовое регулирование банковской деятельности. Лекция 1

Правовое регулирование банковской деятельности. Лекция 1 Совершенствование системы потребительского кредитования в Калининградском отделении Сбербанка России

Совершенствование системы потребительского кредитования в Калининградском отделении Сбербанка России Учет амортизации основных средств

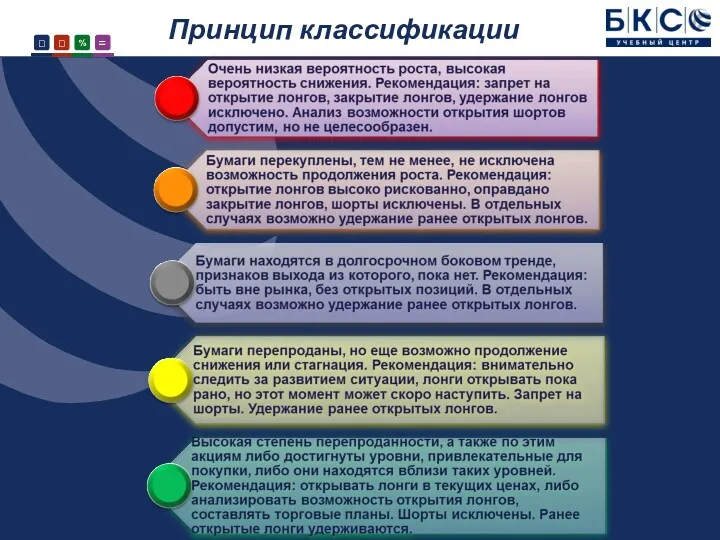

Учет амортизации основных средств Основные рыночные характеристики для отбора акций на долгосрочную перспективу. БКС

Основные рыночные характеристики для отбора акций на долгосрочную перспективу. БКС Направления средств материнского (семейного) капитала на улучшение жилищных условий

Направления средств материнского (семейного) капитала на улучшение жилищных условий Облік валютних операцій (3.1 - 3.3)

Облік валютних операцій (3.1 - 3.3) Анализ институциональной структуры банковской сферы

Анализ институциональной структуры банковской сферы Анализ бухгалтерского баланса

Анализ бухгалтерского баланса Формирование и развитие банковской системы, как объекта государственного управления. (Тема 1)

Формирование и развитие банковской системы, как объекта государственного управления. (Тема 1) Деньги: причины возникновения, формы и функции

Деньги: причины возникновения, формы и функции Финансирование системы образования

Финансирование системы образования Вопросы по продуктам РКО Tinkoff

Вопросы по продуктам РКО Tinkoff Формирование и использование оборотных активов (оборотного капитала) корпорации

Формирование и использование оборотных активов (оборотного капитала) корпорации Ключевые направления деятельности ФНС России по созданию благоприятной налоговой среды

Ключевые направления деятельности ФНС России по созданию благоприятной налоговой среды Управление рисками

Управление рисками Договор страхования

Договор страхования Деньги. Функции и формы денег

Деньги. Функции и формы денег Оценка стоимости контрольных и неконтрольных пакетов акций

Оценка стоимости контрольных и неконтрольных пакетов акций Реализация проекта Финансовая грамотность

Реализация проекта Финансовая грамотность Заработная плата

Заработная плата Аудиторская выборка

Аудиторская выборка Анализ безубыточности

Анализ безубыточности Как легально и выгодно вывести деньги из бизнеса

Как легально и выгодно вывести деньги из бизнеса Денежная система: черты денежных систем в России и в мире, характеристика основных элементов

Денежная система: черты денежных систем в России и в мире, характеристика основных элементов