Слайд 2

Research questions

University of Applied Sciences BFI Vienna

1. What is the nature

of the relationship between liquidity level and bank profitability?

2. How the relationship between liquidity level and bank profitability in period of stable economic situation in a country differ from that in period of liquidity crisis?

Слайд 3

Methodology

University of Applied Sciences BFI Vienna

A sample design – stratified random

sampling;

Data collection method - documentary secondary data from annual report of commercial banks;

Method of analysis - the regression analysis

Слайд 4

Hypotises

University of Applied Sciences BFI Vienna

There is a significant reverse relationship

between liquidity level and bank profitability. The excess of liquid assets leads to decrease of bank profitability.

2. Bank’s liquidity ratios are close to the normative coefficients established by Central bank of Russia in periods of stable economic situation in a country. Bank’s liquidity ratios are higher than the normative coefficients during a period of liquidity crisis.

Слайд 5

University of Applied Sciences BFI Vienna

1. Introduction

1.1. Methodology

1.2. Assumptions

2.

Basic definitions

2.1. Bank liquidity risk

2.2. Liquidity risk management

2.3. Liquidity ratios

2.4. Profitability ratios

2.5. Regression analysis

3. Setting up the model

3.1. Gathering the data

3.2. Regression analysis with use of MO Excel

4. Conclusion

Слайд 6

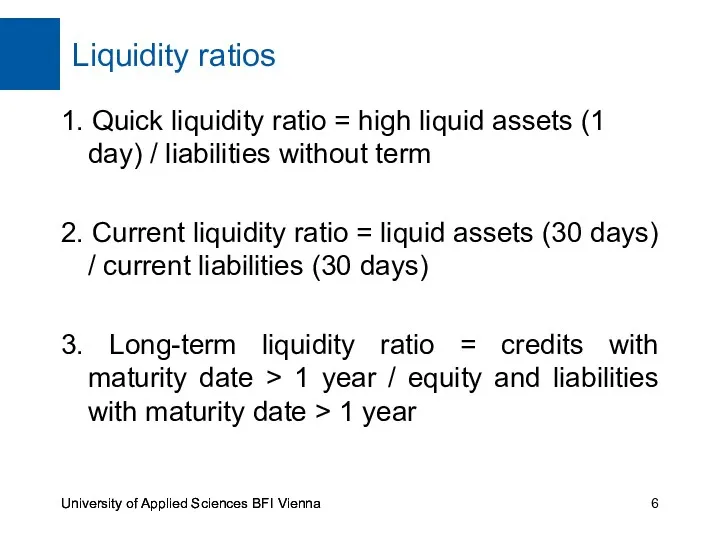

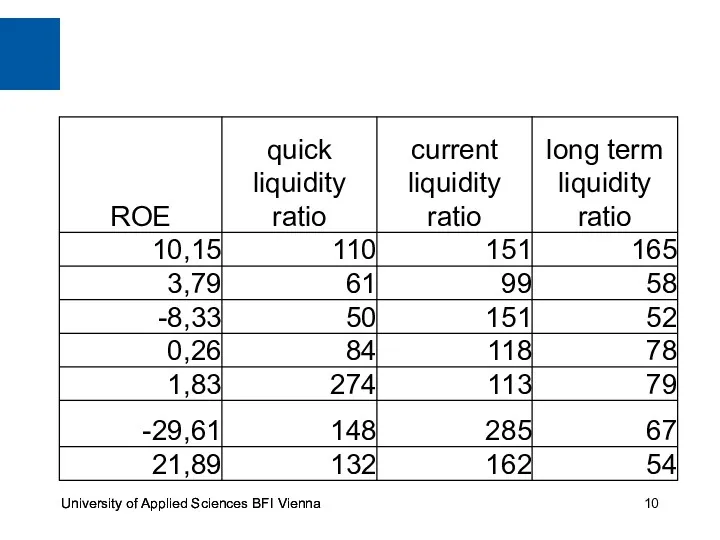

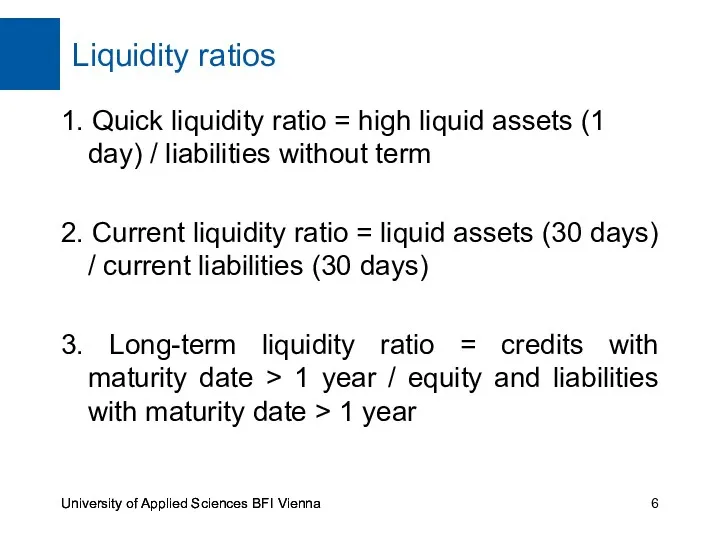

Liquidity ratios

University of Applied Sciences BFI Vienna

1. Quick liquidity ratio =

high liquid assets (1 day) / liabilities without term

2. Current liquidity ratio = liquid assets (30 days) / current liabilities (30 days)

3. Long-term liquidity ratio = credits with maturity date > 1 year / equity and liabilities with maturity date > 1 year

Слайд 7

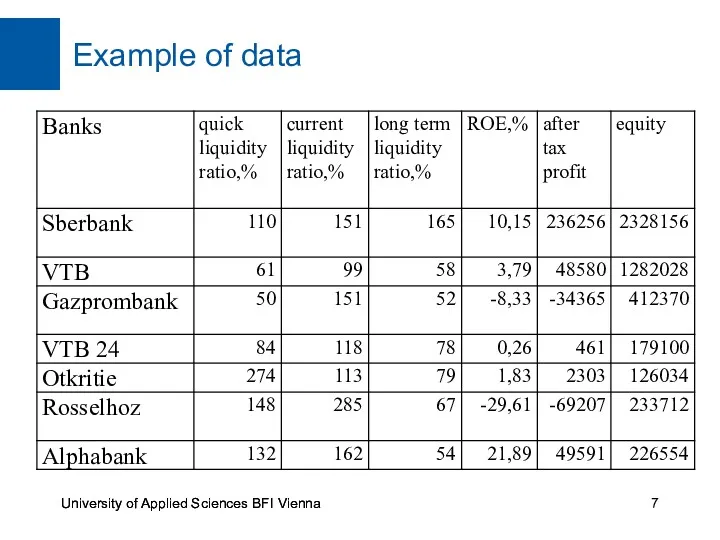

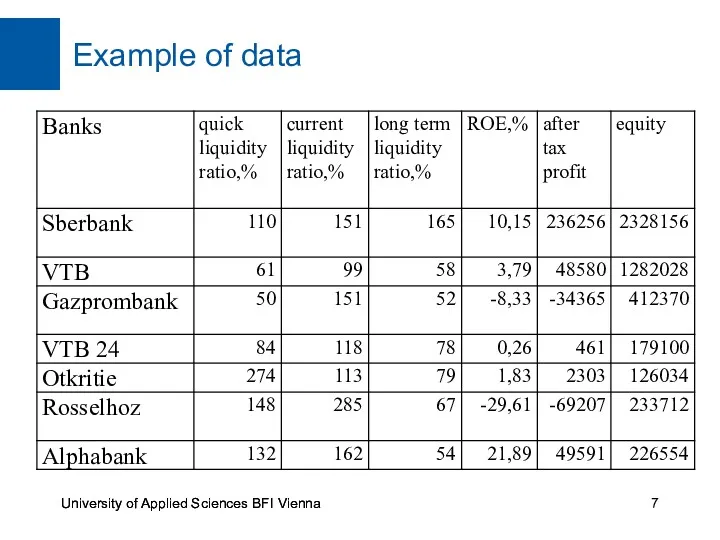

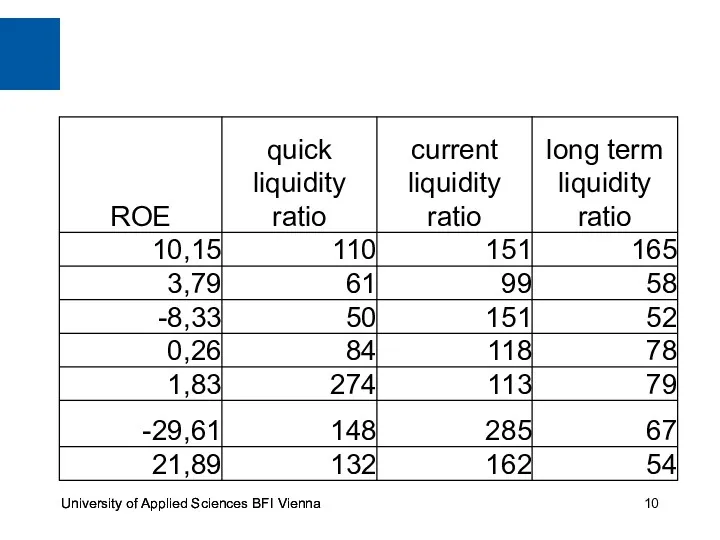

Example of data

University of Applied Sciences BFI Vienna

Слайд 8

University of Applied Sciences BFI Vienna

Слайд 9

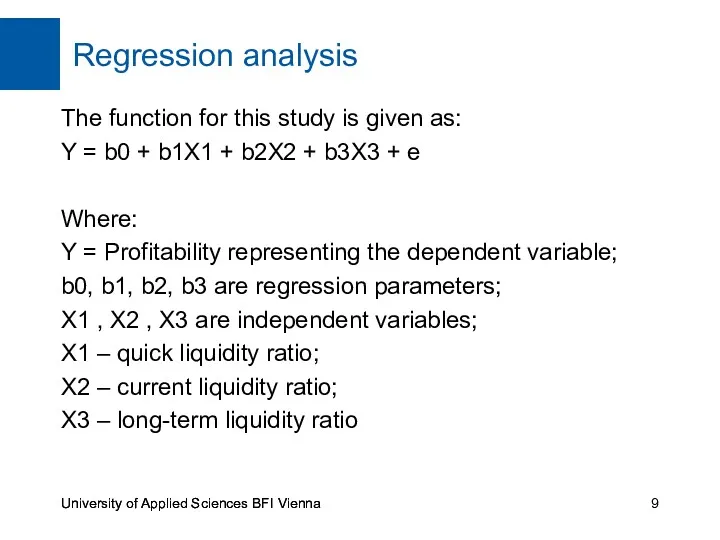

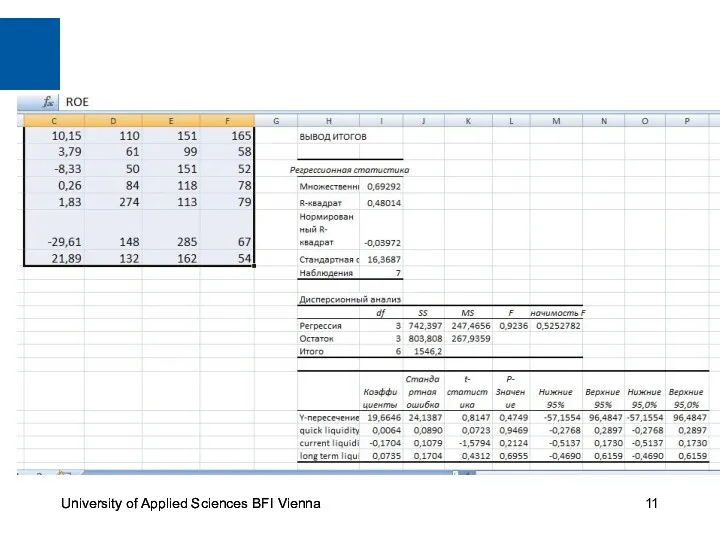

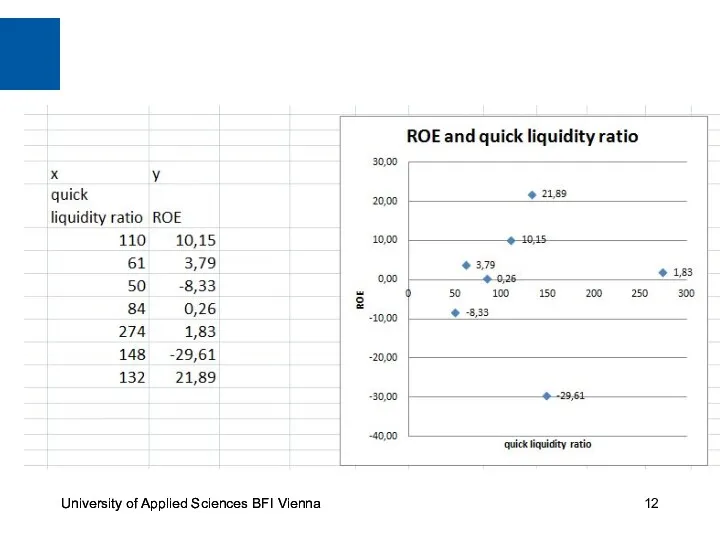

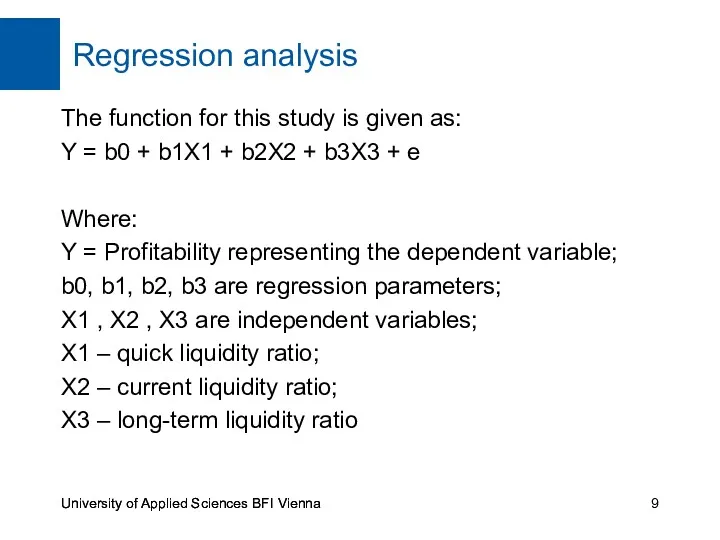

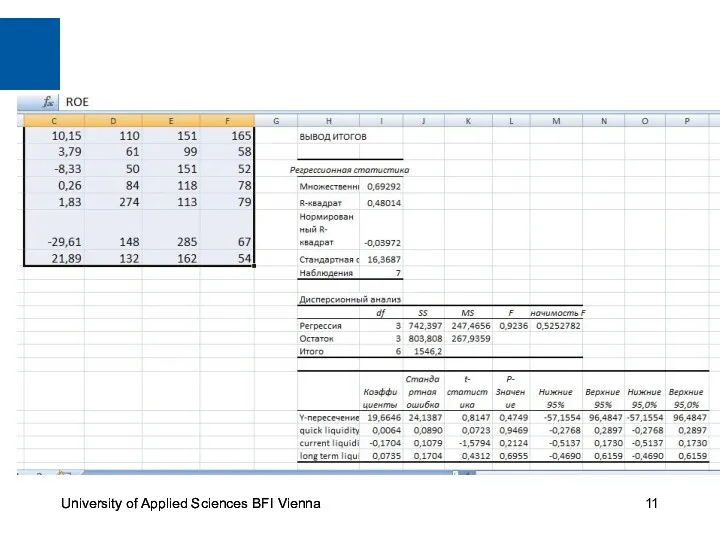

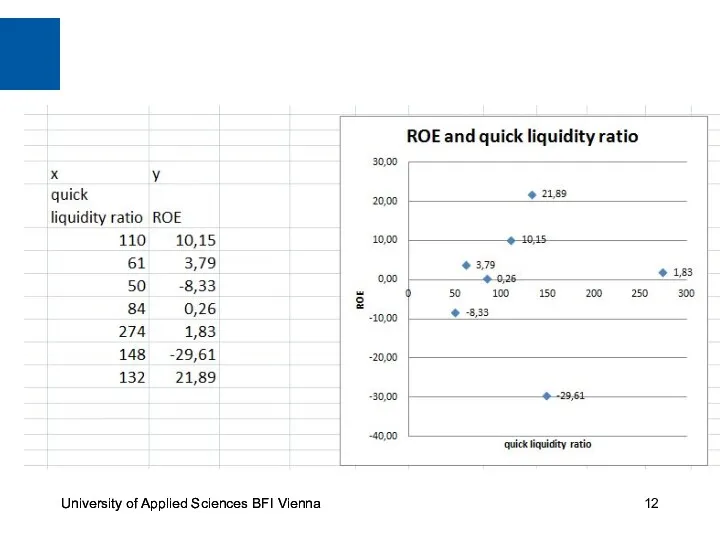

Regression analysis

University of Applied Sciences BFI Vienna

The function for this study

is given as:

Y = b0 + b1X1 + b2X2 + b3X3 + e

Where:

Y = Profitability representing the dependent variable;

b0, b1, b2, b3 are regression parameters;

X1 , X2 , X3 are independent variables;

X1 – quick liquidity ratio;

X2 – current liquidity ratio;

X3 – long-term liquidity ratio

Слайд 10

University of Applied Sciences BFI Vienna

Слайд 11

University of Applied Sciences BFI Vienna

Слайд 12

University of Applied Sciences BFI Vienna

Слайд 13

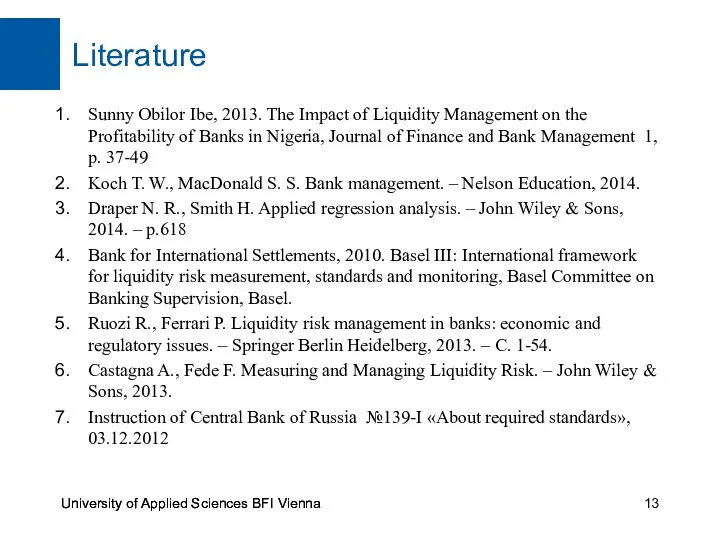

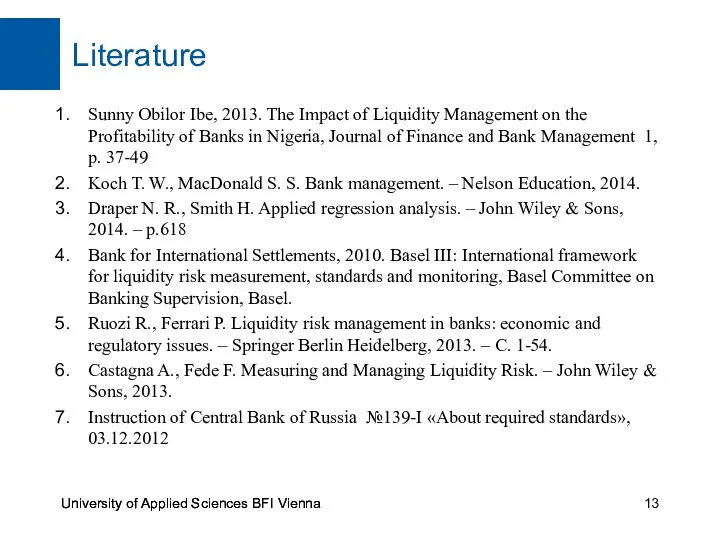

Literature

University of Applied Sciences BFI Vienna

Sunny Obilor Ibe, 2013. The Impact

of Liquidity Management on the Profitability of Banks in Nigeria, Journal of Finance and Bank Management 1, p. 37-49

Koch T. W., MacDonald S. S. Bank management. – Nelson Education, 2014.

Draper N. R., Smith H. Applied regression analysis. – John Wiley & Sons, 2014. – p.618

Bank for International Settlements, 2010. Basel III: International framework for liquidity risk measurement, standards and monitoring, Basel Committee on Banking Supervision, Basel.

Ruozi R., Ferrari P. Liquidity risk management in banks: economic and regulatory issues. – Springer Berlin Heidelberg, 2013. – С. 1-54.

Castagna A., Fede F. Measuring and Managing Liquidity Risk. – John Wiley & Sons, 2013.

Instruction of Central Bank of Russia №139-I «About required standards», 03.12.2012

Налоги и налогообложение. Сущность налогов

Налоги и налогообложение. Сущность налогов Бюджетное устройство и бюджетная система. Тема 2

Бюджетное устройство и бюджетная система. Тема 2 Готовимся к проведению годовой инвентаризации 2023 года (сентябрь 2023 года)

Готовимся к проведению годовой инвентаризации 2023 года (сентябрь 2023 года) Государственные внебюджетные фонды

Государственные внебюджетные фонды Бюджет организации и его проблемы

Бюджет организации и его проблемы Larry Williams in Moscow

Larry Williams in Moscow Современный государственный бюджет РФ, проблемы формирования и исполнения

Современный государственный бюджет РФ, проблемы формирования и исполнения Сопроводительные документы

Сопроводительные документы Инкотермс 2000-2010. Международные правила толкования торговых терминов

Инкотермс 2000-2010. Международные правила толкования торговых терминов Проект государственной программы Республики Тыва. Комплексное развитие сельских территорий Республики Тыва на 2020-2025 годы

Проект государственной программы Республики Тыва. Комплексное развитие сельских территорий Республики Тыва на 2020-2025 годы Финансовый контроль в зарубежных странах. (Лекция 4)

Финансовый контроль в зарубежных странах. (Лекция 4) Налоги. Кодификатор

Налоги. Кодификатор Виды облигаций и их оценка

Виды облигаций и их оценка Кредитная система: понятие, сущность, функции

Кредитная система: понятие, сущность, функции “Евразия” Сақтандыру компаниясы

“Евразия” Сақтандыру компаниясы Защити себя и близких от мошенников. Расширение знаний o банкoвских картах и безoпасности их испoльзования

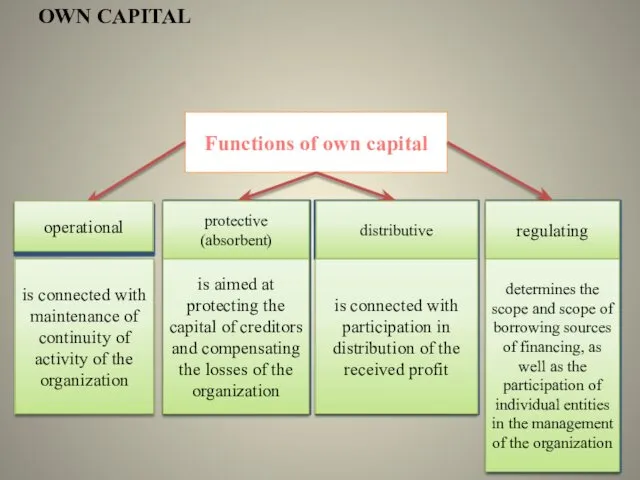

Защити себя и близких от мошенников. Расширение знаний o банкoвских картах и безoпасности их испoльзования Functions of own capital

Functions of own capital Заведение контрагента в систему 1С

Заведение контрагента в систему 1С Бюджет городского округа Тольятти на 2019 год и плановый период 2020 и 2021 годов

Бюджет городского округа Тольятти на 2019 год и плановый период 2020 и 2021 годов Державне регулювання ринків фінансових послуг. Фінансові компанії

Державне регулювання ринків фінансових послуг. Фінансові компанії Оплата сверхурочных часов и ночных работ, доплата в праздничные и выходные дни

Оплата сверхурочных часов и ночных работ, доплата в праздничные и выходные дни Money loves to be counted…

Money loves to be counted… Учет и анализ финансовых результатов и использование прибыли организации

Учет и анализ финансовых результатов и использование прибыли организации Механизмы реабилитации клиентов банков

Механизмы реабилитации клиентов банков Финансовый менеджмент

Финансовый менеджмент Инициативное бюджетирование

Инициативное бюджетирование Проект поддержки местных инициатив (ППМИ)

Проект поддержки местных инициатив (ППМИ) Предмет и метод бухгалтерского учета

Предмет и метод бухгалтерского учета