Содержание

- 2. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. Structural Model Examines whether one variable affects another

- 3. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. Reduced-Form Examines whether one variable has an effect

- 4. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. Structural Model Advantages and Disadvantages Possible to gather

- 5. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. Reduced-Form Advantages and Disadvantages No restrictions imposed on

- 6. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. Early Keynesian Evidence Monetary policy does not matter

- 7. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. Objections to Early Keynesian Evidence Friedman and Schwartz

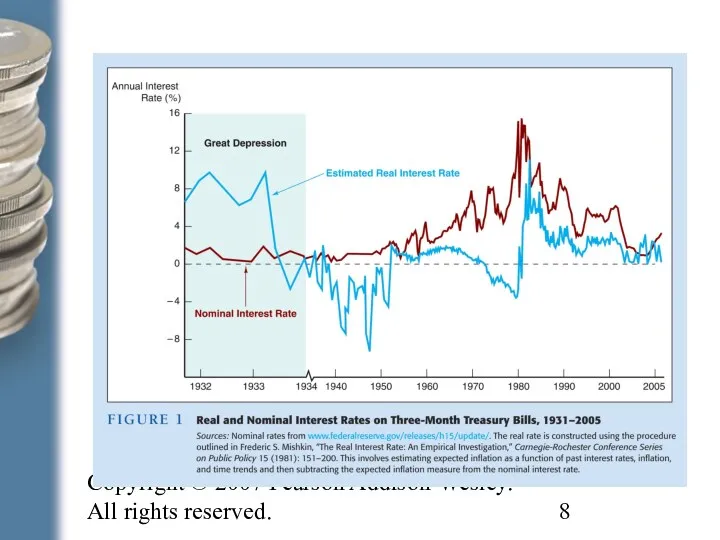

- 8. Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

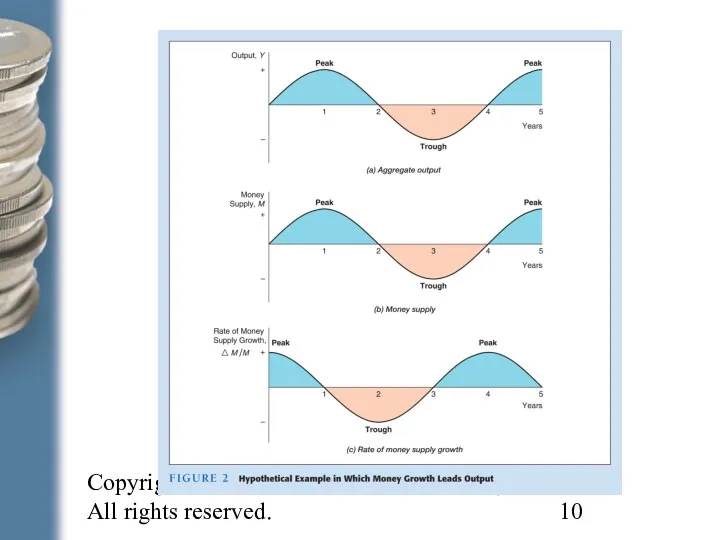

- 9. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. Timing Evidence of Early Monetarists Money growth causes

- 10. Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

- 11. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. Statistical Evidence Autonomous expenditure variable equal to investment

- 12. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. Historical Evidence If the decline in the growth

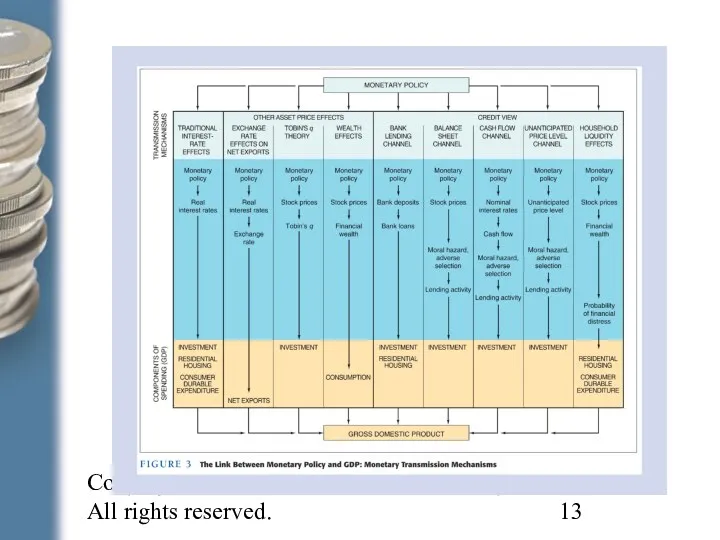

- 13. Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

- 14. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. Lessons for Monetary Policy It is dangerous always

- 16. Скачать презентацию

Опыт реализации инициативного бюджетирования в России

Опыт реализации инициативного бюджетирования в России Методология учета ЕНП

Методология учета ЕНП Планирование производства. Тема 3

Планирование производства. Тема 3 Английские банкноты

Английские банкноты Проектирование бизнеса. Практика 5. Денежные потоки инвестиционного проекта

Проектирование бизнеса. Практика 5. Денежные потоки инвестиционного проекта Основные итоги и ключевые задачи в сфере развития бюджетной методологии

Основные итоги и ключевые задачи в сфере развития бюджетной методологии Pénzáramlások kimutatása

Pénzáramlások kimutatása Электронный документооборот. Унифицированные формы электронных первичных документов бухгалтерского учета

Электронный документооборот. Унифицированные формы электронных первичных документов бухгалтерского учета General Situation in Shipping

General Situation in Shipping Затратный подход

Затратный подход Акции их виды и особенности

Акции их виды и особенности Характеристика отдельных видов ценных бумаг

Характеристика отдельных видов ценных бумаг Применение затратного подхода к объектам культурного наследия

Применение затратного подхода к объектам культурного наследия Денежные доходы и поступления предприятия

Денежные доходы и поступления предприятия Страхование. История страхования

Страхование. История страхования Мотивация сотрудников склада

Мотивация сотрудников склада Планирование себестоимости

Планирование себестоимости Основы теории и организации бухгалтерского учета

Основы теории и организации бухгалтерского учета Объекты учета затрат в системе управленческого учета. (Лекция 3)

Объекты учета затрат в системе управленческого учета. (Лекция 3) Research proposal Liquidity risk management in banks

Research proposal Liquidity risk management in banks Инвентаризация имущества предприятия ООО Луидор-Тюнинг

Инвентаризация имущества предприятия ООО Луидор-Тюнинг Порог рентабельности и запас финансовой прочности. Методы расчета

Порог рентабельности и запас финансовой прочности. Методы расчета Дистанционное хищение денежных средств граждан

Дистанционное хищение денежных средств граждан Оценка стоимости земельных участков

Оценка стоимости земельных участков Pozabankowe formy inwestowania

Pozabankowe formy inwestowania Инвестиционные проекты и оценка их эффективности

Инвестиционные проекты и оценка их эффективности Тема 14. Содержание и порядок составления финансовой отчетности

Тема 14. Содержание и порядок составления финансовой отчетности Государственные и муниципальные ценные бумаги

Государственные и муниципальные ценные бумаги