Содержание

- 2. Learning Goals LG1 Define finance and the managerial finance function. LG2 Describe the legal forms of

- 3. Learning Goals (cont.) LG4 Describe how the managerial finance function is related to economics and accounting.

- 4. What is Finance? Finance can be defined as the science and art of managing money. At

- 5. Career Opportunities in Finance: Financial Services Financial Services is the area of finance concerned with the

- 6. Career Opportunities in Finance: Managerial Finance Managerial finance is concerned with the duties of the financial

- 7. Career Opportunities in Finance: Managerial Finance (cont.) The recent global financial crisis and subsequent responses by

- 8. Focus on Practice Professional Certifications in Finance: Chartered Financial Analyst (CFA) – Offered by the CFA

- 9. Focus on Practice (cont.) Professional Certifications in Finance: American Academy of Financial Management (AAFM) – The

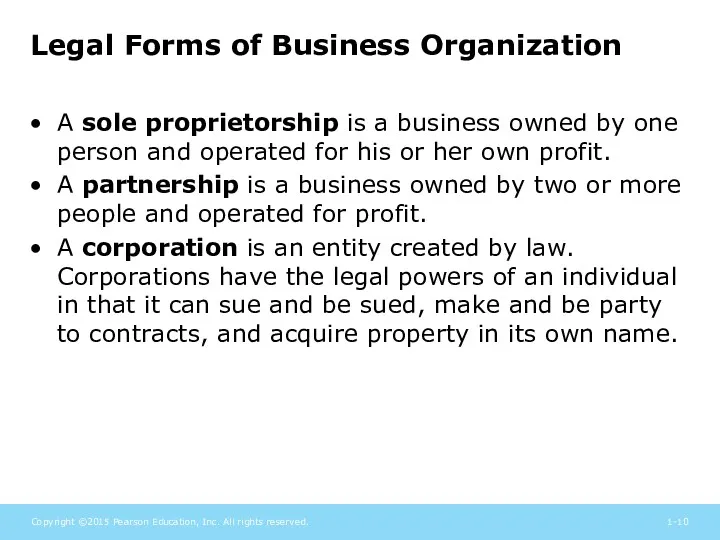

- 10. Legal Forms of Business Organization A sole proprietorship is a business owned by one person and

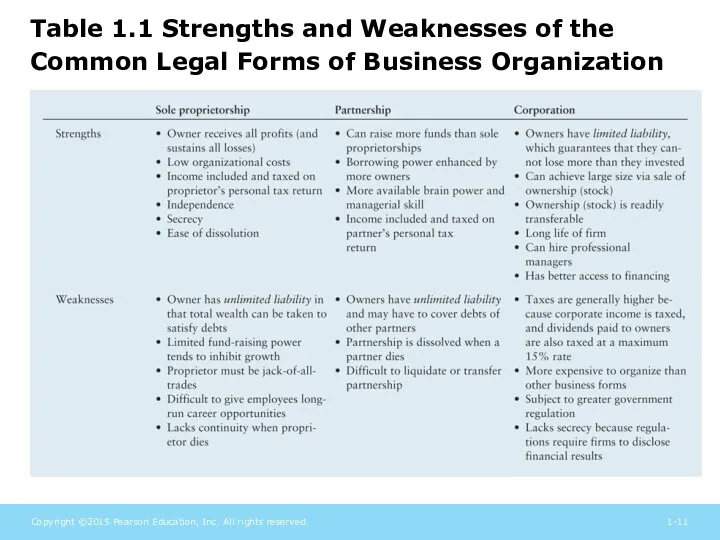

- 11. Table 1.1 Strengths and Weaknesses of the Common Legal Forms of Business Organization

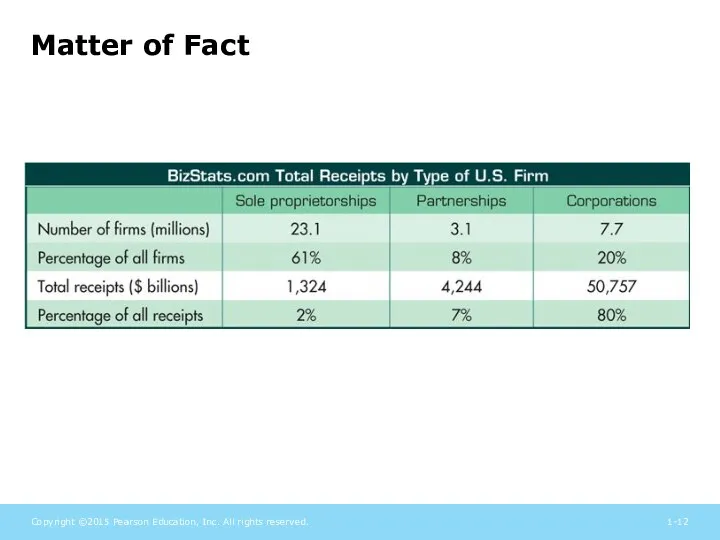

- 12. Matter of Fact

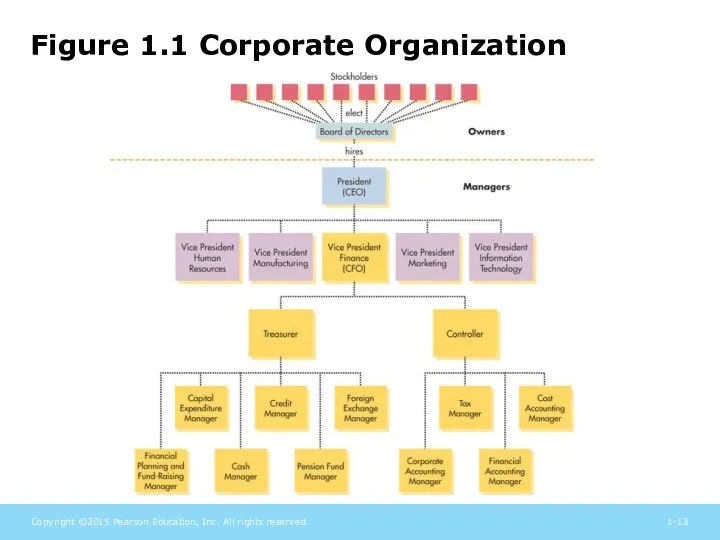

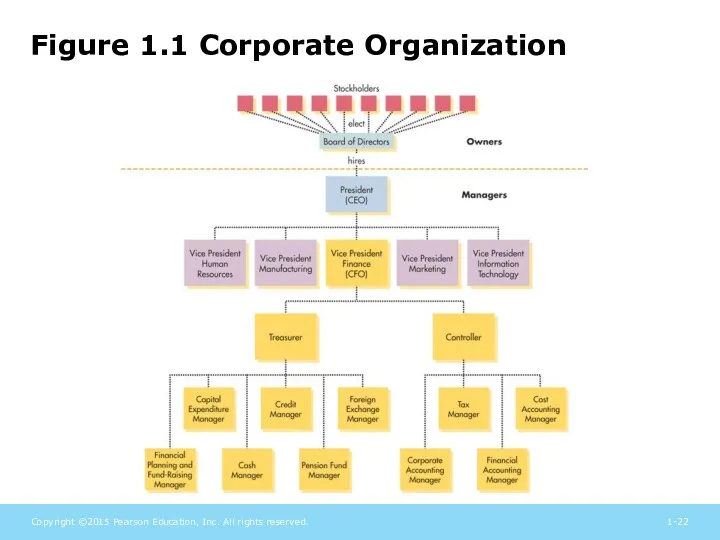

- 13. Figure 1.1 Corporate Organization

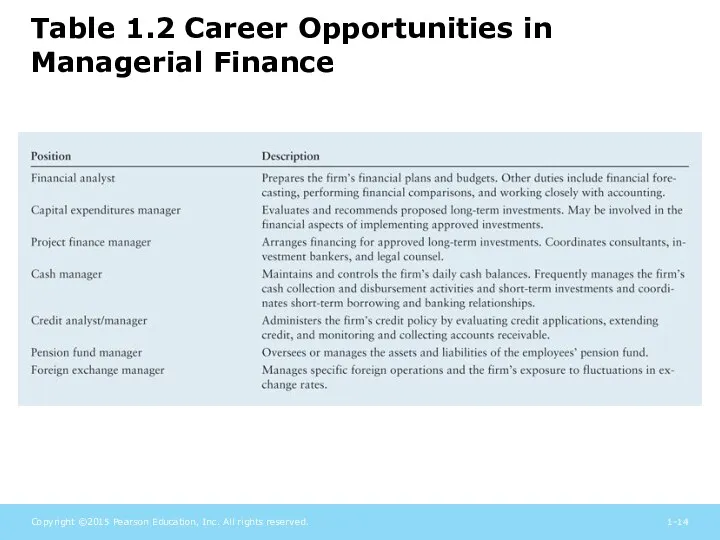

- 14. Table 1.2 Career Opportunities in Managerial Finance

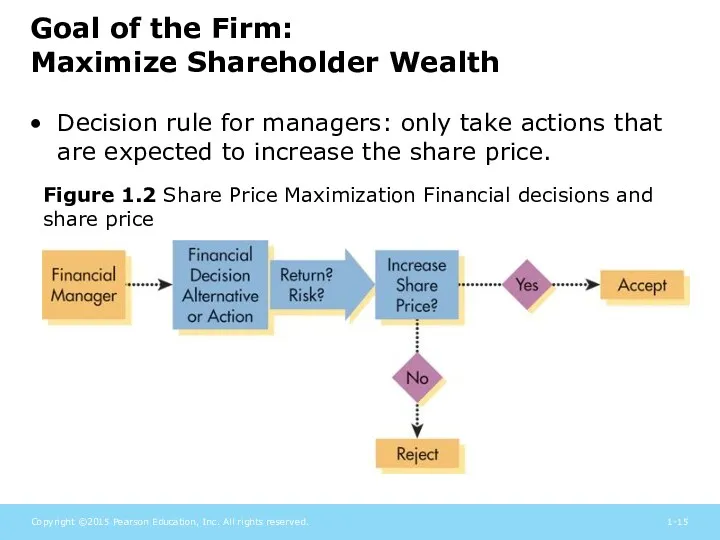

- 15. Goal of the Firm: Maximize Shareholder Wealth Decision rule for managers: only take actions that are

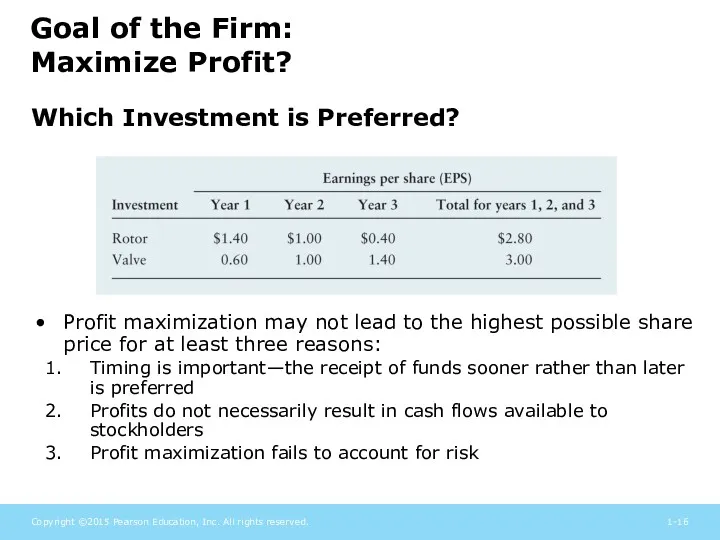

- 16. Goal of the Firm: Maximize Profit? Profit maximization may not lead to the highest possible share

- 17. Goal of the Firm: What About Stakeholders? Stakeholders are groups such as employees, customers, suppliers, creditors,

- 18. The Role of Business Ethics Business ethics are the standards of conduct or moral judgment that

- 19. The Role of Business Ethics: Considering Ethics Robert A. Cooke, a noted ethicist, suggests that the

- 20. The Role of Business Ethics: Ethics and Share Price Ethics programs seek to: reduce litigation and

- 21. Managerial Finance Function The size and importance of the managerial finance function depends on the size

- 22. Figure 1.1 Corporate Organization

- 23. Managerial Finance Function: Relationship to Economics The field of finance is closely related to economics. Financial

- 24. Managerial Finance Function: Relationship to Economics (cont.) Marginal cost–benefit analysis is the economic principle that states

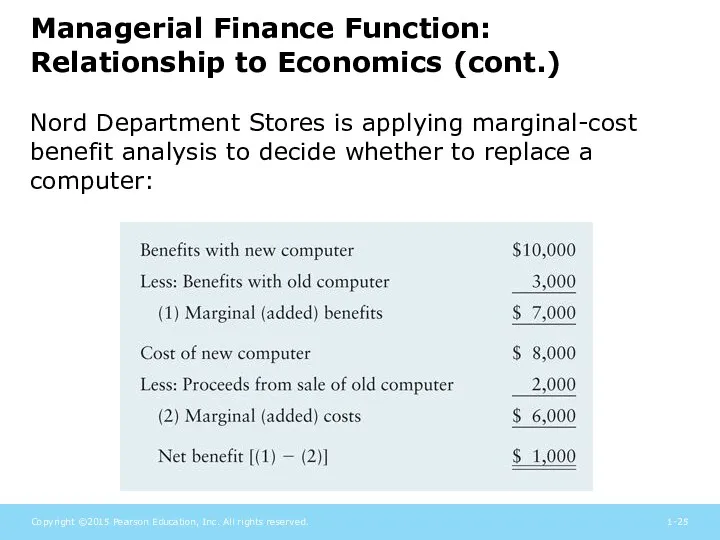

- 25. Managerial Finance Function: Relationship to Economics (cont.) Nord Department Stores is applying marginal-cost benefit analysis to

- 26. Managerial Finance Function: Relationship to Accounting The firm’s finance and accounting activities are closely-related and generally

- 27. Managerial Finance Function: Relationship to Accounting (cont.) Whether a firm earns a profit or experiences a

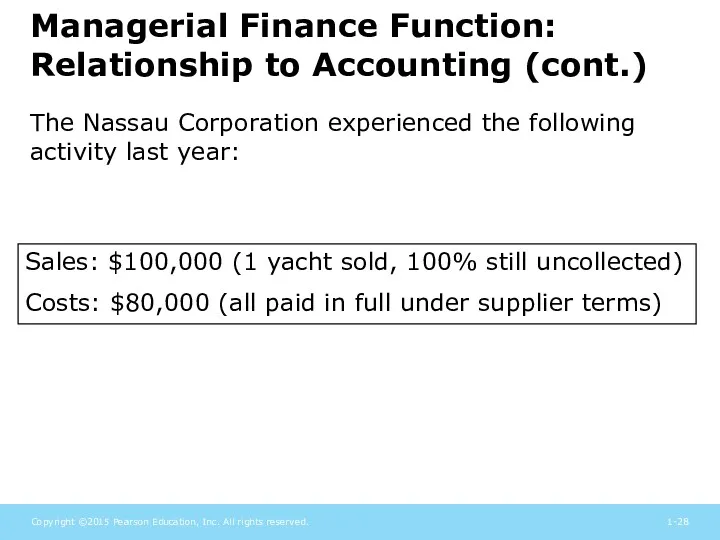

- 28. Managerial Finance Function: Relationship to Accounting (cont.) The Nassau Corporation experienced the following activity last year:

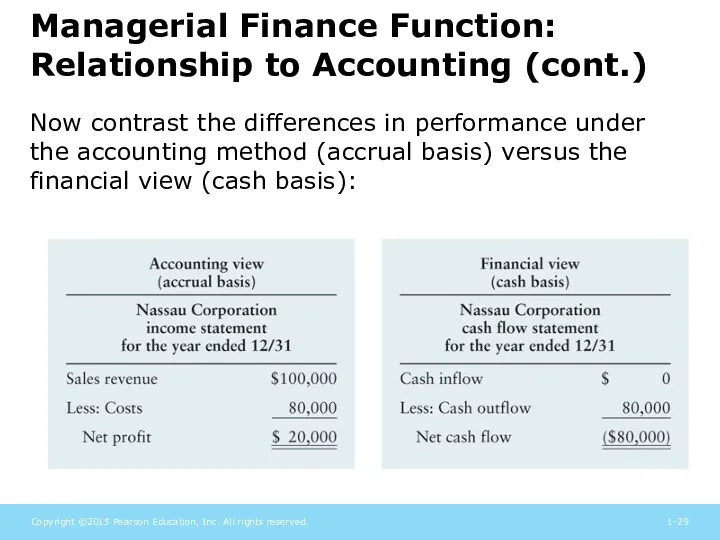

- 29. Managerial Finance Function: Relationship to Accounting (cont.) Now contrast the differences in performance under the accounting

- 30. Managerial Finance Function: Relationship to Accounting (cont.) Finance and accounting also differ with respect to decision-making:

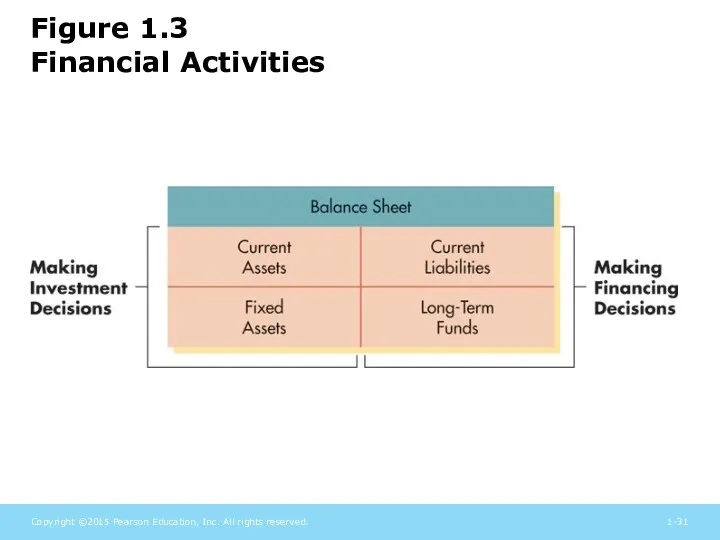

- 31. Figure 1.3 Financial Activities

- 32. Governance and Agency: Corporate Governance Corporate governance refers to the rules, processes, and laws by which

- 33. Governance and Agency: Individual versus Institutional Investors Individual investors are investors who own relatively small quantities

- 34. Governance and Agency: Government Regulation Government regulation generally shapes the corporate governance of all firms. During

- 35. Governance and Agency: Government Regulation The Sarbanes-Oxley Act of 2002: established an oversight board to monitor

- 36. Governance and Agency: The Agency Issue A principal-agent relationship is an arrangement in which an agent

- 37. The Agency Issue: Management Compensation Plans In addition to the roles played by corporate boards, institutional

- 38. The Agency Issue: Management Compensation Plans Incentive plans are management compensation plans that tie management compensation

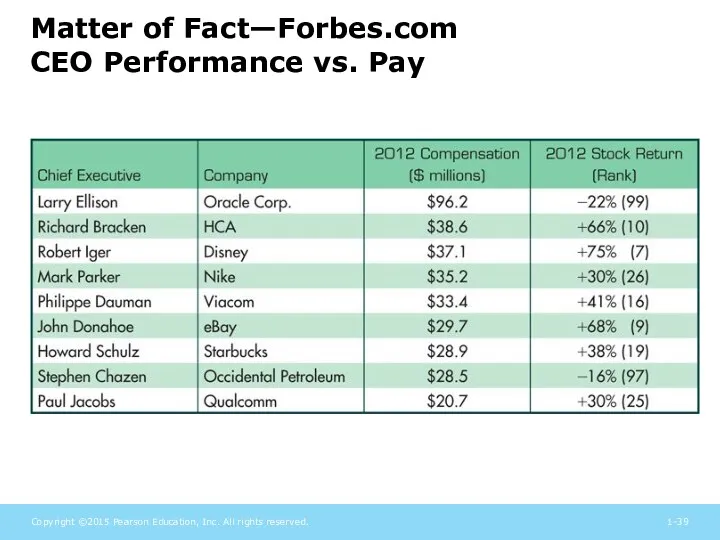

- 39. Matter of Fact—Forbes.com CEO Performance vs. Pay

- 41. Скачать презентацию

1С-Отчетность за 9 месяцев 2019 года, на что обратить внимание. Единый семинар 1С

1С-Отчетность за 9 месяцев 2019 года, на что обратить внимание. Единый семинар 1С Инструменты финансирования публичных компаний. Классификация источников средств: юридический аспект

Инструменты финансирования публичных компаний. Классификация источников средств: юридический аспект Монетарная политика (1). Тема 5

Монетарная политика (1). Тема 5 Финансовая система США

Финансовая система США Валютный рынок

Валютный рынок Денежные обязательства и расчеты

Денежные обязательства и расчеты Организация деятельности Центрального банка

Организация деятельности Центрального банка Привлечение инвестиций в точку общественного питания

Привлечение инвестиций в точку общественного питания Финансы. Введение

Финансы. Введение Порядок заполнения Уведомлений об уточнении вида и принадлежности платежа (код формы по КФД 0531809)

Порядок заполнения Уведомлений об уточнении вида и принадлежности платежа (код формы по КФД 0531809) Условия назначения страховой пенсии по старости

Условия назначения страховой пенсии по старости Оплата труда (заработная плата). Гарантии и компенсации

Оплата труда (заработная плата). Гарантии и компенсации Учет расходов. Тема 10. Часть 1

Учет расходов. Тема 10. Часть 1 Статистика денежного обращения

Статистика денежного обращения Семейный бюджет. 3 класс

Семейный бюджет. 3 класс Деньги и мораль

Деньги и мораль Водный налог

Водный налог Теоретические основы государственных и муниципальных финансов

Теоретические основы государственных и муниципальных финансов Финансовая грамотность: личное финансовое планирование

Финансовая грамотность: личное финансовое планирование Дивидендная политика корпораций

Дивидендная политика корпораций О банке, его финансовых показателях, рейтинге, продуктах и услугах

О банке, его финансовых показателях, рейтинге, продуктах и услугах Рабочий отчет департамента аналитики компании IPO

Рабочий отчет департамента аналитики компании IPO Анализ финансового состояния предприятия

Анализ финансового состояния предприятия Классификация доходов бюджета

Классификация доходов бюджета Налоги. Обязательные платежи в государственную казну

Налоги. Обязательные платежи в государственную казну Виды государственных пенсий. Роль государства в их реализации

Виды государственных пенсий. Роль государства в их реализации Сущность аудита и его содержание

Сущность аудита и его содержание Бухгалтерский учет и анализ финансовых результатов на примере ООО Гермес

Бухгалтерский учет и анализ финансовых результатов на примере ООО Гермес